For several months, electric utilities have been coping with the challenges associated with COVID-19, including moratoriums on utility shut-offs and mandates for flexible payment plans. For gas local distribution companies, or LDCs, the risks have been less immediate, as the pandemic began after the peak winter heating season had passed in most jurisdictions.

As the 2020-2021 heating season approaches and policymakers in many jurisdictions extend service termination moratoriums, gas utilities will face many of the same challenges as their electric counterparts.

Regulators and policymakers continue to grapple with ways to address COVID-19 impacts on utilities. Thus far, 30 of the 53 state-level regulatory jurisdictions followed by Regulatory Research Associates, a group within S&P Global Market Intelligence, have authorized at least one utility to defer COVID-19 related costs, which may or may not include lost revenue associated with the decline in economic activity.

It is important to note that deferral is not a guarantee of recovery. Recovery will likely be addressed in the context of a future base rate proceeding and the commissions may ultimately disallow a portion of the costs as imprudent or require a sharing of the extraordinary costs by stockholders and ratepayers.

In the meantime, this regulatory accounting mechanism eliminates the impact of the deferred costs on utility earnings, without improving utility cash flow.

Three states have adopted a different approach to addressing COVID-19 cost recovery for one or more companies and five have made definitive statements that a customer-specific approach will be taken rather than socializing the costs through deferral or some other broad-based mechanism.

A cost recovery framework is being considered in 18 states and three states appear to have taken no definitive action yet.

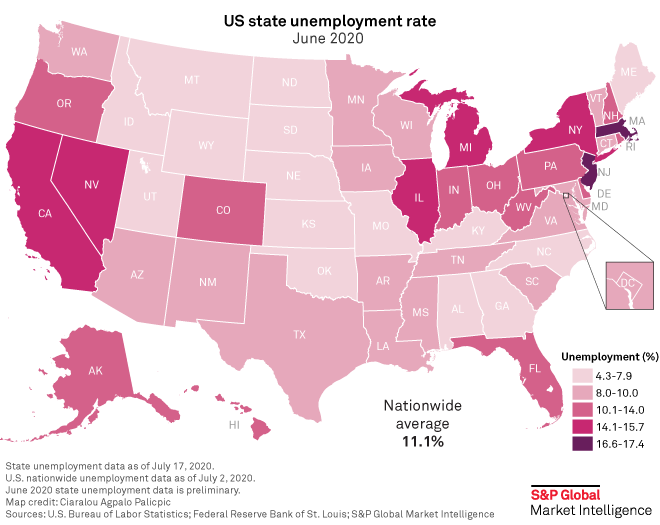

The magnitude of COVID-19 related costs to be recovered and the degree of difficulty regulators and companies will face in addressing recovery of these costs will be impacted by a variety of factors. These factors include the severity of the outbreak in the utility's service territory, the level of unemployment in the service area, the magnitude of capital spending plans, the utility's ability to moderate O&M costs, the individual company's sales and revenue mix and the type of regulatory mechanisms that are already in place to address extraordinary costs and/or revenue volatility.

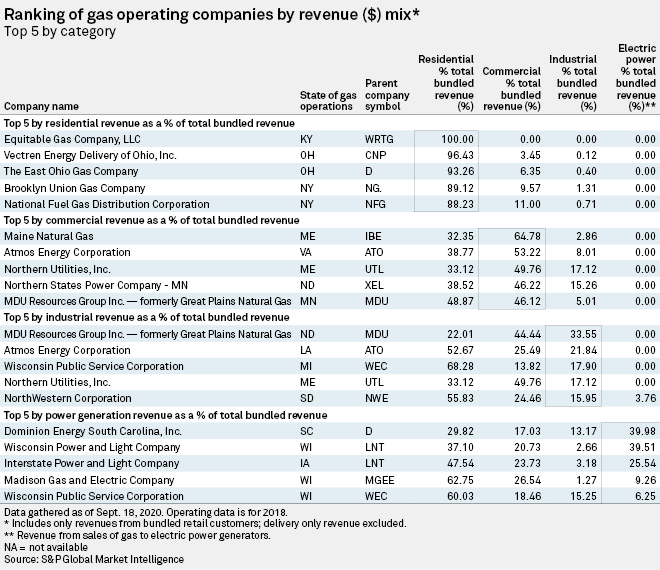

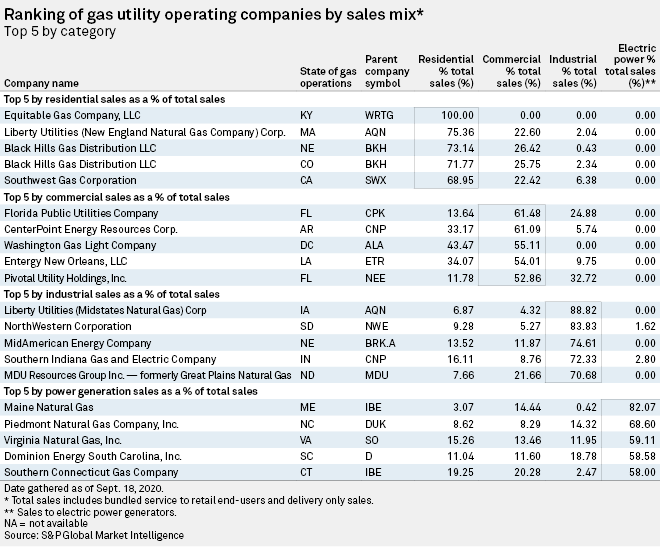

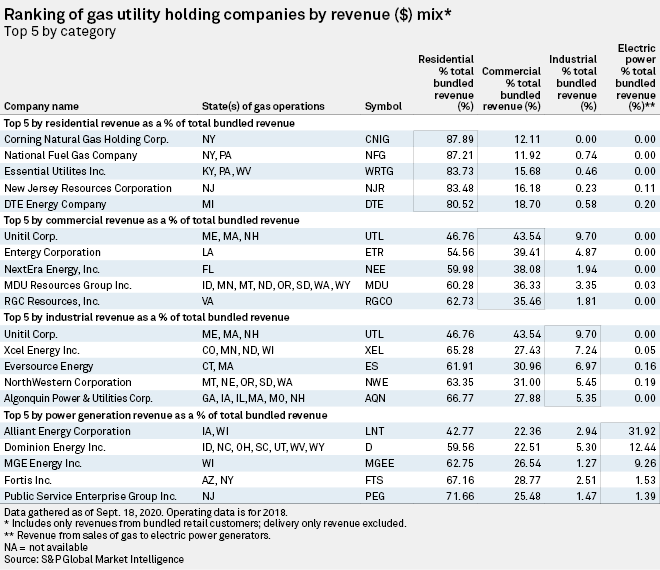

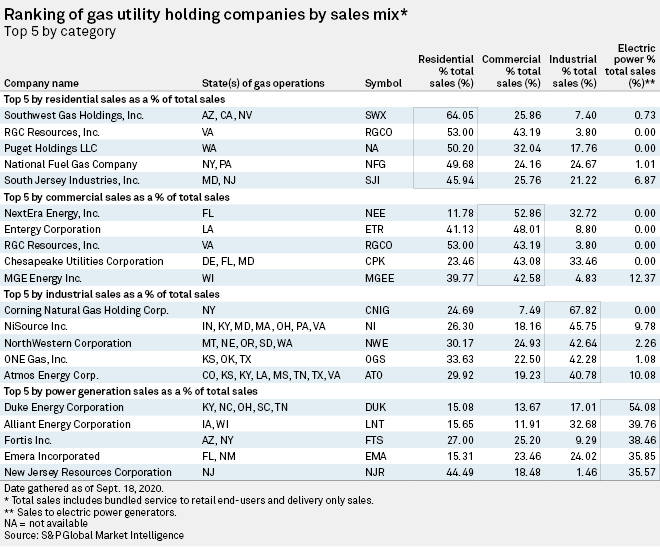

With this in mind, RRA examined the 2018 revenue and sales mix of the covered gas LDCs, by service territory, and utility holding companies with gas LDC operations.

Caveats to keep in mind

Certain nuances complicate the analysis and are worth mentioning at the onset. In many instances, LDCs operate under the same name across multiple jurisdictions; for purposes of this discussion, each state of operation has been treated as a separate division for purposes of the operating company analysis.

Large commercial and industrial gas customers in most states can purchase their gas supply competitively. The revenue data used for this analysis relates to bundled sales only, and industrial revenue comprised a relatively small percentage of total bundled revenue for the companies in the group. Sales data, however, includes both bundled and delivery-only thousand-cubic-foot volumes.

Many, but not all, companies also provide gas to electric generation facilities, and this category of sales and revenue is broken out separately. LDCs for which this segment comprises a significant portion of sales and/or revenue are not only subject to risks inherent in the gas business, but also to the possibility of declining demand in the electric markets.

There were three LDC operating divisions within RRA's coverage universe for which 2018 operating data was unavailable — Southern Co. subsidiary Atlanta Gas Light Co., NiSource Inc. subsidiary Bay State Gas Co. and Essential Utilities Inc. subsidiary Peoples Natural Gas Co. LLC.

Companies at risk

All else being equal, companies that derive a higher proportion of the sales and revenue mix from the commercial customer classes are likely to experience the greatest level of lost revenue as a result of pandemic related downturn.

While companies that have a high proportion of revenue and sales from the residential class may see increases in sales, this may prove to be a double-edged sword, particularly in states where unemployment is high, as a higher level of uncollectibles or bad debt expense may occur.

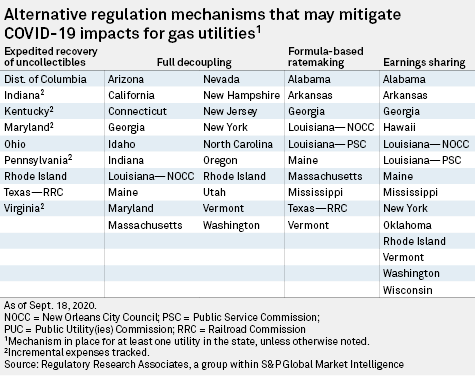

In certain jurisdictions, expedited cost recovery mechanisms for uncollectibles and other forms of alternative regulation, such as revenue decoupling mechanisms, formula-based rate plans and earnings sharing mechanisms may mitigate the risk to some extent.

These mechanisms may not fully address COVID-19 on their own due to certain limitations on the operation of the mechanisms. For example, expedited uncollectibles recovery mechanisms may apply only to the commodity portion of the bill and not the delivery portion.

In many instances revenue decoupling mechanisms and formula based ratemaking mechanisms include limitations on the amount of the rate adjustment that may occur in a given year. Consequently, to the extent COVID-19, along with other factors reflected in the mechanism, cause the requisite increase to exceed the limit, the excess will have to be addressed separately.

In addition, decoupling mechanisms may apply only to certain customer classes and not to others. Therefore, to the extent that COVID-19 sales differ across customer classes, the impact could be magnified rather than reduced.

Earning sharing mechanisms may also contain similar restrictions, and if the mechanism is not symmetrical, i.e., if the plan does not allow for the company to be made whole for earnings below the benchmark, then the degree of mitigation will be diminished.

Operating company rankings

Equitable Gas Co. LLC's Kentucky division is unique among the companies examined, as it is the only one that obtains 100% of its sales and revenue from one customer class — residential. Notably, the Kentucky division represents only a small portion of the company's operations. According to data gathered in June, unemployment is relatively low in that state. Essential Utilities Inc. owns Equitable.

CenterPoint Energy, Inc. subsidiary Vectren Energy Delivery of Ohio Inc. ranked second when it comes to revenue from residential customers as a percentage of total bundled revenue, followed closely by Dominion Energy Inc. subsidiary The East Ohio Gas Co. Neither ranked among the top five in residential sales as a proportion of total sales. Both have an expedited uncollectibles cost recovery mechanism in place. While there is no revenue decoupling mechanism in place for either of these companies, but they use straight fixed variable rate designs that allow 100% of fixed costs to be recovered through fixed charges. Ohio is among the states that has indicated that cost recovery should be addressed on a customer-specific basis. As of June 2020, the state's unemployment rate was somewhat below average.

New York utilities National Grid plc subsidiary Brooklyn Union Gas Co. and National Fuel Gas Co. subsidiary National Fuel Gas Distribution Corp., or NFGD, rounded out the top five with regard to residential revenue as a proportion of bundled revenue, but neither was in the top five for residential sales as a percentage of total sales. Both companies have revenue decoupling mechanisms and earnings sharing plans in place; however, the New York Public Service Commission has not ruled on how cost recovery is to be addressed. Figures for June 2020 show that the unemployment was somewhat higher than average in the state.

Looking at commercial revenues and a proportion of total bundled revenue, two of the top five operate in Maine, where the unemployment rate was well below the nationwide average according to June 2020 results.

Iberdrola SA subsidiary Maine Natural Gas had the highest percentage of commercial sales, while Unitil Corp. subsidiary Northern Utilities Inc.'s Maine operations ranked third. Neither of these companies ranked in the top five with respect to commercial sales as a percentage of total sales. Maine Natural Gas operates under a formula-based rate plan that has an associated earnings sharing mechanism, while Northern Utilities has an earnings-sharing plan in place. Maine is among the jurisdictions that has not yet determined the approach it plans to take with respect to COVID-19 cost recovery.

Atmos Energy Corp.'s Virginia operations ranked second in the commercial revenue ranking. Notably, Virginia comprises a relatively small percentage of the company's total revenue and RRA does not follow the company's base rate proceedings. However, the Virginia State Corporation Commission has authorized the companies to defer COVID-19 related costs. Unemployment rates in Virginia were somewhat below the national average in June 2020.

Similarly, Xcel Energy Inc. subsidiary Northern States Power Co. - Minnesota's North Dakota operations, which came in third, account for a relatively small proportion of the company's total revenue. While the company utilizes a straight fixed variable rate design, no other alternative regulation mechanisms are in place, and North Dakota has not adopted a COVID-19 cost recovery framework. Based on June 2020 data, unemployment has been relatively low in North Dakota compared to nationwide averages.

The Minnesota operations of MDU Resources Group Inc., formerly Great Plains Natural Gas, rounded out the top five companies for commercial sales as a proportion of total bundled sales. There are no alternative regulatory mechanisms in place for gas utilities in Minnesota, but it is worth noting that these operations account for a relatively small proportion of the company's total revenue. Minnesota has authorized deferral of COVID-19 related costs. Unemployment in Minnesota has been somewhat below national averages.

Looking at the sales data for the various operating divisions, after Equitable Gas, which was mentioned earlier, Algonquin Power & Utilities Corp. subsidiary Liberty Utilities (New England Natural Gas Co.) Corp. ranked second on residential sales as a percentage of sales to total sales. A revenue decoupling mechanism is in place for the utility, but the Massachusetts Department of Public Utilities has not ruled on a COVID-19 cost recovery framework. As of June 2020, the unemployment rate in Massachusetts was among the highest in the country.

Black Hills Gas Distribution LLC's operations in Nebraska and Colorado ranked third and fourth, respectively. There are no alternative ratemaking mechanisms in place in either state that would mitigate COVID-19 impacts on the company. The Nebraska Public Service Commission is in the process of considering methodologies for addressing COVID-19 cost recovery, and in Colorado an executive order issued by the governor calls for arrearages to be addressed on a customer-specific basis. The company is a subsidiary of Black Hills Corp. As of June 2020, Nebraska's unemployment rate was among the lowest in the country, while Colorado's was somewhat higher, but still below national averages.

Rounding out the top five is Southwest Gas Holdings Inc. subsidiary Southwest Gas Corp.'s California operations. The company has a revenue decoupling mechanism in place, and the California Public Utilities Commission has approved deferral of COVID-19 related costs. Based on June 2020 data, unemployment was somewhat higher than average in the state.

With respect to commercial sales, Chesapeake Utilities Corp. subsidiary Florida Public Utilities Co., or FPU, ranked the highest, with more than 61% of sales coming from these customers, while NextEra Energy Inc. subsidiary Pivotal Utility Holdings Inc., which also operates in Florida ranked fifth. Neither company has a decoupling or alternative regulation mechanism in place. FPU has filed for commission approval to defer COVID-19 related costs, but Pivotal has not. Based on June 2020 data, unemployment rates in the state approximate national averages.

CenterPoint Energy subsidiary CenterPoint Energy Resources Corp.'s Arkansas operations ran a close second, also garnering more than 61% of sales from the commercial class. However, CenterPoint operates under a formula-based ratemaking framework that includes an earnings-sharing mechanism, and the Arkansas Public Service Commission has approved deferral of COVID-19 related costs. In June, the state's unemployment rate was somewhat below nationwide averages.

Washington Gas Light Co.'s operations in the District of Columbia ranked third on the commercial sales metric. The AltaGas Ltd. subsidiary has an expedited recovery mechanism for incremental uncollectibles costs in the District and has been authorized to defer coronavirus related costs. Based on June 2020 data, the unemployment rate in the District was somewhat below the average of those observed in other jurisdictions.

Ranking fourth was Entergy Corporation subsidiary Entergy New Orleans LLC. A full revenue decoupling, and a formula-based ratemaking framework that includes an earnings-sharing plan are in place. The City Council Of New Orleans, or NOCC, has approved deferral of COVID-19 related costs. Based on June 2020 data, the unemployment rate in Louisiana was somewhat below the average of those observed in other states.

Holding company rankings

Looking at the holding companies in RRA's regulatory coverage universe that have gas utility operations, Corning Natural Gas Holding, which has operations solely in New York, ranked highest with respect to residential revenue as a percentage of total bundled revenue.

National Fuel Gas Company, which does business in New York and Pennsylvania as NFGD, had the second highest percentage of bundled revenue derived from residential customers and ranked fourth with respect to percentage of total sales from residential customers. National Fuel Gas also ranked fourth with respect to the proportion of sales derived from residential customers. In New York, the company utilizes a full revenue decoupling mechanism and a multiyear rate plan that includes earnings sharing. No such mechanisms are in place for the company's operations in Pennsylvania. However, the Pennsylvania Public Utility Commission approved the deferral of COVID-19 related costs for all utilities, while the New York Public Service Commission is addressing deferral on a case-by-case basis.

Essential Utilities Inc., which also has gas operations in Pennsylvania, as well as Kentucky and West Virginia, ranked third. There are no decoupling or alternative regulation mechanisms in place for this company in any of these jurisdictions. While deferral of pandemic related costs is permitted in Pennsylvania, Kentucky is still considering the issue and West Virginia has not taken it up.

Ranking fourth was New Jersey Resources Corp., whose sole gas distribution operations reside in New Jersey. The company has a full revenue decoupling mechanism in place. However, an earnings test applies to the decoupling mechanism, and adjustments are contingent on reaching certain energy conservation targets. The New Jersey Board of Public Utilities, or BPU, has approved the deferral of COVID-19 related costs.

DTE Energy Co. which is also a single-state, single utility holding company ranked fifth. There are no revenue decoupling or alternative ratemaking mechanisms in place for the company's gas operations in Michigan, but deferral of pandemic related costs has been permitted.

Unitil Corp., which has gas operations in Maine, Massachusetts and New Hampshire ranked highest in terms of commercial revenue as a proportion of total bundled revenue. As noted earlier, an earnings-sharing mechanism is in place for its Maine operations and a revenue decoupling mechanism in place in Massachusetts, while no decoupling or alternative regulation mechanisms are in place for its New Hampshire operations. All three jurisdictions have yet to settle on an approach to addressing COVID-19 cost recovery.

Ranking second on this metric, Entergy Corporation has operations in Louisiana that are subject to regulation by both the NOCC and Louisiana Public Service Commission. Entergy also ranked second on the proportion of total sales that comes from the commercial customers. Full revenue decoupling and formula-based ratemaking frameworks that include earnings sharing plans are in place for both segments. The NOCC has approved deferral of COVID-19 related costs, while the PSC continues to deliberate on the issue.

NextEra Energy Inc., whose sole gas operations reside in Florida, ranked third on this metric. NextEra also ranked first in terms of the percentage of sales that comes from commercial customers. The company does not have a decoupling or alternative regulation mechanism in place. Regulators are still considering the appropriate framework for addressing COVID-19 related costs and have approved certain utilities' requests to defer the costs. However, subsidiary Pivotal Utility Holdings has not filed for such treatment.

The company with the next highest exposure to commercial sales volatility is MDU Resources, which has gas operations in eight states. Revenue decoupling mechanisms are in place for the company's gas businesses in Idaho and Washington. In Washington, there are caps/limitations on adjustments that can flow through the full decoupling mechanism. Regulators in Idaho, Minnesota, South Dakota and Wyoming have approved deferral of COVID-19 related costs. Proceedings to address pandemic related cost recovery are pending in Montana and North Dakota, and Colorado has focused on customer-specific cost recovery options.

Rounding out the top five is RGC Resources, Inc., whose only state of operation is Virginia. There are no revenue decoupling or alternative regulation plans in place that would mitigate COVID-19 impacts, but the Virginia State Corporation Commission has approved deferral of COVID-19 costs. Notably, RGC Resources also ranked third in the proportion of its sales that come from residential customers and third with respect to the proportion of sales that come from commercial customers.

Southwest Gas Holdings, Inc., which has operating divisions in Arizona, California and Nevada, ranked first in terms of residential sales as a percentage of total sales. Full revenue decoupling mechanisms apply to the company's operations in all three jurisdictions. California and Nevada regulators have authorized the utilities to defer COVID-19 related costs, while Arizona regulators are still investigating the issue.

Puget Holdings LLC, which ranked third, operates in Washington through subsidiary Puget Sound Energy Inc. The utility has a revenue decoupling mechanism in place, but there are caps on the adjustments that can flow through the mechanism.

As noted earlier, National Fuel Gas Company, whose subsidiary National Fuel Gas Distribution operates in New York and Pennsylvania, ranked fourth.

Rounding out the top five, South Jersey Industries Inc. has two utility subsidiaries in New Jersey. A revenue decoupling mechanism is in place for South Jersey Gas Co., but an earnings test applies and adjustments are contingent on reaching certain energy conservation targets. There are no mechanisms in place for affiliate Elizabethtown Gas Co. that would mitigate the impact of COVID-19 on the utility. As noted previously, the New Jersey BPU has approved deferral of pandemic-related costs.

Looking at the percentage of commercial sales relative to total sales, the top three companies in this category also appear in the top five in other categories discussed previously.

Chesapeake Utilities Corporation, which has operations in Delaware, Florida and Maryland, came in fourth on this metric. There are no mechanisms in place in any of the jurisdictions in which the company operates that would mitigate the impacts of COVID-19 on the utility subsidiaries. However, Delaware and Maryland have approved deferral of the related costs. In Florida, the company has requested authority to defer the costs, but a commission decision is pending.

Completing the top five is MGE Energy Inc., which has gas operations solely in Wisconsin. There are no mechanisms in place for subsidiary Madison Gas and Electric Co. that would mitigate the impact of COVID-19, but the companies in the state are permitted to defer COVID-19-related costs.

For information concerning the full complement of 47 holding companies and 166 operating companies/divisions analyzed for this report, see the attached data tables.

Regulatory Research Associates is a group within S&P Global Market Intelligence.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Global Market Intelligence Energy Research Library (subscription required).

Ciaralou Palicpic contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.