Based on the early release of the U.S. Energy Information Administration's Annual Electric Generator Report, utility-scale battery storage capacity nearly tripled in 2021, from 1.6 GW up to 4.6 GW. S&P Global Market Intelligence data shows 10 GW of new installations expected in 2022 and 38 GW planned through 2024. If President Joe Biden signs the Inflation Reduction Act as expected, the 30% tax credit for stand-alone and hybrid battery storage systems will increase the speed of growth for this technology.

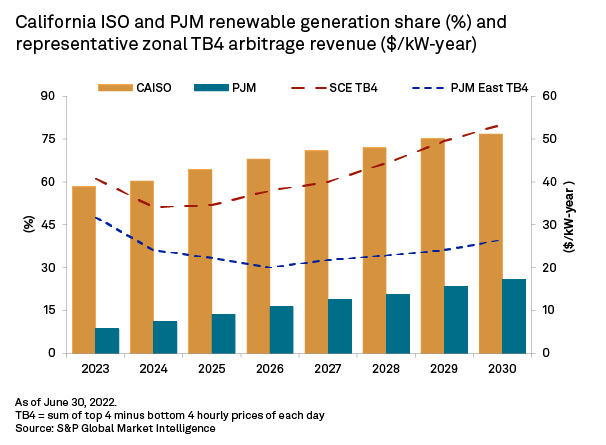

As renewable resources increase their generation share, they change the shape of day-ahead hourly price curves, lowering the daytime prices. Battery storage systems can take advantage of this spread by charging in the low price hours and discharging in high price hours, a strategy called price arbitrage. However, the potential for arbitrage revenues varies across the U.S., with strong potential in renewables-heavy California and lower in the PJM Interconnection.

The EIA report also includes a survey of the applications of the battery systems, showing an increasing percentage of capacity that is used for price arbitrage. This strategy charges the battery storage system at times of low prices and discharges the electricity to the grid at times of high prices, resulting in net positive revenue from the energy market. In 2021, 59% of battery storage capacity was used for arbitrage, up from 17% in 2019. In California alone, 1,800 MW of new battery storage capacity began operation in 2021, and more than 80% of the state's total of 2,339 MW of battery storage was used for arbitrage. On the other hand, states in the PJM Interconnection LLC only added 7 MW to their total of 136 MW of battery storage to the grid, and less than 1% of that took advantage of arbitrage potential.

The most common application for battery storage systems, at just above 60%, is frequency regulation, wherein the fast startup time of a battery can help maintain required grid frequency. Battery storage systems can report more than one application.

Renewable penetration and hourly prices

|

California has one of the most aggressive renewable portfolio and clean energy standards in the United States, with significant existing and planned wind, solar, geothermal, hydro and battery storage capacity to reach its goals. The state mandates that 60% of electricity must come from renewable resources by 2030 and 100% must come from non-carbon-emitting resources by 2045. California saw 33.6% of its generation come from renewable resources in 2021 and 49% from carbon-free resources. The S&P Global Market Intelligence Power Forecast predicts that, on trend to meet the more aggressive 100% CES, 77% of generation will be from renewable resources such as wind, solar, hydro and geothermal by 2030.

|

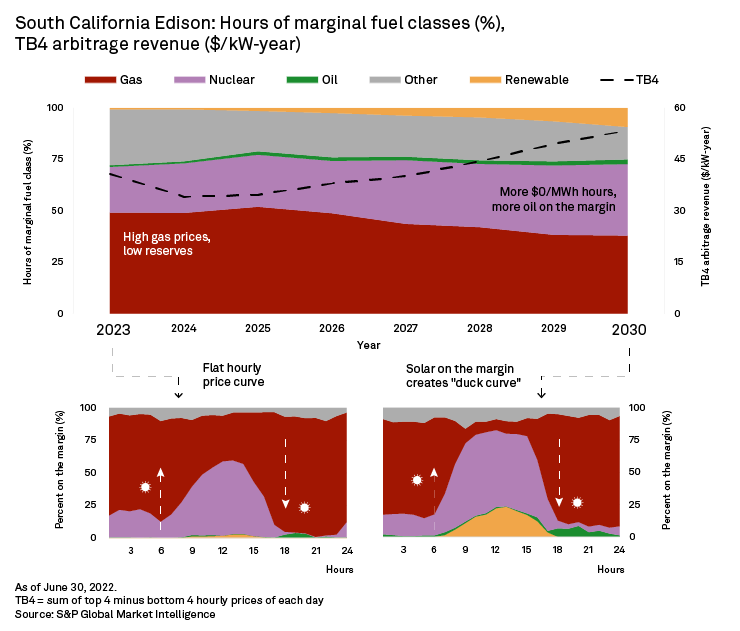

Battery storage arbitrage maximizes its potential when it can charge from $0/MWh prices set by renewable resources on the margin and discharge when expensive gas, coal or oil are setting the price. Not surprisingly, 93% of new battery storage in 2021 in the U.S. was colocated with a renewable resource to charge directly from the zero-cost resource. Areas with high solar penetration like California will increasingly see a "duck curve" in day-ahead hourly prices where daytime prices drop and evening prices increase, creating the belly and head of the duck, respectively. Battery storage can lessen this impact by generating in those peak net demand hours.

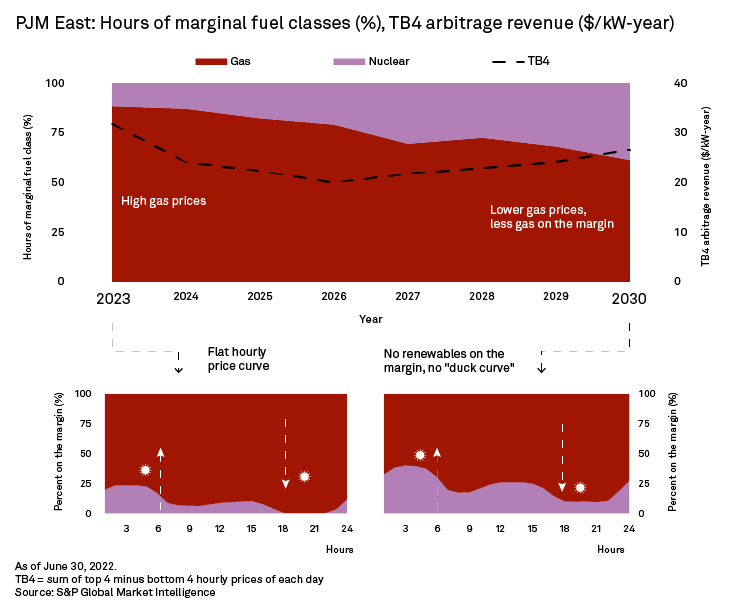

On the contrary, regions with little growth in renewables through 2030, like PJM, see a consistent downward shift in prices throughout the day, with no change in hourly shape, as natural gas prices decrease from their current high. The difference between low and high electricity prices during the day remains relatively similar and much lower than in California or other markets with high renewable penetration.

Marginal renewables boost arbitrage potential

As renewables increase their generation share in California, the fuels that set the marginal price change as well. Natural gas units still set the price for more than 40% of the hours of the year through 2030, but renewables increase in their time on the margin, significantly changing the hourly fuel on the margin from 2023 to 2030. With more than 20% of the 1 p.m. local time day-ahead prices being set by renewables and another 60% set by cheap nuclear — specifically SCE's portion of the Palo Verde nuclear plant — battery storage can charge at very low prices. After the sun sets, the evening fuel on the margin more often becomes oil, which is more expensive than gas, offering higher prices for battery storage discharge. Assuming a four-hour battery storage system, the annual revenue accumulated from the top four hours' prices minus the four bottom hours' prices of each day, or TB4, increases up to $55/kW-year by 2030. Day-ahead arbitrage revenues are higher in 2023 due to high gas prices setting a particularly high evening price, but as gas prices return to normal, the arbitrage potential decreases in 2024, followed by a continuous increase due to the acceleration of renewables.

|

The marginal fuels in PJM East provide a different set-up for arbitrage potential. With only 26% of PJM's generation coming from renewables in 2030, the $0/MWh renewable resources only act to push the marginal resource lower in the supply stack but never set the price themselves. Though the balance between gas and nuclear resources setting the marginal day-ahead prices does shift, gas still sets the price 60% of the time in 2030. Throughout the day, both wind at night and solar during the day shift the marginal fuel from gas to nuclear, keeping the same hourly shape but resulting in an overall downward shift in prices. Since the difference between the low and high price hours stays about the same in 2023 and 2030, the battery arbitrage potential remains low, dependent mostly on gas prices.

|

If the Inflation Reduction Act becomes law as expected, wind, solar and battery storage will all benefit from up to 30% tax credits. Preliminary studies show that this will encourage more than 89 GW of new wind and solar per year through 2026. This will cause substantial changes to the way that marginal prices are set, providing greater opportunity for battery storage arbitrage in addition to the greater revenue potential from ancillary services for grid stability, ramping responses and frequency regulation. With renewables setting the real-time marginal price, weather will increasingly add volatility to market prices, boosting day-ahead/real-time spreads where battery storage systems can realize additional revenue.

Even without government subsidies and tax credits, battery storage is already taking cues from the high arbitrage potential locations with growing renewable generation, seen mainly in California and Texas.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.