The US wind industry is on high alert after President Donald Trump issued an executive order halting offshore leasing in federal waters and pausing both offshore and onshore permits, approvals and loans pending US Interior Department review.

Though industry experts expected the incoming administration to block future offshore wind development and potentially rescind past lease sales and project approvals, the expansion into onshore wind "has the potential to catch the US power sector by surprise especially since it targets the few areas where federal authority can impede projects," Peter Gardett, head of energy transition research at financial services platform Karbone, wrote in a Jan. 21 note to clients.

"States' regional coordinating bodies and independent agencies have more direct say over power project construction — and even most of the interconnection and market access — that onshore wind projects require to energize, [which appears] to insulate the onshore wind sector from the likelihood of White House intervention," Gardett said.

Mona Dajani, global co-chair of energy, infrastructure and hydrogen at Baker Botts LLP, noted in an interview that only about 2% of US onshore wind power is located on public lands.

"The government cannot proactively interfere with private enterprise or private land, and we're assuming that fundamental premise of free economy will not be significantly undermined," Dajani said.

In a Jan. 20 statement, the American Clean Power Association (ACP) adamantly opposed any potential federal intervention in projects sited on private land.

"The possibility that the federal government could seek to actively oppose energy production by American companies on private land is at odds with our nation's character as well as our national interests," ACP CEO Jason Grumet said.

Karbone's Gardett similarly emphasized that the executive order "weaponizes environmental and economic policy with the aim of creating new obstacles for onshore wind power."

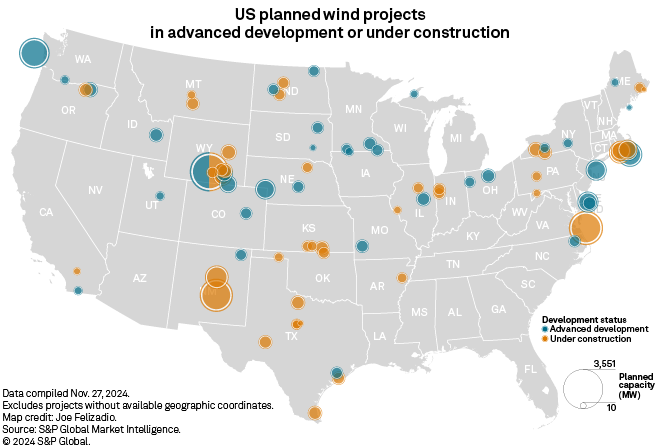

Wind is the largest source of renewable energy in the US, and developers have extensive plans to continue installations over the next several years.

The Trump administration review will consider the environmental impacts of onshore and offshore wind, as well as "the economic costs associated with the intermittent generation of electricity and the effect of subsidies on the viability of the wind industry," according to the order.

Additionally, the order specifically imposes a temporary moratorium on LS Power Development LLC subsidiary Magic Valley Energy LLC's Lava Ridge Wind Project in Idaho on the grounds that the final environmental impact statement "is allegedly contrary to the public interest and suffers from legal deficiencies."

The Interior Department gave final approval in December 2024 to what had been proposed as one of the largest onshore wind farms in the country but reduced the number of turbines allowed by nearly half.

LS Power did not respond to requests for comment about the executive order.

Heightened offshore wind risks

Analysts at both Jefferies and consulting firm ClearView Energy Partners highlighted the order's negative impacts on the offshore wind sector.

"The [executive order] expressly states that the administration may terminate or amend existing wind energy leases, and we think there may be sufficient authority to do so," Timothy Fox, ClearView power sector managing director, wrote in an email. "It also directs departments to complete a 'comprehensive review' of lease sales and project permits, which could seek to justify such an action."

Baker Botts' Dajani agreed that the language providing for a comprehensive review "strongly suggests ... that there may be sufficient authority" to undo leases issued and permitted under the Biden administration.

Reviewing existing leases would specifically present a "critical new risk to monitor" for developers such as Eversource Energy, Dominion Energy Inc. and Ørsted A/S, Jefferies told clients Jan. 21.

Eversource may still be exposed to offshore wind volatility related to the executive order, even after it divested from offshore wind in 2024 to focus on becoming a pure-play utility.

The company still has "critical exposure on Revolution Wind construction," which could lead to Eversource issuing further equity, Jefferies warned. Eversource received $375 million less than the anticipated $1.12 billion in gross proceeds it expected from the sale of stakes in the 132-MW South Fork Offshore Wind Project and 700-MW Revolution Wind Offshore project.

Ørsted also faces challenges to its US offshore wind portfolio. The Danish wind developer booked an impairment of 12.1 billion Danish kroner in the fourth quarter of 2024 as financial and operational challenges deepened.

Increases in long-dated US interest rates during the final quarter of last year hit the value of Ørsted's US portfolio, especially offshore wind projects, prompting the company to book an impairment of 4.3 billion kroner. The value of seabed leases in New Jersey, Maryland and Delaware were revised down due to market uncertainties, adding 3.5 billion kroner in impairments.

Dominion unfazed

Dominion, meanwhile, took Trump's executive order in stride. The company is building the largest offshore wind facility in the country off the coast of Virginia and believes the 2.6-GW project will finish on time despite the presidential action.

"We're confident [the Coastal Virginia Offshore Wind project] will be completed on time and that Virginia's clean energy transition will continue with bipartisan support for many years to come," said Dominion spokesperson Jeremy Slayton in response to the executive order.

Jefferies does not see a capital recovery risk for the project since it operates on an annual regulatory recovery schedule, but the executive order still "raises the question of prudency on further investments" if action is taken on the lease.

Another project that could end up in the administration's crosshairs is the 2,400-MW SouthCoast Wind Energy Offshore Project under development by EDP SA and Engie SA, which received final approval from the Bureau of Ocean Energy Management at the end of 2024.

Environmental groups expressed dismay with President Trump's freeze on new offshore wind leases. In a Jan. 20 statement, Sierra Club Deputy Legislative Director for Clean Energy and Electrification Xavier Boatright promised that the environmental advocacy group "will fight back against this callous decision."

ACP's Grumet added that the order contradicts another executive order declaring a national energy emergency.

"The contradiction between the energy-focused executive orders is stark: while on one hand the administration seeks to reduce bureaucracy and unleash energy production, on the other it increases bureaucratic barriers, undermining domestic energy development and harming American businesses and workers," Grumet said.

When it comes to the industry itself, companies are still primarily in due diligence mode.

"All the onshore and offshore wind clients I have are evaluating right now what to do, but most of them are trying to figure out whether they want to work within the confines [of the order] or vote with their feet and move out of the US," Baker Botts' Dajani said.

As of Jan. 21, US$1 was equivalent to 7.16 Danish kroner.