The locations of 9.4 million fixed wireless access (FWA) subscribers and 1,380 operators unearth the secrets of FWA’s success.

FWA customers and ISPs are now included in our regional MediaCensus broadband data set, which provides data at the state, DMA®, county and ZIP code levels.

FWA technology emerged in the late 1990’s when neighbors started patching together their own broadband networks in rural areas Tier 1 operators avoided. Humble beginnings spawned smaller, regional FWA operators, and many of these rely on inexpensive hardware and antennas from companies like Ubiquiti and use unlicensed (free to use) spectrum.

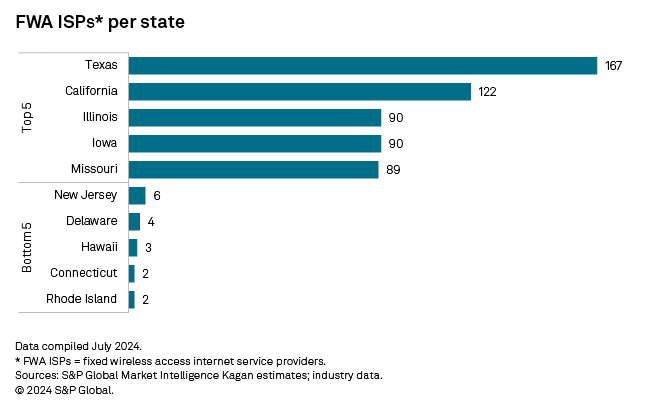

So, in general, physically larger states like Texas and California have more FWA subs (1.2 million and 937,000, respectively) relative to states with less square milage. In New York state, for instance, about half the residents reside near New York City. This is why the Empire State, while ranking fourth among all 50 states in total population, ranks 36th by total operating FWA providers at just 25 compared to the top two FWA states, Texas (167) and California (122).

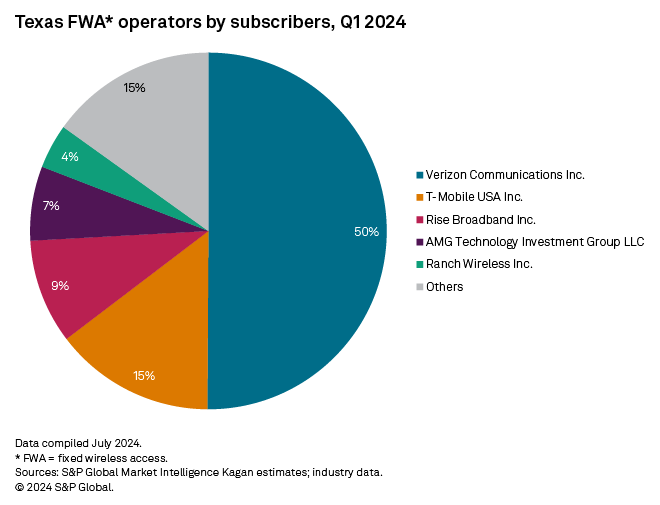

The top five FWA operators in Texas are Verizon Communications Inc. (50% share), T-Mobile US Inc. (15%), Rise Broadband Inc. (9%), AMG (7%) and Ranch Wireless (4%). But 120 of the 167 operators in the state have fewer than 1,000 subs, indicative of the long tail of small, first-moving "mom and pop" wireless internet service providers (WISPs) that have been incumbent to the fixed wireless marketplace for over two decades.

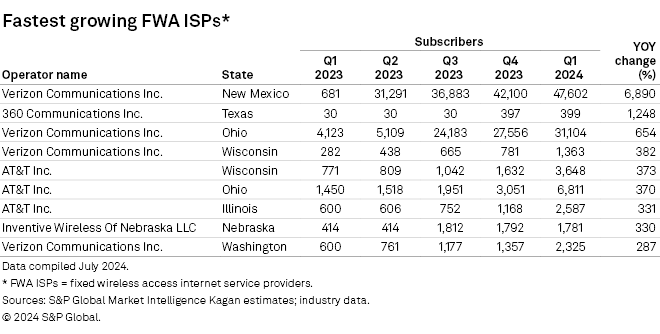

Across all 1,380 operators, the top 10 fastest growing by subscribers are in primarily midwestern states for Verizon, AT&T, 360 Communications Inc. and Inventive Wireless Of Nebraska LLC.

In late 2020 T-Mobile and Verizon entered the FWA space, using mostly licensed wireless spectrum, and now have subscriber bases of 5.2 million and 3.1 million, respectively. Before their entrance, the space had, for years, hovered at about 2 million customers. Both have succeeded not only in finding fresh customers, but also in stealing broadband customers from cable operators.

With about 10% of US homes still lacking a connection to a broadband provider, wireless broadband options like fixed wireless and Starlink will continue to play important roles in closing the digital divide.

Clients can access to ten-year projections of broadband services by technology, quarterly market share updates and other proprietary broadband quantification. Learn more about S&P Global Market Intelligence Kagan.

Multichannel Trends is a regular feature from S&P Global Market Intelligence Kagan.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.