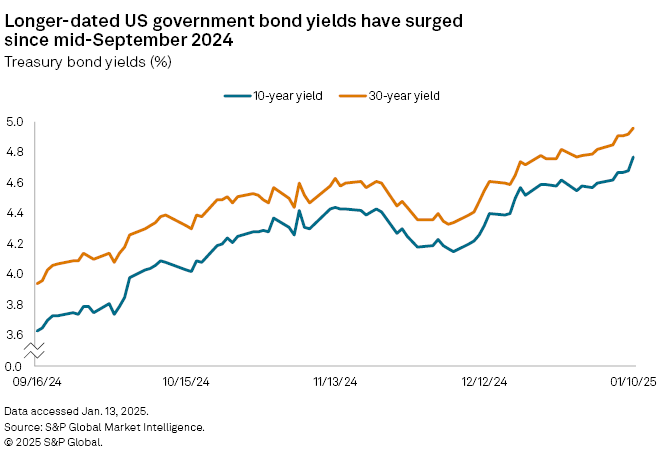

The benchmark US government bond yield has surged more than 110 basis points since mid-September last year as expected interest rate cuts have been upended by persistent inflation and concerns about the incoming administration's trade policies.

The 10-year yield settled at 4.77% on Jan. 10, its highest settlement since Nov. 1, 2023. The 30-year Treasury yield has jumped 102 bps since the middle of September 2024, settling at 4.96% on Jan. 10.

With inflation rising toward 3% annual growth, rather than falling toward the Federal Reserve's 2% growth target, Fed officials have lowered their expectations for rate cuts this year, largely pushing up bond yields, which move opposite prices. With President-elect Donald Trump expected to push forward aggressive tariffs and other policies likely to raise domestic prices, the surge in bond yields is likely to persist, said Padhraic Garvey, regional head of research, Americas at ING.

"Based off this, there is no material reason for the 10-year Treasury yield to fall," Garvey said.

Potentially, the only thing keeping the 10-year yield from jumping above 5% would be weaker employment data, lower inflation readings and, possibly, the incoming Trump administration lessening the reach of its tariff plans, said Kathy Jones, chief fixed income strategist with the Schwab Center for Financial Research.

"Those are relatively large 'ifs' but the move up in yields has been almost without interruption, so some pullback wouldn't be surprising," Jones said.

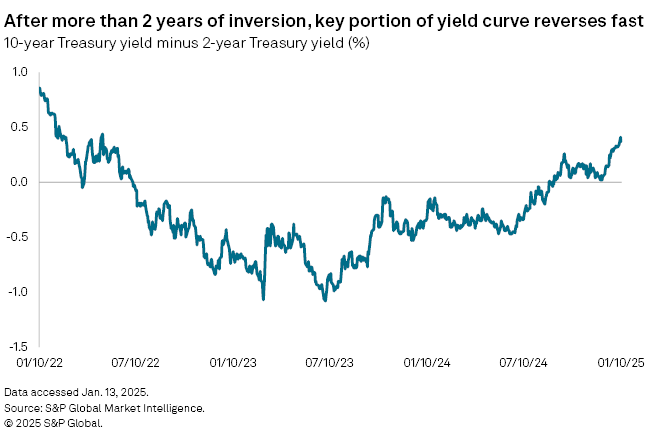

The rise in longer-term yields has caused a significant steepening of the Treasury yield curve, which had been inverted for about 26 months until emerging into positive territory in September. A key portion of the yield curve, the 10-year yield minus the two-year yield, has climbed nearly 40 bps since the start of December.

The move up in longer-term bond yields has been due to a number of factors, including: real growth beating expectations; above target inflation; declining expectations for cuts; less foreign demand for bonds; and Trump policy and nomination views, according to John Luke Tyner, portfolio manager at Aptus Capital Advisors.

For yields to fall, there needs to be some sort of economic stumble, such as significantly weaker employment data, and a substantial drop in risk assets, which Tyner said would need to be more than 10%.

"The problem is the Fed's reaction function were they to overly ease into weakness could create another inflation problem given how strong consumer balance sheets are on top of consumers still having an inflationary present mindset," Tyner said.