Shares in Voya Financial Inc. took a tumble this week after the company announced its medical stop-loss line of business would have a higher loss ratio for 2024 than previously predicted.

The New York-based life and health insurer had reported an estimated full-year loss ratio of 86% for medical stop-loss in its third-quarter earnings presentation, citing higher-than-expected claims activity and an underestimation in pricing for the line.

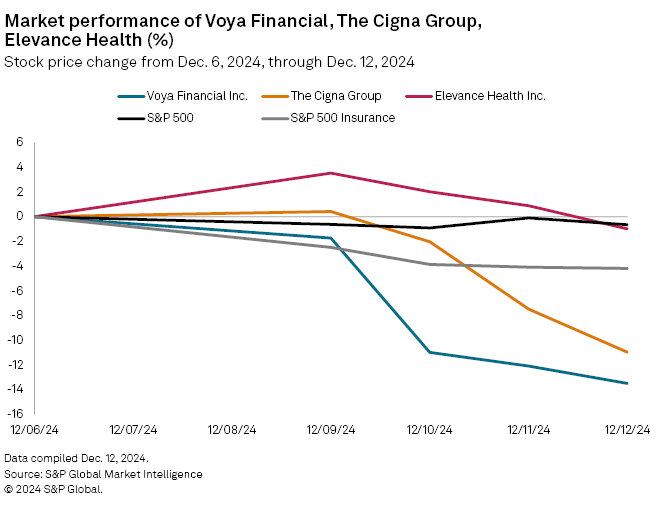

What followed was an 11.1% decrease in its stock by market close Dec. 10. Voya was down 13.49% at the close of trading Dec. 12. The Cigna Group and Elevance Health Inc., which also offer medical stop-loss coverage, were down 11% and 1%, respectively over the same period. The S&P 500 Insurance Index fell 4.19% while the S&P 500 was down 0.64%.

The increased frequency was at the root of the downturn in Voya's stock, said Piper Sandler analyst John Barnidge.

"On Sept. 30, they had roughly one-third of its 2024 policy renewal information in," Barnidge said in an interview. "Now they have 60% of policy renewal information in, and there's been adverse development in that additional 27 [percentage points] such that they had to move their guide for the full year stop loss ratio."

Stop-loss insurance protects employers that self-fund their employee benefit plans but do not want to assume 100% of the liability for losses arising from the plans. Under a stop-loss policy, the insurer is liable for losses that exceed deductibles.

Voya, which also provides coverage for retirement, investment management services and employee benefits, said in its first-quarter presentation that claims experience develops over time. It can take up to 18 months to fully complete due to lag time between when a claim is incurred and when Voya pays the claim.

The company said in its first quarter presentation that "the loss ratio experience can be volatile from quarter to quarter," but they have resulted in ratios between 77% and 80%. The full-year loss ratio estimate in the first quarter was 77.1%, raised to 83.2% in the second quarter and 86% in the third quarter.

Bank of America Securities analyst Josh Shanker said in a research note that the new full-year loss ratio suggests a ratio of 100% to 160% for the fourth quarter and that the charge "will likely wipe out most of 4Q24 earnings."

"The company will likely have to shed stop-loss business for a year or more while margins run below target levels," said Shanker, who downgraded Voya's stock to Neutral from Buy.

Barnidge said the company will have to slow the adverse activity through pricing or nonrenewal.

"Given that the deterioration has been throughout this year, they're going to have to prove it out with improved results next year," Barnidge said.

A Voya spokesperson said in an emailed response that the company "remains committed to its stop loss business ... and is focused on improving performance."

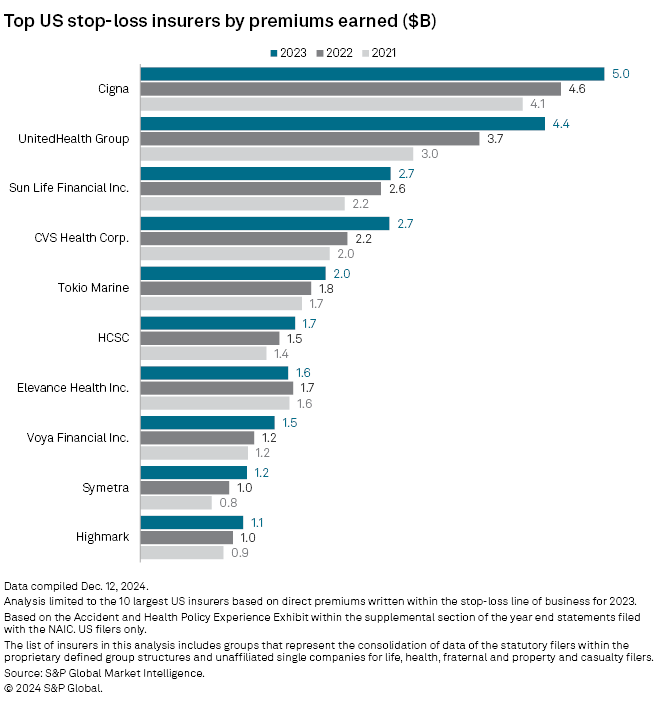

Voya was the eighth-largest stop-loss insurer in 2023 in terms of direct premiums written at $1.5 billion. Cigna is at the top of the list at $5 billion, followed by UnitedHealth Group Inc. at $4.4 billion, Sun Life Financial Inc. and CVS Health Corp. at $2.7 billion, Tokio Marine Holdings Inc. at $2 billion, HCSC at $1.7 billion and Elevance Health at $1.6 billion.

Symetra Financial Corp. at $1.2 billion and Highmark Inc. at $1.1 billion round out the top 10.