A new study unveiled Oct. 28 foresees large cost savings and greenhouse gas emission reductions within the PJM Interconnection if its 13 member states were to agree on a regional clean energy strategy instead of pursuing a piecemeal approach.

The study was conducted by the consulting firm E3 on behalf of the Electric Power Supply Association, or EPSA. The trade group for competitive power producers in February called for a price on carbon emissions or "other economywide, market-based mechanisms" in the face of a "rigid patchwork of state mandates."

State clean energy policies, established through legislation or executive order, have become an increasingly thorny issue within PJM since the Federal Energy Regulatory Commission in December 2019 directed the grid operator to overhaul its capacity market rules to counter out-of-market state subsidies.

Multiple states have responded to that order by exploring the possibility of leaving the PJM capacity market. Meanwhile, FERC issued a new policy statement earlier this month signaling it is open to reviewing proposals submitted by regional grid operators that account for state-determined carbon pricing.

The E3 study released Oct. 28 adds to the discussion by comparing the estimated cost and emissions impacts of existing individual state clean energy goals with several alternative scenarios that assume a coordinated regional approach. Eight states and the District of Columbia have varying clean energy targets, some of which call for special carveouts for renewable technologies like solar or offshore wind, according to the study.

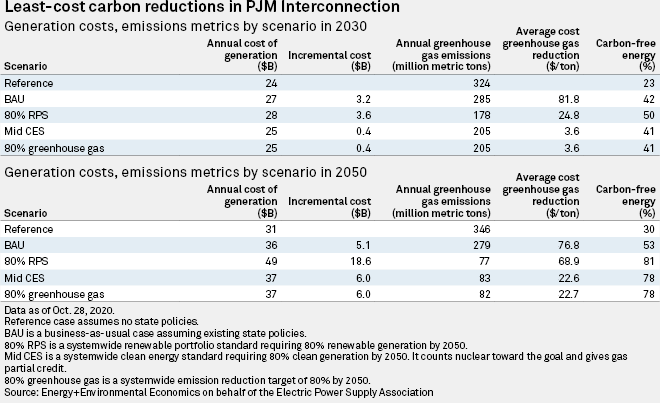

Using proprietary modeling software, E3 studied existing decarbonization strategies within PJM and found that a "fragmented" approach is expected to produce a 53% carbon-free electricity mix by 2050 at a cost of $76.80/ton of greenhouse gas reduction. However, PJM could achieve a 78% carbon-free grid by 2050 at $22.60/ton if member states coalesced around a systemwide 80%-by-2050 emissions reduction goal relative to 2005 levels, the study found.

The study also assessed two alternative systemwide scenarios: a renewable portfolio standard, or RPS, and clean energy standard, or CES. The study found that the CES scenario, which would allow nuclear to count toward an 80%-clean-by-2050 goal and give partial credit to gas generation, would produce cost savings and emissions reductions on par with the 80% greenhouse gas reduction scenario. Under the RPS scenario, the cost of greenhouse gas reduction would rise to $68.90/ton while resulting in an 81% carbon-free electric grid by 2050.

Overall, E3 projected existing state policies will increase electricity bills in PJM by approximately $3 billion per year by 2030 while reducing emissions 30% relative to 2005 levels, or approximately 40 million metric tons compared to a policy-free "reference case."

The study also called the Regional Greenhouse Gas Initiative, or RGGI, a cap-and-trade program that covers a subset of PJM states, "counterproductive" because it does not cover many of the region's coal-fired generators.

Eliminating the program would save customers about $1 billion annually while slightly reducing emissions by encouraging more coal-to-gas switching in states experiencing leakage due to the lack of a carbon price, the study said. And extending carbon pricing to all PJM states could reduce emissions by nearly 100 million metric tons by 2030 at a cost less than that projected under existing state policies, the study found.

"There's certainly going to be a lot of discussion around this and if it were simple and easy it would be resolved by now," EPSA President and CEO Todd Snitchler said Oct. 28 on a call with reporters. "But it's our hope that this study will provide some meaningful data that really helps people see that if they're trying to achieve policy objectives, there is a more efficient way to get there."

Snitchler added that EPSA's members hope the study can help inform states such as Illinois, New Jersey and Maryland, which are all at various stages of determining how they will respond to FERC's December 2019 capacity market order for PJM.

With PJM already studying the impact of carbon pricing within its market, action on the issue could ramp up as Virginia and Pennsylvania prepare to join RGGI, said Tom Rumsey, senior vice president of external and regulatory affairs for Competitive Power Ventures Inc. The firm operates three active natural gas-fired power plans in PJM and in February, announced a 150-MW solar project in Pennsylvania.

"As RGGI expands, the issues of leakage and scale benefit a broader regional approach," Rumsey said in an interview. "I hope [the study] opens people's eyes that you've got a large group of fossil generators saying, 'Put a price on carbon.'"