S&P Global Commodity Insights discusses consensus price forecasts for industrial and precious metals, including platinum group metals, amid broader market trends.

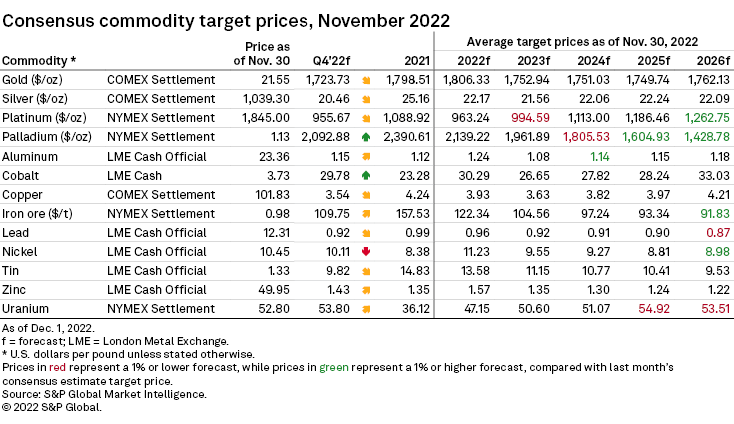

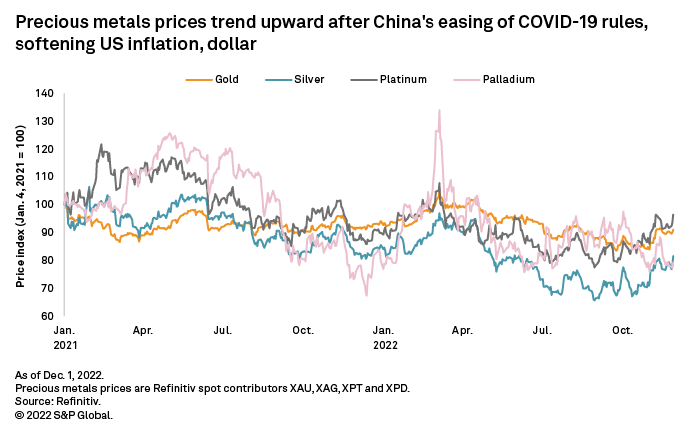

November was a positive month for metals prices, which rallied on news of softer inflation in the U.S. and an easing of COVID-19 rules in China, although both were subsequently tempered. The slowing U.S. inflation trend is fueling expectations for a downshift in U.S. interest rate increases. Inflation remains high in most major economies, however, and will likely prove sticky in Europe and the U.K., with the possibility of recession in many countries. In China, prospects of economic recovery, and consequently demand upticks for many industrial metals, hinge on the status of the COVID-19 policies. Mined and refined supply issues also remain or have emerged in November, balancing the muted demand environment. With that in mind and the end of 2022 just around the corner, changes to consensus metals price forecasts have been quite conservative this month.

November was an eventful month for metals prices, shaped by a barrage of economic data, politics, geopolitics, pandemic measures and social unrest. The U.S. midterm elections were held Nov. 6. Later in the month as the dust began to settle on the midterms results, news broke that inflation had softened in October. Europe, on the other hand, remains under a rising inflationary environment with little hope of easing as the incoming winter will exacerbate its energy supply and price issues. Moreover, a stray Ukrainian missile, initially assumed to be Russian, landed in NATO member Poland, causing fatalities and threatening to widen the conflict. China's population — and economy — welcomed the first steps to ease stringent COVID-19-related measures, but the optimism was quickly countered by a surge in cases, followed by citizen protests against lockdown restrictions.

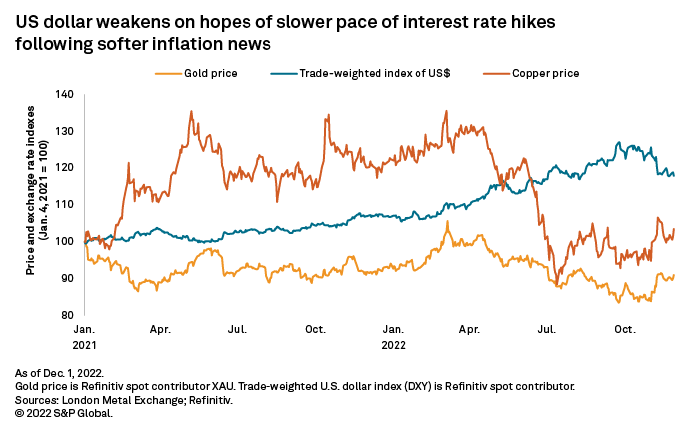

The trade-weighted U.S. dollar index peaked above 112 in early November as the U.S. Federal Reserve raised interest rates 0.75% for a fourth consecutive time. In response to the U.S. inflation data showing a 0.4% reduction month over month in October at 7.7%, the dollar slipped to a three-month low, with the dollar trade-weighted index closing November at 105.95. Markets are hopeful that the Fed will slow its pace of monetary tightening, but comments from St. Louis Fed President Jim Bullard dampened expectations. With such volatility in markets and sentiment, consensus price forecasts have been conservative through the end of the year and for most of the forecast period, with only small changes to upgrades and downgrades.

The London Bullion Market Association gold price followed macroeconomic events throughout November, first breaking above $1,700 per ounce as the U.S. midterm elections were held and peaking at $1,778/oz on Nov. 15 following the missile strike in Poland. The price then dropped as Bullard indicated that further steep interest rate hikes are to be expected to combat inflation in the U.S. Other central banks are also likely to keep raising rates, which could exert further downward pressure on the U.S. dollar and support the gold price. Physical demand for gold has been rising over recent months, however, helped by central banks in countries such as Turkey, Uzbekistan and India, which have all increased their exposure to the precious metal. Consensus price forecasts call for gold to trade firmly around the $1,750/oz mark through to 2026 as economies recover, although price swings are likely to occur in the coming year on the interplay between inflation, GDP growth and monetary policies.

In a month again dominated by macroeconomic events, all other precious metals prices followed the gold price trajectory, as did expectations for their evolution over the medium term. Despite the silver price clawing back some lost ground over November, consensus price forecasts for 2022-25 were downgraded 0.2%-0.3%, with the 2023 price marking a low over our forecast horizon as the likelihood of recession in major economies weighs on silver as both a precious and an industrial metal.

Platinum prices returned to early year levels in November following a sharp rally, although the metal is not expected to trade at its current value in 2023, with the consensus price forecast downgraded 0.6% and 1.0% in 2022 and 2023, respectively. Palladium prices pulled back in the second half of November, despite PJSC Mining and Metallurgical Co. Norilsk Nickel announcing that it expects to see a growing deficit in the palladium market in 2023, with supply from Russia remaining at risk. The medium-term outlook for palladium is mixed, with another 2.0% downgrade for 2024 followed by 2.9% and 8.0% upgrades in 2025-26. This is likely due to anticipated increased use in fuel cells for clean energy generation and as a platinum substitute in catalytic converters and due to potential supply constraints if availability is limited to South African sources.

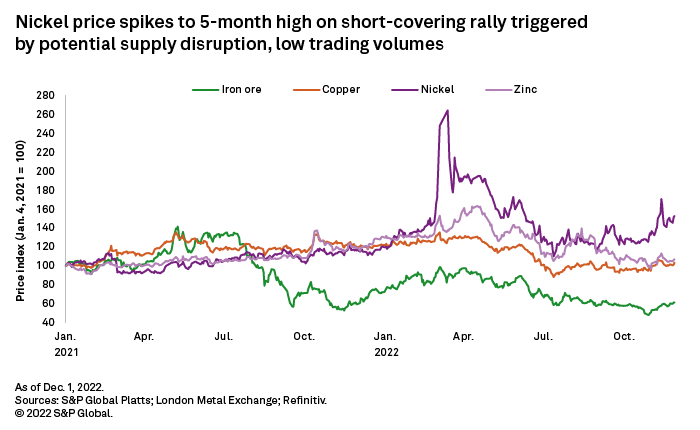

Despite some daily volatility, the London Metal Exchange zinc cash price held steady over November, breaking above $3,000 per tonne midmonth on positive market news — China's long-awaited easing of its COVID-19 policy — and ongoing low refined supply. Smelters in China have been curbing production on energy supply constraints, and smelters in Europe have been doing the same due to higher power prices. Glencore PLC's Valleyfield operation in Canada went on care and maintenance, further reducing supply, while refined stocks at exchanges have continued to dwindle, hitting multiyear lows. An expected sizable market deficit in 2022 is supporting prices, which should remain above pre-pandemic levels through to 2026, regardless of rises and falls in the consensus forecasts.

Copper prices also rose and fell in November, on news of lower U.S. inflation and relaxed Chinese COVID-19 protocols followed by hawkish Fed statements and a surge in COVID-19 cases in China. Despite the inflationary environment and reduced manufacturing activity globally, copper remains at the forefront of many major economies' green agendas. With mined supply periodically threatened by environmental, social and governance-related issues in Latin America and a thinning pipeline that will not keep up with the green energy transition, fundamentals are slowly countering the weak near-term macroeconomic influence. Consensus price forecasts for 2023 and beyond have been upgraded annually by an average of 0.4%, with the 2026 price expected to match 2021 levels.

While the nickel price trajectory in November was similar to that of the other commodities covered, the swings were more dramatic as mixed macroeconomic news was compounded by reports of a blast at a nickel pig iron plant in Indonesia, threatening to disrupt supply. The day-over-day rally — just short of the upper limit that would halt trading — propelled the London Metal Exchange nickel cash price to a five-month high of $29,600/t on Nov. 15. With the primary market expected to be in surplus from 2022 to 2026, prices are expected to decrease year over year through 2025 while remaining above 2021 levels. However, November's 2.1% increase to the 2026 consensus price forecast indicates that prices might start a new upward trend.

The London Metal Exchange cobalt cash price was stable through November on a delicate balance between supply-side issues and muted end-use demand from passenger electric vehicles and consumer electronics as well as some buying activity by China's State Reserve. Consensus price forecasts were unchanged, with expectations for the consensus forecast cobalt price to follow market trends over the forecast horizon, dipping in times of surplus and peaking above the 2022 average in 2026.

Iron ore prices have been most affected by the socioeconomic environment in China, where citywide lockdowns and the struggling property sector throughout the year are capping any potential price upside from fiscal relief or some easing of COVID-19 rules. Further, as the global economy slowed down on the inflationary environment, and the onset of winter in Europe rekindled energy supply issues, iron ore vessels were rerouted for coal shipments during November. With so much dependence on China's uncertain economic future, iron ore consensus price forecasts were downgraded an average of 0.42% annually through to 2024.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.