A majority of banks do not plan to curtail their overall technology spending in the next 12 months, based on a recent survey conducted by S&P Global Market Intelligence.

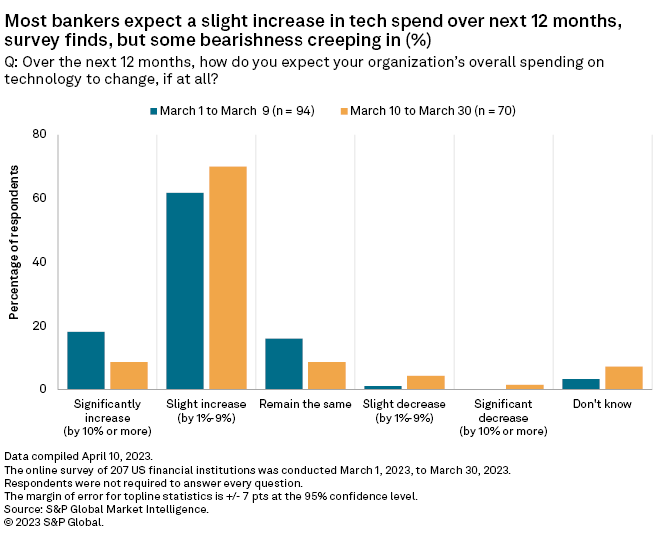

Roughly 65% of respondents expect a slight increase in tech spend between 1% and 9% and another 14% anticipate a significant increase of 10% or more. This is a potentially encouraging sign for the financial technology firms that provide business-to-business services to banks, but a potentially negative one for fintechs directly competing with them.

An important caveat to the survey, though, is how responses changed over time to the tech spend question. Of the respondents that took the survey from March 1 to March 9 — before the failure of Silicon Valley Bank — 18.1% said they expected a significant increase in overall technology spending. But among the respondents that took the survey from March 10 to March 30, the number dropped to 8.6%.

Recent liquidity issues in the banking industry coupled with the possibility of an economic recession are cause for concern for fintech vendors, as banks might start reining in tech spending to preserve capital. Even after March 9, however, the majority of respondents said they planned to increase in tech spending in the next 12 months and that they plan to keep their level of tech employees the same.

While Silvergate Capital Corp.'s Silvergate Bank entered liquidation March 8, it did not seem to create the same shockwaves as Silicon Valley Bank, probably due to Silvergate's heavy concentration in the crypto industry. About 99% of Silvergate's total deposits were digital asset-related desposits as of June 30, 2022.

But fortunately for banks and fintech vendors, the volatility in US bank stocks has declined considerably since the failures of Silicon Valley Bank and Signature Bank, based on the S&P U.S. BMI Banks Index. The standard deviation of the index spiked to 7.5 in the week of March 6 from 1.3 in the week of Feb. 27 but has since settled to 1.7 in the week of April 10.

The S&P US BMI Banks Index is a broad market index that contains 250 banks, including heavyweights like JPMorgan Chase & Co., Bank of America Corp. and Wells Fargo & Co., as well as some of the most volatile bank stocks of late, like First Republic Bank, PacWest Bancorp and Western Alliance Bancorp.

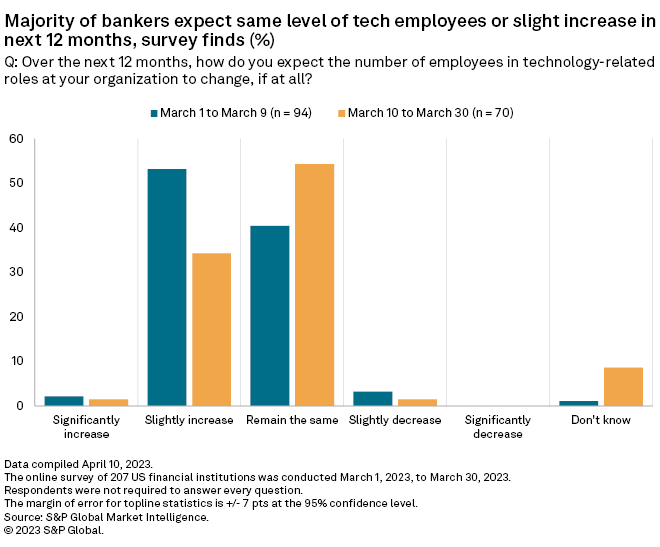

Tech employment

Overall, 46.3% of survey respondents expected the number of tech employees at their companies to remain the same in the next 12 months and another 45.1% anticipated a slight increase over that time. Only 1.8% predicted a significant increase and 2.4% expected a slight decrease. But here too, the bank failures seemed to make the respondents less bullish. Of those that took the survey from March 1 to March 9, 55.3% predicted either a slight or significant increase in the number of tech employees. But that dropped to 35.7% in the cohort that took the survey from March 10 to March 30.

Banks might want to cut costs at the moment, given economic uncertainty and investor concerns over the industry's capital adequacy. But as we have written before, we think there is an opportunity for banks to pick up talent from tech companies doing layoffs. Meta Platforms Inc., for instance, has reportedly started another round of layoffs, including employees in technical roles. And it is not alone. A number of companies within the fintech industry have also trimmed their ranks.

Customer digital adoption

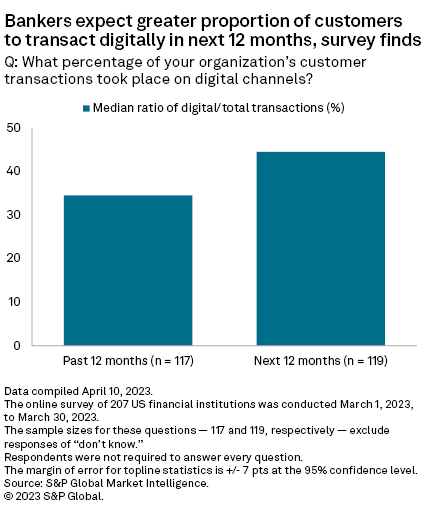

Another surprising result from the survey, in our view, was that more than half of banking customers are still not transacting via digital channels. The median estimate of the proportion of digital customer transactions was only 34.5%, even after the pandemic forced many customers to consider online options.

Survey respondents did, however, expect that number to grow to a median 44.5% in the next 12 months. And some, like Bank of America, have seen a lasting shift from the pandemic. The bank reported April 18 that 51% of total sales in its consumer banking division were done digitally in the first quarter of 2023, up significantly from 33% in the first quarter of 2020. Bank of America defines digital sales as ones that are initiated or booked via digital platforms.

Fintech vendor usage

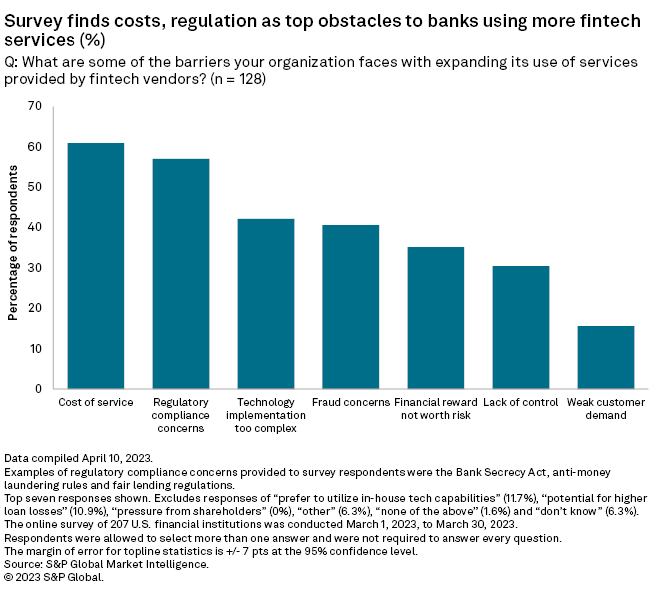

The cost of fintech products and services is the main reason banks do not use them more, according to the survey. Approximately 61% of respondents cited cost as their top reason for not expanding the use of fintech services provided by vendors, followed closely by regulatory compliance concerns at 57% — respondents were allowed to choose more than one answer to the question.

There seems to be robust customer demand for fintech vendor products and services. Only 15.6% of respondents cited weak demand as the reason for not expanding fintech usage.

Banks could theoretically spend all of their tech budgets on in-house projects. But, as the survey showed, many banks use fintech vendors. Banks that used at least one vendor outnumbered those that used none by 2.7:1. Additionally, the banks that used fintech products and services tended to have relationships with multiple vendors. On average, banks had relationships with five vendors, as we wrote about in a prior article on the survey.

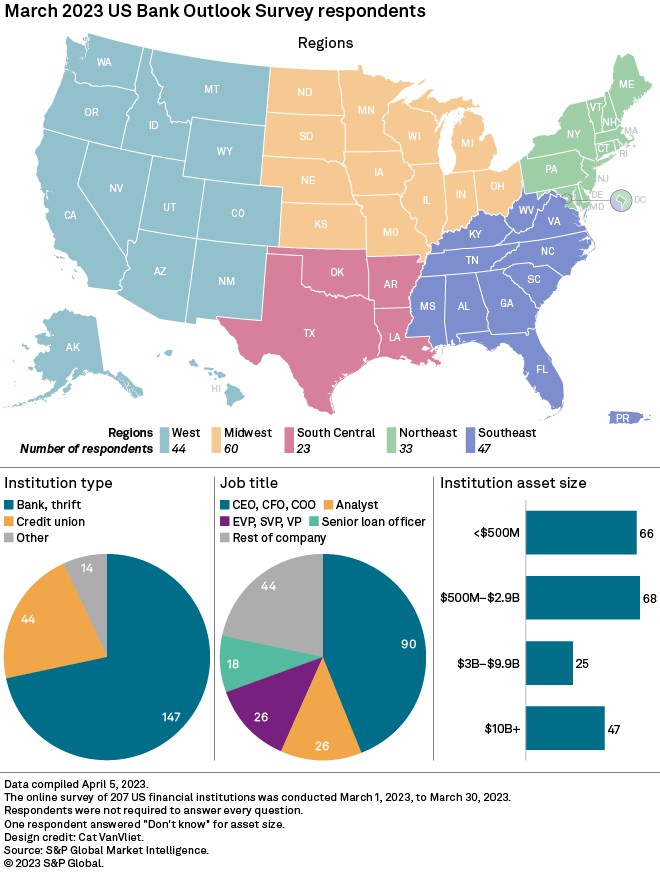

S&P Global Market Intelligence surveyed 207 US financial institution clients on various topics including expected loan and deposit growth, projected interest rates and financial technology use. Of the 207 participants, 147 worked for commercial banks or thrifts, 44 for credit unions, 14 for other US institutions and two were unspecified.

The online survey was conducted between March 1, 2023, and March 30, 2023. Click here for a downloadable version of the results.

If you would like to participate in future US banking surveys, please contact david.hayes@spglobal.com.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.