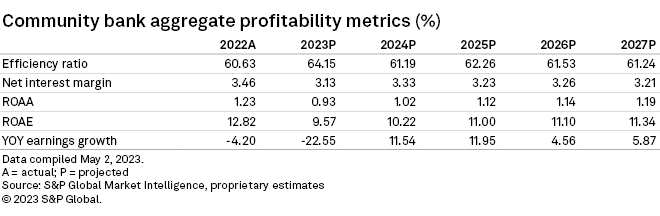

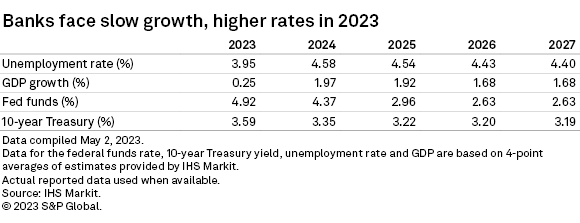

The liquidity crunch that emerged in March will lead to considerable pressure on community bank margins in 2023, contribute to normalization in credit trends and cause the group's earnings to drop by more than 20% from year-ago levels.

Swift rate increases and a liquidity crunch at a handful of banks, including several major failures in recent months, put a far greater premium on deposits at US banks. Increases in deposit costs at community banks lagged their larger counterparts in 2022, but that divide will narrow in 2023 as customers quickly move funds out of noninterest-bearing deposits into higher costs deposits like certificates of deposits (CDs). Banks will also respond to the liquidity crunch by building reserves for loan losses, slowing loan growth and building cash on their balance sheets. Taken together, the shift in balance sheet composition will hit community bank margins and earnings.

Liquidity crunch takes a bite out of community bank margins

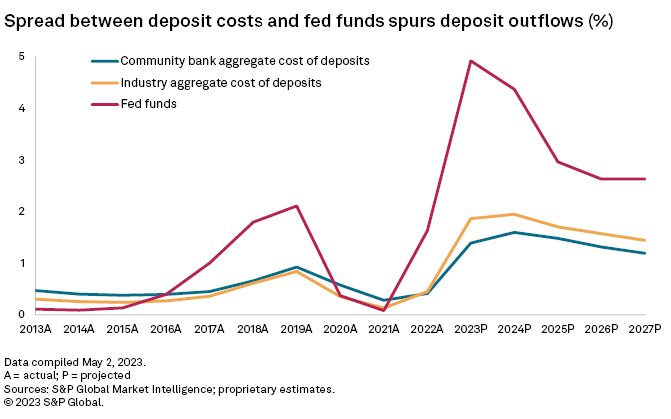

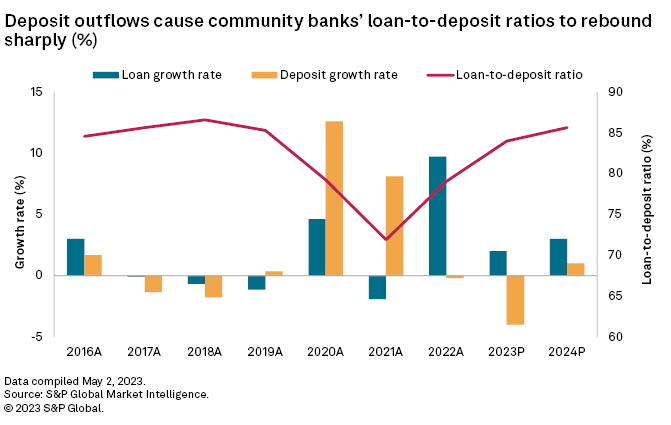

Significant increases in interest rates boosted community bank margins in 2022 as loan yields jumped, while funding costs rose only modestly. The environment began to change in the fourth quarter, when more customers moved their funds out of banks in search of higher rates in the Treasury and money markets. Those deposit outflows accelerated in the first quarter, leading to even greater liquidity pressures.

The failures of Silicon Valley Bank, Signature Bank and most recently, First Republic Bank illustrate that liquidity pressures became quite pronounced, particularly for institutions with high concentrations of uninsured deposits that were deployed into securities and longer duration loans when interest rates were at historic lows.

While those situations contained some unique characteristics, the fallout from the second, third and fourth-largest bank failures in US history has sparked concerns about funding in the banking industry. However, the vast majority of banks have reported modest outflows. That is good news for community banks, which like larger institutions, sit on underwater bond and loan portfolios due to the sharp increase in interest rates, and would feel pain if they have to sell assets to meet liquidity needs.

Some community banks will prune their bond portfolios, sell securities at a loss and reinvest the cash into higher-yielding assets. Other institutions could look at sales as a way to pay down higher-cost borrowings. For instance, some regional banks such as Cadence Bank, First Interstate BancSystem Inc., Atlantic Union Bankshares Corp. and others announced securities sales during first-quarter earnings season as they sought to bolster future earnings.

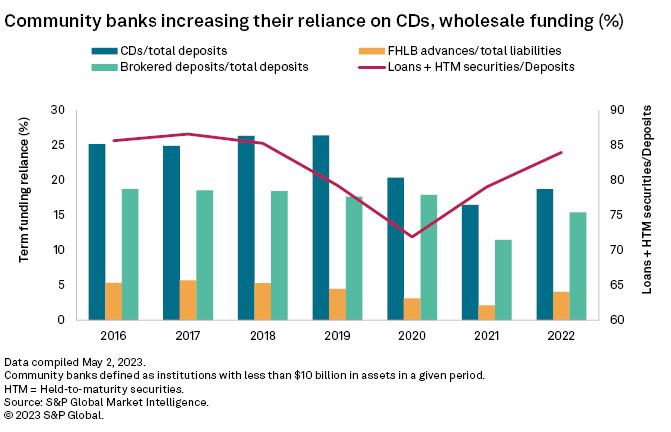

But, the majority of community banks likely will eschew securities sales and become more reliant on higher-cost funds like CDs and borrowings, while noninterest-bearing deposits decline. Community banks will feel pressure to do so as the spread between deposit costs and the fed funds rate remains quite wide. That will cause deposit betas — the percentage of change in fed funds passed on to depositors holding interest-bearing accounts — to continue to rise.

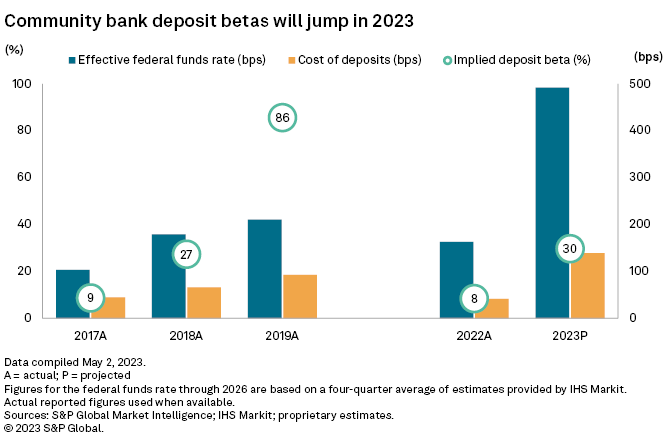

Community banks recorded a quarter-over-quarter interest-bearing deposit beta of 30.0% in the fourth quarter, up from 16.0% in the third quarter and 5.6% in the second quarter. The industry recorded a beta on all deposits, including non-interest-bearing funds, of 20.7%, nearly in line with the 22% projected in our outlook in mid-December.

The pressure was even greater in the first quarter as deposit outflows accelerated due to the liquidity crunch at a few banks, where shareholders and depositors lost confidence in the viability of the institution. We expect community banks to defend their deposits to an even greater degree by marketing deposits with higher rates.

For full year 2023, we project betas to reach 30%, more than triple the level witnessed in 2022 due to liquidity pressures in the market.

The higher deposit beta will cause community bank margins to contract significantly. We project net interest margins to contract 33 basis points in 2023 but then rebound significantly in 2024 as interest rates inch lower and funding costs and liquidity pressures stabilize. Community banks have higher concentrations of longer-term loans and their earning-asset yields should continue to rise even as rates dip in 2024.

Credit quality will begin to slip this year

Community banks will tighten lending standards to preserve liquidity and adjust to stress in the markets. We expect community banks to maintain tighter lender standards — which surfaced yet again in the Federal Reserve's latest senior loan officer survey in April 2023 — in the near term and the pull back in lending will contribute to credit costs moving higher for the group.

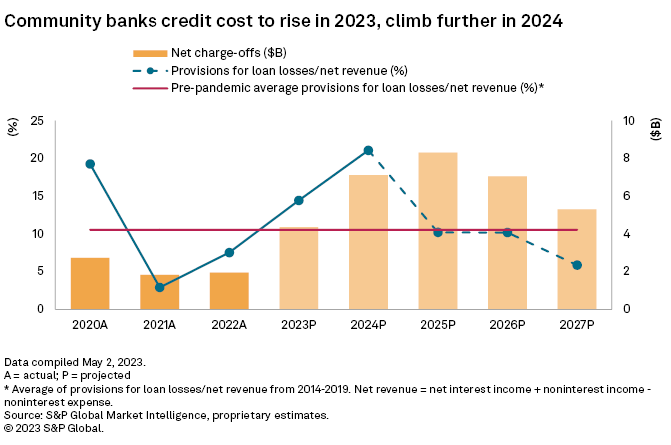

Community banks, like their larger counterparts, have effectively over-earned on credit over the last year as persistently low rates and the remnants of government stimulus dispersed during the pandemic resulted in historically low loan losses. That dynamic should begin to change in 2023 as community banks build reserves to prepare for the impact that significantly higher interest rates and elevated inflation will have on their borrowing base, particularly in the commercial real estate sector.

Credit trends remain benign as the reported unemployment rate stands near historical lows, US household-to-debt to income stands 1.4 percentage points below the 40-year average and early warning indicators, such as criticized loans, remain quite low.

The increase in credit card delinquencies over the first few months of 2023 has gained attention, but even with net loss rates among the six largest card companies rising 52 basis points year over year to 1.58% in March, the net loss rate remains 69 basis points below the average net loss rate seen in the seven years leading up to the pandemic.

Investors have shown concern about banks' exposure to the commercial real estate market, particularly subsets like office and retail, which have seen less demand in the aftermath of the pandemic. The office market in particular appears considerably stressed as more companies adopt hybrid working models and a number of employees work from home. The stress has been reflected in the valuation of publicly traded REITs focused on the office sector, with those entities trading at median discount to net asset value (NAV) of 57.9% at the start of May.

Select bank disclosures show that they underwrote office properties with loan-to-values around 60% to 65%, but current valuations in the market suggest that the decline in values could burn through the equity cushion associated with bank office loans.

There are signs of weakness in the market, with an inverted yield curve, which is often a precursor of a recession. Higher mortgage rates have slowed transaction activity in the housing market, where the inventory of homes for sale stands at 8.2 months of supply at the current sales rate, compared to the 40-year average of 6.0 months of supply.

US consumers have maintained spending but have largely done so by borrowing more while working through excess savings accumulated during the pandemic. Bank lending has also slowed in the aftermath of the liquidity crunch, and if credit becomes harder to access or unavailable for some challenged borrowers such as office landlords, they might find it difficult to secure financing elsewhere.

Most bankers seem to expect a slowdown soon and many have assumed that a recession, albeit a mild one could surface in 2023.

We expect net charge-offs to jump in 2023 off a historically low base to 0.19% of average loans. Credit slippage will come on top of many community banks adopting the current expected credit loss model — a reserve methodology that requires institutions to reserve for losses over the life of their loan portfolios — at the beginning of 2023. The implementation and higher loss content will mandate higher provisions for loan losses, which will serve as a modest hit to earnings.

We expect provisions to rise to 14.4% of net revenue in 2023, up from just 7.5% in 2022. From 2013 to 2019, banks' provisions equated to 10.5% of net revenue on average.

Scope and methodology

The outlook discussed in this article is based on a proprietary Market Intelligence model that utilizes the actual results of nearly 10,000 active and historical commercial and savings banks and savings and loan associations. The outlook is based on management commentary, discussions with industry sources, regression analysis, and asset and liability repricing data disclosed in banks' quarterly call reports. While taking into consideration historical growth rates, the analysis often excludes the significant volatility experienced in the years around the credit crisis.

The outlook is subject to change, perhaps materially, based on adjustments to the consensus expectations for interest rates, unemployment and economic growth. The projections can be updated or revised at any time as developments warrant, particularly when material changes occur.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.