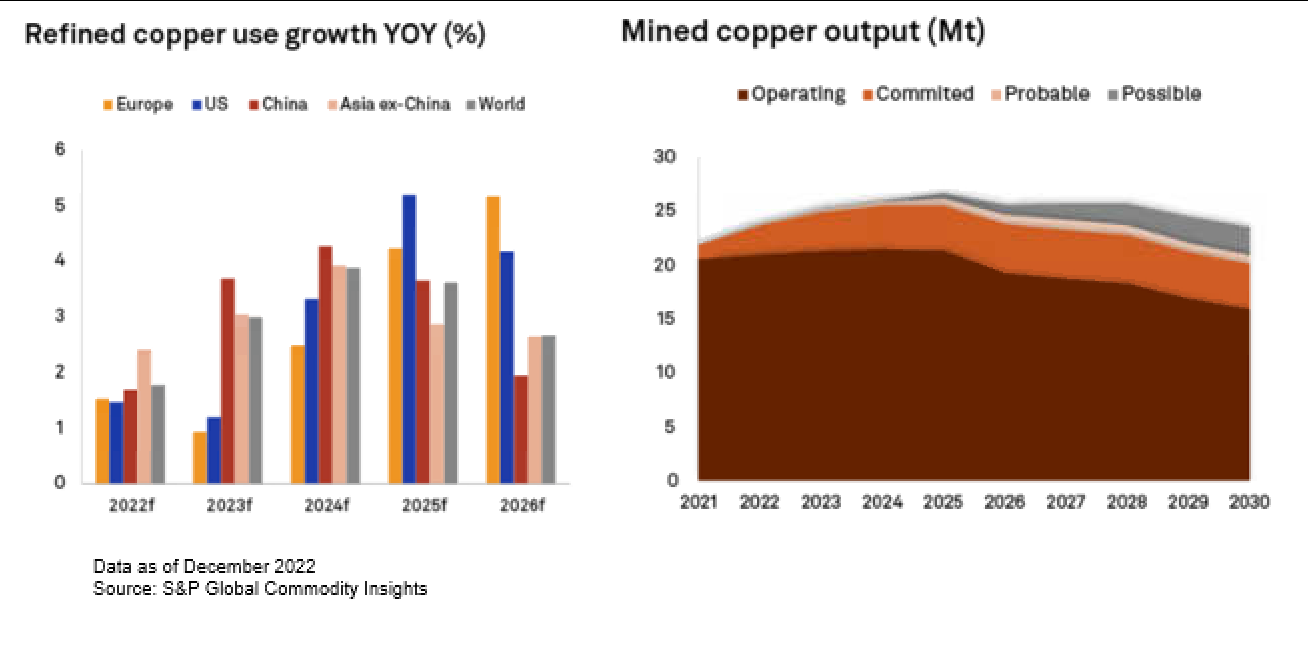

The short-term outlook is set within a global macroeconomic environment that is strained by high energy prices, rampant inflation and the increasing likelihood of recession – at least in some key economies. Longer-term, the energy transition will drive consumption growth, led by the U.S. as demand from projects initiated by the Inflation Reduction Act of 2022 materialize.

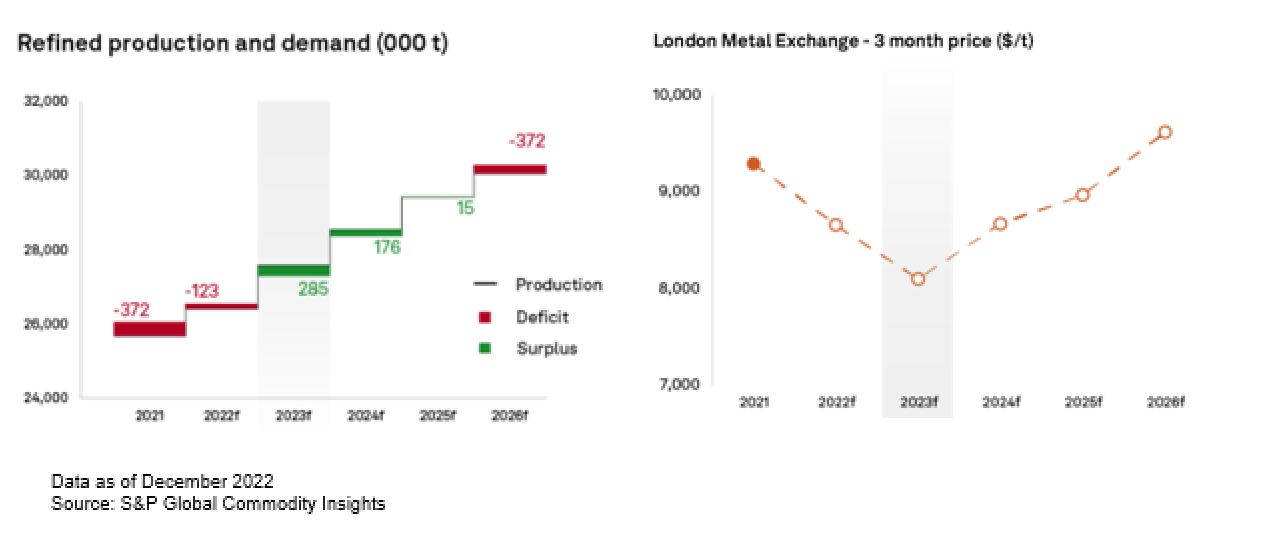

We expect copper demand growth to be suppressed into 2023, causing the refined market surplus to widen, and our estimate of the annual average three-month price to be the lowest on our rolling five-year forecast horizon.

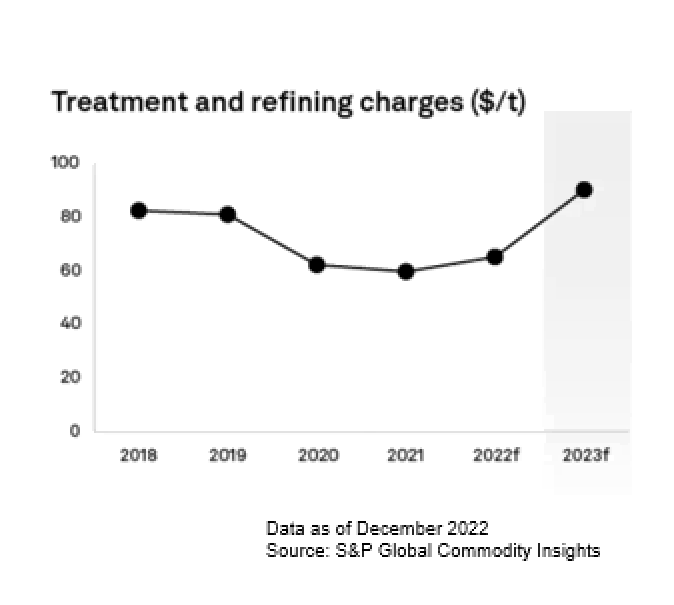

We expect the supply response to lag, however, on a thinning pipeline caused by dwindling exploration budgets and a dearth of significant discoveries.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro

Copyright © 2022 by S&P Global Market Intelligence, a division of S&P Global Inc. All rights reserved. No content, including by framing or similar means, may be reproduced or distributed without the prior written permission of S&P Global Market Intelligence or its affiliates. The content is provided on an “as is” basis. If you wish to distribute this information, contact: market.intelligence@spglobal.com