Introduction

While payment service providers may like to believe otherwise, cost likely will always be a top factor that merchants consider when choosing their primary payment service provider, or PSP. In fact, 66% of respondents to 451 Research's Voice of the Enterprise: Customer Experience & Commerce, Merchant Study 2022 note that keeping payment acceptance costs as low as possible is a high priority for their business. Our survey indicates that cost remains the number one attribute merchants consider when selecting a PSP, although encouragingly, additional factors like quality of tech platform, software integrations and value-added service are not far behind — a signal that more merchants are weighing their PSP selection decisions against multiple business priorities.

Cost should always be a consideration in any vendor selection decision, but we urge merchants to ensure that it is not their sole determining criterion when choosing a payment service provider. Merchants should weigh the total cost of payments, including how factors such as uptime, authorization rates and preexisting payment method integrations can directly impact their top and bottom lines. As commerce technology decision-makers consider a greater array of factors, we observe a trend of merchants using more than one PSP to meet their business objectives, creating an opportunity for payment orchestration platforms to optimize the added operational complexity that leveraging more than one PSP can bring.

Payment service provider selection criteria

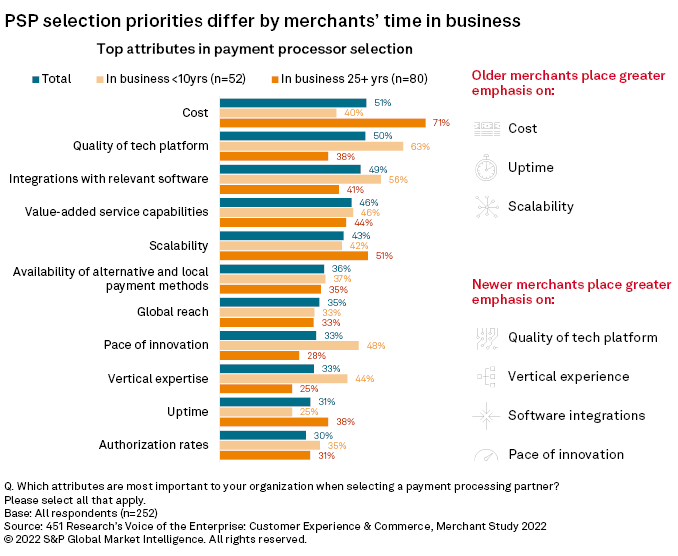

The top attributes merchants seek in PSPs are by no means universally consistent, especially regarding how long they have been in business. Traditional factors in the payments industry — cost, uptime and scalability — matter considerably more to merchants that have been in business for over 25 years. Cost is by far the number one factor for merchants in business for 25-plus years when selecting a PSP (71%), but considerably less for merchants in business for fewer than 10 years (40%), where it falls outside of the top five attributes they prioritize. Scalability and uptime also matter more to older merchants than newer ones (9-point and 13-point differentials, respectively). One plausible reason for these differences is that older companies' operations have likely grown more expansive over time, intensifying the business consequences of payments on both their expenses and revenues.

Compared with their longer-tenured counterparts, merchants in business for fewer than 10 years place significantly more emphasis on the quality of a PSP's tech platform (26-point differential), their vertical expertise (19-point differential), integrations with relevant software (15-point differential) and pace of innovation (10-point differential). This tells us that newer merchants favor PSPs that understand them and can quickly plug and play while providing a strong platform to build and expand business. We believe newer merchants are more likely to think of payments as a growth lever for their business and are seeking PSPs that can help accelerate their trajectory.

Generally, while payment-processing fundamentals are more top of mind for longer-established merchants, newer ones place greater emphasis on technology and innovation. Overall, it is also evident that a wide variety of factors influence PSP selection, with each attribute selected by at least one-quarter or more respondents. There is not a correct answer regarding which PSP attributes matter more, and priorities will inevitably differ based on business requirements.

We believe merchants should always consider the total cost of payments when choosing a PSP. For instance, it is not uncommon for a merchant's proposal reviews to quickly eliminate the PSP with the highest processing rate. It is entirely possible, however, that the PSP's ability to increase authorization rates or reduce developer hours and enhance conversions could offset the higher rate, thanks to the PSP's preexisting integrations with alternative payment methods. Similarly, a PSP with the lowest rate may also have high instances of downtime, which would quickly negate any potential cost savings.

The rise of the multi-processor approach to payments

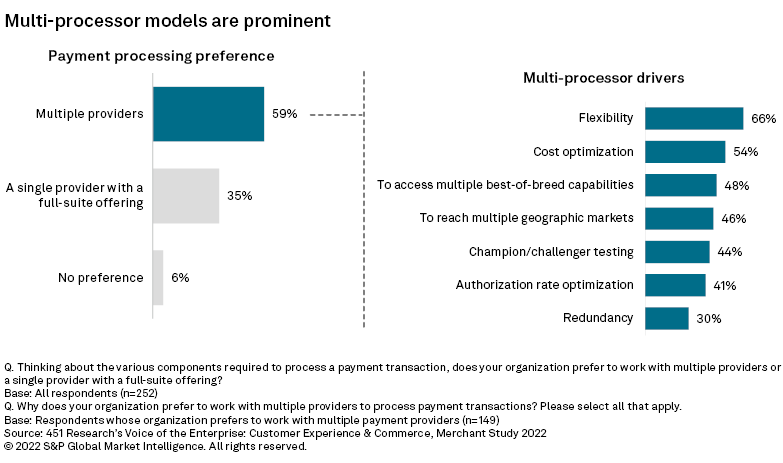

The wide variety of merchant payment priorities is a key reason why it has become common practice to enlist multiple PSPs to address specific business needs — 59% of respondents to our Merchant Study 2022 indicate that their business prefers this approach. Given the significant variations in payment types and regulations from country to country, multinational merchants (particularly those operating in three or more regions) exhibit the strongest preference for leveraging multiple PSPs (71%). There are numerous drivers that influence merchants' decisions to work with more than one PSP, including a desire for flexibility (e.g., reducing vendor lock-in), cost optimization (e.g., least-cost routing) and accessing multiple best-of-breed capabilities (e.g., a PIN debit routing engine, a fraud prevention tool).

The trade-off for utilizing a multi-PSP model is that it creates added operational complexity. Simply put, more partners mean more integrations to maintain and ultimately more fragmentation in merchants' payment environments. Many merchants lack the in-house resources to fully extract these benefits — consider that 57% of respondents highly agree that their business needs to reduce the time developers spend on payment functions, rising to 71% of respondents whose businesses generate more than $500 million in annual revenue.

This has given rise to a vendor segment known as payment orchestration, which includes providers with platforms that streamline PSP integration, transaction routing, reporting and token vaulting. Examples of vendors offering payment orchestration platforms include Spreedly Inc., Gr4vy Inc., ModoPayments, LLC, Very Good Security Inc., Paydock, Primer, Apexx and Cellpoint Digital. Nearly two-thirds (64%) of respondents agree that payment orchestration is highly strategic for meeting their organization's long-term e-commerce needs.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.