Various health insurance stocks in the US were down Dec. 6 as the managed care space reeled from the apparently targeted killing of UnitedHealthcare Inc. CEO Brian Thompson.

Thompson, 50, was shot and killed by an unknown assailant on his way to a UnitedHealth Group Inc. investor conference the morning of Dec. 4 in Manhattan, New York. The shooter has not been located, and the motive remains unknown, according to the New York Police Department.

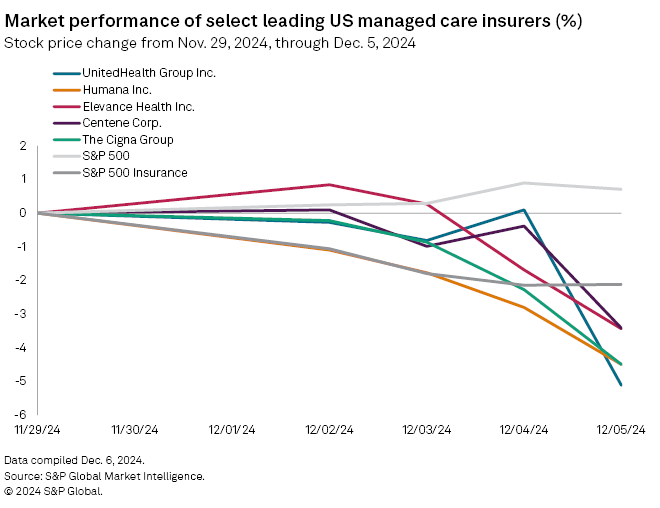

UnitedHealth's stock had initially been in positive territory this week after it released adjusted 2025 earnings-per-share figures. But UnitedHealth's stock fell 5.1% by close of trading Dec. 5 compared with the last of trading in the prior week.

The health insurer's managed care competitors were also down during the same period. The Cigna Group and Humana Inc. both fell 4.5%, while Centene Corp. and Elevance Health Inc. each slid 3.4%.

The S&P 500 and S&P Insurance Index also experienced declines over the same period, falling 2.03% and 2.12%, respectively.

2025 outlook

UnitedHealth quickly ended its investor conference following the news of Thompson's death and issued a statement offering condolences to his friends and family.

"Brian was a highly respected colleague and friend to all who worked with him," the statement reads. "We are working closely with the New York Police Department and ask for your patience and understanding during this difficult time."

UnitedHealth has not announced whether the investor conference will be rescheduled.

Figures released the night prior to the planned conference gave UnitedHealth an initial 2025 adjusted EPS outlook of $29.50 to $30 per share and affirmed the company's 2024 adjusted EPS guidance at $27.50 to $27.75 per share, both above analyst consensus.

In a research note released the night of Dec. 3, Stephens analyst Scott Fidel rated the company "overweight," highlighting the initial 2025 outlook, which he said points to adjusted EPS growth of 7.7% at the midpoint from current 2024 guidance.

Fidel offered an updated research note Dec. 5, first acknowledging Thompson's death, describing it as a terrible tragedy.

"[Thompson] was a highly accomplished executive, but he was also very friendly and carried himself with humility," Fidel wrote. "The managed care investment community is shocked and saddened by this development."

Fidel and his colleagues maintained UnitedHealth's overweight rating but acknowledged that the company's growth strategy for its health benefits business is heavily focused on growing in Medicare and Medicaid.

"This strategy entails both reimbursement and regulatory risk," Fidel wrote. "Increased competition in the Medicare Advantage market represents a risk to UnitedHealth's core business line along with regulatory and reimbursement updates."

In a research note issued ahead of the planned conference, J.P. Morgan analyst Lisa Gill also rated UnitedHealth "overweight," pointing to the strong 2025 estimates.

"We note that 2025 guidance mix possesses some differences vs consensus expectations, with notable elements including: stronger than anticipated revenue growth coupled with higher than expected [medical loss ratio], better than expected [selling, general and administrative expenses, and higher investment income, among other areas," Gill wrote.