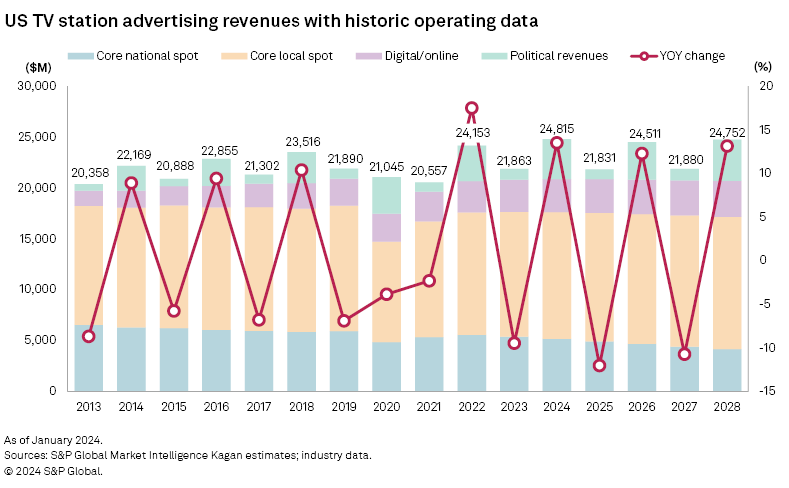

For TV stations, spending in the 2024 presidential election year is expected to surpass prior records, with a possible rematch of Joe Biden vs. Donald Trump at the top of the ticket. Toss-ups in some US Senate and Congressional races could shift power in both houses, in addition to the presidency. And issue-based ads around controversial propositions could add even more revenue to some station's coffers. Political ad spending on TV stations is expected to reach $3.94 billion, up 10.0% from the last presidential election year in 2020.

In 2024, TV station industry revenue, including gross national/local spot advertising, digital and retrans fees, is expected to climb 8.3% to $40.04 billion, up from $36.96 billion estimated in 2023. Total spot ad revenue, excluding digital, is expected to grow 15.4% with a boost from political to $21.57 billion.

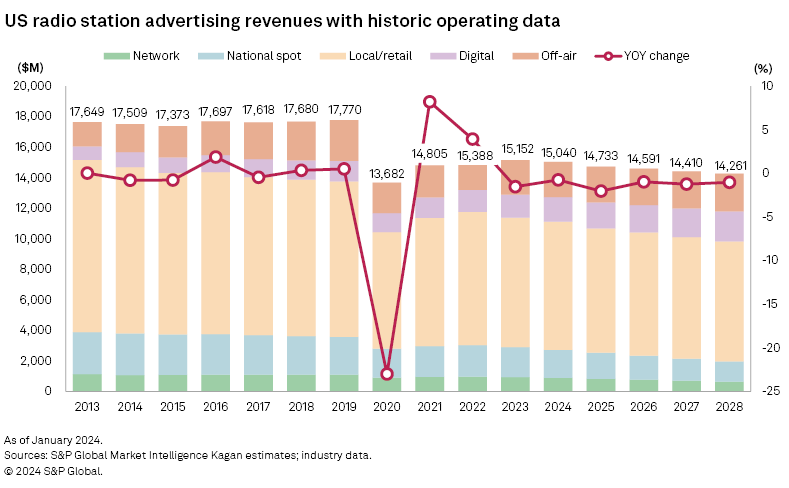

The radio station business has been challenged to remain relevant and part of national ad budgets, although it is still relatively strong in the local ad markets. Kagan Research projects a decline in US radio ad revenue of 0.9% to $11.86 billion in 2024. That is roughly $1 billion higher than radio ad revenue in the pandemic ad recession of 2020 but still approximately $2 billion lower than pre-pandemic levels. Radio ads are predominantly local and focused on the auto, retail, travel and entertainment categories, which have been under pressure from inflation and a higher interest rate environment over the past couple of years.

Radio also must compete with streaming music and podcasting alternatives and with a remote working class that has reduced commuting hours during prime in-car radio time. Despite those challenges, radio's lower ad cost, community outreach and relatively high return on investment compared to other media should help maintain its ad share in its local markets.

Challenges and opportunities facing US broadcast stations today:

National advertising

Core ad trends started to improve in the third and fourth quarters of 2023 with an expanded schedule of NFL games and a resolution in writers and actors strikes. The strikes disrupted the majority of scripted TV programming in the 2023–2024 season, which should see a return to normalcy in the 2024–2025 network upfronts. National core spot advertising is expected to be up by low to mid single digits, although the big question for NBC and Telemundo affiliates is how much core advertisers will spend during the Paris 2024 Summer Olympics with the crowd-out factor of political ads.

Political advertising

Political advertising will be spent disproportionately on local stations in swing-state markets and those with higher expected population growth — such as Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania, Texas and Wisconsin — which are forecast to rise more than the national average. Markets in three of those eight — North Carolina, Texas and Wisconsin — are among the top five TV and radio markets that are expected to grow most quickly, based on our most recent ad revenue growth forecasts for the 2023–2028 period.

Local advertising

Broadcasters continue to hold on to an advantage over their digital rivals, which is the ability to serve and build trust with communities, including through local news, weather and sports programming. Over-the-air households have been growing over the past decade as the traditional cable bundle becomes more expensive and even cheaper streaming options are raising their prices and including ad-tiers. We expect local advertising on TV stations to deliver low to mid single-digit growth in 2024, with small and midsized markets likely outperforming large markets and urban centers.

TV ratings

Based on Comscore Local Market audience data, TV station average household ratings gained in the second half of 2023, boosted by live sports, especially NFL and college football games. Despite that upward trend to close the year, TV station average household ratings were down versus 2022, with the actors and writers strike impacting the scripted TV programming slate, coupled with retrans disputes and households dropping their legacy multichannel subscriptions.

On a positive note, according to data from Nielsen Holdings PLC and Adobe Analytics, Super Bowl 58 held in Las Vegas on Feb. 11 set a new audience record with nearly 124 million viewers across Paramount Global's owned-and-operated and affiliate CBS (US) TV stations, the kid-friendly simulcast on Nickelodeon/Nick At Nite (US), Spanish-language broadcast on TelevisaUnivision Inc.'s Univision (US), streamers Paramount+ and ViX, and NFL digital platforms. This showcased that the Super Bowl is still a big draw and that broadcast is an important part of reaching that audience for the NFL and advertisers.

Sports

Sports and broadcast have been intertwined since the beginning of radio and TV and have become even more vital for the broadcast business as audiences are still tuning in for the live games despite the multitude of alternative entertainment options.

Over the past year, broadcasters including Gray Television Inc., Nexstar Media Group Inc., Sinclair Inc. and The E.W. Scripps Co., have been opportunistic in securing local sports rights deals with major professional teams because of the collapsing regional sports network business, with Warner Bros. Discovery Inc. shuttering all of its RSNs and Diamond Sports Group LLC going through Chapter 11 bankruptcy restructuring.

Even if Diamond Sports Group can exit bankruptcy and extend all of its current rights deals, we expect local stations to continue to carve out rights deals in their markets, as we have seen recently with the Milwaukee Bucks and Oklahoma City Thunder. And while broadcast stocks dipped on the news of Walt Disney Co., Warner Bros. Discovery Inc. and Fox Corp.'s streaming sports bundle joint venture, local ABC (US) and FOX (US) affiliate stations are likely still going to be included in this subscription service.

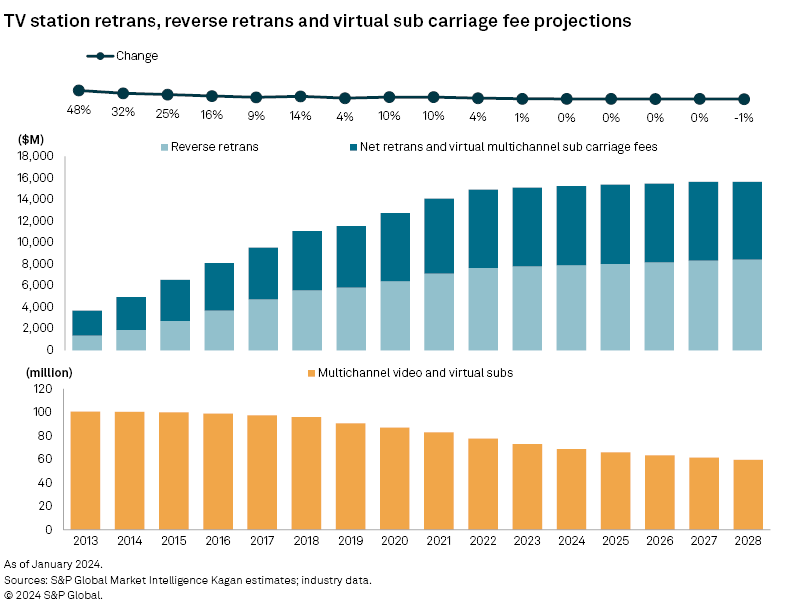

Retrans

US TV station traditional subscriber gross retransmission and virtual sub-fee revenue was estimated at $15.09 billion in 2023, up 1% from $14.91 billion estimated in 2022. For 2024, we expect a similar trend of rate hikes in renewals, slightly outpacing the cord-cutting trend with gross retrans and virtual sub-fee revenue up 1% to $15.22 billion. In the longer term, we project that retrans and virtual sub fees will grow more slowly than our previous forecast, to $15.64 billion by 2028.

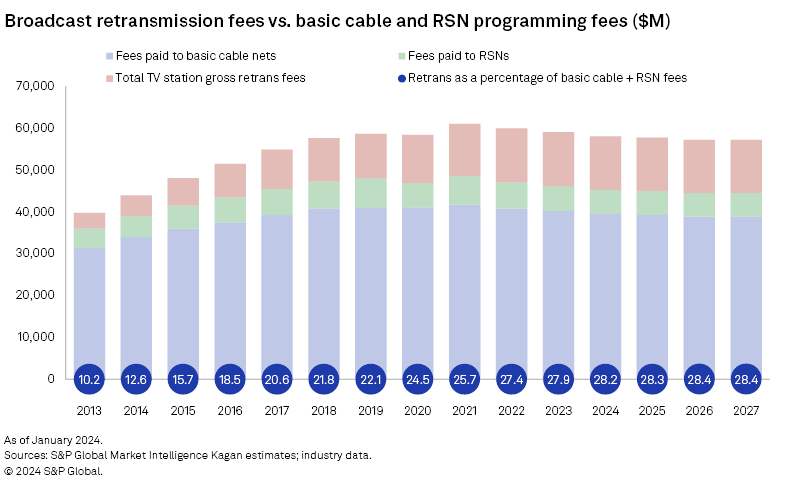

TV station group owners still see a disparity in broadcast audience delivery, which ranges from 30% to 40%-plus, depending on the market and what they receive in gross retrans fees versus the carriage fees that multichannel operators are paying for cable networks and RSNs, which we estimate was 27.9% at the end of 2023 and expect to grow to 28.2% in 2024.

Based on Kagan's estimates, the average annual dollar per retrans per sub per month totaled $19.10 at the end of 2023 and is expected to rise to $20.45 in 2024 and $24.05 by the end of the projection period in 2028. The Big Four TV network affiliate stations receive the bulk of that retrans fee, with CBS, NBC and FOX stations higher than ABC stations based on their sports rights, including NFL games.

Technology

AI has made huge gains over the past couple of years and has impacted every industry, including broadcast. While AI was a big topic during the writers and actors strikes, the creative process is probably less impacted in the early stages of generative AI (GenAI) models and will have more influence when it comes to technologies around TV and film production, editing and delivery processes, and the advertising targeting and transactional workflows.

Another factor at play is NextGen TV, also known as ATSC 3.0, which at the end of 2023 was available to some 70% of US households. Chicago went live in early February, increasing that reach to 75%, and San Antonio, San Diego and Cleveland are going to be lit this year, which will increase coverage to 81% of the US by the end of the year. Given the voluntary nature of this new broadcast TV standard, the next challenge is for consumer adoption without the US FCC-mandated TV analog-to-digital switchover that occurred in June 2009 for all full-power TV stations.

Deal market

Many industry professionals consider the current broadcast ownership caps outdated with some rules decades old, predating the rise and unfettered reach of digital and social media companies — direct competitors for advertising and subscription dollars. Despite lobbying from individual station owners and the National Association of Broadcasters' ownership cap relaxation proposals for TV and radio, things have gained little traction at the Democrat-led FCC under Chair Jessica Rosenworcel.

The FCC's 2018 Quadrennial Regulatory Review released at the end of 2023 reaffirmed the current broadcast ownership caps for local radio and TV. In addition, the FCC tightened the top-four dual network rule to prohibit a station owner from acquiring another top-four network affiliation in the same market by placing it on a low-power TV or class A station or on a multicast programming stream, which would be prohibited if it was on a full-power station. This ruling poured cold water on an already tepid broadcast deal market in 2023 and prospects for 2024.

Total broadcast station deal volume reached $578.4 million in 2023, down from $959.5 million in 2022 and $4.72 billion in 2021. The TV deal market in 2023 registered $365.9 million, of which 81% ($295.5 million) came from the two top deals of the year: Hearst Corp. acquiring two full-power stations in Ft. Myers-Naples, Fla., from Waterman Broadcasting Corp. and Mission Broadcasting Inc. acquiring one full-power station, WADL, in Detroit from Adell Broadcasting Corp.

Radio's 2023 deal volume of just $212.5 million was down 35.6% from the total of $329.9 million in 2022, but there was more activity in the second half of the year and could be more prospects in 2024, with the Chapter 11 bankruptcy restructuring of Audacy Inc. and smaller privately held radio owners such as Neuhoff Family LP exiting the business.

Looking at the deal market in 2024, there was a $30 billion unsolicited bid, including debt and equity, by Byron Allen's Allen Media Group for Paramount Global, although David Ellison's Skydance Media has also been a rumored buyer for a few months. Allen was rebuffed in his $3.5 billion bid for Paramount's BET (US) and VH1 (US) cable nets. Outside of Paramount, no other major deals are on the horizon, although there could be renewed efforts for private equity to take another stab at a broadcast deal if interest rates dip, despite Standard General Fund LP's unsuccessful buyout of TEGNA Inc.