S&P Global Commodity Insights discusses consensus price forecasts for industrial and precious metals, including platinum group metals, amid broader market trends.

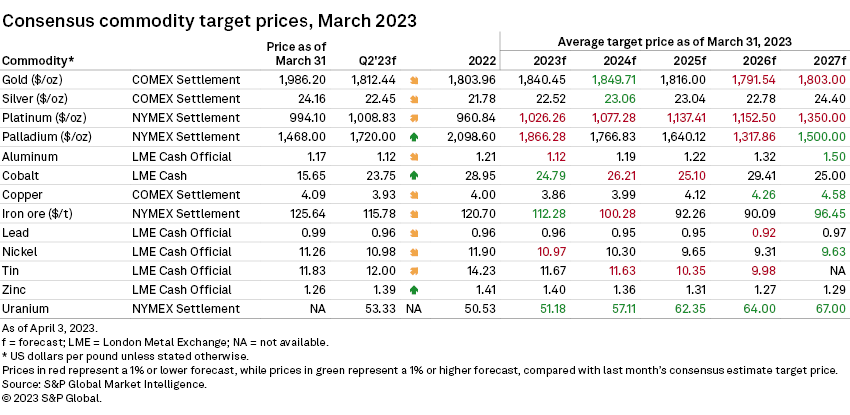

News of turmoil in the US and European financial sector dominated the headlines in March, adding another layer of uncertainty to already-volatile commodities markets. Gold benefited from both an investors' flight to safe haven following bank failures and a pressured US dollar as the US Federal Reserve began shifting its stance toward month-end. While most other metals prices ended March higher than in February, demand remains muted for a number of reasons: lower consumer spending on electronics for cobalt, cuts to China's steel production because of decarbonization goals for iron ore, and higher availability of scrap for copper, also in China. These and other factors at play in the current commodities markets may have caused changes to consensus price forecasts to be generally conservative.

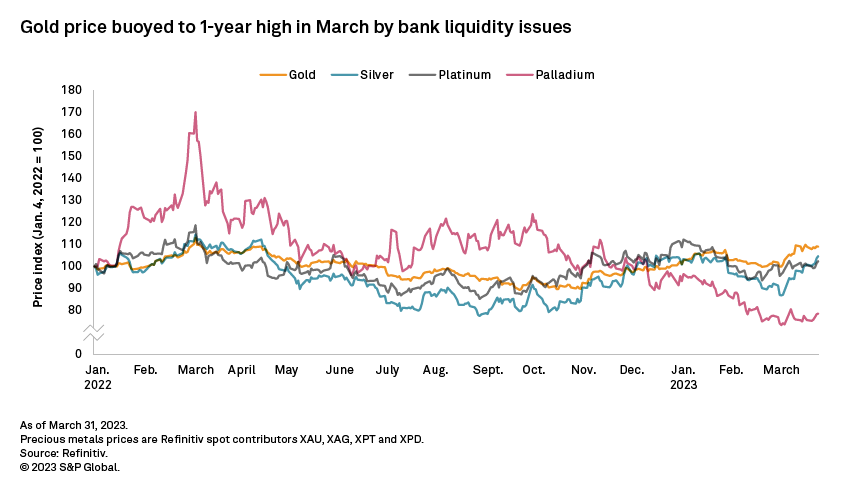

Financial and commodities markets were rocked in March by the sudden collapse of California-headquartered Silicon Valley Bank (SVB), followed by the fall of New York-based Signature Bank and then by UBS Group AG's arranged takeover of Swiss bank Credit Suisse Group AG. The upheaval led to gold prices surging to a 12-month high, fueled by strong demand from investors for a safe haven.

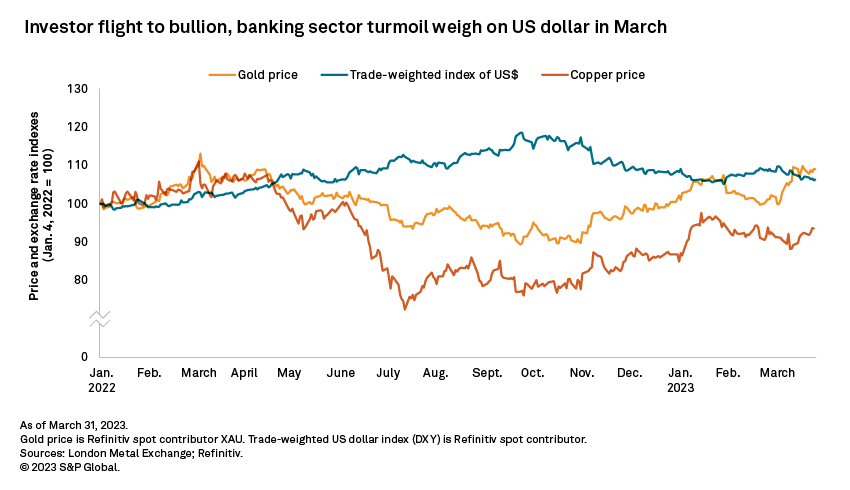

These events followed Fed Chairman Jerome Powell's testimony to Congress on the state of the US economy March 7–8 and preceded the latest 25-basis-point interest rate hike March 22. In his congressional speech, Powell restated the Fed's hawkish stance in the face of inflation in the US, which was further emphasized by mixed monthly economic data for February — lower inflation and nonfarm payroll additions but higher unemployment. However, the Fed's pivot to a more dovish tone later in the month sent the trade-weighted US dollar index downward and helped to support gold prices.

Meanwhile in Europe, inflation fell in February in Germany and Spain, albeit at different rates, on the back of tumbling energy costs. It remains to be seen whether this will influence the European Central Bank's monetary policy tightening amid the current uncertainty clouding the banking sector. China's economic recovery is underway, with the National Bureau of Statistics manufacturing purchasing managers' index indicating expansion for the third consecutive month in March. Headwinds emerged, however, in the shape of energy constraints due to power shortages and decarbonization targets, which are curtailing smelting activity and steel production.

The London Bullion Market Association gold price threatened to breach $2,000 per ounce through the beginning of April as recent bank failures in the US and Europe sent investors toward safe-haven assets. The major liquidity issues brought to light through the sudden collapse of SVB were attributed to heavy investment in the bond market in a low-interest environment. The Fed's interest rate hike March 22 further amplified negative market sentiment and propelled the gold price to a one-year high of $1,993.50/oz the following day. Consensus price forecasts remain conservative, however, likely not having fully factored in the impact of financial sector uncertainties on gold prices, with the 2023 average upgraded just 0.9%.

While the London Bullion Market Association silver price had been on a general declining trend since its February peak, the events transpiring in the financial markets and supporting the gold price similarly lifted the silver price in the second half of March. The price breached $24/oz on the last trading day of the month, hitting a two-month high. As with gold, recent developments do not seem to be reflected in consensus silver price forecasts, which have been raised a conservative 0.1% for 2023.

Platinum and palladium prices also climbed in March, gaining 5.5% and 4.1%, respectively, month over month, supported by the macroeconomic environment. In contrast with gold and silver, expectations are for these precious metals prices to average higher over the year than their current trading levels. The consensus prices forecasts have nevertheless been downgraded for platinum by 1.0% and for palladium by 1.5%.

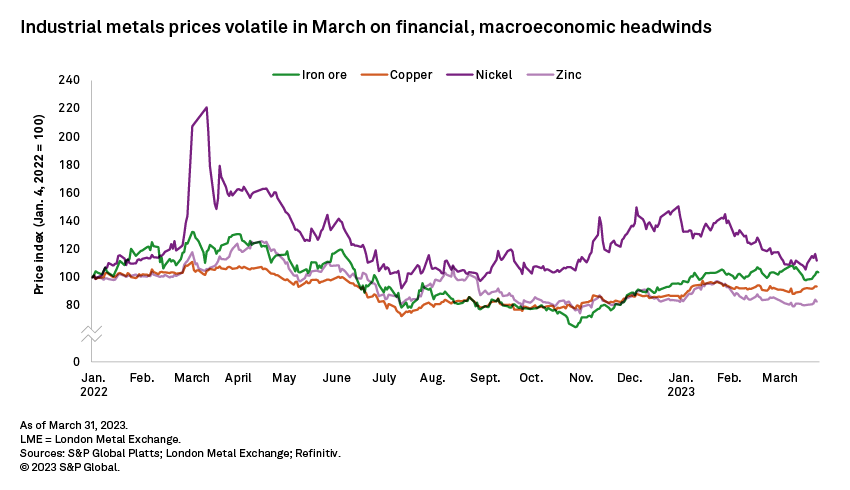

Base metals were not spared the fallout from the banking sector woes, with the London Metal Exchange (LME) copper cash price dropping to a two-month low of $8,480.75 per metric ton March 15, although the price has since recovered some lost ground, heading above $9,000/t spurred by a risk-on tone in the market and a softer US dollar. A slowly recovering global economy, higher availability of copper scrap in China, and improving mined supply following production restarts in Indonesia and Peru and renewed shipments from Panama are capping the price upside. As we expect seasonal improvements in demand from China, in addition to firm US demand of late, we nevertheless anticipate a tight copper market. Amid the current volatile market, consensus copper price forecasts for 2023 were modestly revised downward by 0.2%.

The nickel market had its own set of events in March, with Asian trading hours finally resuming on the LME one year after the short squeeze, while still awaiting the launch of a new nickel contract on the Chicago Mercantile Exchange. Trading volumes on the LME remain low, however, and the price remains volatile. Also, as with the other commodities, nickel's price reacted to interest rate expectations. The price was at times buoyed by hopes that the banking sector woes and general economic outlook would elicit a more dovish take on US interest rate hikes, yet the price was weighed down by the arrival of the Fed's latest rate increase. With the LME nickel cash price tumbling the most (6.0%) month over month in March, consensus price forecasts were downgraded 1.1% for 2023, the largest downward revision among 2023 forecasts for the industrial metals covered here.

The LME zinc cash price trended downward during March, dropping 3.3% month over month under pressure from the global macroeconomic environment and from market fundamentals. While refined supply in Europe has improved as smelters restart operations on decreasing energy prices, China's energy constraints may temper domestic smelting activity. On the demand side, China's manufacturing sector is recovering, with its two main purchasing managers' indexes firmly in expansionary territory in March, but global zinc demand remains muted on recessionary fears and the recent turmoil in the US and European financial markets. Consensus zinc price forecasts for 2023 were unchanged in March.

After a steady decline since the start of the year, the LME cobalt cash price stabilized in March, although at levels last seen at the end of 2020. Demand from the two main end-use sectors — traction batteries and consumer electronics, had been flagging — capped by weaker discretionary spending. Terminated or lowered government subsidies on electric vehicles in China and Europe are pushing battery-makers and automakers to cut costs, namely by favoring battery chemistries with little to no cobalt content, even as falling lithium prices are making such lithium-iron-phosphate batteries even more cost-competitive. Consensus price forecasts were upgraded 2.15% for 2023, with the annual price averaging higher than current levels.

The S&P Global Platts IODEX 62% Fe iron ore price peaked at $133.10 per dry metric ton March 15 as market sentiment improved; steel output and restocking activity had picked up in China ahead of an expected seasonal rise in construction activity. This upturn may be short-lived, however, as China is beginning to cut steel production to curb emissions and meet its annual decarbonization targets. We also expect ex-China steel output to remain constrained by the global economic recovery still being slow and uncertain. With the seaborne balance loosening to a small surplus in 2023, consensus price forecasts were upgraded 1.4% for the year.

Platts is an offering of S&P Global Commodity Insights. S&P Global Commodity Insights is owned by S&P Global Inc.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.