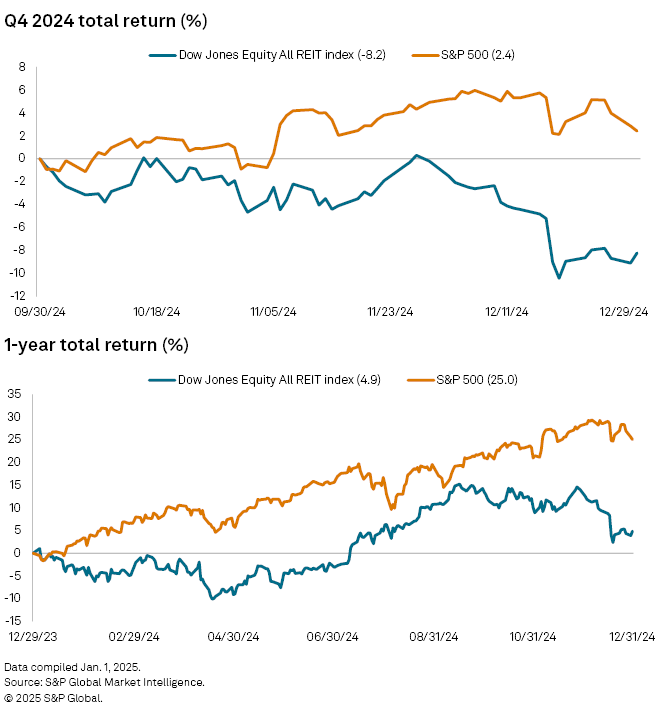

Share prices for US equity real estate investment trust stocks plummeted in the fourth quarter of 2024 after soaring the quarter prior. The Dow Jones Equity All REIT Index closed the final quarter of the year with a negative 8.2% total return, underperforming the S&P 500's positive 2.4% return over the same time period.

The Dow Jones Equity All REIT Index closed full year 2024 with a 4.9% return, vastly below the S&P 500's 25.0% total return.

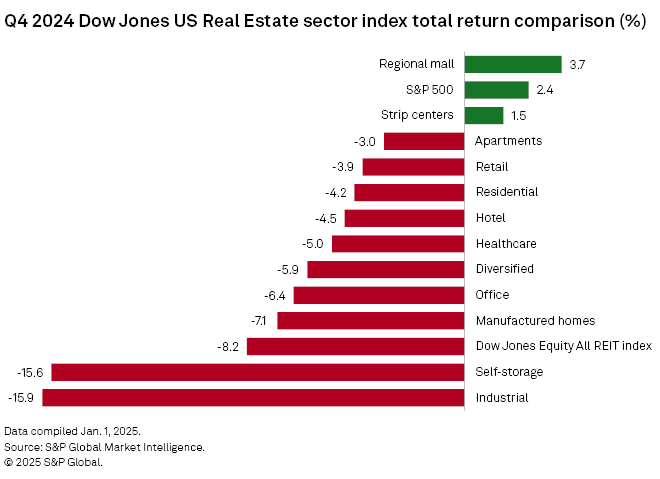

Among the Dow Jones REIT property sector indexes, only the regional mall and strip center indexes closed the fourth quarter of 2024 in the black, with returns of 3.7% and 1.5%, respectively. On the other end, the industrial REIT index closed the quarter with the lowest return, at negative 15.9%, followed by the self-storage REIT index with a return of negative 15.6%.

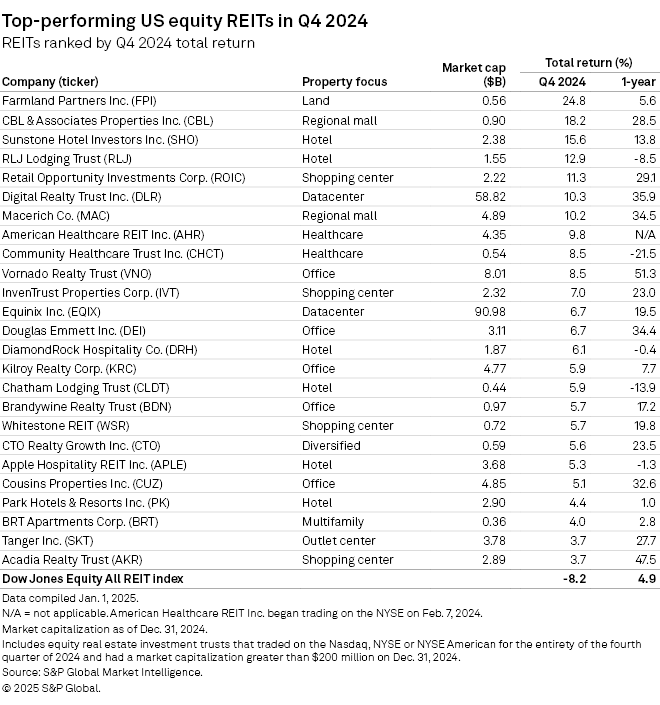

Top-performing REITs

Farmland REIT Farmland Partners Inc. was the top-performing REIT stock above $200 million in market capitalization during the fourth quarter of 2024 with a total return of 24.8%. Farmland Partners' share price rose significantly during the week following its third-quarter earnings release on Oct. 30, 2024, when the REIT reported adjusted funds from operations of $1.4 million, or 3 cents per share, compared to a loss of $465,000 for the same period in 2023.

Regional mall REIT CBL & Associates Properties Inc. ranked second with a total return of 18.2% for the fourth quarter, followed by hotel REIT Sunstone Hotel Investors Inc. with a 15.6% return.

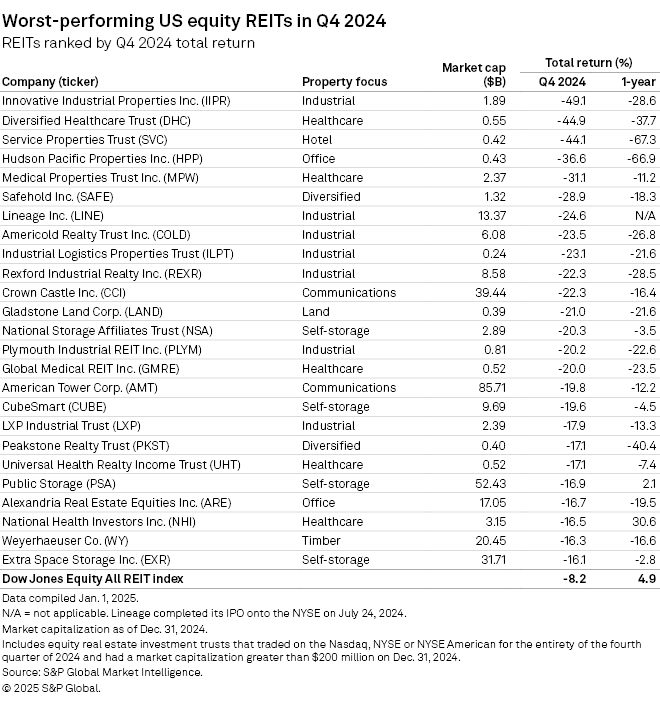

Bottom-performing REITs

Innovative Industrial Properties Inc. ranked as the worst-performing REIT stock during the quarter, with a return of negative 49.1%. The share price of the cannabis-oriented REIT plummeted in the latter half of December 2024 after PharmaCann Inc., its largest tenant by rental revenue, defaulted on its rent obligations for December under six of the 11 leases with Innovative Industrial Properties.

Healthcare REIT Diversified Healthcare Trust's share price also tanked during the fourth quarter of 2024, ending with a return of negative 44.9%. The large share price drop for the REIT followed mixed results in its third-quarter 2024 earnings release on Nov. 4, 2024. While net operating income for the REIT's consolidated senior housing portfolio increased 32.6% year over year, net operating income for its medical office and life science segment was down 4.9% over the same period.

Hotel REIT Service Properties Trust followed next with a return of negative 44.1% for the quarter.