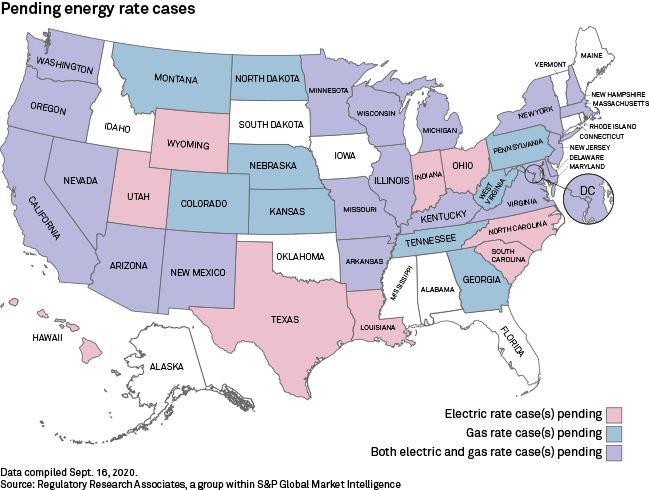

Thus far in 2020, the pace of state-level rate case activity remains fairly robust nationwide but has moderated somewhat versus 2019's pace. As of Sept. 8, there were 94 electric and gas rate proceedings pending in 39 jurisdictions including the District of Columbia, compared to 113 cases pending at this time last year.

An additional 15 electric and gas rate cases are expected to be filed by the end of 2020. The level of uncertainty and economic disruption wrought by the COVID-19 pandemic is a major driver of the lagging rate case activity, as the timing of many rate case filings planned for this year has been delayed or in some instances postponed. As the utility industry seeks to navigate this uncharted territory, modifications to pending rate case procedural schedules have also occurred, as well as voluntary delays in the implementation of approved rate changes in order to ease the economic hardship for ratepayers during these unprecedented times.

Stay-at-home and business restrictions called for by state policymakers to stem the spread of the virus have created several challenges for U.S. utilities, including reduction in usage from extended closure of businesses, schools and government buildings, lower revenues stemming from higher levels of bad-debt and higher operating costs associated with enhanced employee and customer personal safety measures and sequestration of essential employees in order to maintain sufficient staffing to ensure safe and reliable utility service.

With many lockdown restrictions lifted, several of the moratoriums put in place on utility service disconnections have been discontinued or are nearing an end.

In the pending 94 electric and gas rate cases, the utilities are seeking rate changes aggregating to about a $7.5 billion net rate increase, excluding the later-year steps of multiyear rate requests.

The returns on equity requested in the 94 pending electric and gas cases range from 8.38% to 11.00%, averaging 10.23% in the vertically integrated electric rate cases, 9.63% in the electric distribution rate cases, 9.58% in the electric limited-issue rate proceedings where an ROE is specified and 10.14% for gas local distribution general rate cases. The gas limited issue rider cases are premised upon previously approved ROEs and so no new return determinations are sought.

Over the last several weeks, Regulatory Research Associates, a group within S&P Global Market Intelligence, surveyed large electric and gas companies and state public utility commissions concerning pending rate cases.

For additional regulatory insights regarding pending rate cases nationwide, refer to the full report and related spreadsheet. (subscription required)

Regulatory Research Associates is a group within S&P Global Market Intelligence.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit S&P Global Market Intelligence Energy Research Home Page. (subscription required)

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.