| The market for sustainability funds is consolidating amid regulatory and political pressures, but energy transition investments are set to continue. |

The coming energy policy shift under President-elect Donald Trump and new regulations overseas are prompting investors to be more cautious, but they will likely have a limited impact on the sustainable investment market in 2025 and beyond, analysts and financial firms predicted.

Funds seeking to capitalize on energy transition opportunities while hedging climate-related risks face market uncertainty in the US. Those with operations in Europe must also contend with stricter taxonomy regulations for any investments with an environmental, social and governance label.

Such pressures will accelerate closures and consolidations of ESG funds globally, Hortense Bioy, head of sustainable investing research for Morningstar, said in an interview.

Bioy and other experts who spoke with S&P Global Commodity Insights said investors are not abandoning strategies they have been fine-tuning for several years. The market will also continue to respond to real-world economics that extend beyond Washington politics, they predicted.

"Renewables are now cheaper than fossil fuel, and the money is going to flow where it makes sense to invest and where you can make money," Bioy said.

Morningstar, a financial services firm, uses the ESG and sustainability terms interchangeably in its fund research, as do many other industry players.

Beyond labels and taxonomy, however, larger economic trends are pushing companies in new directions, investors said.

Cost-conscious corporate executives will continue to adopt technologies that make their businesses more energy-efficient and resilient, said Charlie Donovan, principal economist with Impax Asset Management Group PLC, a UK-based sustainability-focused firm with about $41.8 billion in managed assets.

"Fundamentally, what we're talking about are trends that are global in nature … and that really work toward an economic logic around resilience and operational efficiency — more so than trying to [worry about] who's in the White House," Donovan said.

Fewer funds

ESG funds have lost ground in the US in the last year following a backlash from Republican lawmakers who enforced new laws and litigated against financial firms perceived to oppose fossil fuel industries and conservative social values. High interest rates have also hampered investments in renewable energy projects at the same time as regulators on both sides of the Atlantic have cracked down on greenwashing in the ESG investment market.

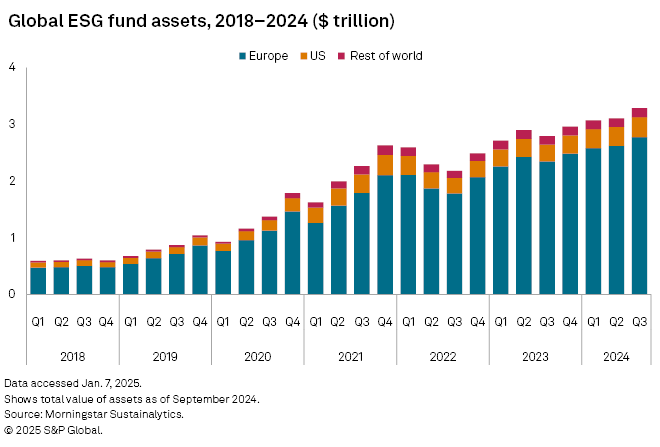

At the end of September 2024, the US had 595 ESG funds, down from 647 at the beginning of 2024, according to Morningstar. At the same time, the total value of ESG fund assets continued to grow in 2024, albeit at a slower pace than at the start of the decade.

The US market for investments with a sustainability or ESG label stood at $6.5 trillion by the end of 2024 based on public disclosures, according to the US SIF Foundation. The group advocates on behalf of investor members with $5 trillion in combined assets under management.

A 2024 US SIF member survey capturing 265 institutions found that 73% expected the market to grow over the next couple of years. However, only 39% thought their own organization would increase sustainable investing, reflecting "more subdued" market enthusiasm possibly due to political pushback, the report said. The survey covered asset managers, institutional investors, wealth managers and others in the sustainable investment space.

Higher investment standards

Another survey of institutional investors by Schroder Investment Management North America Inc. found that 77% of North American firms are investing in the energy transition or plan to do so within the next two years. The report published in November 2024 included 300 North American investors.

At the same time, investors are becoming more careful about how they market and communicate such investments.

"What we've seen for the past two years is a period of self-reflection, which … is something that needed to happen," said Maria Lettini, US SIF Foundation's CEO. "I think organizations, down to the portfolio management level, are really beginning to think about what the specific ESG strategies are for their different products and what benchmarks they're using to showcase performance. I think we're being held to a higher and slightly different standard."

The market for sustainability- and ESG-focused investments is maturing as better data becomes available and practices evolve, added Sireen Hajj, US SIF Foundation's director of investor outreach.

Investors are asking themselves, "Why am I doing this? Am I focusing on risk? Am I looking at opportunity? Am I tailoring particular products? What is the data that I have … to do this in the best way possible?" Hajj said. "There is definitely this drive to be more careful and more nuanced, given where the market is right now in terms of the reporting and the data."

ESG stock index staying strong

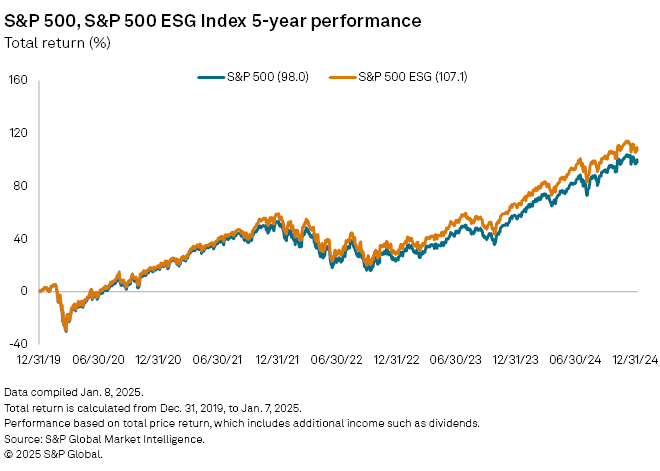

Thus far, the focus on ESG and sustainability has not affected stock performance. The S&P 500 ESG index continues to slightly outperform the parent index. The ESG index was launched in 2019 to measure the performance of securities meeting certain sustainability criteria while maintaining similar overall industry group weights as the S&P 500.

Recent analysis from S&P Dow Jones Indices found that companies excelling in areas such as human capital development and talent attraction and retention contributed to the outperformance of the ESG index over the last five years.

The S&P 500 ESG index is not designed to improve such social criteria scores. "But within the overall aggregate ESG scoring framework, social criteria contributed positively to the relative performance of the index," said Maya Beyhan, global sustainability lead within the company's index investment strategy group and author of the report.

Wanted: Climate risk experience

Investment firms with a sustainability focus are also drilling deeper to make sure they place their money wisely. Impax, for example, has been in talks with US electric utilities since 2021 on how they are preparing for extreme weather and risks exacerbated by the warming climate.

Impax found that companies that have already been exposed to climate risks — such as the wildfire disasters that struck Xcel Energy Inc. and Hawaiian Electric Industries Inc. in recent years — offer the best opportunity for investors trying to manage such risks, Donovan said.

"I want to know that they have a real handle on issues related to climate change … that had a demonstrable, and not just a hypothetical, potential impact on the value of that firm," Donovan said.

Power companies that are shifting their long-term planning and capital expenditures to try to reach a 2050 net-zero target can bring better value for investors because their resource portfolios become more diverse and therefore less risky, Donovan said. He added that for Impax, it is more about the "here and now."

As an investor, Impax wants to know if companies today can navigate multibillion-dollar losses associated with an accident, crisis or other exposure, he said.

"Companies that are moving in that direction have an awareness of the social and environmental context in which they operate," Donovan said. "We just feel they have a much better potential to deliver shareholder returns over time."

S&P Dow Jones Indices and S&P Global Market Intelligence are divisions of S&P Global Inc.