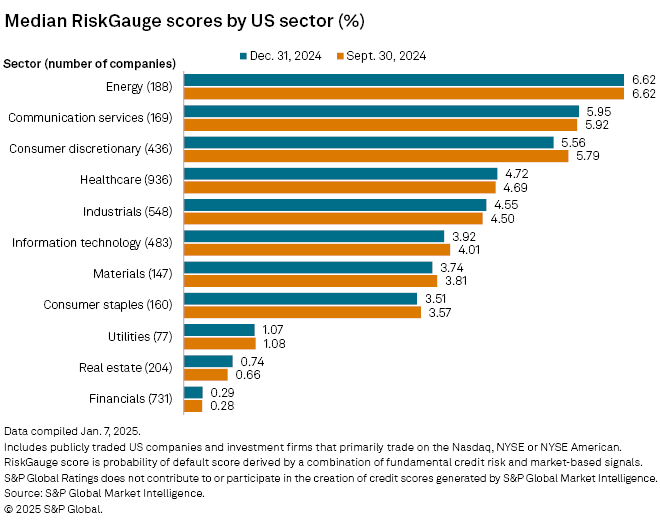

The energy sector recorded the highest median odds of default at the end of 2024 as risk scores were mixed across other sectors, according to data from S&P Global Market Intelligence's RiskGauge model.

The probability of default was 6.62% for the median publicly traded, US-based energy company as of Dec. 31, 2024. The score was unchanged from the end of the third quarter of 2024. Across other sectors, the median probability of default scores fell in five sectors and rose in five others.

RiskGauge scores represent the median odds of default on debt within a year. They are based on financial reports and the volatility of share prices for public companies on major US exchanges, accounting for country- and industry-related risks and other macroeconomic factors.

The 88 US corporate defaults in 2024 as of the end of November slightly trailed the comparable 2023 total of 89, according to data from S&P Global Ratings. Ratings does not contribute to or participate in the generation of Market Intelligence's RiskGauge scores.

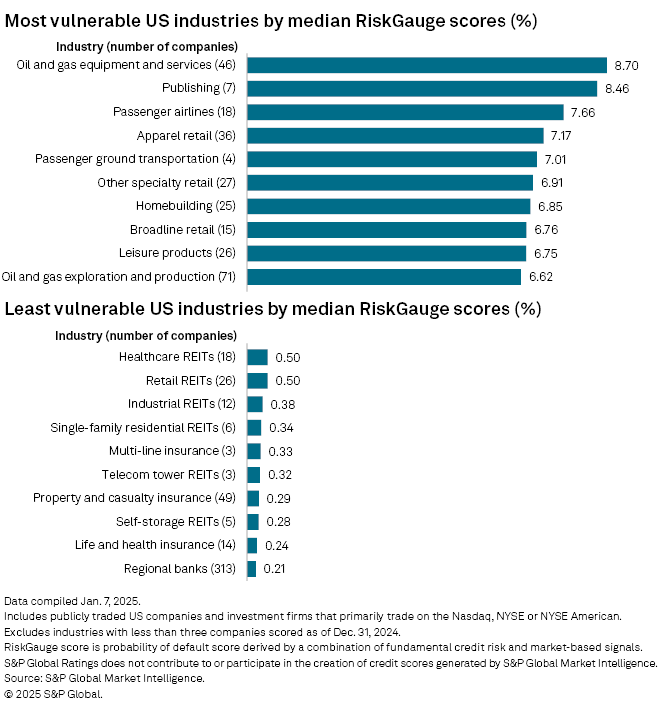

Most, least vulnerable

Oil and gas equipment and services companies and publishers topped the list of the most vulnerable US industries as measured by median probability of default score. Publishers have been among the most vulnerable US industries for at least four straight quarters, according to Market Intelligence data.

Regional banks recorded the lowest median probability of default score among US industries at 0.21%. Scores among the least vulnerable industries rose slightly from the third quarter of 2024.

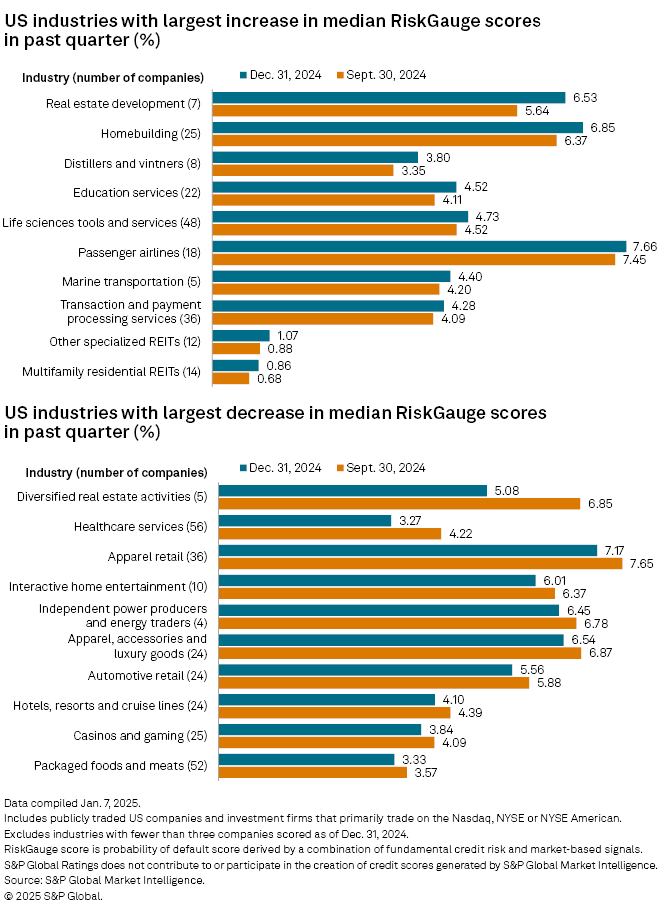

Biggest increases, decreases

The median probability of default score jumped 89 basis points quarter over quarter for real estate development companies, the largest increase for any single US industry during the fourth quarter of 2024. Homebuilding companies recorded the second-highest increase, with the median RiskGauge score rising to 6.85% as of Dec. 31, 2024, from 6.37% three months earlier.

Meanwhile, median default risk fell 177 basis points for diversified real estate activity companies, the largest drop among any single industry. The score for healthcare service companies fell 95 basis points, the second-highest drop among US industries.