The wave of market consolidation among Asia-Pacific's mobile markets continues in 2023. One approved merger in Thailand will transform the market into a duopoly, and the conditional approval of two mergers in Taiwan will reduce market players from five to three.

![]()

Hefty capital investments in 5G, fiber and digital transformation, coupled with a higher cost of capital due to rising interest rates have put operators in Asia-Pacific in a tight spot at a time when they should be focusing on monetizing 5G. To better compete with market leaders, some relatively smaller operators have agreed to merge to save costs and redirect capital toward debt reduction and new investments. While Thailand and Taiwan are down to three operators after the aforementioned deals, Indonesia and Malaysia remain fragmented, so opportunities exist for further market consolidation.

![]()

In an earlier report about the state of M&A deals in the Asia-Pacific telecommunications sector, we explored how operators in the region looked toward M&A deals to survive current economic headwinds. While that report focused on tower divestments, this report focuses on market consolidation among major mobile operators in the region in 2022, specifically those in Indonesia, Malaysia, Thailand and Taiwan.

To better understand the effects of these operator M&A deals, we considered these deals through the Herfindahl-Hirschman Index (HHI) guidelines used by the US Department of Justice. HHI is a measure of market concentration calculated by taking the sum of the squared market shares of all players in a market. HHI can range from 0, which indicates perfect competition, to 10,000, which indicates a monopoly.

When analyzing M&A deals, the US Justice Department looks at the potential HHI after the deal as well as the change from the current HHI. Post-merger HHI below 1,000 are considered unconcentrated markets; those between 1,000 and 1,800 are moderately concentrated markets, while those above 1,800 are highly concentrated markets.

M&A deals resulting in unconcentrated markets typically are not challenged. For deals resulting in moderately concentrated markets, those that result in an HHI increase of 100 could face regulatory challenges. The bar is lower for deals resulting in highly concentrated markets. If the change in HHI is between 50 and 100, the deal is deemed to introduce significant competitive concerns, and if the change is above 100, the merged entity is deemed by regulators to yield enhanced market power.

Previously, we have calculated that almost all mobile markets in Asia-Pacific are highly concentrated, with most markets having only three to four players. As a utility, the mobile service industry benefits from consolidation as economies of scale introduce savings in capital investments and operational expenses. Having fewer market players reduces the need to deploy overlapping infrastructure, allowing for capital to be routed to more efficient uses. Highly concentrated markets, however, run the risk of forming companies with strong market pricing power that could be detrimental to consumers. This is one of the main reasons why utilities such as mobile services are highly regulated in many jurisdictions.

Since Indonesia, Malaysia, Thailand and Taiwan are all highly concentrated markets to begin with, it is no surprise that all operator M&A deals in these markets yield new operators with enhanced market power. In other words, these deals would be challenged by the US Department of Justice if they were to occur in the US. Indeed, these deals have faced many hurdles from market stakeholders and regulators in each of their respective jurisdictions. As of April 2023, operator deals in all of these markets except for those in Taiwan have passed regulatory scrutiny.

Indonesia: Indosat Ooredoo and Hutchison 3 Indonesia

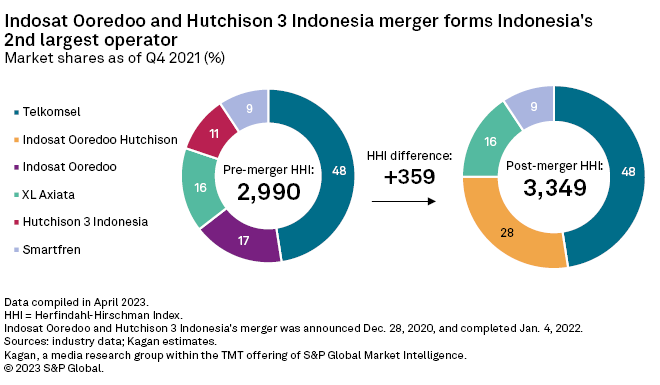

On Dec. 28, 2020, Qatar-based Ooredoo QPSC and Hong Kong-based CK Hutchison Holdings Ltd. announced the merger of their mobile business units in Indonesia, PT Indosat Ooredoo Tbk and PT Hutchison 3 Indonesia, respectively. The deal closed Jan. 4, 2022, for $1.18 billion.

Prior to the merger, Indosat Ooredoo and Hutchison 3 Indonesia were Indonesia's second- and fourth-largest mobile operators, respectively. The completion of the merger formed PT Indosat Ooredoo Hutchison Tbk (IOH), which became Indonesia's second leading operator with a pro forma market share of 28% as of fourth quarter 2021. PT Telekomunikasi Selular (Telkomsel) remained the market leader with a market share of 48%.

The merger creates a formidable player that could better compete with Telkomsel. IOH could benefit from its combined spectrum holdings and infrastructure. Press releases from the deal note an expected annual savings ranging from $300 million to $400 million in three to five years following the deal completion, which provides the company the opportunity to better deploy new services, especially 5G. While its market share is far from that of Telkomsel, IOH could change the dynamics of Indonesia's mobile industry depending on how it strategizes moving forward.

Prior to the merger, Hutchison 3 Indonesia's strategy of aggressively lowering its prices prompted competitors to do the same, resulting in narrow margins and low average revenue per user for the whole industry. Its merger with Indosat Ooredoo eliminates this pricing pressure and gives operators an opportunity to increase their ARPU.

Access our 10-year industry projections for Indonesia through 2032.

Malaysia: Celcom and Digi

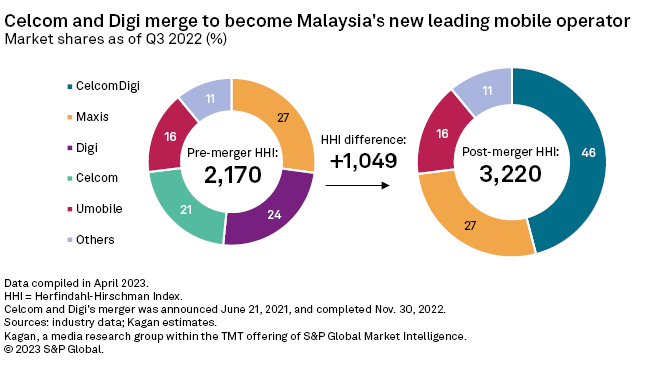

In Malaysia, the merger between Celcom Axiata Bhd. and Digi.com Bhd. created a new market leader. Announced on June 21, 2021, the merger between Celcom and Digi closed Nov. 30, 2022, with a completion deal value of $3.78 billion. The resulting entity was named Celcomdigi Bhd. and controlled a pro forma market share of 46% as of the third quarter of 2022, leapfrogging previous market leader Maxis Bhd., whose market share stood at 27%.

Malaysia's situation is similar to that of Indonesia. In both cases, operators offering low tariffs and fueling price wars (Digi and Hutchison 3 Indonesia) have merged with another operator with a more general strategy to pricing (Celcom and Indosat Ooredoo) to better compete with the market leader (Maxis and Telkomsel). Malaysia's merger resulted in a higher HHI increase of 1,049, signaling greater market consolidation.

The creation of a new market leader has prompted the local telco regulator to reduce the dominance of Celcomdigi. The regulator required the new entity to return 70 MHz of mid-band spectrum to level the playing field with other competitors. The merged entity is also required to host mobile virtual network operators on favorable terms to foster competition while reorganizing its relationships with regional distributors.

It remains to be seen if Celcom and Digi's merger will erode Maxis' market share. Maxis always has emphasized its higher-cost postpaid plans — a quite different target market from both Celcom and Digi, which are now positioned to capture the midrange prepaid segment of the market.

Thailand: True and DTAC

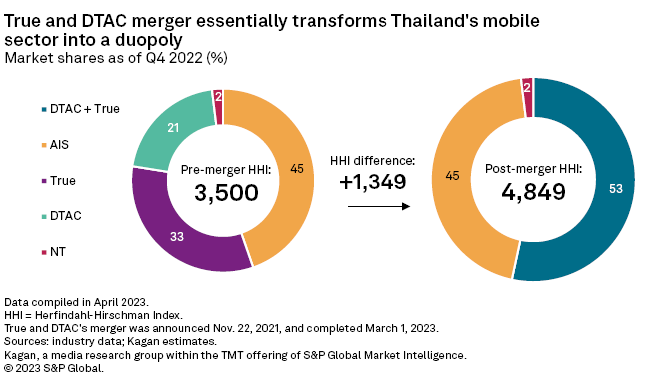

Among all the deals discussed here, True Corp. and Total Access Communication PCL's (DTAC) merger in Thailand is arguably the most controversial. Valued at $5.53 billion at completion, it is also the most expensive operator M&A deal in our analysis.

True and DTAC's merger faced regulatory and market stakeholder hurdles since it effectively reduces Thailand's mobile industry to a duopoly. While government-owned CAT Telecom PCL and TOT Mobile merged earlier on Jan. 8, 2021, to form National Telecommunications PCL, the merged entity only had 2% market share as of the fourth quarter of 2022 and essentially does not wield the same market power as private operators. The merger leaves two major private operators: the combined True and DTAC, the new market leader with 53% market share, and previous leader Advanced Info Service PCL (AIS) with 45% market share.

Concern about the market regressing to a duopoly is the main reason why the deal dragged from its announcement on Nov. 22, 2021, to its completion on March 1, 2023. A duopoly is undesirable in the context of market competition since it creates monopolistic characteristics and concentrates market power — think pricing and limited consumer choice in particular — or market collusion. A study by the local regulator noted that the merger could reduce Thailand's GDP growth by 0.05% to 1.99% due to potential collusion between the remaining duopoly players.

The completion of the merger raises the possibility of price hikes for mobile services in Thailand. The same study by the local regulator noted a potential uptick of 0.05% to 2.07% in inflation due to price hikes after the merger.

Despite these, the local regulator took an offhand stance on the deal and said it has "no authority to approve or reject the proposed merger plan." Critics of the deal have accused the regulator of shirking its duty, and lawsuits against the deal remain pending.

Taiwan: Taiwan Mobile and Taiwan Star, Far EasTone and Asia Pacific Telecom

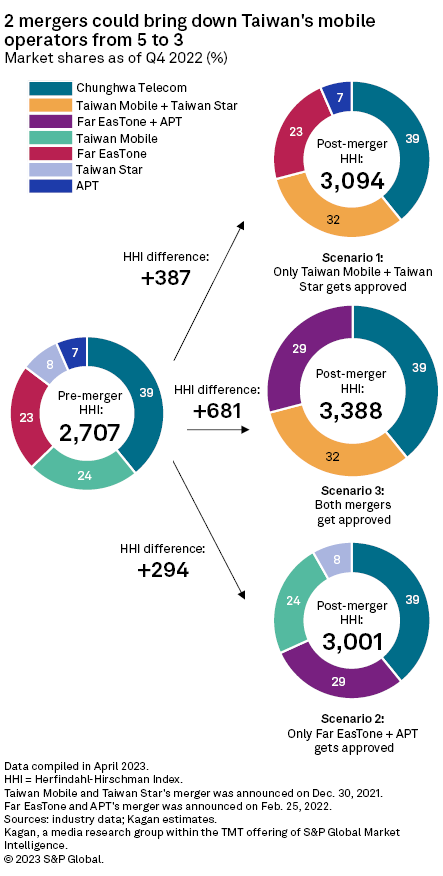

Taiwan is up for two pending operator M&A deals that could bring the number of market players from five to just three. The first deal was announced by Taiwan Mobile Co. Ltd. and Taiwan Star Telecom Corporation Limited on Dec. 30, 2021, initially valued at $1.50 billion. It was followed on Feb. 25, 2022, by Far EasTone Telecommunications Co. Ltd. and Asia Pacific Telecom Co. Ltd.'s (APT) $1.25 billion merger deal.

Taiwan's current five operators can be split into three major operators (market leader Chunghwa Telecom, Taiwan Mobile and Far EasTone) and two smaller operators (Taiwan Star and APT). These two deals involve the combination of one major operator and one smaller operator, with market leader Chunghwa Telecom being the only one left out of the picture.

Although the local telco regulator has provisionally approved the two mergers subject to certain conditions, both deals still have to pass the scrutiny of the local competition regulator. While the approvals remain conditional, three possibilities remain:

– First, only the merger of Taiwan Mobile and Taiwan Star could be approved, resulting in a four-player market, with the combined entity having the second-largest pro forma market share of 32% as of the fourth quarter of 2022. This scenario results in an HHI increase of 387.

– Second, only the merger of Far EasTone and APT could get approved, similarly resulting in a four-player market. The merged entity will also rank second, albeit with a smaller pro forma market share of 29% and a smaller HHI increase of just 294.

– Third, both deals are approved, transforming the local market into a three-player industry. The HHI increase in this scenario is 681.

The third scenario is the most likely outcome since approval of only one deal could raise protests from parties of the other deal. The local telco regulator appears supportive of the two deals in its statement of conditional approval, citing synergies and cost savings. However, the regulator required all parties to divest some of their spectrum and raise their 4G and 5G coverage targets.

Wireless Investor is a regular feature from Kagan, a part of S&P Global Market Intelligence.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.