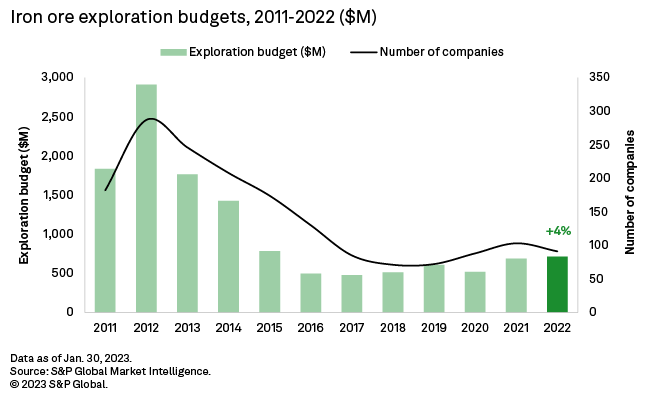

Iron ore exploration budgets increased 4% year over year to $713 million in 2022, below the global average growth of 16% in nonferrous exploration. This followed a 32% surge in ferrous exploration in 2021, after the recent low annual budget in 2020. Although this was the second consecutive year of recovery for iron ore exploration, the total remained far from the peak a decade ago, with the 2022 total equating to 24% of the $2.91 billion budget in 2012.

Iron ore exploration budgets rose to a seven-year high of $713 million in 2022, with a tepid increase of 4% year over year following the 32% surge in 2021. Major companies continued to dominate the exploration field, although it was the juniors' additional investments for the year that contributed the most to the budget increase. Australia remained the top explored country despite allocations decreasing in 2022, while budgets to Brazil, the other top iron ore exporter, climbed to the country's highest since 2013. Operational iron mines were still the preferred sites for exploration, but there was increased interest in late-stage assets in 2022.

Given the challenging outlook for iron ore demand in the first half of 2023, we expect iron ore exploration to trend downward in 2023. As iron ore supply is forecast to outpace slowing demand, resulting in surpluses as early as 2026, budgets are expected to follow suit and slow down in the short and medium terms.

Majors top explorers despite underperformance

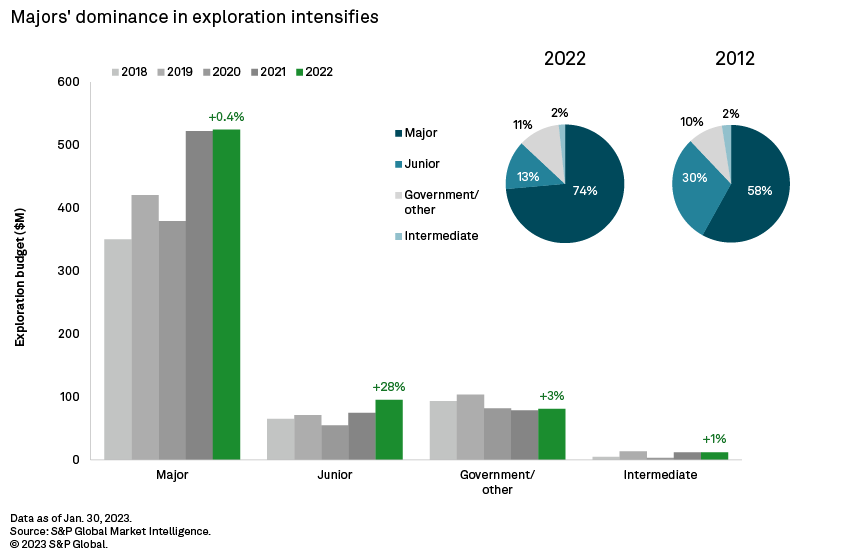

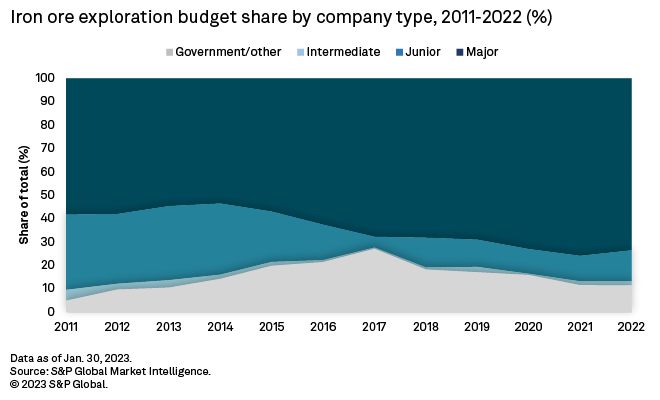

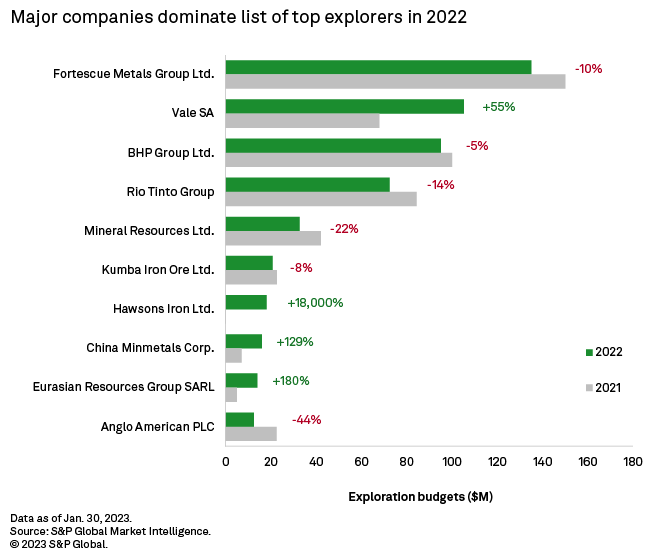

The exploration scene for iron ore continues to be dominated by major producers, particularly by the "Big 4" explorers: Fortescue Metals Group Ltd., Vale SA, BHP Group Ltd. and Rio Tinto Group. These companies have had an almost uninterrupted reign as the top four explorers since 2015. Fortescue Metals focuses its iron ore exploration on Australian assets such as Iron Bridge. Vale has numerous iron mines in Brazil, where its exploration budget in 2022 was mostly allocated. BHP has advanced assets in Australia, such as Yandi and East Jimblebar, and Rio Tinto's budget mostly went to the Hamersley Consolidated assets in Australia and the Simandou project in Guinea. Considering the significant footprint of these companies, it is not surprising that majors are responsible for the bulk of global iron ore exploration. In 2022, however, the significant increase in allocations by the juniors made a slight dent in the majors' share of the total, lowering it to 74%, from 76% in 2021.

Majors led iron ore exploration in 2022 with a total budget of $525 million, nearly flat from $522 million in 2021 but an eight-year high. Fortescue Metals recorded the highest estimated budget among the Big 4 in 2022 at $135 million but also declined the most year over year in dollar terms, down $15 million. Rio Tinto also weighed on the total with a $12 million, or 14%, decrease to $72 million. Allocations by Anglo American PLC, which owns the Minas Rio iron ore mine in Brazil, were down $10 million to $12.5 million, a three-year low for the company. Only Vale's $37 million budget increase was enough to offset these negative trends, resulting in a marginal increase for the majors.

As for the juniors, the company group has historically accounted for 20%-30% of total exploration budgets, specifically in the years 2011-2015. Since then, the group's share of the total has barely climbed to 15%. After the juniors' share shrunk for three consecutive years, it flattened in 2021. In 2022, the group recorded a $95 million total budget, up $21 million year over year. Consequently, this raised the juniors' share to 13%, from 11% in 2021. The bulk of the group's increase came from Hawsons Iron Ltd., which focuses its efforts on its flagship asset, the Hawsons iron project in New South Wales, now undergoing drilling and bankable feasibility studies. Another notable contributor was Magnetite Mines Ltd., which increased its allocation to the Mawson late-stage project in South Australia. Hawsons Iron and Magnetite Mines took second and third places for junior budgets, respectively. Kumba Iron Ore Ltd. remained the top junior explorer for the fifth consecutive year with an estimated $21 million budget, an 8% decrease from 2021, with the total dedicated to its iron mines in South Africa.

The shares of both the intermediates and of the government-owned or other companies remained virtually unchanged from a decade ago. Allocations by government-owned and other companies increased 3% to $81 million, while budgets by intermediates eased up 1% to $12 million.

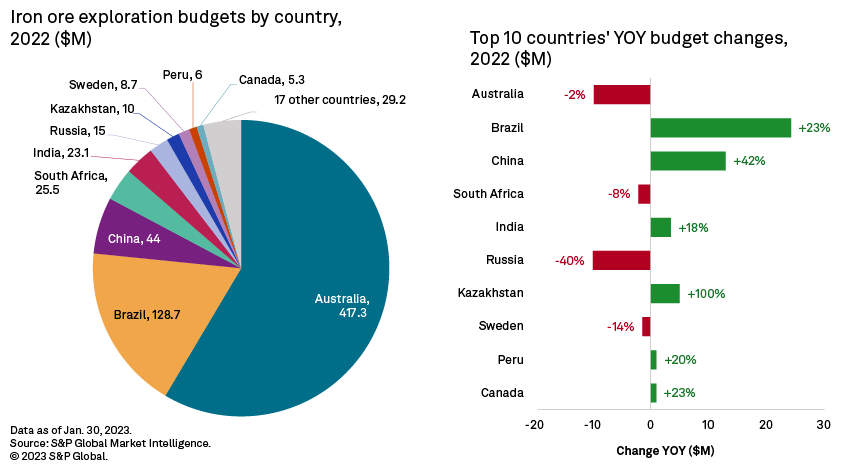

Increases in Brazil, China cushion downtrends in Australia, Russia

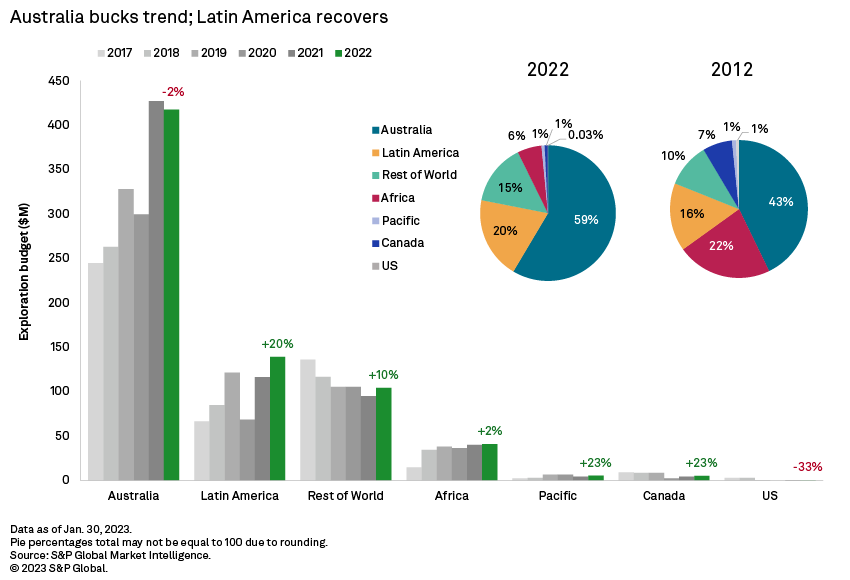

Australia has been the top country for iron ore exploration since the start of CES ferrous exploration budgetary records in 2011. In 2022, allocations to ferrous exploration in the country totaled $417 million, accounting for 59% of global budgets despite a 2% decrease from 2021. Declines in some major producers' budgets to Australian iron ore mines had a negative effect, but the country's total was buoyed by added allocations from juniors to their late-stage assets. Fortescue Metals had its fourth year of ranking first in iron ore exploration in Australia, despite lowering its budget year over year. Mineral Resources Ltd.'s budget decreased $9 million to $33 million in 2022, weighing on the country's total, along with the declines from Rio Tinto and BHP. Junior companies Hawsons Iron and Magnetite Mines added investment to their respective Australian late-stage assets, cushioning the impact of the majors' budget cuts.

Brazil maintained second place with $129 million by increasing the most in dollar terms year over year. Much of the increase was due to Vale's allocations to its Brazilian assets being up more than half to $105 million, with most being dedicated to its iron ore mine activities. China had the third-highest budget at $44 million and the second-highest dollar increase after Brazil at $13 million. Budgets to Russia declined by $10 million, the largest decrease for the country in six years.

The strong growth of exploration budgets to Brazil in 2022, coupled with the lackluster increase in allocations to Australian assets, boosted Latin America's share of the total to 20%, similar to 2019 and the highest share for the region since CES records began in 2011.

Due to the importance of Australia, Canada and the U.S. to global exploration, they are considered separate regions in regional analyses.

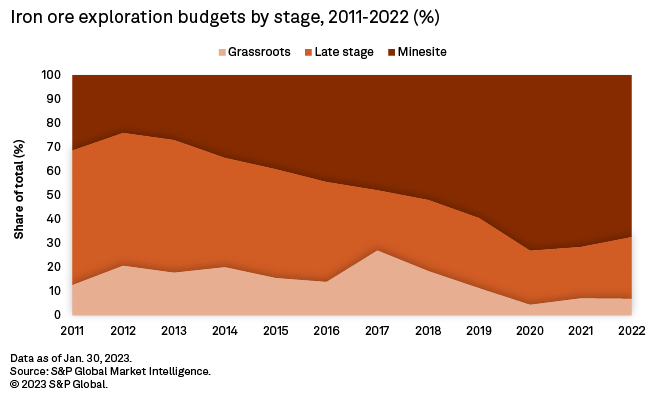

Minesite assets still highly favored; late-stage budgets at 6-year high

Back in 2012, iron ore explorers largely favored late-stage projects, which accounted for just over half of the annual total. The allocations for the stage have trended downward since then, however, as companies have become more risk-averse, investing more in near-mine work and prioritizing confidence over potentially greater rewards. In 2022, iron deposits near or at mines remained the most sought-after, with minesite exploration at $481 million. This was despite minesite allocations receding 2% from $492 million in 2021 due to declines by majors exploring Australian and Russian iron ore mines.

Exploration budgets for late-stage assets grew 25% to $183 million, the highest for the stage since 2017. This can be attributed to the juniors spending more on their advanced projects, particularly in Australia. Grassroots exploration increased a marginal 1% to $49 million.

Demand headwinds to negatively impact exploration

After China eased COVID-19-related restrictions in December 2022, the S&P Global Platts IODEX 62% Fe iron ore price rallied to a seven-month high in January following improved demand sentiment in China. According to our recent Iron ore Commodity Briefing Service report, prices are expected to remain strong in the March quarter but may face headwinds going forward as iron ore demand looks challenging in the first half, with possible further interest rate hikes in the European and U.S. economies weighing on economic growth. Supply is also expected to outpace demand in the short and medium terms, resulting in forecast surpluses as soon as 2026. Consequently, iron ore exploration for 2023 may slow under negative pressure from slowing demand, and this trend may extend into the medium term as demand fails to catch up with supply growth.

Platts is an offering of S&P Global Commodity Insights. S&P Global Commodity Insights is owned by S&P Global Inc.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.