The top multichannel groups in the Latin America and Caribbean region lost nearly 2.0 million subscribers in 2021, as the still-mighty cable and direct-to-home regional operators continued to feel the consequences of cord cutting, losing customers to the growing roster of available over-the-top services and other streaming providers. This extended the regional pay TV decline to five years, mostly led by the loss of popularity of satellite options offered by major groups.

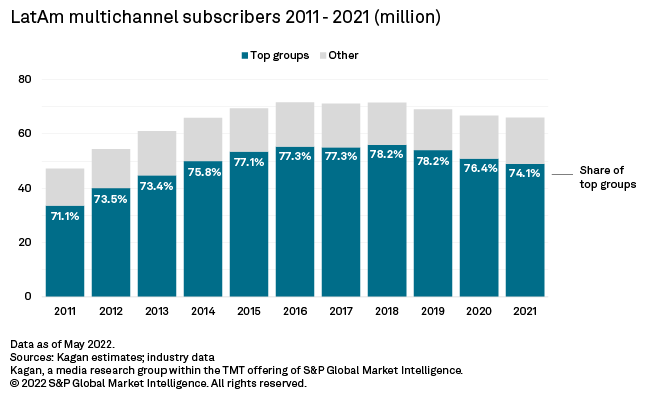

Our most recent research into Latin America's top 11 multichannel and fixed broadband providers — América Móvil, Telefónica, Vrio Corp. (formerly AT&T), Liberty Latin America, Millicom International Cellular, Grupo Televisa, Megacable, Telecom Argentina, Oi, Empresa Nacional de Telecomunicaciones (Entel Chile) and Telecom Italia — showed that the companies ended 2021 with an estimated 48.9 million pay TV customers, showing a 3.9% decline from 2020 or a 2.0 million user drop. The top groups service 74.1% of all multichannel subscribers across the region.

The Take

* Latin America's top 11 multichannel and broadband operators lost 2.0 million pay TV subscribers in 2021, a 3.9% loss year over year, ending at 48.9 million subs.

* Multichannel penetration stood at 35.6% of regional TV households in 2021. The top operators have lost 11.5% of their pay TV customers since the region's multichannel heyday of 2016, outpacing the industry as a whole, which lost 7.8% subscribers during the same time period.

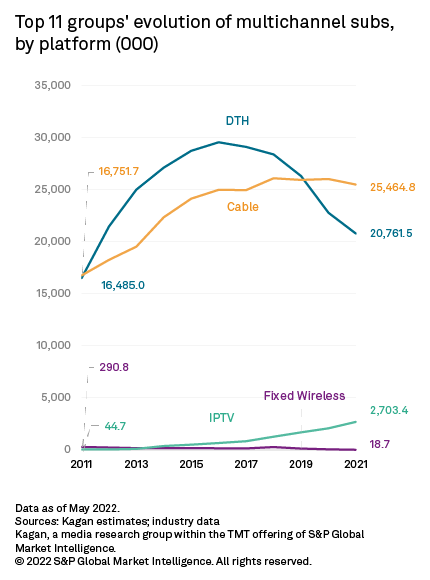

* Accelerated disconnections to DTH services from the top operators have mostly caused the drop, falling 8.8% in 2021 as customers migrated to triple-play options or replaced their subscriptions with broadband to take advantage of streaming or virtual multichannel services. Cable, on the other hand, appears to have stabilized at about 25 million to 26 million subscribers in recent years; IPTV subscriptions are growing apace, but not enough to offset the large drop in DTH.

* Multichannel revenues and average revenues per user remained on a downward trend, with a compound annual growth rate of negative 2.1% and negative 6.7%, respectively, in the last 10 years.

Latin America's multichannel sector expanded at a 3.4% CAGR in the 10 years between 2011 and 2021. However, that growth was concentrated between 2011 and 2016, when the region's pay TV operators expanded from 47.2 million to 71.6 million subscribers. The region has recorded a decline in pay TV customers since 2017, as large segments of the population have chosen to disconnect their pay TV subscriptions in favor of broadband access and the versatility of OTT services, including Netflix Inc., Amazon.com Inc.'s Prime Video and Walt Disney Co.'s Disney+.

Already a client? Please check our Latin America regional forecast table here for total multichannel market data, including projections, and our TMT Geography Knowledge Base here for country-level data.

The top operators in our analysis represented 74.1% of all multichannel subscriptions in the region by 2021 and have remained consistently above 70% of the market share since 2011. Of the top 11 operators, Telecom Italia, which operates only in Brazil, offers no multichannel services and focuses on mobile, broadband and fixed telephony.

DTH continues downward spiral

Satellite pay TV services bore the brunt of the subscriber decline, as the nature of the technology makes it difficult to integrate multiservice platforms such as triple-play bundles, putting it at a disadvantage to more versatile platforms such as cable and IPTV.

The segment — led regionally by Vrio Corp.'s DIRECTV Latin America operations and Televisa's Sky — lost 1.6 million subscribers in 2021 to end the year with 25.2 million users. However, among the top 11 groups surveyed in this article, the loss reached 2.0 million, dropping 8.8% year on year to end at 20.8 million subscribers. About 1.1 million lost subscribers corresponded to Vrio, previously a unit of AT&T`s Latin American operations, sold in 2021 to Argentina-based Werthein Group.

The disconnection of DTH accounts over the years has been accompanied in several countries by the launch of parallel, virtual multichannel services such as Vrio's DIRECTV GO, which already has presence across the region in Argentina, Brazil, Chile, Colombia, Ecuador, Mexico, Peru and Uruguay.

Despite the losses, DTH remained the second largest platform for pay TV across the region as of 2021. The platform had a still-positive 10-year CAGR of 2.3% in terms of users for the 11 groups, sustained by the accelerated growth of the platform between 2011 and 2016. DTH ended at 42.4% of all subscriptions for the top 11 operators in 2021.

Cable stable, as IPTV's 'niche' grew steadily

The cable segment took over the leading position in Latin America as a whole in 2017 and in 2019 for the top 11 Latin America operator groups. Kagan estimated that the 11 groups finished 2021 with 25.5 million subscribers, or 74.9% of the cable industry in the region, but the platform reached what appears to be a plateau in 2018 when the companies reached 26.1 million subscribers, oscillating between 25 million and 26 million users since then.

The ability to sustain high-speed broadband services as part of triple play offerings has likely kept the segment afloat in recent years, as the connectivity requirements brought about by the COVID-19 pandemic — coupled with price freezes in several countries across the region during stay-at-home mandates — helped companies reduce churn. The top companies in this report showed a 10-year CAGR of 4.3% to 2021.

Cable customers represented 52.0% of all multichannel subscriptions for the top groups as of the end of 2021.

The bright spot for pay TV providers remained fiber optics-based IPTV services, which generally offer higher, symmetrical broadband speeds. The segment reported a 50.7% CAGR to 2021, according to Kagan estimates, as many companies have launched accelerated projects to migrate customers to fiber-based services or deploy fiber optics to new markets. With 2.7 million subscribers as of year-end 2021, the platform still took up only 5.5% of the multichannel offering for the top groups.

However, as an increasingly high number of smaller and single-country operators enter the market, the total estimate for the whole Latin American IPTV market reached up to 6.3 million subscribers, making it the only platform not dominated by the leading providers.

Revenues and ARPU on downward trend

The loss of subscribers drove multichannel revenues for the top groups down by 3.9% between 2020 and 2021, but increasing competition and regional currency depreciation have influenced revenues to decrease at a 2.0% 10-year CAGR between 2011 and 2021. The groups ended the year with $11.02 billion in multichannel revenue, led by América Móvil with 23.3% of the pay TV pie, followed by Vrio with 22.7% and Grupo Televisa with 16.7%.

Weighted average revenue per user for the groups has also been trending downward over the years, mostly on top of competition and depreciation. The service's average monthly bill reached $18.39 in 2021, a negative 6.7% 10-year CAGR, despite a 1.0% uptick between 2020 and 2021. For the total Latin American multichannel market, revenues ended 2021 at $14.66 billion, while ARPU closed at $18.40.

Already a client? Access our historical multichannel operator database here.