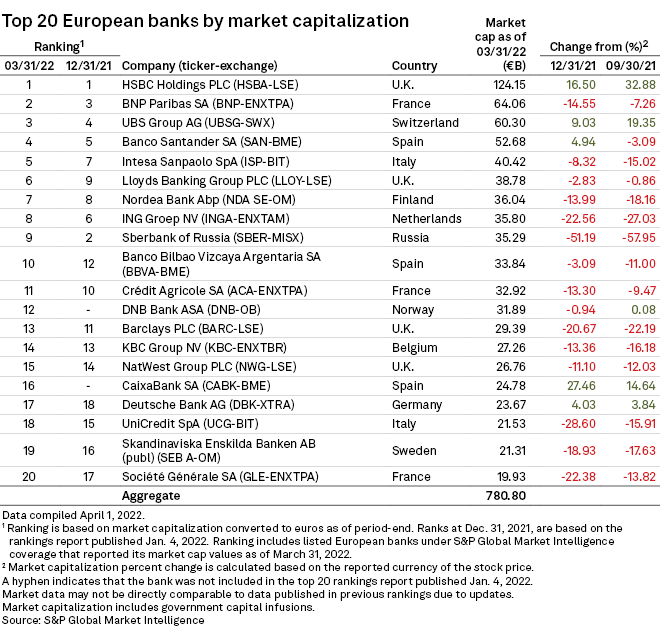

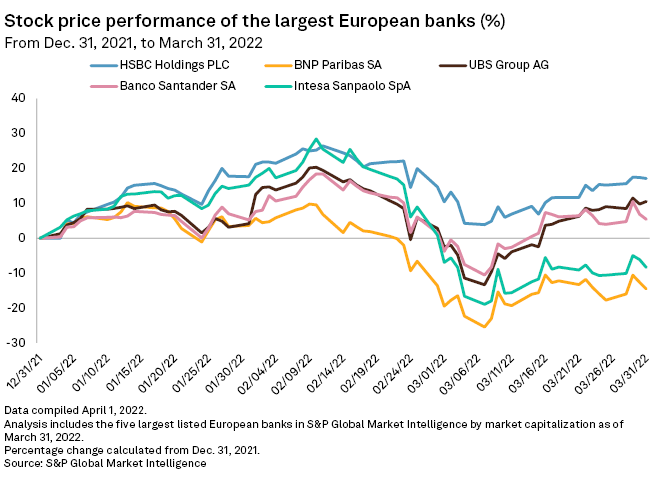

Fifteen of Europe's 20 largest banks saw the value of their shares decline in the first quarter as Russia's invasion of Ukraine triggered a sell-off in the period, according to S&P Global Market Intelligence data.

| For an S&P Global Market Intelligence ranking of Middle Eastern and African banks by market capitalization, click here. |

Losers, gainers

Russian government-owned Sberbank of Russia suffered the steepest decline, losing more than half of its value in the three months to March 31. The sanctions-hit bank fell seven notches to ninth in the ranking.

France-based Société Générale SA and Italy's UniCredit SpA, which have exposure to Russia, saw double-digit declines in their market cap of 22.38% and 28.60%, respectively, to place 20th and 18th in the ranking. The market caps of Dutch bank ING Groep NV, U.K.-based Barclays PLC and Sweden-based Skandinaviska Enskilda Banken AB (publ) fell 22.56%, 20.67% and 18.93%, respectively.

Only U.K.-based HSBC Holdings PLC, Swiss bank UBS Group AG, Spain-based Banco Santander SA and CaixaBank SA, and Germany's Deutsche Bank AG saw increases in their market cap. CaixaBank registered the highest increase in valuation, of 27.46%, and re-entered the list to place 16th.

Top 5

HSBC, the top bank in previous periods, saw its market cap increase to €124.15 billion, up 16.50% from 2021-end. BNP Paribas SA rose one notch to place second despite its market cap falling 14.55%, while UBS' rose 9.03%, pushing the bank up one notch to third place.

Santander climbed to fourth spot from fifth at 2021-end as its market cap grew by 4.94%. Rounding out the top five was Italy-based Intesa Sanpaolo SpA, which rose two notches despite a 8.32% fall in its market cap.

Absent from the list was Credit Suisse Group AG, which ranked 19th as of 2021-end. The Zurich-based bank, which is still reeling from costly scandals in 2021, is subject to a U.S. inquiry looking into the bank's compliance with sanctions against Russia.