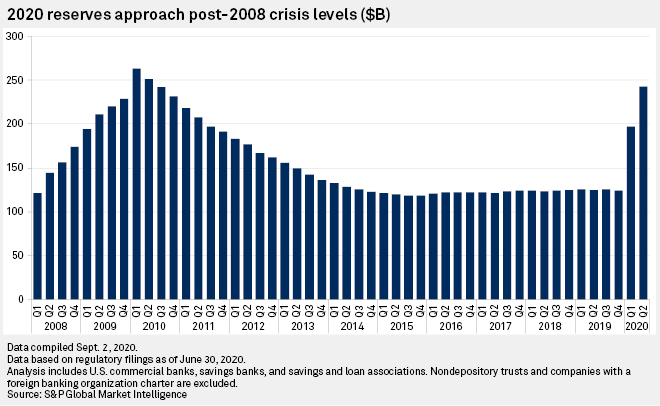

Banks' loan loss reserves approached Great Financial Crisis levels in the second quarter, but analysts are hopeful that the recent drop in deferral rates will enable a similar decline in provisioning.

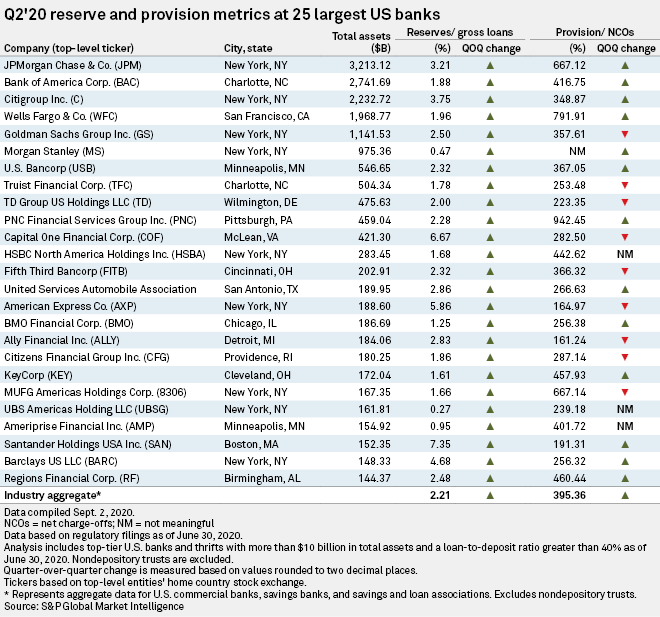

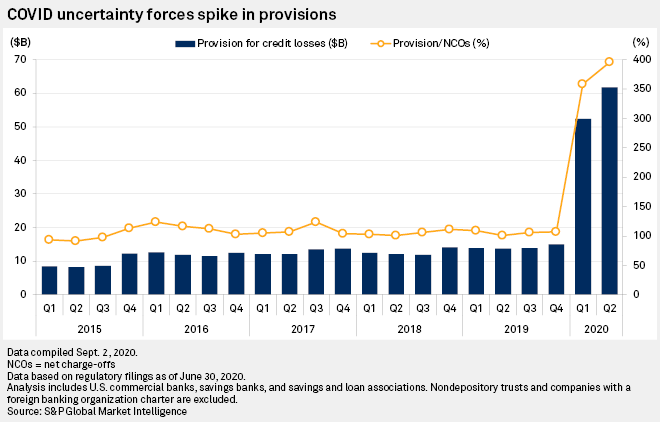

During the second quarter, the banking industry, in aggregate, had loan loss reserves totaling $242.79 billion, only slightly behind the Great Financial Crisis' peak of $263.11 billion in the 2010 first quarter. Quarterly provisioning reached similar levels, with banks setting aside $61.73 billion for credit losses in the quarter, compared to a peak of $71.63 billion in the 2008 fourth quarter.

The COVID-19 recession has notably differed in that banks have yet to realize a significant increase in net charge-offs, which came in at $15.61 billion in the second quarter. That translated to a provision-to-NCO ratio of 395.4%, nearly double the previous peak in the 2008 fourth quarter.

In recent weeks, banks have disclosed deferral rates that analysts have described as encouraging and potentially suggestive that the reserve builds could shrink in quarters to come. Numerous banks reported deferral rates in the single digits compared to peaks in the high-teens or higher.

"Prior reserve calibrations generally assumed a harsher unemployment backdrop. Reserve build should significantly slow/likely end in [the second half]," wrote David George, an analyst for Baird Equity Research in a Sept. 10 report titled: "Q3 Update: Beyond the Peak in Provisioning."

Still, some banks might have a tough time navigating the post-pandemic landscape because deferral rates in certain segments, such as hotels, remain particularly elevated.

For instance, TowneBank reported on Sept. 10 that when excluding Paycheck Protection Program lending, its total-loan deferral rate as of Aug. 20 fell to 6.6%, which was down nearly 70% from April and nearly 50% from mid-July. However, the bank said its seven largest hotel loans were in deferral, and a research report from Keefe Bruyette & Woods analyst Catherine Mealor noted that the company's hotel portfolio still carried a deferral rate of 49%.

"[TowneBank's] deferral trends are in-line to what we've seen reported in recent days/weeks from peers, and we're pleased to see deferrals fall," Mealor said. At the same time, Mealor retained a "market perform" rating on the stock, noting that the bank's allowance for credit losses were below peers' at 1.04% of total loans, excluding PPP.

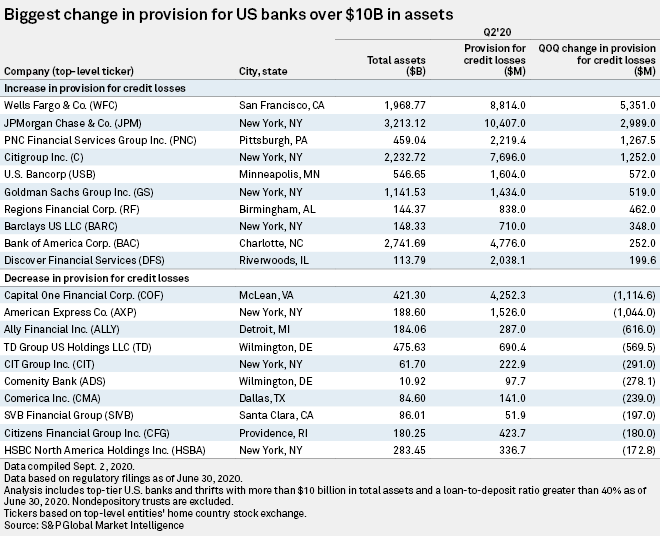

At the end of the second quarter, Wells Fargo & Co. stood out among the largest banks with its reserves at 1.96% of gross loans despite a 792% leap in provisioning on a linked-quarter basis, or a $5.35 billion jump in its provision for credit losses in a single quarter. That was the largest single-quarter increase in provisioning on a nominal basis across the banking industry, yet the bank's 1.96% reserve ratio was still behind the industry aggregate of 2.21%.

Wells Fargo's massive credit costs pushed the bank's earnings into a net loss in the second quarter. In a Sept. 2 rating action, Moody's affirmed the bank's ratings but changed its rating outlook to "negative" from "stable," citing its slower-than-anticipated resolution of risk management issues. The bank remains under an asset cap restriction from the Federal Reserve amid years of governance issues initially stemming from its unauthorized accounts scandal. The costs associated with resolving those issues have restricted the bank's ability to respond to credit deterioration in a flexible manner, Moody's analysts wrote in a Sept. 11 report.

During a Sept. 14 investor conference, Wells Fargo CFO John Shrewsberry said losses have been smaller than expected in some commercial credits. He noted that certain situations involving retailers were challenged because pandemic-related quarantine measures raised questions about the liquidation process.

"That has sort of worked its way through the system, and those outcomes have been better [than] originally forecast," he said according to a transcript.

Shrewsberry added that consumers have been aided by deferrals and stimulus measures, but "it's probably a little too soon" to know if the outcomes will surpass expectations. "We're not anticipating those losses being worse sitting here in the third quarter, but it's hard to know whether they're going to be better," he said.