Artificial intelligence governance aims to ensure that an organization develops and deploys its machine-learning models in an ethical, responsible, fair, legal and compliant way. With the proliferation of AI and ML models, AI governance has risen in importance and has spawned startups with dedicated software platforms to address it. Enterprise data science platforms need AI governance to ensure that the data-driven decisions organizations make using these offerings' insights can be trusted and relied on to meet internal compliance mandates as well as external regulations and laws. Some enterprise data science platform providers will rely on internal engineering or partnerships with AI governance specialists to deliver it. But others could plug this gap or boost existing functionality by acquiring an AI governance startup, opening the door to a new wave of M&A.

The Take

Enterprises are recognizing the value of AI governance because the governance of AI and ML projects is a roadblock that prevents these projects from getting into production. Roughly 35% of respondents to 451 Research's Voice of the Enterprise: AI & Machine Learning, Use Cases 2023 survey said their organization plans to invest in AI governance tools, platforms or functionality — whether purchasing from a vendor or building in-house — over the next 12 months. This represents an opportunity for enterprise data science platform providers to meet corporate AI governance requirements within the software stack they already provide.

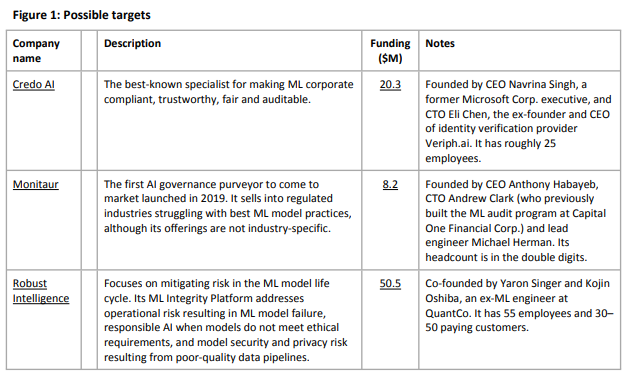

Hewlett Packard Enterprise Co., Databricks and DataRobot seem most likely to use a strategic tuck-in to fully address AI governance as it is a consolidation strategy they have employed before. But the cloud hyperscalers also might go shopping in this area as AI governance has become a strong focus for them. Credo.AI, Monitaur and Robust Intelligence would make attractive targets, although they are not the only specialists operating in the space. Fairly AI, Saidot, ModelOp and Datatron could also be considered depending on the nature of the AI governance an acquirer requires.

Context

AI governance platforms offer a framework for the governance of ML models, providing both structure and context tailored to an individual organization's needs. Equally important, these offerings codify laws, regulations and best practices for AI governance, as well as include standardized assessment and reporting features to deliver evidence to both internal stakeholders and outside bodies that organizations are adhering to AI governance policies.

Effectively and efficiently implementing AI governance can be difficult, though. AI regulations and laws are popping up across the globe, making it challenging to keep up with a constantly evolving landscape. Furthermore, high-profile AI failures continue to mount, acting as a reminder to businesses that AI needs to be developed and rolled out in a responsible, corporate-compliant and legal way. The dangers of not doing so are high, involving financial risk, brand and reputational risk, and threats to customer trust and engagement.

There has not yet — to our knowledge — been an acquisition of an AI governance specialist. But it is only a matter of time because enterprise software suppliers are now emphasizing AI governance's importance. For example, in May, IBM Corp. unleashed its new data and AI platform called watsonx, which has a governance component that is based in part on Big Blue's acquired OpenPages governance, risk and compliance offering.

Possible acquirers

HPE could be in line to make an AI governance purchase. The company has been building out its software portfolio for the past few years, and it has already used consolidation to elevate its data science and ML credentials. It kicked off 2023 by reaching for partner Pachyderm to obtain the target's ability to make ML data pipelines reproduceable, and in May it "acq-hired" Athens-based Arrikto for its expertise with the Kubeflow open-source ML model training and deployment tool and Kubernetes container environment. HPE already has a Machine Learning Development System that is a turnkey stack for ML model development and training at scale, which it obtained by snagging open-source ML startup Determined AI in June 2021.

Additionally, HPE Swarm Learning is a decentralized model-training framework that enables data scientists to train models with better accuracy and fewer biases without infringing on privacy protection rules. However, the company could benefit from rounding out its ML and data science portfolio as it is not a known contender outside of its installed base. Scooping up an AI governance specialist would help address this as well as serve existing customer requirements.

Databricks could also be interested in buying its way into the AI governance realm. The company is focused on building out a comprehensive platform for data, analytics and AI. Furthermore, Databricks has deep pockets to spend on M&A after raising $1.6 billion in series H funding led by Morgan Stanley's Counterpoint Global in August 2021. The vendor is not a seasoned acquirer, however. It has only printed four pickups, according to our M&A KnowledgeBase. Yet three of them have been related to data science and analytics. And its most recent deal — the acquisition of Okera, which Databricks announced in May — is all about nabbing data access governance capabilities. Databricks clearly recognizes the importance of governance, and an AI governance purchase would reinforce that. DataRobot is another potential buyer. The enterprise data science platform provider already has a well-oiled M&A engine, which it has deployed to make several strategic tuck-ins.

DataRobot has acquired 10 companies so far, according to our M&A KnowledgeBase. The company could use this experience to bolster the AI governance expertise it already has. For example, DataRobot offers so called "humility rules" to ensure that an organization's model predictions are made with confidence and that it automates model documentation for compliance purposes. The vendor could do more, though, such as offer compliance assessments and evidence for specific regional- and industry specific laws.

Source: 451 Research; S&P Capital IQ Pro.

© 2023 S&P Global.

Generative AI software market to exceed $36bn in aggregate revenues by 2028, with 58% CAGR between 2023 and 2028

Read more