The average annual earned return on equity for the Financial Focus energy coverage universe of utility operating companies has trailed the average authorized equity return for more years than not over the past 15 years, but much more so for gas utilities than electric utilities.

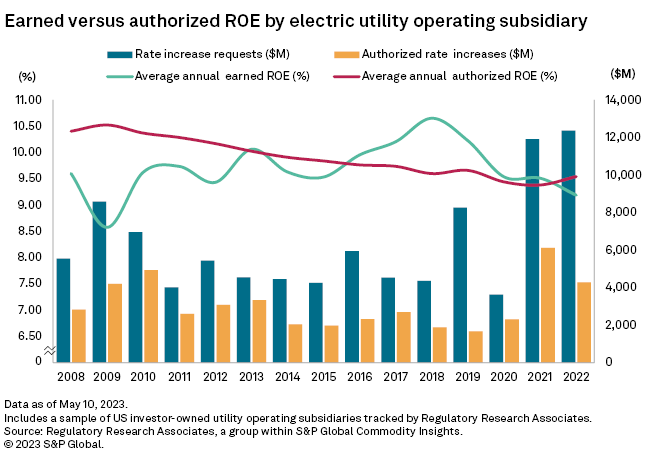

Electric utilities' average annual earned return on equity (ROE) climbed steadily from 2015 to 2018 and exceeded the average authorized ROE from 2016 to 2021. The average earned ROE, however, declined in 2022, falling below the average authorized ROE as utility disconnection moratoriums expired and states of emergency were lifted in the wake of the COVID-19 pandemic.

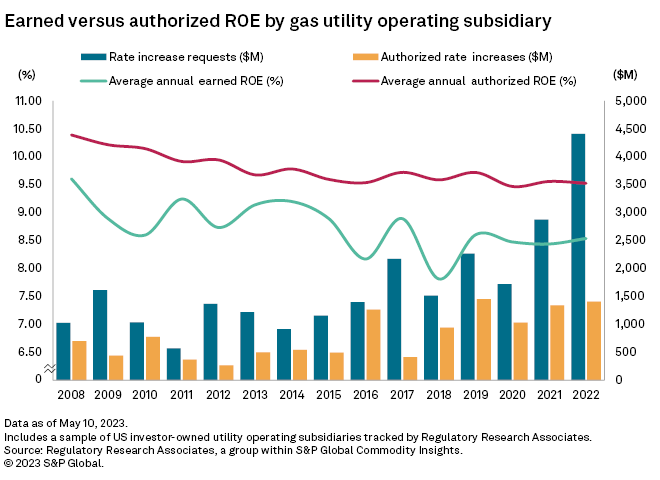

In contrast, the average annual earned ROE from a sample of US investor-owned gas utility operating companies never exceeded its authorized ROE over the 15-year time frame. The closest the group came to meeting its average authorized ROE was in 2013 and 2014 when the average earned ROE fell short by 54 and 58 basis points, respectively.

➤ Energy utility-earned ROEs, on average, have been pressured over the past three years, reflecting the difficult operating environment for utilities during a period of tremendous volatility brought about by the COVID-19 pandemic. But when the data is broken down by service type, electric utilities have fared far better.

➤ After a number of years of overearning authorized ROEs, electric utilities on average slipped below that threshold in 2022. A hotter-than-normal summer and a record number of rate cases that address growing capital spending plans by utilities, however, could pave the way for a return to higher earned returns.

➤ Gas utilities underearned authorized ROEs on average for the entire 2008–22 time frame, though some in our sample of gas utilities showed consistent overperformance.

➤ While there is new evidence of rising authorized ROEs in data collected by Regulatory Research Associates, history cautions about the stickiness of authorized returns. Commissions may be less inclined to boost approved returns in an environment of high inflation and interest rates.

Following the outbreak of the COVID-19 pandemic in 2019, states began to institute service disconnection moratoriums for customers unable to pay their utility bills as businesses shuttered or curtailed operations. In turn, earned ROEs for US investor-owned electric and gas utility operating subsidiaries fell. The decline since 2019 has been much more pronounced among electric utilities.

Disconnection moratoriums have largely expired, and states of emergency imposed by state governors and the federal government have also been lifted. In the past two years, utilities have filed some of the largest rate cases ever witnessed by RRA, and underearning has been frequently cited as a factor by utilities in testimony. Rate requests by utilities totaled a combined $16.78 billion in 2022, up about 13% from a record-setting 2021, as tracked by RRA. Coinciding with record-breaking capital investment plans by utilities, this should bode well for utilities and could point toward a rebound in earned ROEs.

Utilities have noted several capital market factors that could increase their cost of equity, including changes in monetary policy, exceptionally high inflation, increasing interest rates and volatile market conditions. Inflation and rising interest rates, in particular, pose challenges to the recovery of capital investment and authorized ROEs.

Examining the period from 2008 to 2022, the variability in average earned ROE has only been slightly higher for electric utilities compared to gas utilities. The largest variance between average earned ROE and average authorized ROE occurred in 2009, the height of the global financial crisis. The average electric earned ROE fell short of the average authorized ROE by 195 basis points. At that time, the economy was in the depths of a sharp recession, and the US GDP declined 2.5%.

By comparison, the biggest variance for gas utilities occurred in 2018 when the average earned ROE was 178 basis points below the average authorized ROE.

Earned ROEs peaked for electric utilities in 2018 at 105 basis points above authorized ROEs on average but dropped in 2022 to 36 basis points below authorized ROEs.

Interestingly, in 2022, both gas and electric utilities experienced favorable weather. The US experienced a higher-than-average number of cooling degree days during the summer and a higher-than-average number of heating degree days during the waning months of the year.

Regulator-approved authorized ROEs have drifted steadily lower through the review period for both gas and electric utilities. Most recently, however, RRA has seen an increase in authorized ROEs. The average ROE authorized for electric utilities was 9.71% for rate cases decided in the first quarter of 2023, up from the 9.54% average observed in full year 2022. The average ROE authorized for gas utilities was 9.75% for cases decided in the first quarter of 2023, up from the 9.53% average observed in full year 2022.

For a chronological listing of the major energy rate case decisions issued during 2023, as well as historical summary data going back to 1990, see Regulatory Research Associates' latest "Rate Case Decisions Quarterly Update."

In RRA's view, macroeconomic factors could reduce customer and regulatory tolerance for rate increases, which could maintain downward pressure on authorized ROEs. If history is any guide, the contraction in spreads between US Treasury Bills and average authorized returns may continue, causing authorized ROEs to remain relatively flat, or perhaps even fall in some instances, as interest rates continue to rise. For more information, refer to "Macro challenges give utility regulators a chance to differentiate themselves."

An important issue to note is whether the authorized equity return accurately represents the utility's cost of equity capital. Unlike the cost of debt, which can be observed, the cost of equity cannot be directly observed/measured as it is an investor expectation, and expectations, as a psychological concept, do not always lend themselves well to measurement. Regulators utilize various models to estimate the required ROE. Because it is not directly observable, the required ROE cannot be conclusively demonstrated that the authorized ROE, as estimated by regulators, is the company's actual cost of equity capital, which may be higher or lower.

Comments on methodology

The earned ROE data used in this analysis was primarily taken from the latest pull of data reflected in Financial Focus Utility Subsidiary Quality Measures Databooks, while the authorized ROE data is derived from RRA's "Major Rate Case Decisions" reports. Both are available in the Research Library.

The earned ROE data represents the simple average of the returns for the electric and gas utility operating companies in the Financial Focus coverage universe, and the authorized ROE is the simple average of the equity returns adopted by regulators in the specified 12-month period. As noted, RRA uses the average annual authorized ROE as a proxy for the average required equity return in each annual period.

RRA emphasizes that this analysis is an overall industry study and not one of individual companies. For some companies, determining the authorized ROE is difficult, if not impossible, since rate cases can be resolved through black box settlements that do not specify an authorized ROE. In addition, some utilities operate in multiple regulatory jurisdictions, and the authorized ROE can differ across jurisdictions. Also, for multijurisdictional companies, ROE determinations in various jurisdictions may have occurred in different years.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

Brian Collins contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.