Southeast Asia is rapidly replacing cash, but banks and financial technology companies aiding the transformation are not reaping much revenue from it. In our view, companies issuing cards and wallets must chart a new path to boost revenues.

Banks in Southeast Asia are staring at a significant slowdown in interchange revenue due to the rise of noncard payments and regulatory interventions. While fintechs will lead the growth in payments — thanks to their dominance in electronic money-based mobile wallets — the revenue opportunity is considerably small for the ambitious technology companies.

Growing price compression in the industry should spur changes to the revenue models. Banks must build a cloud-based issuing environment to meet consumers' demands for digital experiences and to support emerging payment methods. Fintechs with an insignificant market position in e-money need to shift their gaze to merchant acquiring activities, where there is potential to generate high-margin revenues by providing software and services for improving payments performance and accelerating turnover through loyalty programs.

Soaring transaction values, scant revenues

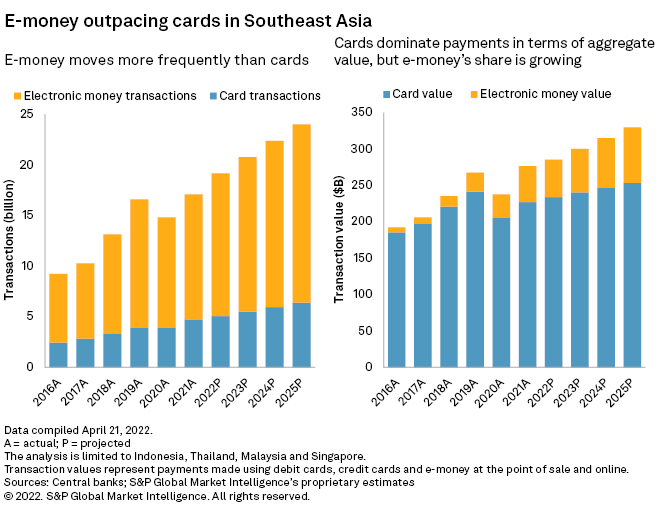

S&P Global Market Intelligence estimates aggregate cashless retail payments to grow at a CAGR of 14% to $3.024 trillion in 2025 in four large economies in the Association of Southeast Asian Nations: Indonesia, Malaysia, Singapore and Thailand. Our analysis looked at the usage of three popular retail payment instruments in the region: debit and credit cards; electronic money, comprising reloadable prepaid cards and digital wallets; and real-time payments facilitated through mobile banking apps and internet banking.

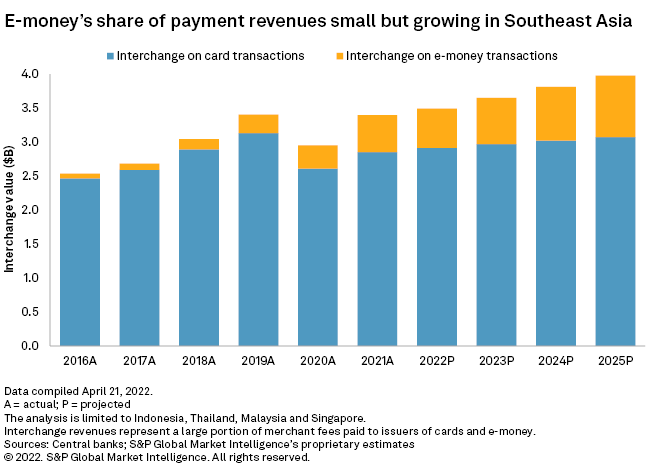

Issuer revenues from payments, however, are expected to grow at a more sedate CAGR of 4% to clock nearly $4 billion in 2025. We define issuer revenues as the portion of merchant fees that goes to banks and nonbanks issuing payments instruments such as cards and e-money. Instant payments attract no fees and do not directly contribute to payment revenues.

Banks will bear the greater brunt of the revenue slowdown as card payments will lag fintech-dominated e-money payments and instant transactions. We expect banks in the four countries to see their aggregate interchange revenue grow at a tardy CAGR of 2% to $3.07 billion in 2025. Along with the rise of noncard payments, heightened competition among technology companies and low-cost utility models of government-run payment networks are driving down merchant fees in the region.

Fintechs, which offer popular mobile wallets, will lead the payment revenue growth as we expect e-money revenues to rise by an over 13% CAGR to $905 million from $544 million in 2021. But the aggregate revenue opportunity in payments is not large enough for fintechs. Further, as we explained in our previous research, fintechs in Asia do not generate positive margins on a transaction level as payment revenues are often not enough to meet processing costs incurred for drawing customer funds into their stored-value wallets.

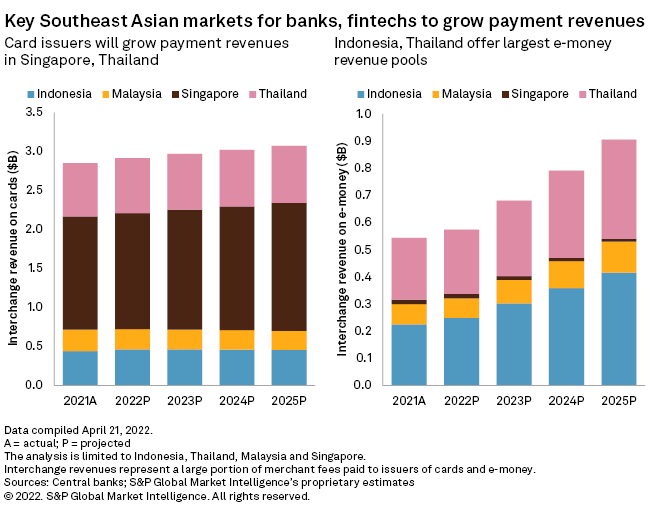

In our analysis, we have ranked markets for banks and fintechs based on revenue growth potential. Although the region is increasingly becoming integrated with various banks and fintechs building regional businesses, growth opportunities vary from country to country.

Sluggish growth in card interchange revenue

Despite already being the largest market in terms of value, Singapore remains the best bet for card issuers to grow interchange revenues. We forecast interchange revenues on debit and credit card transactions in Singapore to grow at a CAGR of 3% to $1.64 billion in 2025. Thailand and Indonesia could also register steady growth in card interchange revenues at CAGRs of 2% and 1%, respectively. Malaysia, on the other hand, is expected to see its card revenue contract a CAGR of negative 3%, driven by regulatory pressure on interchange rates.

Our sober outlook on card interchange revenues reflects the underwhelming usage of credit cards. As the pandemic dampened the risk appetite of banks, the supply of credit cards took a hit. We expect a slow rebound in credit card usage through 2025 as the share of consumers with revolving needs rises with economic recovery. Debit cards proved to be relatively resilient through the pandemic and will see faster growth through 2025.

Banks have historically leveraged credit card businesses to boost their non-interest income and develop relationships with consumers and merchants. Providing transactional services has helped banks in the region improve the share of low-cost, sticky deposits such as current and savings accounts in their deposit mix. With the slowdown in card payments becoming a secular trend, banks must find alternative paths to drive client engagement and make up for the revenue shortfall.

Investing in a digital transformation could potentially create two options: For banks with resources and market-leading positions, providing compelling mobile banking experiences that promote in-house card and non-card payment methods as well as unsecured consumer lending solutions. Aligning with popular consumer-facing fintechs to underwrite their "buy now, pay later" and other point-of-sale financing options could be the way to go for smaller banks. But both options call for modernizing their issuing platforms through the deployment of microservices and application programming interfaces to enhance flexibility and scalability.

Growth markets for fintechs

The dominance of nonbanks as e-money issuers across the region makes e-money a good proxy for fintech payments. Our analysis shows that nonbanks account for the majority of e-money license holders in Thailand, Indonesia and Malaysia. In Singapore, the central bank has issued payment licenses to 29 nonbank e-money issuers. Banks in the island nation do not need a license to offer stored-value accounts, which differ from interest-paying deposits. It is not clear how many financial institutions in Singapore issue e-money.

Indonesia offers the highest revenue potential for fintechs as e-money is becoming the archipelago's primary payments instrument. The aggregate e-money value in the country surpassed credit cards for the first time in 2021, growing to $21 billion from $14 billion in 2020. We expect e-money revenues in the largest Southeast Asian economy to nearly double to $416 million in 2025 from $225 million in 2021. Thailand will be the second-highest revenue pool for fintechs, with its revenues on e-money transactions expected to rise at a CAGR of 13% to $365 million in 2025.

A growing consumer and merchant base allows leading e-money issuers to add adjacent revenue streams by targeting populations with unmet credit demands. Low penetration of credit cards and small business financing solutions presents opportunities for tech companies to provide a virtual revolving line of credit.

Market leaders such as Grab Holdings Ltd., Sea Ltd. and PT GoTo Gojek Tokopedia Tbk have either secured banking licenses or acquired stakes in banks to take a bigger bite of regulated financial services. Other fintechs with less advantageous market positions and limited resources will likely shift focus from issuing to merchant acquiring activities. Merchant acquirers' revenue models will initially be linked to providing software and services for transaction processing, payment performance improvements and managing loyalty programs, and they will eventually have an opportunity to promote financing solutions such as BNPL offerings and working capital financing.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.