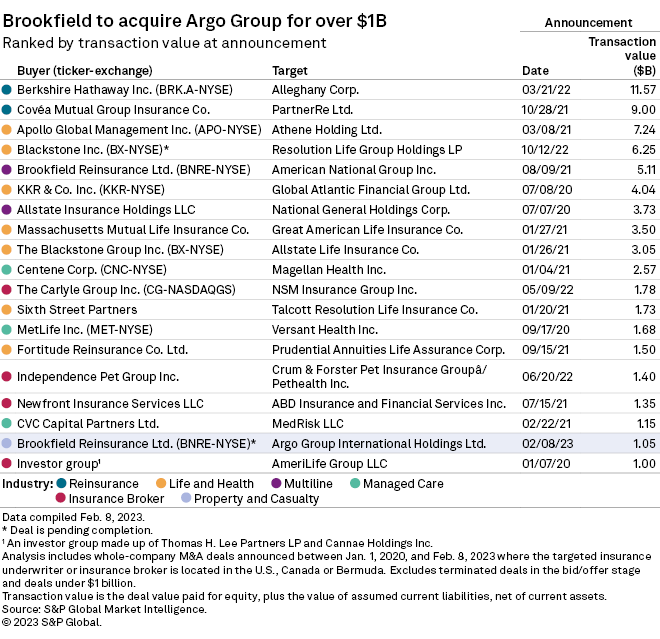

Assuming the eventual completion of its newly announced $1.05 billion acquisition of Argo Group International Holdings Ltd., Brookfield Reinsurance Ltd. will not closely resemble the entity that the predecessor to Brookfield Corp. spun off to shareholders in June 2021.

Rather than an emphasis on the assumption of North American life and annuity business through block and flow reinsurance transactions, Brookfield Reinsurance will become a multiline insurer and reinsurer with a decided property and casualty bent.

This evolution may represent a commentary both on the company's initial experience as a stand-alone entity, as well as the increasing competitiveness in the overall market for attractive blocks of life and annuity business. Brookfield Reinsurance is one of an ever-increasing number of alternative asset managers targeting the addition of various forms of liabilities in that realm.

Brookfield Asset Management notably exited specialty P&C insurance, Argo's chosen niche, several years prior to establishing Brookfield Reinsurance.

Conceived as a vehicle to, among other things, source large-scale reinsurance transactions in the life and annuity market, Brookfield Reinsurance intended to leverage Brookfield Asset Management's ability to invest the associated assets in high-quality, long-dated assets.

There is a large addressable market in North America and Western European for the business model, but many peers have also established their own strategies to pursue the related opportunities. Private equity-backed vehicles such as Apollo Global Management Inc.'s Athene Holding Ltd., KKR & Co. Inc.'s Global Atlantic Financial Group Ltd., The Carlyle Group Inc.'s Fortitude Group Holdings LLC and Sixth Street Partners LLC's Talcott Financial Group continue to compete themselves and, in certain cases, through co-investment vehicles for in-force blocks. Blackstone Inc. has made a splash in the space as well, most notably spearheading a strategic partnership intended to rapidly scale life and annuity consolidator Resolution Life Group Holdings LP's global expansion.

In addition to competitive developments, Brookfield Reinsurance and American Equity Investment Life Holding Co., the reinsurer's initial U.S. annuity cedant, have been engaged in a well-publicized dispute over the latter entity's strategic direction.

And while Brookfield Reinsurance made headlines in August 2021 with an agreement to acquire multiline U.S. insurer American National Group Inc. for $5.11 billion in a transaction that provided diversification by business line and investing focus at different points along the yield curve, Chairman and CEO Sachin Shah said during a September 2021 investor meeting that transactions of the sort represented something that the company would engage in "once in a while."

And, he added at the time, "For the most part the bulk of our growth should come from block reinsurance."

Direct to dominate

Brookfield Reinsurance is divided into three business segments: direct insurance, reinsurance and pension risk transfer. Those segments accounted for 47.1%, 31.7% and 21.2%, respectively, of the company's net premiums in the third quarter of 2022, according to its financial report for that period.

The direct business reflects the wide-ranging American National operations, which include the following: whole, universal, and credit life insurance; deferred, single-premium immediate and variable annuities; personal auto and homeowners insurance; commercial auto, business owners' property and liability, workers' compensation, and umbrella insurance geared to farmers, ranchers, and various small to mid-sized businesses; and various specialty coverages such as renters, mortgage security, aviation, private flood, collateral protection and guaranteed auto protection insurance.

The reinsurance business currently focuses on covering in-force blocks of fixed annuities, fixed index annuities and payout annuities as well as covering new business through flow arrangements. Brookfield Reinsurance's pension risk-transfer business, meanwhile, has been focused on the Canadian market.

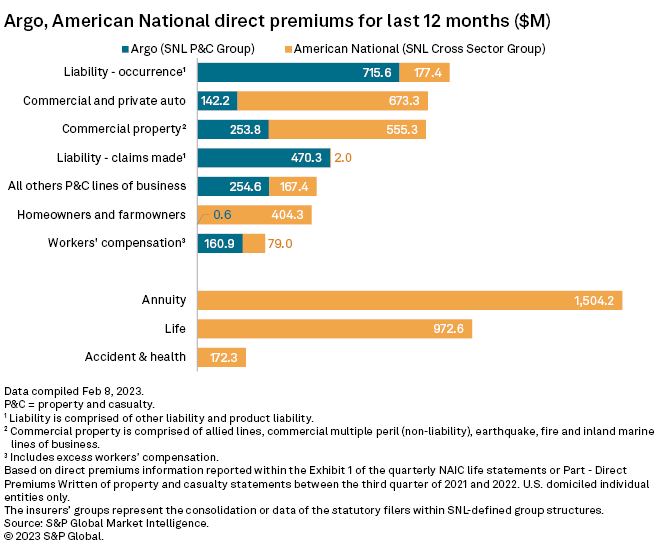

On a statutory basis, the American National U.S. P&C companies generated $2.06 billion in direct premiums written during the trailing-12-month period ended Sept. 30, 2022, with a nearly equivalent split of commercial and personal lines business. The American National life companies produced $2.65 billion in direct premiums and considerations during the same time frame, with 54.4% from ordinary individual annuities and nearly 35.0% from ordinary life.

The addition of Argo, which repositioned itself as a U.S.-focused specialty lines insurer, would tip the scales in favor of the P&C business. The U.S. P&C units of Argo were nearly as large from a premium volume standpoint as American National's, having generated direct writings of $2.00 billion during the trailing 12 months ended Sept. 30, 2022. With Argo's commercial focus, nearly three-fourths of the pro forma direct premiums written of the combined organization of $4.06 billion would come from the commercial lines. The other liability lines would rank as the most prominent with $1.28 billion in direct premiums written across the two groups.

From a segment revenue standpoint based on third-quarter 2022 results, we estimate that the inclusion of all of Argo into the Brookfield Reinsurance direct insurance business would lead it to account for 61.6% of the combined company's total as compared with 52.6% on an as-reported basis.

Shah said in a Feb. 8 release that Argo would be "a foundational piece to our expanding U.S. P&C operations." Argo Executive Chairman and CEO Tom Bradley expanded on that in emails to employees and brokers, writing that Brookfield Reinsurance plans to operate the company as the core of its U.S. commercial P&C insurance platform and expand it into a market-leading specialty insurer with capabilities across the admitted and excess-and-surplus lines markets.

Back to the future?

Argo will not represent the first specialty P&C business under a Brookfield company's ownership. In 2017, Brookfield Asset Management spun off Trisura Group Ltd. as CEO James Bruce Flatt said at the time the business "didn't really fit with what the company is today."

Flatt in 2017 described Trisura, which today operates in the U.S. and Canada in the surety, risk solutions, corporate insurance and fronting market segments, as a "great little company" that had been "highly profitable." But he said that Brookfield Asset Management sought to separate from it "because we really don't understand the business."

Trisura generated C$2.3 billion in gross premiums written through the trailing 12 months ended Sept. 30, 2022. Its U.S. P&C subsidiaries reported $1.21 billion in direct premiums written during that period.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.