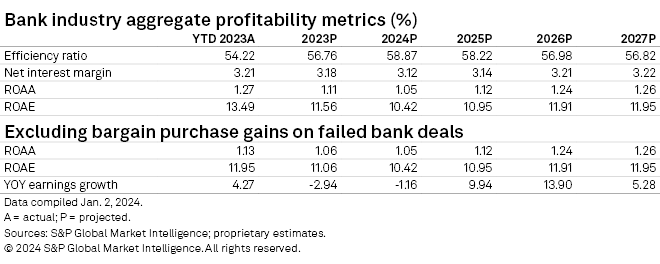

Even with interest rates likely near their peak, bank net interest margins have not quite bottomed yet.

Funding costs continue to grind higher, even in the absence of additional rate hikes by the Federal Reserve, as deposits shift into higher-cost products. The movement will lead to additional modest pressure on margins in the near term, but the key profitability metric should trough soon. As that headwind dissipates, a new one should emerge in the form of higher credit costs. Still, the hit to earnings should be modest and allow for many banks to continue reporting attractive returns.

Click here to access data exhibits and the US banking industry's projections template.

Outflows ending soon but deposits still precious

Deposit outflows have continued to slow, with deposits falling 0.49% quarter over quarter in the third quarter after declining 0.53% in the second quarter and 2.46% in the first quarter, when the liquidity crunch erupted. The Federal Reserve's H.8 data, which tracks commercial banks on a weekly basis, suggests that deposits actually held up since the end of the third quarter.

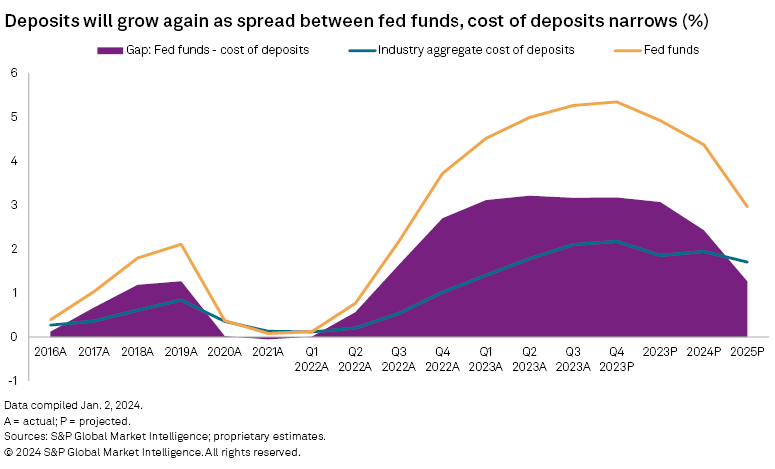

Banks have defended their deposit bases by offering notably higher rates on deposits, narrowing the gap between those products and higher-yielding alternatives in the Treasury and money markets. While outflows have slowed, funds continue to move out of noninterest-bearing deposits and into higher-cost products for institutions, such as brokered deposits and certificates of deposits.

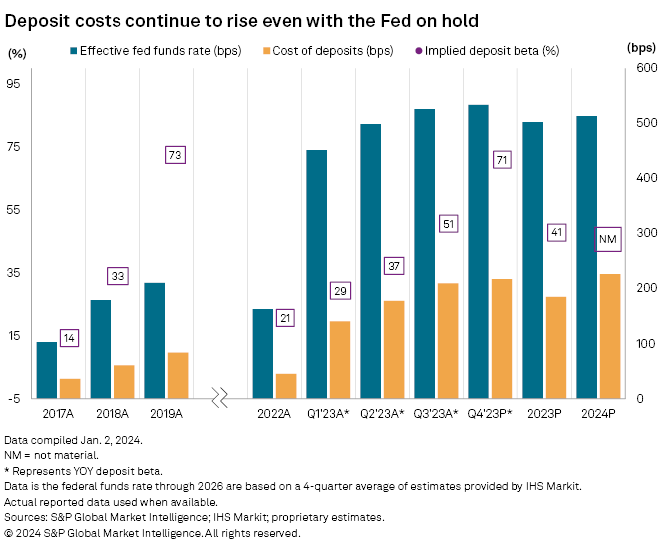

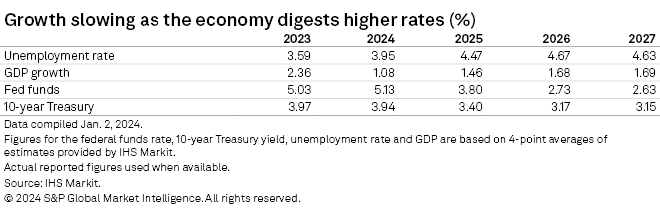

Interest-bearing deposits rose modestly through the first nine months of 2023, but noninterest-bearing deposits dropped 16% in the period. The decline pushed the industry's noninterest-bearing concentration down to 22.6% of total deposits at the end of the third quarter from 25.9% at year-end 2022. We expect noninterest-bearing deposits to fall to 21.5% of deposits by year-end 2023 and decline to 19.0% by year-end 2024. The continued change in deposit mix will cause deposit costs to continue rising through the end of 2024, even as the Fed pivots to lower short-term rates in the second half of 2024.

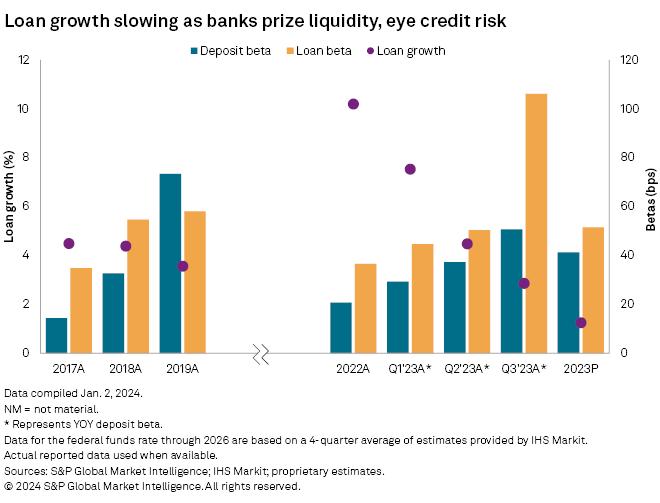

We expect minimal outflows in the fourth quarter and for deposit growth to resume in 2024 but believe that institutions will continue to place a higher premium on funding, even with the Federal Reserve expected to pivot toward lower rates in the second half of 2024 as the regulators encourage banks to build cash and develop more thorough plans for contingent liquidity. Regulatory scrutiny has come at the same time that the Federal Home Loan Bank system's regulator, the Federal Housing Finance Agency, plans to propose rules that would curtail banks borrowings from the FHLBs to ensure they are not used as a "lender of last resort."

Regulatory pressures and the upcoming March 11 expiration of the Fed's Bank Term Funding Program could lead to even more deposit competition as banks place a higher value on deposits than other forms of funding.

The banking industry's aggregate cost of deposits rose to 2.10% in the third quarter of 2023, up 32 basis points from a quarter earlier. That equates to a beta, or the percentage of change in fed funds passed on to depositors, of 117.9% in the period, compared to 79.1% in the previous quarter.

We expect the deposit costs to continue to rise as higher-cost products, such as CDs, become larger portions of banks' deposit bases. CD concentrations have grown back to pre-pandemic levels and should grow further as banks market attractive rates on the products. For instance, the number of banks marketing one-year CDs with rates above 4% had risen to 749 banks as of Dec. 15, 2023, up 46% from the end of June and more than double from the end of March.

Looking ahead

While banks face additional declines in margins, that pressure will eventually ease and be replaced with higher credit costs, producing a headwind to earnings.

We expect earnings to dip just shy of 3% year over year in 2023, when excluding the nearly $15 billion in bargain purchase gains that First Citizens BancShares Inc., JPMorgan Chase & Co., and New York Community Bancorp Inc. generate on their respective failed-bank purchases of Silicon Valley Bank, First Republic and Signature Bank.

As it becomes challenging to grow earnings, more institutions could announce efficiency programs. Comerica Inc. is the most recent to do, announcing Jan. 8 an expense program aimed at improving earnings power and creating capacity for future investments. More institutions could follow suit, but others will face earnings walls, and that should ultimately prompt more M&A discussions as deals offer the opportunity to cut costs.

Bank M&A activity has been anemic, with the punitive rate marks that a buyer must take on a seller's portfolios standing in the way of many transactions, as sharp increases in interest rates have left many banking assets underwater. Further seasoning of loan and bond portfolios and lower rates could soften the blow of those required marks. Some institutions could become more motivated sellers if they run into credit issues.

While we do not expect considerable deterioration in credit quality, we do see greater delinquencies and charge-offs in the future. Banks have tried to prepare for slippage by tightening lending standards and building reserves for loan losses. We expect slow loan growth in the fourth quarter of 2023 and modest growth in 2024 as institutions approach new originations with greater caution. Rising funding costs could also give some banks pause to grow their balance sheets notably, but many banks are also putting less cash to work in the bond market as they seek to remain liquid. We also expect banks to continue to build reserves as they work to shore up their balance sheets to clear any potential hurdles ahead.

There are some signs of credit normalizing, with auto loan and credit card delinquencies rising off very low bases. Potential loss content in banks' commercial real estate (CRE) portfolios has gained the most attention. CRE delinquencies have risen off historically low bases as well, and banks have increased reserves against the portfolios, particularly related to office credits, but overall loss content still remains historically low.

Banks will feel some pain in their commercial real estate books, particularly as borrowers digest the impact of higher interest rates, less credit availability and far lower occupancy since the pandemic. Regulators have reiterated the importance of banks maintaining strong risk management of their CRE portfolios, particularly for institutions with elevated CRE concentrations. The FDIC has also said that it is increasing examination staff in anticipation of more "problem banks" and plans to subject institutions to tougher exams.

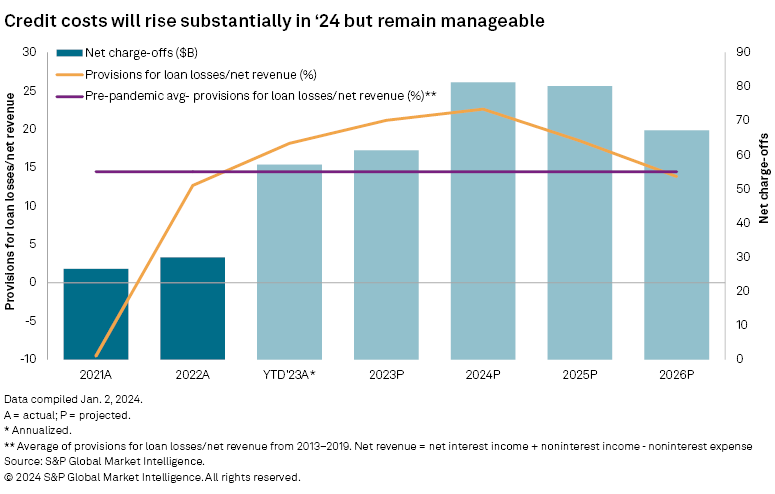

We expect stiffer financial conditions will cause credit quality to slip a little further in the fourth quarter but eventually lead to notably higher charge-offs in 2024. However, even with net charge-off losses in 2024 expected to more than double from 2022 levels, losses and the reserves required to fund them should prove a modest hit to earnings as opposed to the headwind that would occur during a severe downturn.

Scope and methodology

The outlook discussed in this article is based on a proprietary S&P Global Market Intelligence model that utilizes the actual results of nearly 10,000 active and historical commercial and savings banks and savings and loan associations. The outlook is based on management commentary, discussions with industry sources, regression analysis, and asset and liability repricing data disclosed in banks' quarterly call reports. While taking into consideration historical growth rates, the analysis often excludes the significant volatility experienced in the years around the credit crisis.

The outlook is subject to change, perhaps materially, based on adjustments to the consensus expectations for interest rates, unemployment and economic growth. The projections can be updated or revised at any time as developments warrant, particularly when material changes occur.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.