S&P Global Commodity Insights discusses consensus price forecasts for industrial and precious metals, including platinum group metals, amid broader market trends.

Access the databook.

See Commodity Insights' most recent market outlooks for copper, gold, iron ore, lithium and cobalt, nickel and zinc.

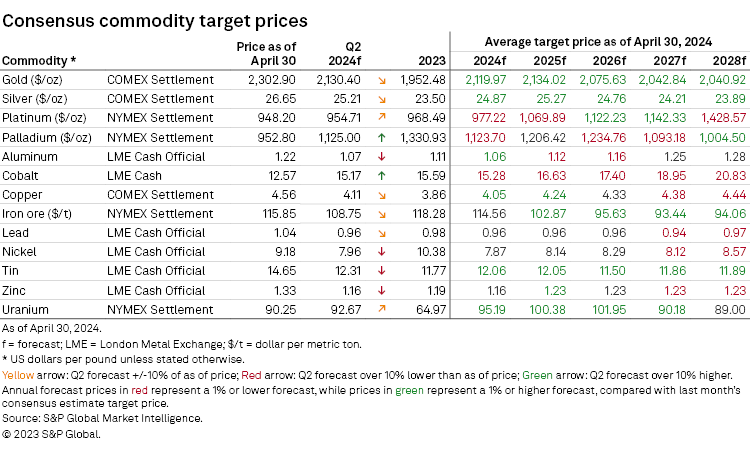

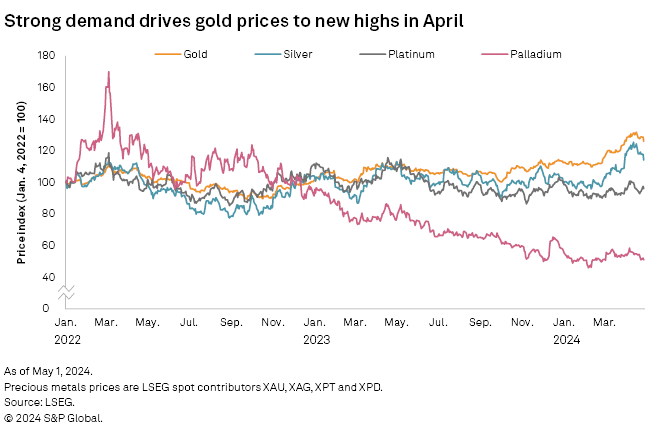

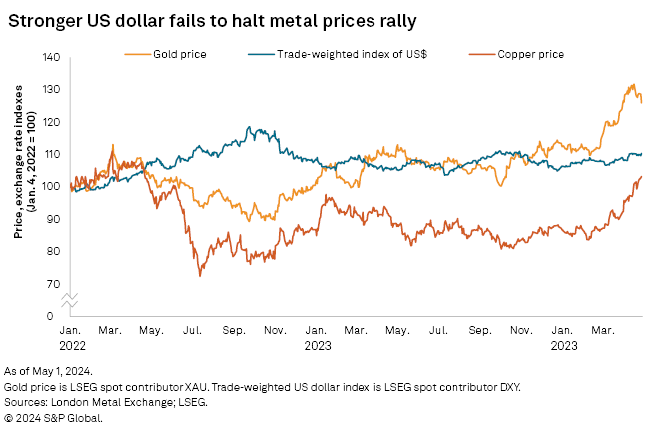

Gold prices captured headlines again in April, surging to new highs as escalating geopolitical tensions spurred demand. While investors' flight to safety carried sway over a strengthening US dollar, the US Federal Reserve's move toward more dovish tones blunted the impact a late-month sell-off had on gold prices. Below-expectations US jobs data in April has raised the prospect of interest rate cuts materializing sooner, resulting in sharp upgrades to gold price forecasts. Rate cuts in the second half could also speed up economic growth, which would buoy industrial metals demand. While manufacturing is currently leading the way on the recovery front, further support for China's property sector will be needed to sustain price momentum. For the time being, tight supply is providing key support for base metals prices.

The London Bullion Market Association (LBMA) gold price closed at a record $2,412.97 per ounce on April 12, driven by safe-haven buying as intensifying geopolitical risks outweighed the impact of macroeconomic factors. Gold prices have now closed above $2,000/oz for over 100 consecutive trading days. With expectations that prices will average above this new threshold through year-end, consensus price forecasts have been upgraded sharply. Industrial metals prices were also higher in April, with London Metal Exchange (LME) copper prices breaking through $10,000 per metric ton on tightening supply and improving demand sentiment.

Fueled by strong demand and bullish sentiment, gold prices reached new highs in April despite headwinds from a rise in US Treasury yields and a stronger dollar. The escalation of the Ukraine-Russia war and conflict in the Middle East continue to spur demand, while announcements of further sanctions on Russia-based entities by the US and UK governments are encouraging China's central bank to continue stockpiling gold reserves. The geopolitical effect on the gold price outweighed the then-hawkish tone of the US Federal Reserve after US inflation rose to 3.5% in March, but a profit-taking sell-off lowered prices toward $2,300/oz at the end of April. Recent data showing weaker US business sentiment and below-expectations job growth, however, has raised the prospect of Fed interest rate cuts coming sooner than previously expected. Changing rate cut expectations have helped to lift consensus gold price forecasts by 5.1% each year through to 2028 to an average of $2,083/oz.

Following gold higher, silver prices moved within touching distance of $29.00/oz in mid-April before retreating to $26.65/oz at month-end. Fundamentals remain supportive for prices, with a manufacturing recovery providing a fillip for silver demand, while the energy transition is fueling robust growth in the production of silver-containing solar panels. With expectations for elevated gold prices now set alongside a brighter outlook for silver demand, consensus price forecasts for silver average 3.4% higher annually through to 2028.

Palladium prices struggled to make headway in April, briefly falling below platinum prices for the first time since February, weighed by demand concerns. While consensus price estimates were revised sharply lower for both metals this month, palladium prices are forecast to fall further, while platinum prices are set to rise through to 2028. The healthier outlook for platinum comes from its use in hydrogen fuel cell electric vehicles, which is projected to be a key growth market in the green economy. Demand for palladium, however, will be dampened by the phase-out of internal combustion engine vehicles and the rising substitution of platinum in catalytic converters.

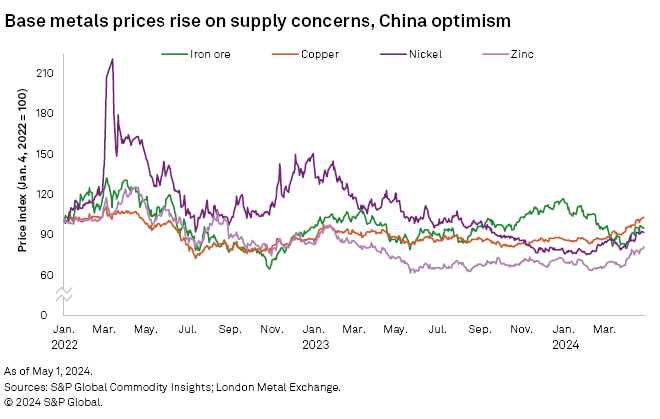

The LME three-month copper price was up $1,000/t through April, ending the month at about $10,000/t, the highest level in almost two years. An improved demand outlook has lifted prices following a flurry of upgrades to GDP growth forecasts for the US and China, where respective manufacturing purchasing managers' indexes were stronger in March. Despite the recent positivity around a manufacturing recovery, copper demand in other end-user segments in China has lagged. Supply factors are also supporting prices, with recent mine stoppages disrupting concentrate flows from Latin America and Africa. Meanwhile, BHP Group Ltd.'s unsuccessful bid for Anglo American PLC in April could potentially lead to an increased second offer, which, if successful, would result in the combined entity producing over 10% of global copper supply. With copper fundamentals tightening, consensus price forecasts have been upgraded an average of 2.2% in 2024 and 2025.

Easing supply concerns have weighed on consensus zinc price forecasts, with average downgrades of 0.5% annually through to 2028. After reaching a 13-month high at April-end, the LME three-month price pulled back in early May after Trafigura Group Pte. Ltd. announced plans to restart its Budel Dorplein smelter in the Netherlands. Government help with reducing energy costs will result in the smelter being back in operation from May 13, albeit at a reduced capacity. This will mark the second zinc smelter in Europe to come back online in 2024, with Glencore PLC having restarted its Nordenham smelter in Germany in February. With smelters resuming in Europe, the resulting boost for zinc concentrate demand is set against a backdrop of curbs to zinc mine production globally. This has led to a sharp fall in treatment charges as the zinc concentrates market has tightened.

Nickel prices broke above $19,000/t in April after the LME banned the delivery of new Russia-origin metal into its warehouses following sanctions imposed by the US and the UK due to Russia's invasion of Ukraine. The LME announcement sparked supply concerns, with Russia being second only to China in the production of refined class 1 nickel — the only LME-deliverable primary nickel product. While the move is expected to cement China's position as the main market for Russia's refined class 1 nickel exports, the sanctions are expected to have a minimal impact on an already oversupplied market. On the other hand, the global manufacturing recovery has improved the nickel demand outlook and, alongside recent supply concerns, pushed consensus price estimates an average of 0.8% higher across 2024 and 2025.

Cobalt prices continued to move sideways in April, as stronger demand for electric vehicle batteries was offset by slowing sales of electronic goods and rising seaborne supply. China was the driver of robust first-quarter EV sales, more than offsetting slowdowns in the US and Europe, where affordability issues are impacting EV demand. Moreover, with the consumer electronics market entering its weaker season, demand is unlikely to support cobalt prices until the second half of the year. At the same time, supply pressure is growing, with cobalt shipments from the Democratic Republic of the Congo recovering from late 2023 lows, helped by logistical improvements and the resumption of exports from Tenke Fungurume. With the cobalt market expected to be in surplus through to 2026, consensus price forecasts are downgraded an average of 5.6% through to 2028.

After briefly dipping below $100 per dry metric ton in early April, the Platts 62% Fe iron ore price recovered to $120/dmt on May 6, fueled by optimism around the China demand outlook. Restocking buoyed China's iron ore imports in April, as a seasonal rise in construction activity and a manufacturing recovery boosted domestic steel prices and turned mill profit margins positive for the first time since September 2023. While the pace of China's property sector recovery remains a concern, hopes for further government support for the sector, alongside signs of a broader economic recovery in the country, are behind the upgrades to consensus price forecasts, which average 2.4% higher annually through to 2028.

Platts IODEX 62% Fe iron ore benchmark is an offering of S&P Global Commodity Insights. S&P Global Commodity Insights is a division of S&P Global Inc.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.