Download The Full Report

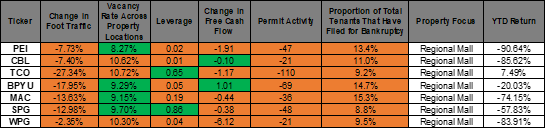

Click hereAdd another item to the list of ‘firsts’ for 2020 - markets saw two REITs declare bankruptcy on the same day for the first time.[1] CBL Properties (CBL) and Pennsylvania Real Estate Investment Trust (PEI) filed for bankruptcy protection on Monday, November 2, 2020. An examination of those factors common to CBL and PEI reveals similar operational and fundamental characteristics. Our analysis reveals seven REITs that share these common characteristics: 1) a high percentage of anchor tenants that have declared bankruptcy; 2) a decline in building permit activity, 3) a decline in foot traffic, 4) a high degree of leverage, 5) declining cash flow, and 6) a high proportion of tenants that have filed for bankruptcy. (Table 1)

Table 1. REIT Risk Factors (Select REITs, October 2020)

Green (Orange) Indicates REIT’s Ratio is Better (Worse) than Peers

Source: S&P Global Market Intelligence Quantamental Research. Data as of November 6, 2020.

In Figure 1, we identify REITs that have both a high percentage of tenants in bankruptcy[2] and have substantially scaled back permit-requiring activity[3]. Using these criteria, we identified 7 REITs (including CBL and PEI): Macerich Co (MAC), Brookfield Property REIT (BPYU), Washington Prime Group Inc (WPG), Simon Property Group (SPG)[4], and Taubman Centers Inc (TCO). These seven REITs are located far from the cluster of data points associated with the other REITs in the universe.

[1] An analysis of REIT bankruptcies among Russell 3000 REITs, going back to January 2016, revealed only one other bankruptcy (which occurred in August 2019): RAIT Financial Trust (NYSE: RAS).

[2] Using the bankruptcy ratio defined in Appendix A with an 8% cutoff.

[3] Using the permit ratio defined in Appendix B with a 20 permits/property cutoff.

[4] We note that SPG and BPYU are currently in talks to buy the operating and retail assets of J.C. Penney to help the retailer out of Chapter 11.