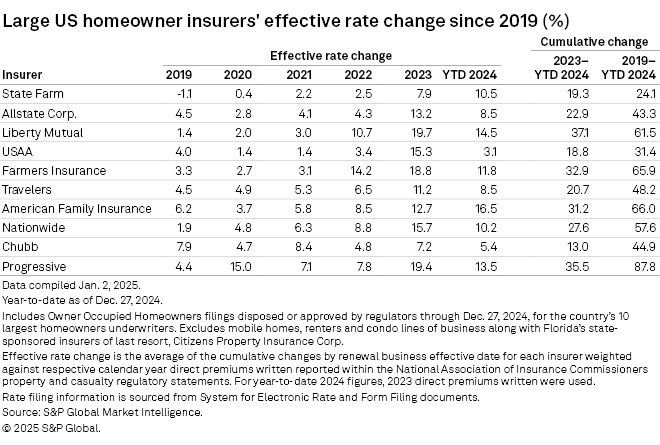

US homeowners insurers have hiked premium rates by double-digits over the past two years, according to S&P Global Market Intelligence's RateWatch application.

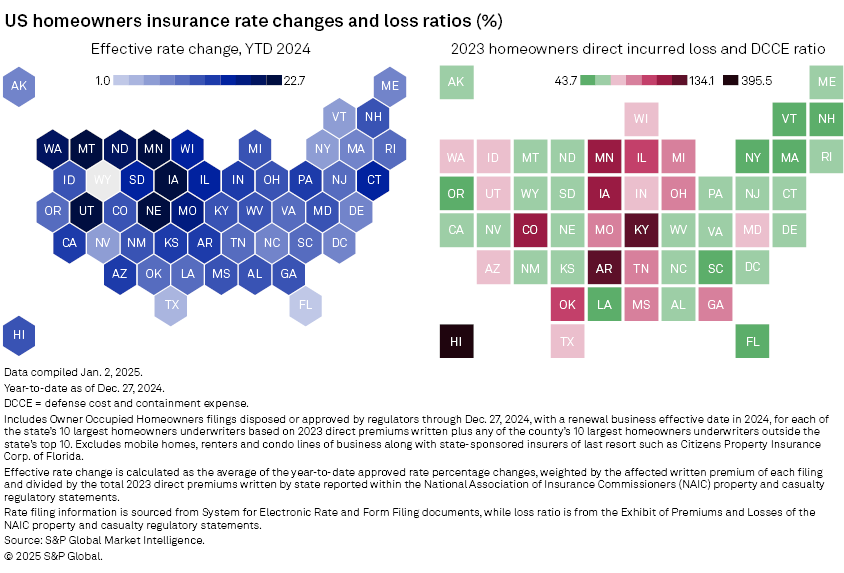

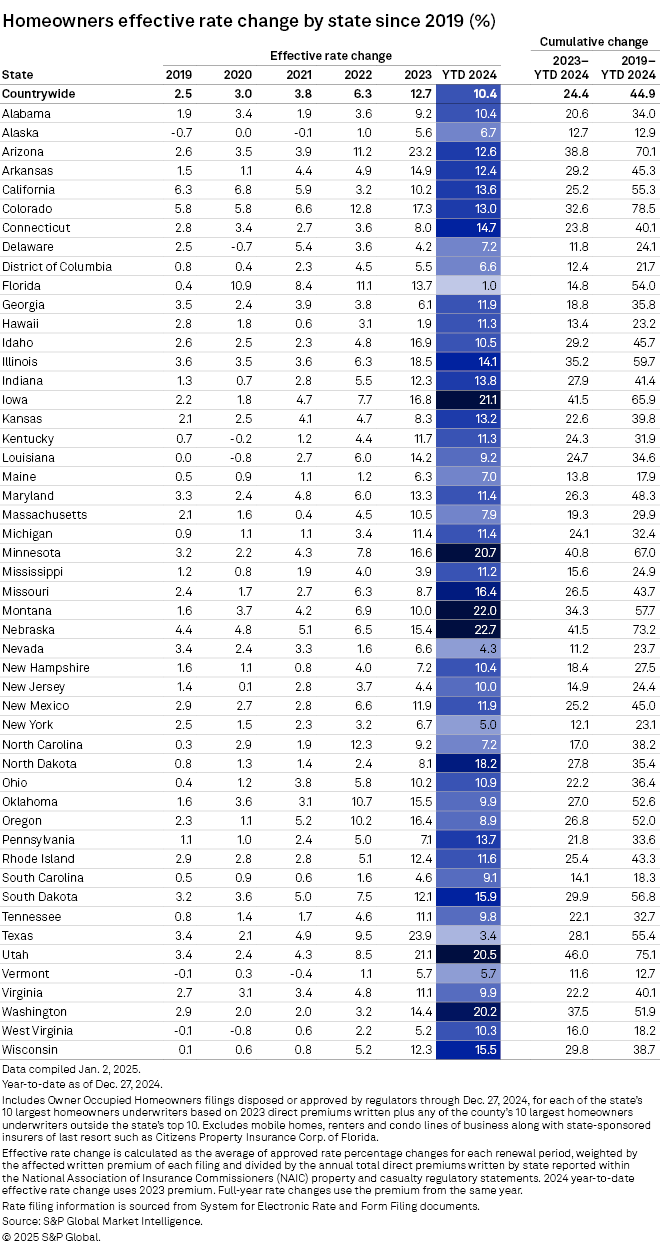

Based on approved filings through Dec. 27, 2024, the national calculated weighted average effective rate increase for homeowners insurance was 10.4% last year. That uptick followed a 12.7% rise in the previous year. In total, 33 states had double-digit calculated effective rate increases in 2024, with the largest calculated increase occurring in Nebraska at 22.7%.

Five other states reflected premiums rising by more than 20% in 2024: Montana, Iowa, Minnesota, Utah and Washington.

The rate information is sourced from disposed owner-occupied homeowner rate filings collected by S&P Global Market Intelligence that are submitted to the Department of Insurance in various states. The analysis is limited to rate filings of each state's 10 largest homeowner underwriters based on 2023 direct premiums written plus any of the country's 10 largest homeowner underwriters outside the state's top 10, excluding state-backed insurers of last resort like Citizens Property Insurance Corp. of Florida.

The effective rate change is the average of the cumulative changes by renewal business effective date for each insurer weighted against respective calendar year direct premiums written reported within the National Association of Insurance Commissioners property and casualty regulatory statements. For year-to-date 2024 figures, 2023 direct premiums written were used. The calculations are based on rate filings entered into the database through Dec. 27, 2024, for 49 states plus the District of Columbia. Wyoming has been excluded as a limited number of rate filings are available within the database.

Read more about S&P Global Market Intelligence's RateWatch.

The states with the lowest calculated weighted average increase in 2024 were Nevada at 4.3%, Texas at 3.4% and Florida at 1.0%. Florida's calculation does not include any changes by Citizens Property Insurance Corp., the state-backed insurer of last resort. Citizens is the largest homeowners underwriter in the Sunshine State and is seeking a statewide average increase of 13.5% on its homeowners multiperil policies that would become effective in 2025.

Overall, the Florida homeowners market has seen improvement following legal reforms in 2023. However, back-to-back costly hurricanes this past year may impede the recovery. According to information collected by the state's regulator, estimated insured losses so far on residential properties are $2.39 billion from Hurricane Milton and $496.8 million Hurricane Helene, with total insured losses equaling $3.62 billion for Milton and $2.08 billion for Helene.

American Family, Liberty Mutual ratchet up rates

Among the country's 10 largest private homeowners insurers, American Family Insurance Group had the largest companywide calculated average effective rate change of 16.5% on its owner-occupied homeowner rate filings approved through Dec. 27, 2024.

The Wisconsin-based insurer boosted rates across 42 states, with a double-digit calculated increases occurring in 32 of them. The insurer's three-largest weighted-average rate increases occurred in Missouri at 30.1%, Illinois at 27.5% and Nebraska at 27.1%.

| – Download a document with the top homeowner insurers' 2024 effective rate change by state. – Download a template to analyze rate filings across select entities, lines of business and states over a selected period. |

Liberty Mutual Holding Co. Inc.'s calculated weighted-average rate change of 14.5% in 2024 was the second largest among the nation's largest homeowners insurers. In total, Liberty Mutual had a double-digit calculated rate increase across 36 states, with the most significant change taking effect in Montana at 44.1%.

The insurer had multiple rate increases in Montana in 2024. The first round of increases for its two largest underwriting units in the state — Safeco Insurance Co. of America with 24.0% and American Economy Insurance Co. with 35.0% — took effect April 22. An additional 13% rate hike applied to both units' renewal business, effective in October.

Liberty Mutual had a calculated rate increase of more than 30% in three other states with Nebraska at 38.3%, Colorado at 32.1% and Washington at 31.4%.

The third-largest companywide calculated average increase belongs to The Progressive Corp. The Ohio-based insurer boosted its homeowners rates by a weighted average of 13.5% during 2024. The increases were spread across 42 states during the year, ranging from 50.8% in Virginia to 1.3% in Nevada.

Three of the remaining 10 largest private homeowners insurers in the US also had a calculated effective rate increase greater than 10% in 2024: Farmers Insurance Group of Cos. with 11.8%, State Farm Mutual Automobile Insurance Co. with 10.5% and Nationwide Mutual Group with 10.2%.

Farmers' 53.5% calculated increase in Maryland was the highest calculated change during the year among the nation's largest homeowners insurers.