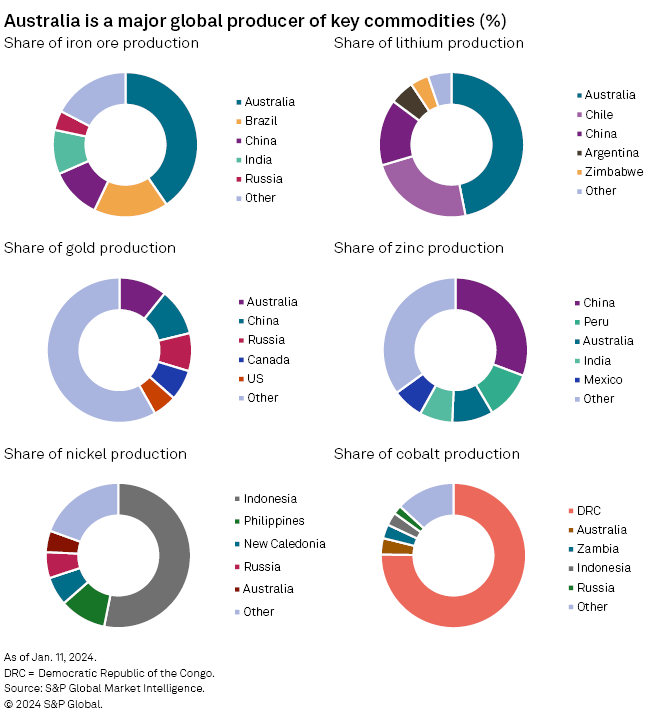

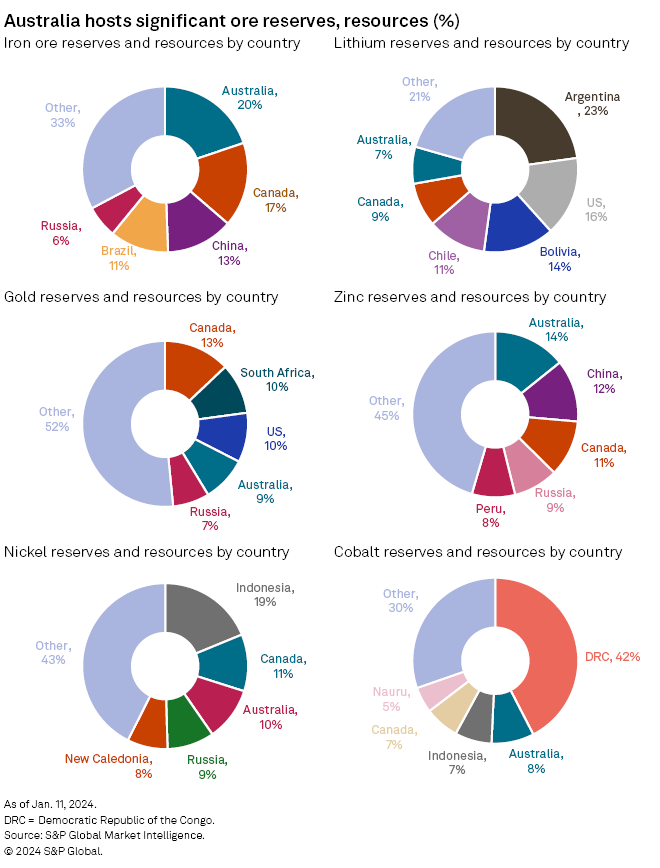

Australia remains one of the most important countries for the mining industry, hosting significant mineral resources and playing a key role in the production of most commodities. The country is among the top producers of iron ore, lithium, gold, zinc, nickel and cobalt. In 2023, Australia remained the top lithium producer, with an estimated 468.1 million metric tons of lithium carbonate equivalent produced.

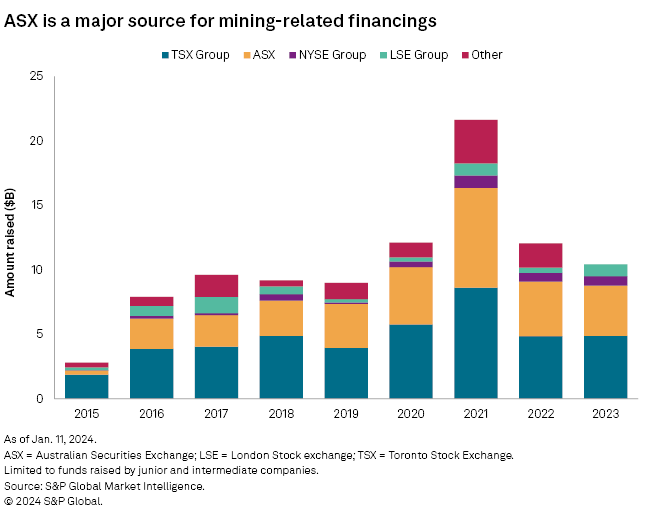

The Australian Securities Exchange hosts a large number of global metals exploration companies. The junior and intermediate sectors raised a total of US$3.9 billion on the ASX in 2023, down from US$4.2 billion in 2022, in the second consecutive year of decline for the exchange. Despite this decrease, the exchange remains the second largest in terms of junior and intermediate financings for the mining industry, just behind the Toronto Stock Exchange group of exchanges. In terms of market capitalization, however, ASX-listed companies rank above TSX-listed ones and second to companies listed on Asian exchanges.

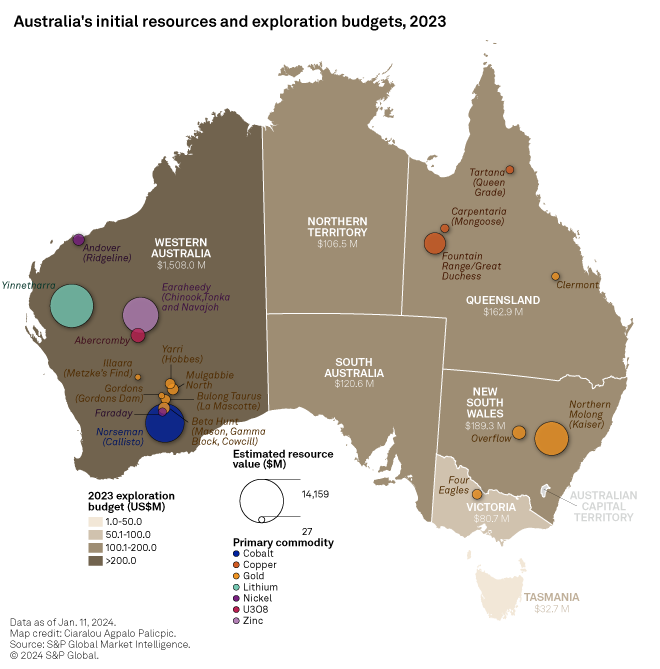

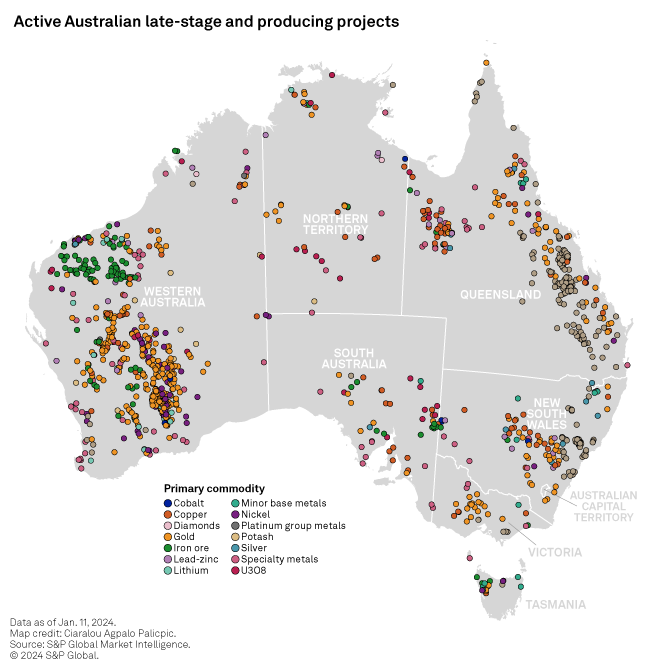

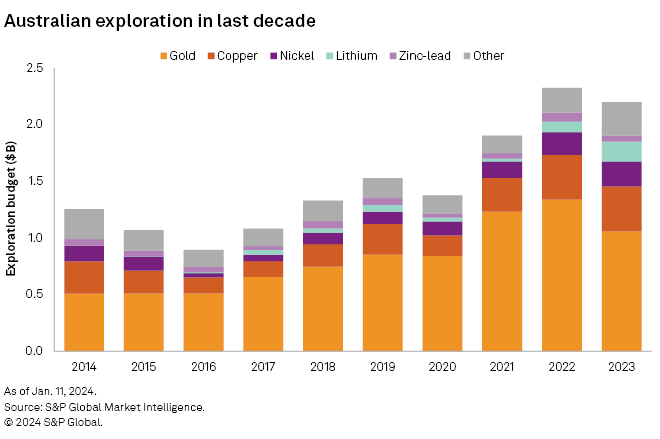

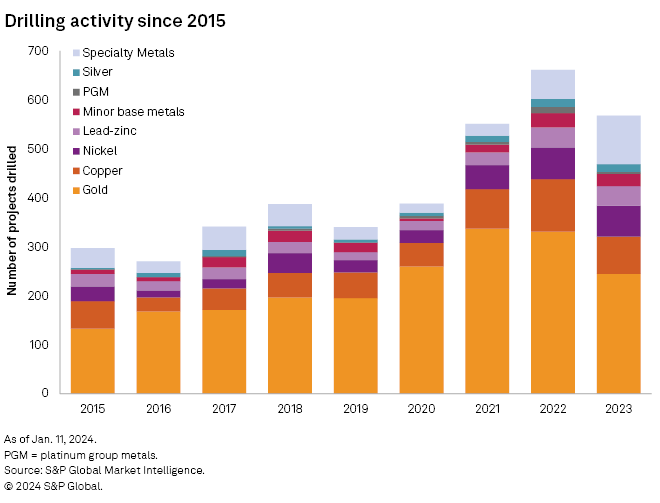

Australia is the second-largest exploration destination in the world behind Canada for the third consecutive year, having previously topped the list in 2019 and 2020. Exploration allocations to Australia slightly decreased to US$2.2 billion in 2023, from US$2.3 billion in 2022. This dragged down drilling activity, with reported drillholes down 29% to 18,196 at 486 distinct projects.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.