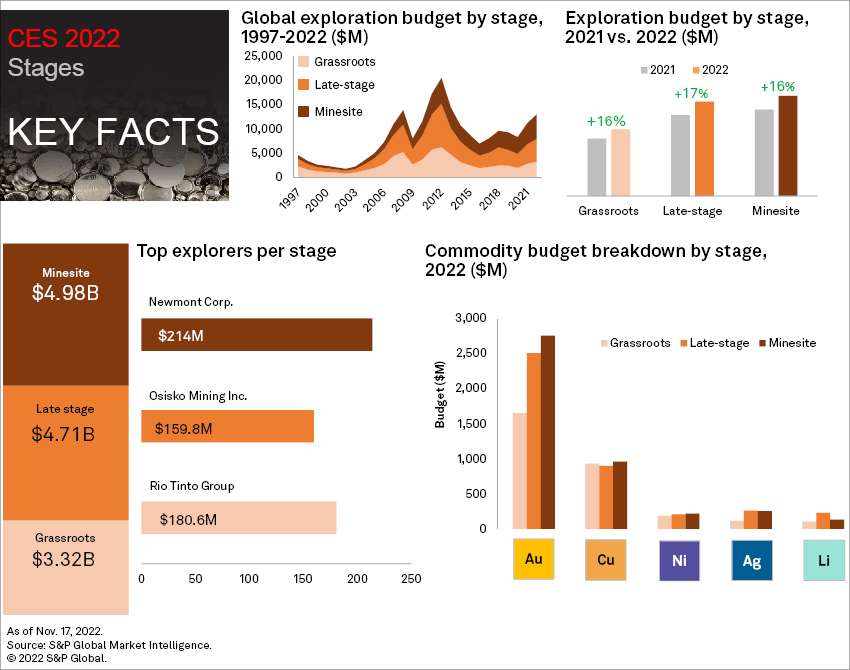

The mining industry continues to be risk averse when it comes to exploration budgets, preferring to focus on minesite work amid global economic headwinds. Allocations to near-mine work account for 38%, or $4.98 billion, of the global exploration budget for 2022. Late stage is a close second with 36%, or $4.71 billion, while grassroots is still the least preferred, with share just above the record low at 25%, or $3.32 billion.

All stages of development have posted virtually equal increases in exploration budgets year over year in 2022, maintaining their shares of the global budget. Explorers continue a long-term trend toward favoring near-mine exploration at the expense of early-stage investment, despite a spike in grassroots budgets in 2021. While financing activity was strong from the end of 2021 through early 2022, market conditions have since worsened. There has been a considerable decline in exploration financing activity in the second half of 2022 to date — due to geopolitical instability, rising inflation and fear of recession — making investors and explorers more risk averse and increasing their focus on the most promising mining assets.

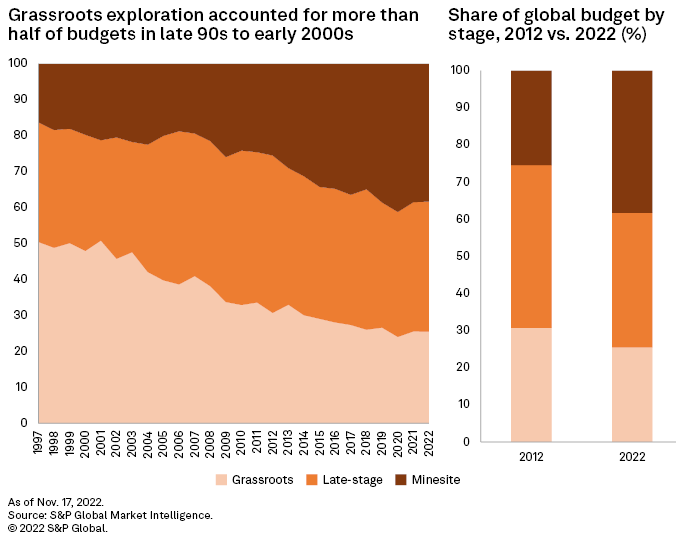

In the late 1990s to early 2000s, explorers were on a quest for new discoveries, as evidenced by the dominance of grassroots exploration, which regularly garnered nearly half of annual global budgets. Since the early 2000s, there has been a continuous decline in the grassroots share as explorers have shifted from generative, early-stage programs to more advanced late-stage and minesite exploration. The shift was partly natural, as assets matured over time; however, changes in the investment climate after the 2008 global financial crisis forced many companies to focus more on extending resources at known deposits, which may be less rewarding but are usually less risky than exploring new ground.

This has resulted in far fewer major discoveries over the past decade. While the industry continues to add tonnes and ounces to reserves, these tend to be at existing mines or older known projects than at entirely new discoveries.

As the world transitions toward decarbonization, the demand for "green" energy metals is increasing, but their future supply looks bleak. S&P Global Market Intelligence forecasts a shift to supply deficits for many of these commodities within the next five years. The looming scarcity is rooted in a general under-investment in the project pipeline, including the lower focus on early-stage exploration programs.

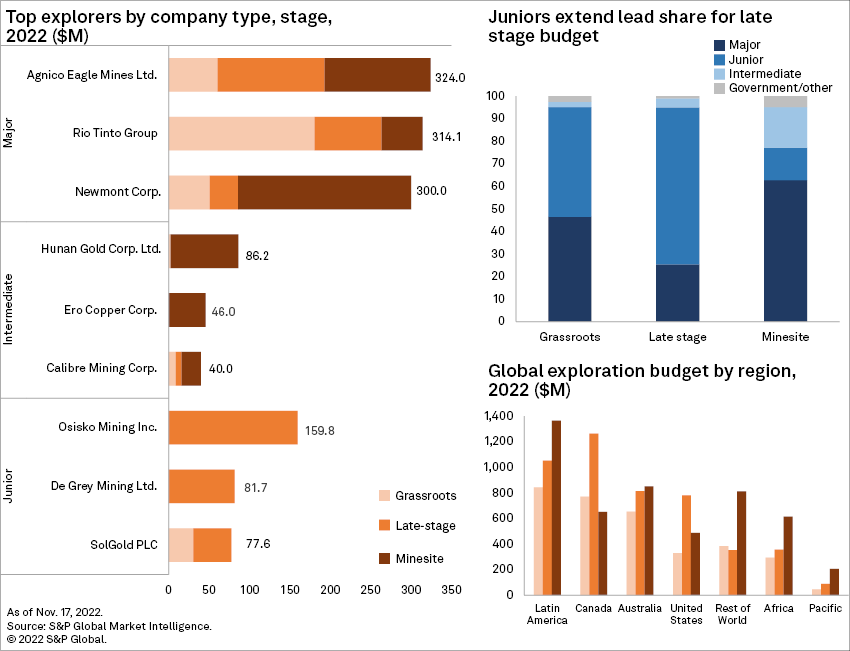

Despite metals prices recently revisiting or even exceeding their historical highs seen in 2011, global nonferrous exploration budgets remain well below decade-ago levels. Major and intermediate explorers have cut their budgets due to closer management oversight of spending and more discerning capital markets. In addition, to grow their resources after an initial discovery, explorers shift their spending to advanced drill programs and economic studies to determine the economic viability of their existing assets. This shift led to late-stage work taking a leading share of the global exploration budget, averaging 41% from 2005 to 2013.

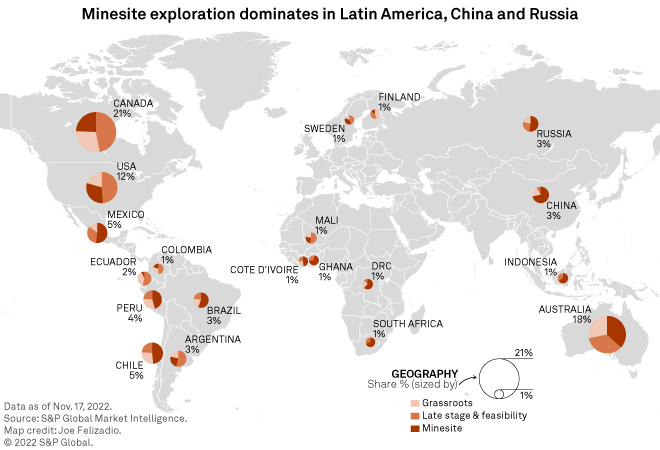

Minesite exploration's budget share has increased almost uninterruptedly for the past 16 years, from a low of 19% in 2007 to a peak of 41% in 2020, and despite the share slipping three percentage points in 2022, it continues to be the preferred stage of development for a third consecutive year as producers focus on extending the lives of their operating mines.

Although near-mine exploration continues to be dominated by the major producers, the juniors have shown growing interest in less risky operations, increasing their minesite budgets almost 50% annually for two straight years. Bellevue Gold Ltd. has allocated $53 million for its Bellevue gold project in Australia and recently announced that plant construction is underway, with first production expected in the second half of 2023. Juniors Sabina Gold & Silver Corp. and Marathon Gold Corp. have budgeted $40.0 million and $36.0 million, respectively.

Minesite will likely continue dominance in 2023

As inflation and recession fears continue to dominate the headlines, companies both large and small are expected to tighten their belts in 2023 to ride out the currently precarious economic environment. With juniors focusing more narrowly on their more promising late-stage projects, their grassroots budgets will likely fall further. On the other hand, healthy cash flows from production during a period of high metals prices will probably result in the majors taking a more prominent role in global exploration, meaning a further boost to late-stage and minesite exploration.

While one year of reduced early-stage spending will not mean much to the long-term pipeline, the concern is that continuing a decades-long trend will inevitably place more strain on the medium-term pipeline.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.