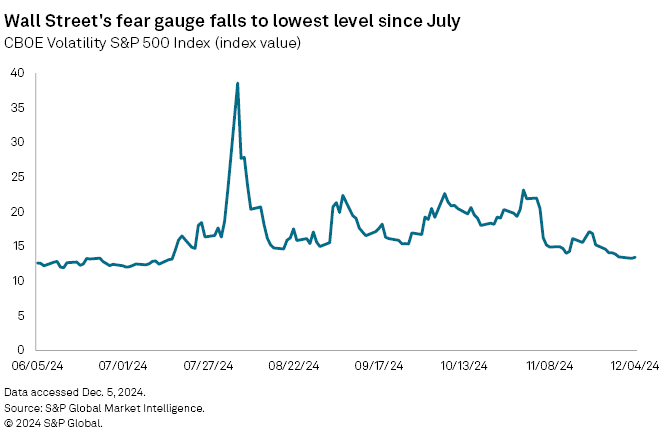

The CBOE Volatility S&P 500 Index (VIX), also known as the market's "fear gauge," dropped this week to its lowest point since July, a sign that investor fear has abated as the stock market repeatedly touches record highs.

"Investors just got through a very contentious period full of worries and are now breathing a sigh of relief, resulting in a collapse in volatility," said Bret Kenwell, a US investment analyst at eToro. "The market got what it craved most from the election — certainty — and we now turn our attention to a seasonally strong period of the year."

Potentially inflation triggering tariffs and mass deportations when Trump returns to the White House are not causing market jitters. Instead, the drop in the VIX reflects investors' "overwhelming enthusiasm" for Trump's victory, said Michael O'Rourke, chief market strategist with JonesTrading.

"At this point in time the market is pricing in the most optimistic of expectations, exhibiting little to no regard for potential risk and uncertainty," O'Rourke said. "Will it be sustained once policy emerges? Even with strong policy execution, it will be hard to match the market's high expectations."

Volatility dynamics in the stock market have shifted since the election when many investors crowded into downside stock market hedges on fears that a Democratic victory could lead to taxes on unrealized capital gains, said Tyler Richey with Sevens Report Research. This also hurt the performance of short volatility strategies, which had been crushed by a massive VIX squeeze at the start of August, Richey said.

"Between the post-election unwind in broad stock market hedges and a suffering short-volatility crowd [throughout 2024], the derivatives market pendulum swung hard from one extreme to another with the VIX index and VIX futures both getting pressured in a big way over the last month," Richey said.

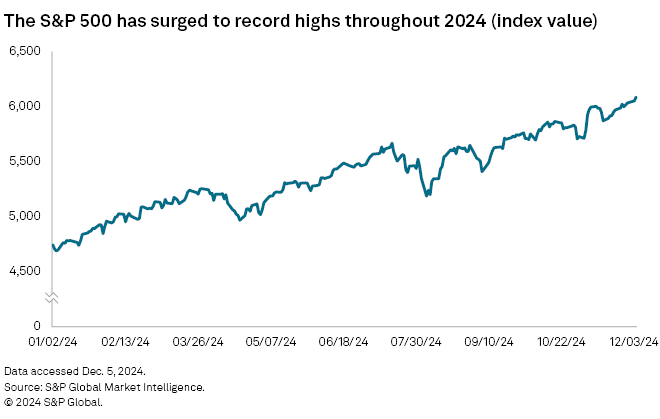

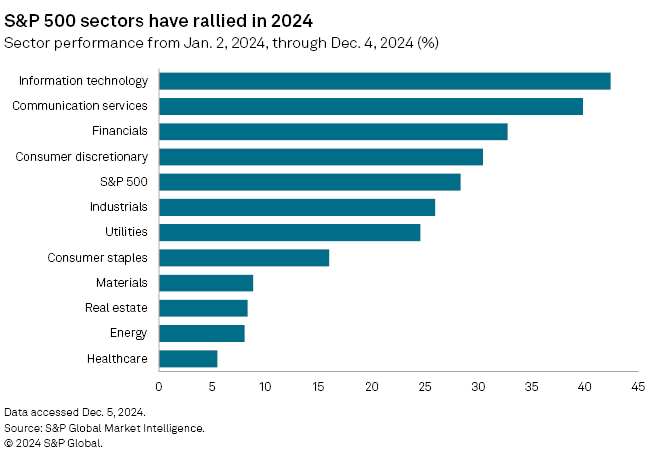

The S&P 500 has settled at all-time highs on 56 days in 2024 and has risen more than 28% since the start of this year. The index has added more than 5% since President-elect Donald Trump's victory last month.

The market is largely looking past geopolitics since that is always a concern, and the VIX is falling largely due to timing, according to Paul Schatz, founder and president of Heritage Capital.

"The VIX is and should be declining this time of year," Schatz said. "Earnings are done, the election is over and the Fed is basically neutral. Late fourth-quarter declines from new highs are rare."

The stock market will likely continue to rally on the Republican sweep as income taxes are not expected to rise, corporate taxes are likely to fall, regulations will loosen up, and a "tsunami" of M&A activity is expected as the Federal Trade Commission turns more corporate-friendly, Schatz said.

The widespread market rally has been driven largely by strong earnings growth, a solid economy and lower interest rates, factors likely to persist into 2025, eToro's Kenwell said.

While there are long-standing concerns about more geopolitical flare-ups and elevated valuations, there appears to be little near-term tension in the stock market, said Matthew Weller, global head of research with FOREX.com and City Index.

"Until a catalyst prompts investors to focus on those concerns, the path of least resistance remains higher," Weller said.