Facing substantial unrealized losses, banks sought to shield even larger portions of their securities portfolios from changes in market values in the third quarter of 2022.

Higher interest rates have negatively impacted the values of most bonds that institutions own, serving as a hit to tangible book values. Tighter financial conditions have led to deposit outflows in recent quarters and prompted concerns that some banks might have to sell bonds at a loss for liquidity needs. However, as loan-to-deposit ratios remain below historical standards, it seems more likely that banks will act by defending their funding by offering higher rates on deposits or accessing wholesale funding before realizing losses in their securities portfolios.

Regulators, investors question if banks will sell bonds for liquidity

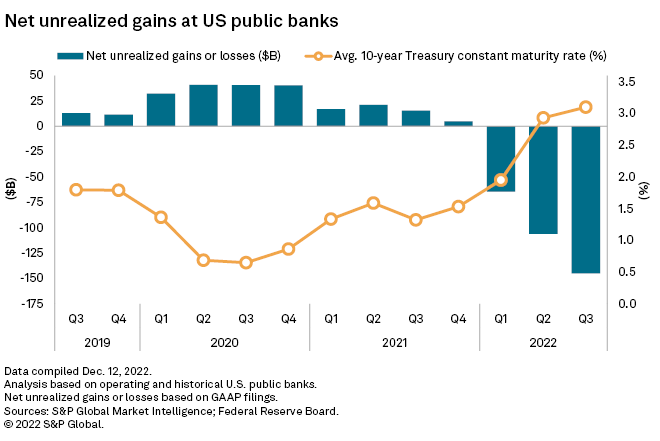

Further increases in interest rates pushed bank bond portfolios deeper underwater in the third quarter. As unrealized losses grew in banks' available-for-sale securities portfolios, which continue to hold the majority of bonds that most banks own and must be marked to market on a quarterly basis, some investors have expressed concern that banks might sell securities at a loss to meet their liquidity needs.

Regulators have recently begun to share some investors' concerns, questioning whether banks would need to purge their bond portfolios to meet their liquidity needs. In other cases, capital plans of some institutions that have seen their tangible equity decline because of the negative marks on their available-for-sale portfolios have also faced skepticism from regulators.

Thus far, most institutions seem hesitant to sell underwater bonds, even for restructuring purposes. However, if banks hold on to underwater bonds, they could see recent margin expansion stall or even reverse course as they sit on lower-yielding securities while funding costs rise.

Any institution forced to purge underwater bonds for liquidity needs likely would face some pain. The recent liquidity strains at Silvergate Capital Corp. offer a cautionary tale of what action an institution has to take in the current market environment. Silvergate's issues are certainly unique and different from traditional institutions, but the bank was forced to sell a pool of bonds at a substantial loss to meet its liquidity needs after billions in cryptocurrency-related deposits left the institution.

|

* Set email alerts for future Data Dispatch and Research & Analysis articles. * Download a template to calculate deposit and loan beta and growth rates. * View U.S. industry data for commercial banks, savings banks and savings and loan associations. |

Funding at the vast majority of banks is far more stable, even though institutions' liquidity has become more stretched in recent quarters. Deposits have declined for two consecutive quarters as the Federal Reserve aggressively tightened monetary policy and consumers utilized some of the excess savings accumulated during the pandemic.

Liquidity needs have grown since the end of the third quarter and likely will increase further in the coming quarters as loan growth remains elevated as institutions battle modest deposit outflows. Banks have not defended their deposits aggressively thus far, but institutions' funding bases should be far more sensitive to changes in rates going forward.

Despite recent liquidity pressures, the median loan-to-deposit ratio at the end of the third quarter across the industry remains more than 10 percentage points below year-end 2019 levels. More recently, the Federal Reserve's H.8 data, which tracks commercial bank balances on a weekly basis, shows that deposits actually grew across the banking industry in the fourth quarter, which could alleviate some concerns over bank liquidity.

The rebound in deposits appears to have come at a cost as increases in certificates of deposits were responsible for the growth. Institutions have also reported increases in borrowings from the Federal Home Loan Bank as well.

Tangible book values under pressure

The large amount of unrealized losses sitting on those books has negatively impacted tangible book values. The majority of bonds most banks own remain in available-for-sale, or AFS, portfolios and changes in the value of those portfolios flow through accumulated other comprehensive income, or AOCI, and impact tangible common equity.

In the third quarter, the yields on the 2-year, 5-year and 10-year Treasurys ended the period 130 basis points, 105 basis points and 85 basis points higher, respectively, than at the close of the second quarter. Those increases in rates put even greater pressure on the values of AFS portfolios.

In the third quarter, institutions including U.S. commercial banks, savings banks, and savings and loan associations that file GAAP financials reported $144.85 billion in unrealized losses in their AFS portfolios, compared to $105.79 billion in unrealized losses in the prior quarter. Those institutions saw their median tangible book values fall 5.0% from the linked quarter despite more than $45 billion in earnings in the period.

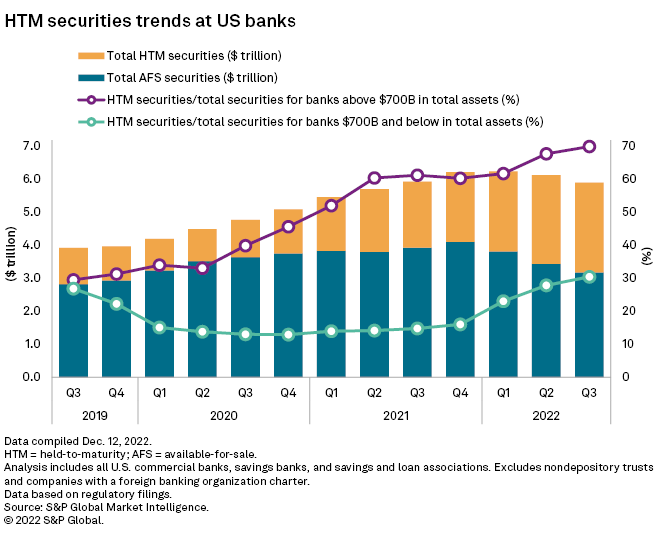

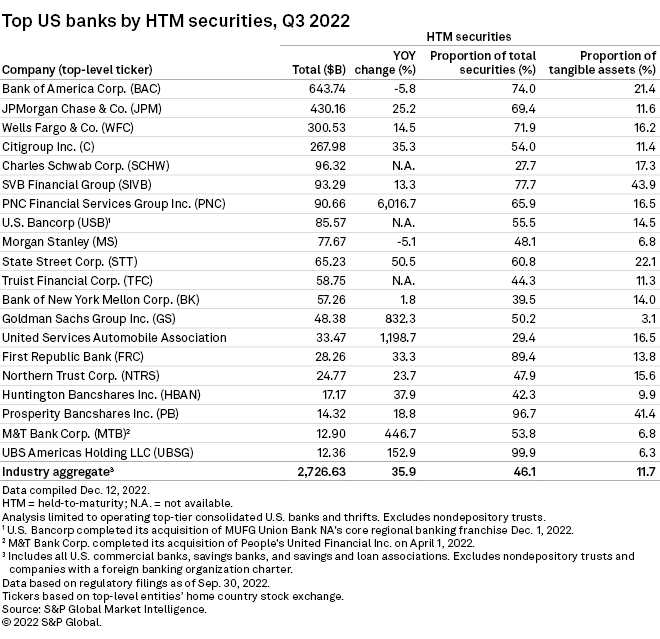

Some banks, particularly the nation's largest institutions, have sought to protect large portions of their securities portfolios from swings in the market by placing bonds in their held-to-maturity, or HTM, portfolios, which are not marked on a quarterly basis. For banks with over $700 billion in assets, changes in AOCI would impact regulatory capital in addition to tangible book value.

Large banks classified as U.S. global systemically important banks, or G-SIB, holding companies — those with more than $700 billion in assets — have placed close to 70% of their bond portfolios in held-to-maturity, or HTM, portfolios. That is up from 67.8% in the second quarter and just shy of 30% three years ago.

Large banks have been mindful of a potential capital hit that could come with higher interest rates, particularly since the institutions deployed funds in the bond market when rates were near historic lows during the height of the pandemic. Banks with over $700 billion in assets have grown their HTM securities 231% since the fourth quarter of 2019.

Meanwhile, HTM securities at banks with less than $700 billion in assets have risen in the last few quarters, increasing to 30.5% of total securities in the third quarter from 27.9% in the prior quarter and 23.1% in the first quarter.

The pressure on bank bond portfolios might be as great in the fourth quarter, with intermediate and long-term rates trading in the period near the levels witnessed at the end of the third quarter.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.