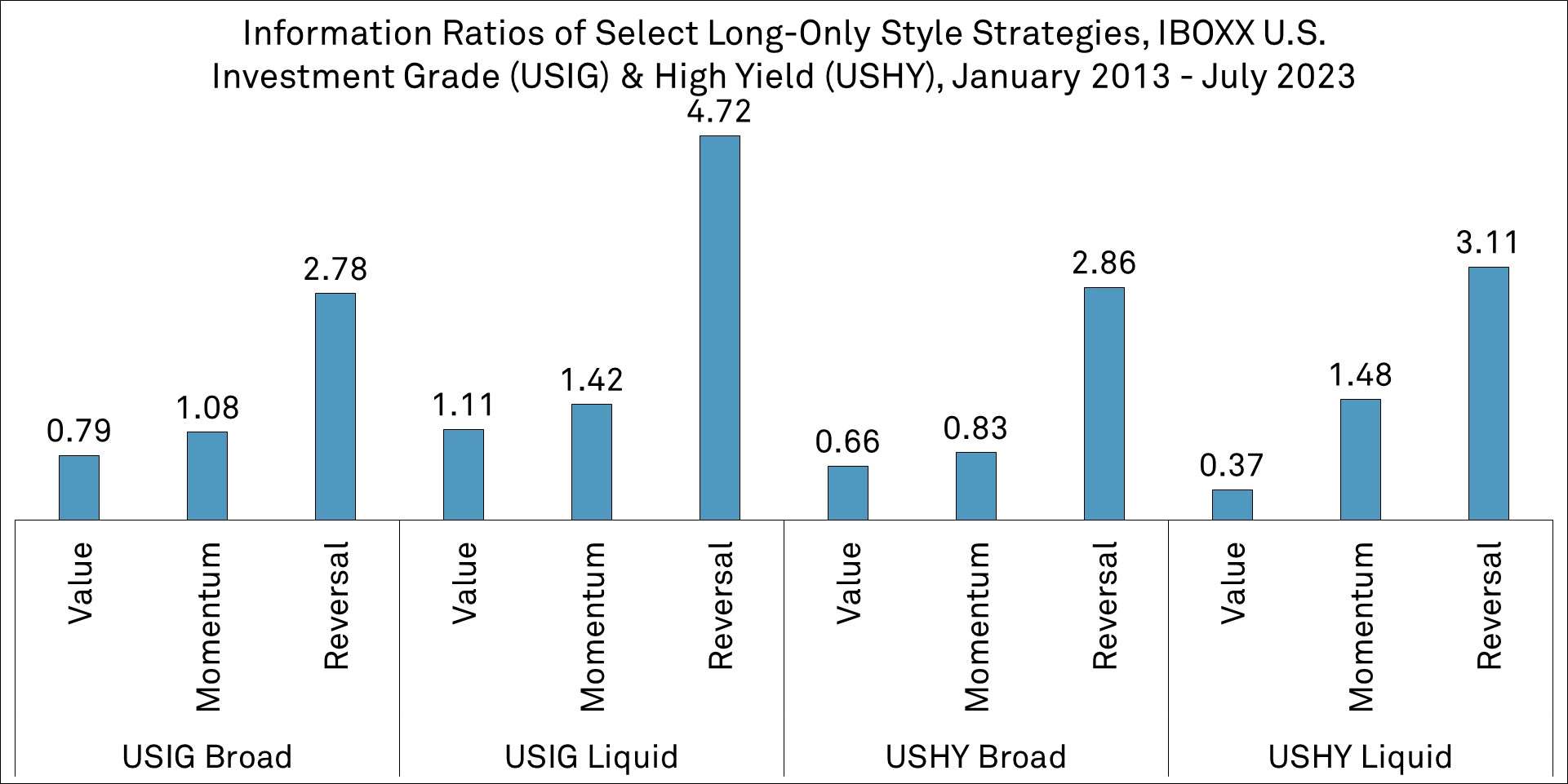

The application of 'smart beta' strategies is expanding into corporate bonds, beyond its equity roots. This paper explores value, momentum, and short-term reversal styles in fixed income, highlighting the potential to enhance returns and diversify portfolios. The analysis shows that value and momentum strategies in iBoxx U.S. investment-grade (USIG) and high-yield (USHY) bonds generated statistically significant alpha, with low correlations to the comparable equity styles and markets premia.

VIEW THIS PAPER’S SOURCE CODE

(with your S&P Global Marketplace Login)

Source: S&P Global Market Intelligence Quantamental Research. Data as of July 2023.

Key research findings include:

- Value and Momentum: Back-test results show long/short USIG (USHY) value and USIG (USHY) momentum styles delivered 2.0% (2.7%) and 1.1% (4.7%) annualized alpha respectively, after controlling for common equity styles and markets risk premia.

- Momentum and Liquidity: Momentum performed better in the liquids bond universe relative to the broader bond universe with an annualized 0.4% in the USIG and 0.9% in the USHY.

- Low Correlations: Returns to value and momentum styles have historically shown weak correlations with commonly used style factors including equity styles. Correlations range from -0.3 to 0.3, suggesting diversification benefits.

- Value, Momentum and Credit Rating: Value performance strengthened as spread dispersions widened from AAA to BB ratings. This advantage diminished in B ratings, as default risk subsumed the value premium. The momentum signal proved more effective in lower rated credit with more room for price appreciation.

Explore the data used to conduct this research

S&P Global Market Intelligence bond pricing and liquidity data forms the basis of bond returns and liquidity-related robustness checks. Bond pricing data is updated daily covering US, European and Asian corporate bonds with historical records available since January 2013. We used the following S&P Markit iBoxx fixed income indices and their analytics in signal and factor portfolio construction.