Renewable energy capacity contracted by U.S. corporations soared 45% in the past 12 months, epitomizing the energy supply and demand tectonic shifts now magnified by greater energy security concerns. S&P Global Commodity Insights found that all tracked business sectors boosted their green energy portfolio markedly, with increases ranging from 16% to 79%.

Corporate renewables remain on a steep upward trajectory, setting another record for contracted capacity in the past 12 months and shining a light on trends pointing to further momentum.

The implications are manifold. With businesses accounting for half of global electricity usage, the corporate appetite for green energy helps fuel the development of solar and wind projects, strongly contributing to a rising share of renewable energy on the grid. With these mechanics now boosted by the Inflation Reduction Act, a green energy boom appears on the horizon.

Aside from environmental considerations, this evolution could prove strategically critical. As corporations' renewable energy procurements rise, so does their independence from the geopolitics of fossil fuels. With renewables theoretically a deflationary force, businesses at the forefront of the energy transition are building a competitive edge while giving policymakers and central banks a hand in fighting inflation.

As anticipated a year ago, 2022's shifts in international relations, and their associated energy market disturbances, brought energy security considerations to the fore, among other things, highlighting green energy's relative geography independence. Though not entirely location-neutral, renewables projects, once up and running, provide a certain degree of insulation against geopolitical fallouts. That said, in their development phase, they are not immune to sanctions, shipping lane disruptions and other sourcing challenges brought about by international disputes.

For organizations that depend on reliable power, energy security may be more front-of-mind than abstract environmental goals. Whatever the reason, the fact remains that there was a significant ramp-up in green energy procurement by the U.S. corporate world in 2022. Commodity Insights tracked more than 24.5 GW of additional renewable energy capacity contracted by U.S. corporate off-takers, bringing the group's total inventory close to 80 GW. Among notable corporations not identified as U.S. entities, Commodity Insights has tracked an additional 10.5 GW of contracted renewable energy capacity, with nearly 45% of this figure procured by U.S. renewable projects.

Key findings:

* More than 200 tracked new deals inked by U.S. corporate off-takers in the last 12 months.

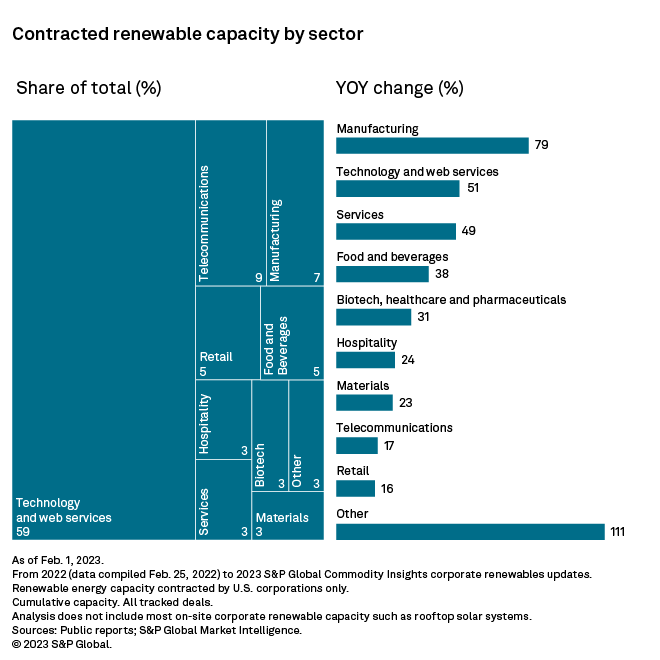

* The technology and web services sector accounts for more than half of the tracked total corporate renewable capacity, but manufacturing logged the largest year-over-year increase.

* Amazon.com Inc. alone freshly contracted more than 8 GW worldwide during the period under review, topping the 20 GW mark overall, or a quarter of the corporate renewable total tracked by S&P Global Commodity Insights.

* The tracked total capacity reflects the global nature of most U.S. corporate off-takers, spanning 26 markets, but the U.S. accounts for about 80% of the total.

The dynamics described above are not expected to abate anytime soon. Corporate renewable energy laggards playing catch-up with the space's leaders will likely translate into sustained green energy dealmaking impetus. Additional policy support would quicken its pace. In 2022, the Inflation Reduction Act had a catalyzing effect on the U.S. green energy space, but policy barriers remain. Our analysis reveals, for example, that corporate off-takers tend to shy away from vertically integrated regulated markets, preferring deregulated ones, where they can more easily procure renewable energy at the source.

In the U.S., Commodity Insights has tracked 450 specific wind and solar projects with known corporate power purchase agreements, or PPAs. Combined with known corporate deals from unannounced projects, over 66 GW of wind and solar capacity is contracted to non-utility off-takers, including capacity from non-U.S.-based corporations. Texas extended its lead in corporate PPA capacity, adding 6,700 MW in this cycle and pushing its statewide total past 20 GW. The top five states remained unchanged from the previous update, apart from Oklahoma leapfrogging Virginia for fourth place.

Internationally, U.S. companies have contracted over 15 GW of additional wind and solar capacity across 26 markets. Despite signs of slowing corporate PPA activity in 2022, over 5 GW of European renewable projects attached to U.S.-based companies were identified over the past year. Mirroring the trend observed domestically, tech leaders Amazon, Microsoft Corp. and Google (Alphabet Inc.) paved the way in Europe, newly signing a combined 3 GW of wind and solar capacity. Microsoft made headlines with 900 MW of wind and solar deals in Ireland, but Pittsburgh-based aluminum manufacturer Alcoa Corp. logged the largest individual agreement after the 400-MW The Rock Wind Farm (Øyfjellet) in Norway came online in the first quarter of 2022.

Click here to access our detailed 2023 corporate renewables update PowerPoint report and Excel companion.

In a move that perhaps signals an emerging market, multiuse paper manufacturer Kimberly-Clark Corp. signed a hydrogen supply agreement in August 2022 with Carlton Power Ltd. from the Barrow Hub in the United Kingdom, which is expected to come online in 2025. Amazon also announced a green hydrogen supply deal in August 2022 with Plug Power Inc. for 10,950 tons of green hydrogen annually, beginning in 2025.

|

The tech industry maintained its dominance in corporate renewable purchases in 2022. The sector's continuously growing appetite for electricity due to expanding data center networks combined with aggressive clean energy commitments clearly outlines the increasing demand for renewable energy deals. Technology and web services companies account for over 59% of the corporate renewable market as of this update, with the top four individual corporate renewable off-takers — Amazon, Google, Meta Platforms Inc. and Microsoft — all falling in this segment.

The telecommunications industry is a distant second at 9%, though the sector's activity is driven largely by just three companies: Verizon Communications Inc., AT&T Inc. and T-Mobile US Inc. Verizon surpassed 3 GW of corporate renewable capacity during this period, adding 690 MW across the U.S. The manufacturing industry, led by General Motors Co., makes up about 7% of corporate renewable capacity, though the segment had the largest percentage increase over the past year, adding 2.6 GW of wind and solar — a 79% jump from the figure in our 2022 update.

Following the sun

Corporate renewable PPAs have been largely in lockstep with overall technology trends in the U.S. in recent years. To date, utility-scale wind capacity has outpaced solar by a roughly 2-to-1 ratio. Similarly, through project online year 2021, operational corporate-tied wind capacity stood at 23 GW compared to 12.9 GW for solar. Thanks to decreasing costs, along with other drivers, the momentum has shifted drastically toward solar: 2021 marked the first year more utility-scale solar was installed than wind, and the gap is only expected to widen. According to Commodity Insights data, three times more solar than wind capacity is projected to be installed through 2025.

Planned U.S. corporate renewable capacity is in alignment with this shift, as corporate-tied projects in development favor solar 20 GW to 7 GW. Among projects due to come online in 2024, solar is expected to officially surpass wind in terms of operating capacity tied to non-utility off-takers, based on currently announced contracts. In 2023, a record 16.3 GW of corporate renewable capacity is expected to come online — three-quarters coming from solar projects. In this update, solar made up 56% of new capacity additions around the globe and over 70% of new corporate contracts in the U.S.

Notable additions include the 514-MW Hecate Energy Frye Solar Project in Texas, developed by Hecate Energy, with Amazon as the sole off-taker. SoftBank Group Corp. subsidiary SB Energy Global Holdings Ltd. signed an agreement with Google for four large solar projects in Texas totaling nearly 1,200 MW. In August 2022, Ford Motor Co. made one of the largest corporate renewable agreements with a utility, buying 650 MW of solar capacity via DTE Energy Co.'s MIGreenPower program.

Battery storage continues to increase its foothold in the corporate renewables market, with storage capacity tied to corporate renewable projects increasing from 2.2 GW to 3.8 GW since the previous update. Over 30 corporate-contracted utility-scale solar and wind projects have proposed storage attached to them, according to Commodity Insights data. Facebook operator Meta Platforms signed two deals in 2022 for large-scale solar-plus-storage projects. The 200-MW Valley Farms Solar Project in Arizona, being developed by NextEra Energy Inc., and the 195-MW Angelo Solar Project in Texas, developed by Apex Clean Energy Inc., have a respective 200 MW and 175.7 MW of proposed colocated battery storage capacity.

For wholesale prices and supply and demand projections, see the S&P Global Market Intelligence Power Forecast.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

Chris Allen Villanueva, Joseph Reyes and Ciaralou Palicpic contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Gain energy intelligence to quantify the value of energy transition for the US power sector

Request Follow Up