Introduction

After years of soaring above the economy, tech got dragged down in 2022. Growth stalled, markets sputtered, stocks plunged. Last year snapped tech's decade-long up-and-to-the-right trajectory, which had helped fuel a record run for M&A in the sector. The once-exceptional "new normal" for tech dealmaking now looks a lot more normal than it has for some time.

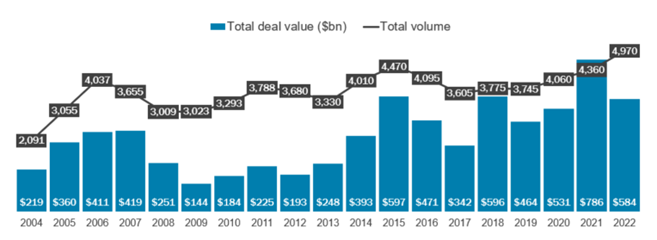

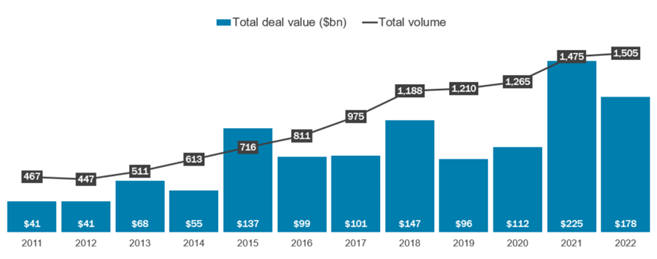

Figure 1: Recent Annual Tech M&A Activity

Source: 451 Research's M&A KnowledgeBase

Explore Our Tech M&A Insights

Request Follow UpThe end of what we have termed an era of post-pandemic "tech-ceptionalism" saw spending on tech and telecom transactions drop by about one-quarter in 2022 compared with the previous year, according to 451 Research's M&A KnowledgeBase. Overall, acquirers around the globe doled out $584 billion last year — an annual total that is skewed by two of the four largest tech deals in the past 20 years of the M&A KnowledgeBase. But those are outliers in 2022. Big prints seemed out of step in a shaky market.

After last year's blockbusters of Microsoft Corp. handing over $74 billion for videogame maker Activision Blizzard Inc. and Broadcom Inc. paying $61 billion for the much-shuttled-around VMware Inc., there wasn't a whole lot to talk about at the top end of the market as tech vendors hunkered down to get through the roughest patch in years. The widespread slowdown wiped out trillions of dollars of value from a sector that has pretty much only known increasing valuations.

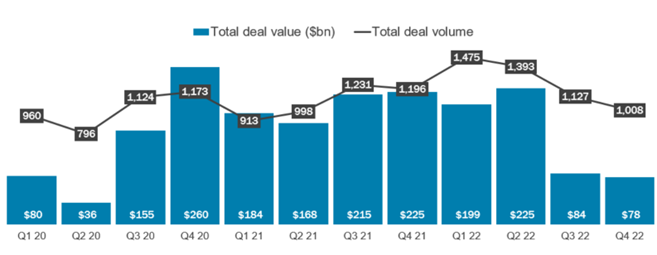

Figure 2: Recent Quarterly Tech M&A Activity

Source: 451 Research's M&A KnowledgeBase

During the once-in-a-generation slump, companies shifted from playing offense to playing defense. Among other changes, that meant buyers couldn't even think about doing deals that they wouldn't have even had second thoughts about doing at any other time since rebounding out of the pandemic. The M&A KnowledgeBase indicates that tech acquirers announced only slightly more than half as many transactions valued at more than $1 billion in 2022 vs. 2021.

The market deteriorated as the year went along, as both acquisition pipelines and financing dried up. Without the will to do deals and fewer ways to pay for them, monthly spending totals, particularly since last summer, plunged to the lowest levels since the pandemic.

Spending on acquisitions in the second half of 2022 plummeted 60% compared with the first half, according to the M&A KnowledgeBase.

If annualized, the value of transactions announced from last July through December would have been the lowest yearly total since 2013.

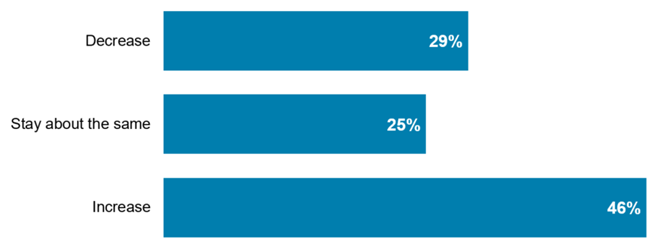

And yet, even the midyear break that appeared to break the market in 2022 doesn't seem likely to weigh on M&A in 2023. Almost half of respondents to 451 Research's annual Tech M&A Outlook predicted an acceleration in dealmaking this year.

Figure 3: Forecast Change for Tech M&A, 2023 vs. 2022

Source: 451 Research's Tech M&A Outlook Survey, December 2022

As they looked at the year ahead, respondents to our mid-December survey, which included some of the industry's busiest bankers and buyers, gave a significantly more bullish forecast for tech M&A than the previous edition. More respondents anticipated an uptick (46% in this survey vs. 28% in the previous one), while slightly fewer expected a downturn (29% vs. 31%).

However, to get deals going again, tech is going to have get growing again. The slowdown that the industry experienced last year, which extended to segments that were previously considered "recession proof," has forced companies to reevaluate the business they already have rather than necessarily looking to add to it. Nearly two-thirds of acquirers and advisers who responded to the Tech M&A Outlook said the industry's top-line travails would result in fewer acquisitions in 2023.

For more on what's coming in 2023, we invite you to join us for a special webinar on February 8 where we will look at forecasts for activity and valuations in the year ahead, as well as highlight several tech sectors that we expect to be particularly busy.Registration for our "M&A In Focus"event is now available.

Top-line travails

To understand the connection between corporate expansion and corporate acquisitions, consider their interplay at two tech pioneers that have relied on M&A to add billions of dollars in market value, far beyond anything they could have garnered from their original products. For tech vendors, growth — whether organic or inorganic — gets rewarded.

Salesforce Inc.: A relentless buyer that has snapped up more than 70 companies (at a total cost of over $60 billion), the SaaS giant hasn't printed anything significant since Slack Technologies Inc. in December 2020. During that time, the company's revenue growth has dipped from the mid-20% range to not even half that level, according to the consensus Wall Street forecast tracked by S&P Capital IQ. Salesforce laid off 10% of its workforce in early January, cuts that can make it unsightly to turn around and add employees via M&A.

Meta Platforms Inc.: Boosted by a pair of purchases that have turned into two of the most heavily used apps on the planet, the company formerly known as Facebook has more than quadrupled revenue over just the past half-decade. It regularly posted 40%-50% year-over-year growth but is now actually shrinking. (As is Meta's workforce.) Although the company continues to acquire, its recent deal flow is just one-third the pace it was at its peak.

The slowdown at the two vendors, which are accustomed to adding billions of dollars to their top line each year, hit them hard on Wall Street. Salesforce stock was nearly cut in half in 2022, while Meta gave up almost two-thirds of its value. The deep-red performance of those two stocks was part of a larger rout of tech that knocked the sector to its worst performance in a decade and a half.

The S&P 500 IT Index lost about 30% of its value in 2022, a decline that erased nearly $4 trillion of market value, according to S&P Global Market Intelligence.

And don't expect a quick rebound. Even after the declines that were almost twice the level of the broader market, tech still isn't drawing buyers on Wall Street. In an early-January survey by S&P Global of 300 institutional investors, sentiment toward tech stock had slumped to its most bearish level since we started asking about sectors in October 2020.

Strategics: No more stock in trade

A prolonged drubbing in the highly visible equity markets — like tech experienced in 2022 — complicates acquisitions in many ways, both perceptional and mechanistic. It undermines buyer confidence ("Are we on the right track?") and pressures valuation assumptions ("If we are worth less now, aren't other companies, too?") while also, tangibly, taking away a popular way to pay for deals.

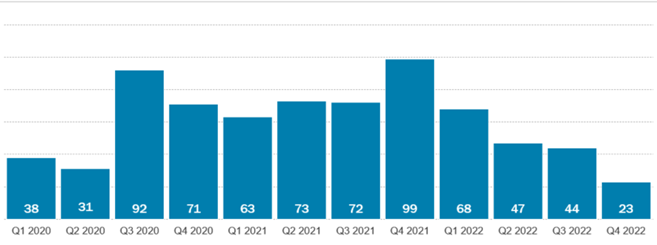

Figure 4: Number of Tech Transactions with an Equity Component

Source: 451 Research's M&A KnowledgeBase

Fundamentally, M&A comes down to what you buy, what you pay and how you pay for it. In the long-running bull market, stock provided a convenient, almost cost-free answer. (The same, incidentally, can be said about equity-heavy compensation packages in the tech industry.) Shares that seem to only go up appeal to both sides of a transaction.

For instance, both Salesforce and Meta regularly used their own shares to pay for their deals. Virtually all of their significant acquisitions — Slack, Tableau Software Inc. and MuleSoft Inc. for Salesforce; Oculus, WhatsApp and Instagram for Meta — included some equity component. Yet, as a sign of the times, the M&A KnowledgeBase indicates that neither company announced any stock deals in 2022.

Nor was that an isolated occurrence in last year's grinding bear market for tech, when a dollar of stock didn't go nearly as far as it did in boom times. The number of transactions in the M&A KnowledgeBase that included some equity in the consideration dropped 40% last year compared with 2021. Further, our data shows that decline in "paper deals" far outpaced last year's drop-off in the overall number of deals done by public companies.

Financials: Constricted credit

Speaking of favored M&A currencies that fell out of favor for market participants, it wasn't just the big-name strategic acquirers that had to scramble to come up with new ways to pay for their deals in 2022. Financial buyers, which had thrived when credit was cheap and readily available, found themselves facing the highest interest rates and tightest lending market since the Great Financial Crisis more than a decade ago.

After a record-shattering shopping spree that saw them triple the number of acquisitions over the past decade, buyout shops announced just 2% more transactions in 2022 compared with 2021, according to the M&A KnowledgeBase.

Activity has been tailing off as buyout shops recalculate the cost of deals in the current environment of higher interest rates and reluctant lenders. (That's true even though they have been steadily increasing their record cash holdings.) In the final quarter of 2022, private equity firms and their portfolio companies announced the fewest purchases since the COVID-19 outbreak.

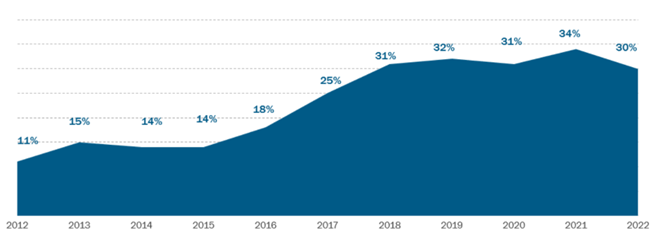

Figure 5: PE Tech M&A Activity, Since 2011

Source: 451 Research's M&A KnowledgeBase

Even in the deals they have gotten done, PE firms have had to make concessions to address a tight credit market. That has forced changes on an industry that had relied on a well-versed M&A process to accelerate past the market's longtime leaders (public companies) to their current pace of accounting for one of every three transactions recorded in the M&A KnowledgeBase. These deal machines, however, got jammed up in 2022.

In some transactions, PE firms have had to skip over the traditional sources of financing and instead look to tap into newly formed pools of capital that typically come at a higher cost. In other deals, the buyout shops are bypassing borrowing altogether and just writing a full check for a target. (Can't call it a leveraged buyout if there's no leverage used.)

Both tactics effectively increase the purchase price for sponsors, making it harder to put up returns on the deals they are doing now. But that's a problem for another day (and the next fund).

Figure 6: Recent PE Deal Volume, as % of Overall Tech M&A

Source: 451 Research's M&A KnowledgeBase

Despite the unfavorable environment, PE firms are not expected to stay on the sidelines, according to the prevailing view in our Tech M&A Outlook. When asked about market participants, some 57% of respondents to our survey (including a significant number that work at companies) indicated that PE acquirers would be "more competitive" than corporate buyers in deals in the coming year, compared with just 43% that predicted the other way around.

Pricing under pressure

Along with the rest of tech, deals got discounted last year. Prevailing pricing for tech acquisitions dropped by about one-quarter from record highs, although valuations are still lofty compared with historical averages. The market's munificent multiples may be coming down even more in 2023, according to the acquirers and advisers surveyed in our Tech M&A Outlook.

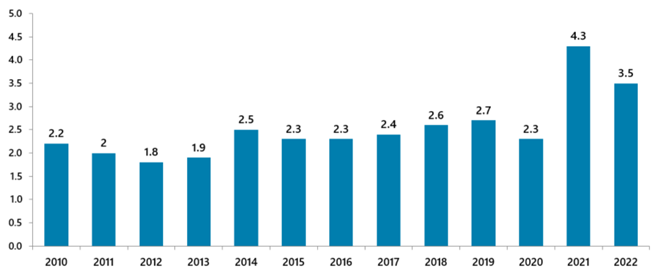

Figure 7: Average Price/Sales Multiple, Since 2010

Source: 451 Research's M&A KnowledgeBase

On average, acquirers paid 3.5 trailing sales for the tech vendors they bought in 2022, according to the M&A KnowledgeBase. That basically splits the difference between recent levels: one turn lower than they handed out in the go-go year of 2021 and about one turn higher than they paid over the previous decade. Among the roughly 5,000 deals listed in the M&A KnowledgeBase for 2022, a couple of key transactions highlight the prevailing downward pressure on multiples that appear likely to continue to shape pricing into this year:

In his unorthodox take-private of Twitter Inc., Elon Musk paid 10x trailing sales for the social media service. Rival ad-supported sites currently trade at closer to 3x trailing sales, and Musk has admitted that he "overpaid" for Twitter.

Adobe Inc. paid a triple-digit multiple in its slightly defensive acquisition of fleet-footed, web-based rival Figma. Respondents to our Tech M&A Outlook voted it as the second-most-likely deal announced last year that would struggle to generate hoped-for returns, with most pointing to the rich valuation paid.

After spurning a much-higher takeout offer in early 2022, Zendesk, Inc. limped off the NYSE in a take-private in June that valued the customer support software provider at 7x trailing sales. Previous negotiations had the bid valuing Zendesk at 11x trailing sales.

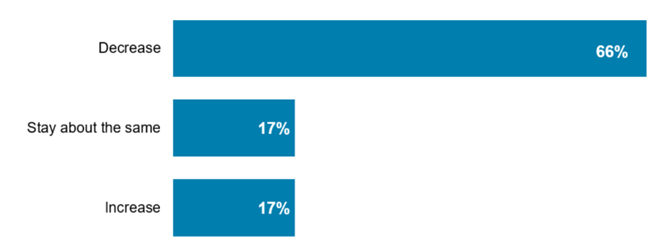

Figure 8: Forecast Change in M&A Valuations, 2023 vs. 2022

Source: 451 Research's Tech M&A Outlook Survey, December 2022

The downdraft will continue, with further discounting expected. Fully two-thirds of respondents to our Tech M&A Outlook predicted that acquisition valuations across the market would decline this year compared with last year. (That was almost twice the level that gave a bearish outlook in our previous survey.) While the current market is still relatively pricey, the prevailing forecast calls for deal valuations in 2023 to drop back closer to what they were than what they have been recently.