During the upcoming earnings season, U.S. banks will likely report the hottest loan growth since the beginning of the pandemic, but the spike in interest rates and faltering economic momentum are raising concerns about the outlook for the rest of the year.

"There are lots of investor questions regarding the sustainability of the strong loan growth," Piper Sandler analyst R. Scott Siefers said, adding that banks are likely to be candid about the shift in the macroeconomic environment over the last three months. "There very well could be more of a notion of, 'Hey, we're sticking to our guidance, but it's probably going to be pretty front-loaded in the first half of the year, whereas we're bracing for perhaps some weaker trends the further out we get.'"

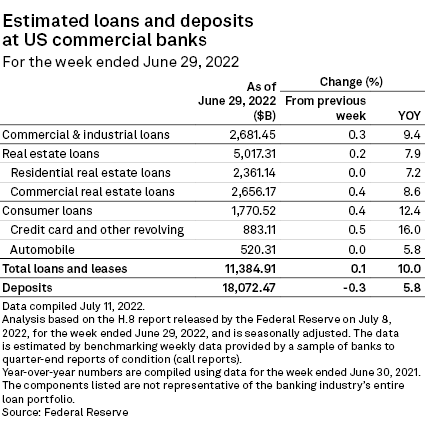

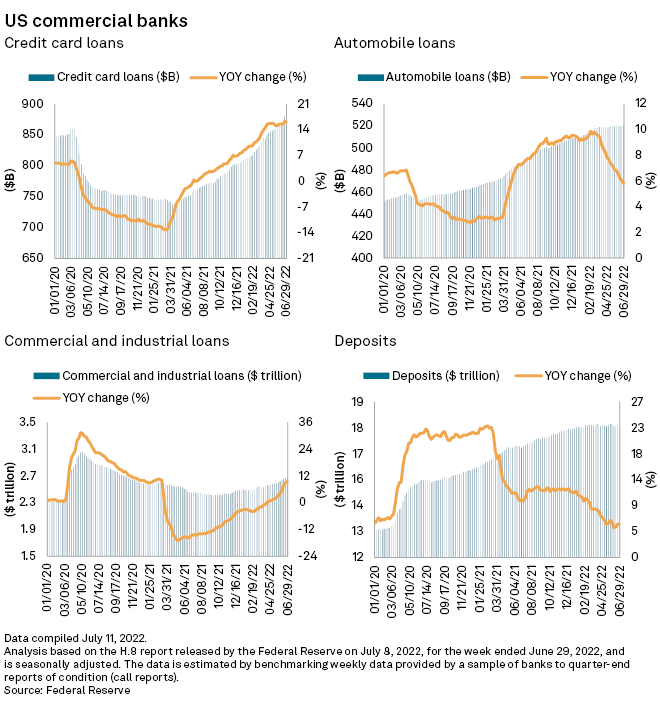

Total commercial bank loans increased 3.7% to $11.385 trillion from March 30 through June 29, according to seasonally adjusted data from the Federal Reserve, building on a strong 2021 fourth quarter and continued momentum in the first quarter this year. The growth in the second quarter this year continued to be broad based, with commercial and industrial loans up 6.0% to $2.681 trillion from March 30 through June 29, and consumer loans up 2.8% to $1.771 trillion.

Banks were largely positive on the lending outlook in investor presentations in June, with Bank of America Corp. citing factors like recovering business credit line utilization rates and PNC Financial Services Group Inc. saying its commercial loan growth had been a little stronger than expected. PNC is among the first banks to release earnings, as it is scheduled to report July 15, one day after JPMorgan Chase & Co. is set to report. BofA is scheduled to report July 18.

|

Guidance from banks has pointed to "accelerating loan growth throughout 2022," analysts at Raymond James said in a note July 7. But rate hikes that slow the economy could weigh down lending in the second half of the year and 2023.

"We do not anticipate much in the way of change to growth outlooks on [second-quarter] earnings calls, but we are somewhat concerned that the more aggressive pace of Fed hikes could be pulling forward demand to some extent," the Raymond James analysts said. They added that banks posting outsized loan growth are likely to prompt investor questions about underwriting in a weakening economy.

Banks also may be benefiting from a reversal in bond market conditions as rates and credit spreads have jumped — formerly easy access to capital market funding put pressure on bank lending for much of the pandemic.

"Because capital markets volumes fell quite dramatically and spreads widened out, some borrowers turned back to their banks for loans," said David Fanger, a senior vice president at Moody's. "That's probably good in the sense that [it's] unlikely the banks are significantly weakening their underwriting standards at this point in the cycle," and instead are capturing borrowing on their balance sheets that would have gone elsewhere in previous quarters.

"The capital markets essentially being shut down for issuance purpose has probably helped commercial loan growth," Piper Sandler analyst Jeff Harte concurred. He added that a deceleration in consumer spending growth could eventually blunt growth in credit card borrowing and that weakening CEO confidence is a signal that commercial demand could erode.

In June, Wells Fargo & Co. said it expected loan growth to slow down as the Fed hikes interest rates and that the bank will protect itself as stressed borrowers seek additional funds. Wells Fargo is scheduled to report earnings July 15.

|

|

* |

Download a tear sheet to run a stress test on banks and thrifts.

* Download a template to generate a bank's regulatory profile.

* Download a template to compare a bank's financials to industry aggregate totals.

On the deposit side, outflows have emerged, with total commercial bank deposits down 0.1% after seasonal adjustment to $18.072 trillion from March 30 through June 29, and down 1.5% without seasonal adjustment.

Analysts fear that rapid rate hikes by the Fed could force up deposit costs faster than expected, with deposit outflows simultaneously hurting net interest income by holding back the size of balance sheets.

Indeed, seasonally adjusted assets were up just 0.8% to $22.842 trillion from March 30 through June 29, and the rapid loan growth squeezed other asset categories. Cash was down 6.4%, or $232.30 billion, to $3.400 trillion, and securities portfolios were down 0.6%, or $32.80 billion, to $5.792 trillion.

While higher interest rates have made securities purchases more attractive, banks have been cautious over uncertainties about how much liquidity they have to deploy under different deposit flow scenarios. Higher rates have also hurt the value of banks' bond portfolios, restraining their capital capacity.