Introduction

The nomination of Chairman Richard Glick to a new term at the Federal Energy Regulatory Commission appears stalled after the office of Sen. Joe Manchin, D-W.Va., chairman of the U.S. Senate Energy and Natural Resources Committee, indicated Manchin is "not comfortable holding a hearing" on the nomination: Manchin defers action on Glick nomination, leaving fate of FERC chair in doubt.

In what could be Glick's penultimate meeting at FERC, the agenda for the commission's open meeting Nov. 17 includes high-profile proceedings related to complaints filed by state regulators in Arkansas, Louisiana and Mississippi over a cost-based formula rate and the 10.94% return on equity that applies to sales to operating companies of Entergy Corp. from the Grand Gulf nuclear plant: Entergy reaches settlement in Mississippi over Grand Gulf nuclear plant and Three Southeast regulators reject Entergy settlement over nuclear plant cost.

The meeting agenda also indicates the commission is poised to act on a complaint filed by the Ohio Consumers' Counsel against American Electric Power Service Corp., FirstEnergy Corp. subsidiary American Transmission Systems Inc. and Duke Energy Ohio Inc. asking FERC to deny the companies a 50-basis-point incentive ROE adder for their participation in a regional transmission organization, or RTO.

The complaint filed by the Ohio Consumers' Counsel followed a decision by FERC in February to deny AES Ohio's request for the RTO adder for the company's participation in the PJM Interconnection LLC: FERC sticks by denial of AES Ohio's bid for incentive tied to RTO membership.

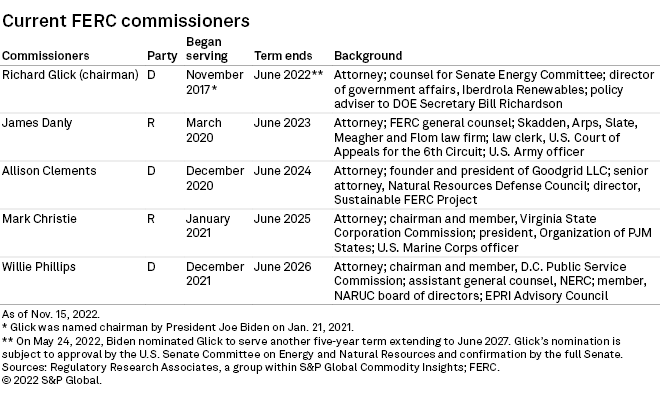

* FERC would be left with a 2-2 split along party lines if Glick is not confirmed before the end of the year, increasing uncertainty over the future of many of the chairman's major policy initiatives. Glick could be renominated in 2023 and potentially paired with a Republican nominee when Commissioner James Danly's term expires June 30, 2023.

* Significant pending proceedings that Glick has prioritized include base and incentive ROE policy for electric utilities, revisions to the commission's transmission planning and cost allocation methods and proposals to significantly modify policies related to certifying and assessing greenhouse gas emissions of new natural gas projects.

* Authorized returns continue to feature prominently in current FERC cases, even as the commission's electric ROE policy remains unsettled after the D.C. Circuit vacated and remanded FERC's orders establishing the current policy in the Midcontinent Independent System Operator cases on Aug. 9.

Noteworthy developments at FERC during the last month in the electric power sector include a settlement of a complaint filed by electric cooperatives in North Carolina against Duke Energy Corp. subsidiary Duke Energy Progress LLC, or DEP, asserting the 11% ROE in a wholesale power sales agreement was unjust and unreasonable. The settlement reduces the ROE in the agreement to 10%.

In another wholesale power supply proceeding, two nonprofit organizations in the Southeast U.S. filed a protest alleging that Southern Co. subsidiary Georgia Power Co. favored an affiliated company's generating facilities over competing nonaffiliated bidders to fulfill a need for new capacity resources.

The commission also confirmed a request filed by National Grid USA subsidiary Niagara Mohawk Power Corp. to recover the company's costs related to the $1.1 billion Smart Path Connect transmission project in New York if the project is canceled or abandoned for reasons beyond the utility's control. FERC earlier rejected ROE incentives for the project, which is designed to expand the deliverability of renewable power from northern and western regions of the state to support New York's clean energy goals.

In the natural gas sector, the parties in a formal rate proceeding involving TC Energy Corp. subsidiary ANR Pipeline Co. notified FERC that they had reached a settlement in principle. In the company's rate case filing, ANR Pipeline proposed a capital structure of 66% equity and a 15.7% ROE, as well as a new tracker or rider to recover costs the pipeline incurs under a five-year system modernization program.

A more detailed discussion of these developments that Regulatory Research Associates is following is provided below.

The commission

Glick, a Democrat, was serving a term that expired June 30, 2022, but he may continue to serve until the end of the current Congress. If his renomination is approved by the Senate Energy and Natural Resources Committee and confirmed by the full Senate, Glick will serve a new five-year term expiring June 30, 2027.

The other FERC commissioners and the dates their terms expire are James Danly, a Republican, June 2023; Allison Clements, a Democrat, June 2024; Mark Christie, a Republican, June 2025; and Willie Phillips, a Democrat, June 2026.

Wholesale power ROE — Duke Energy Progress

On Nov. 7, 2022, FERC approved a settlement of a complaint filed by the North Carolina Electric Membership Corporation, or NCEMC, that argued the 11% ROE incorporated in a power supply agreement with DEP was unjust and unreasonable. NCEMC is a generation and transmission cooperative providing full or partial power supply requirements for its 25 members throughout North Carolina.

The settlement provides that the 11% ROE in the power supply agreement would continue to apply through Dec. 31, 2021. The ROE will be reduced to 10% effective Jan. 1, 2022, and the reduced ROE will remain in effect through Dec. 31, 2024.

NCEMC purchases energy and capacity from DEP under a power supply agreement originally entered into on Dec. 19, 2008. In its complaint, NCEMC asserted that the 11% ROE incorporated into the agreement has become excessive, and FERC should set the ROE no higher than the 7.78% ROE proposed by NCEMC.

The NCEMC complaint was filed in October 2020, subsequent to FERC's Opinion Nos. 569 and 569-A establishing a three-model methodology for determining electric utility ROEs. In accordance with the commission's policy, NCEMC applied the discounted cash flow, or DCF, capital asset pricing model, or CAPM, and risk premium models using financial data for the six-month period ending July 31, 2020.

NCEMC stated that the DCF model produced an ROE range of reasonableness of 6.76% to 9.75%, the CAPM produced a range of 8.22% to 10.54% and the risk premium model produced a 9.38% result.

NCEMC averaged the high and low ends of the ranges produced by the DCF and CAPM models and an imputed risk premium range, producing a composite zone of reasonableness of 7.68% to 10.33%.

Affiliate power sales protest — Southern Co.

On Nov. 10, 2022, the Southern Alliance for Clean Energy, or SACE, and Southface Energy Institute Inc. protested Southern Power Co.'s request for FERC's approval of power purchase agreements, or PPAs, governing sales to its affiliate, Georgia Power Co., or GPC.

The PPAs between Southern Power and GPC resulted from a request for proposals, or RFP, that SACE and Southface allege "was ostensibly open to all sources of generation but whose eligibility criteria eliminated potentially more economic options, creating an undue preference for Southern Power's generation resources." SACE and Southface asked FERC to reject the PPAs as "inconsistent with its affiliate abuse precedent and in violation of … the Federal Power Act."

SACE and Southface stated that GPC initiated the RFP as part of its 2019 integrated resource plan, or IRP, which was approved in 2019 by the Georgia Public Service Commission, or GPSC. SACE and Southface noted that "ultimately, GPC opted to purchase a total 2,356 MW of capacity from six existing gas plants, five of which Southern Power owned and some from which GPC currently purchases power."

The protest of SACE and Southface continued: "[T]he commission must apply a thorough and searching review to the RFP process that led [GPC] to select its affiliate's generating facilities to fulfill a capacity need over competing bidders. [GPC] designed the solicitation in a manner that favored gas-fired resources over standalone storage resources and storage resources coupled with renewable resources. Effectively eliminating these resources from contention cleared the way for Southern Power's existing gas plants—some of which currently sell to Georgia Power—to prevail in the RFP."

The protest concluded by asserting that "by unduly favoring [GPC]'s affiliate, the RFP's design ran afoul of commission precedent applicable to such solicitations. At a minimum, the commission must review the entire record to assess whether the RFP granted an undue preference to Southern Power's generating facilities, including a full accounting of the bids received and communications between [GPC], the [independent evaluator] and PSC Staff in constructing the RFP."

Transmission incentive — Niagara Mohawk Power

On Oct. 24, 2022, FERC accepted a compliance filing submitted by Niagara Mohawk and confirmed the commission's authorization allowing the utility to recover the costs associated with the $1.1 billion Smart Path Connect transmission project in the event the project is canceled or abandoned for reasons beyond the utility's control.

On Nov. 19, 2021, Niagara Mohawk filed a petition for declaratory order seeking authorization for the canceled or abandoned plant incentive. Niagara Mohawk stated that when the petition was filed, the utility still required approvals for the project from the New York Public Service Commission, or NYPSC, under New York Public Service Law.

On March 11, 2022, FERC granted Niagara Mohawk's petition conditioned upon the NYPSC issuing a Certificate of Environmental Compatibility and Public Need and an Environmental Management and Construction Plan, or EMCP, for the project. FERC directed Niagara Mohawk to make a compliance filing showing that "the Certificate of Need process adequately considered and found that the project will ensure reliability or reduce the cost of delivered power by mitigating congestion."

In a subsequent compliance filing made on Aug. 23, 2022, Niagara Mohawk stated that the NYPSC approved its application for a Certificate of Environmental Compatibility and Public Need. Niagara Mohawk added that an approved EMCP is still pending but asserted that it had satisfied the commission's conditions. FERC agreed and accepted the company's compliance filing.

FERC had earlier rejected certain other incentives Niagara Mohawk had sought for the project, including a total ROE of 11.5%. The commission determined that a 2015 settlement governing Niagara Mohawk's transmission formula rate incorporating a total ROE of 10.3% applies to all of the utility's transmission facilities, "including its going forward investments." FERC rejects higher incentives, return on equity for NY transmission project.

Pipeline rate case — ANR Pipeline Company

On Nov. 10, 2022, ANR Pipeline notified the commission that the participants in the company's general rate proceeding reached a settlement in principle that would resolve all remaining matters set for hearing. ANR stated that the settlement is supported or not opposed by all participants, and "the participants are now in the process of memorializing the specific terms of the settlement in writing for filing with the [commission]."

According to the company, the settlement would address, among other things, the establishment of base transportation and storage rates for two defined periods, including a three-year and three-month rate moratorium, a new rate case filing in six years and the establishment of a carbon tax regulatory asset.

ANR initiated the case on Jan. 28 when it requested a system-wide general rate increase that would raise certain firm transportation reservation charges to 132% on average for deliveries received from the Southeast and 192% on average for deliveries from the Southwest. ANR also proposed implementing a new tracker or rider to recover costs incurred under a five-year system modernization program and comply with current and prospective regulatory requirements.

ANR proposed a cost of service of $1.125 billion for a 12-month base period ending Oct. 31, 2021, adjusted for known and measurable changes for the test period ending July 31, 2022. ANR's proposed rates reflect a 34% debt and 66% equity capital structure, a 15.7% ROE and an overall rate of return of 11.76%.

In support of its application, ANR stated that its rate base has grown since its last rate case in 2016 from $1.847 billion to $3.440 billion, due largely to the company's system modernization investments, including $837 million in capital expenditures pursuant to a settlement of the 2016 rate case.

ANR asserted that its proposed cost recovery rider, the system improvement modernization mechanism, or SIMM, conforms to FERC's policy statement issued in 2015 that allows interstate natural gas pipelines to seek recovery of certain capital expenditures made to modernize system infrastructure through a tracker or surcharge mechanism. ANR also stated that the amount that may be recovered through the SIMM over the proposed five-year term would not exceed a cap of $900 million, subject to a 15% tolerance above the cap.

Numerous stakeholders filed comments or protests regarding various aspects of ANR's rate filing, including the company's cost-of-service components and the proposed 15.7% ROE. The protesters included multiple shipper groups, the Michigan Public Service Commission, Xcel Energy Inc. subsidiary Northern States Power Co., Atmos Energy Corp. and DTE Gas Co.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.