Download the full report

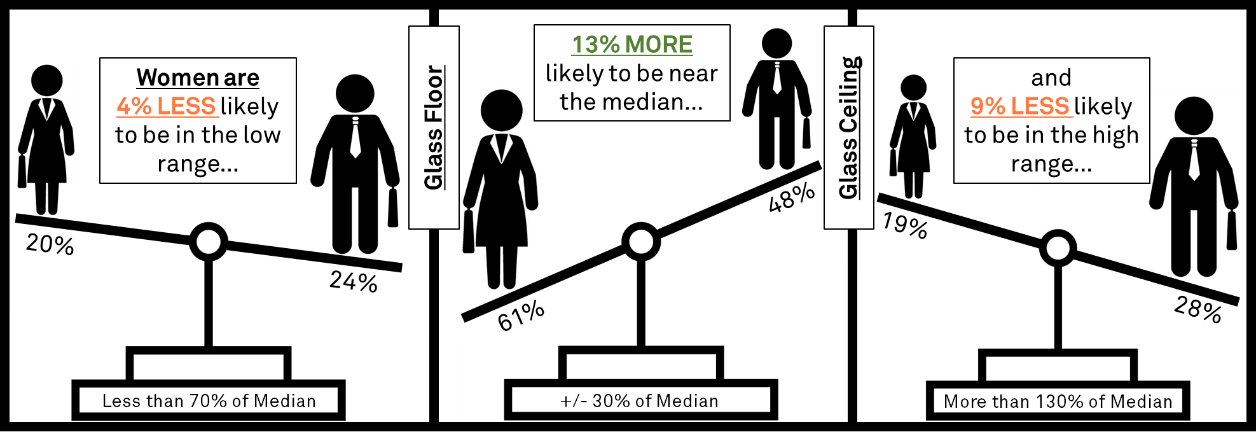

Click HereThe gender wage gap describes the disparity in compensation between women and men doing the same work. Progress on this issue is commonly measured by comparing the median compensation for women to men. This research demonstrates that firms are catering to the focus on median compensation and are paying women in a tighter range around the median, compared to men in equivalent positions. Effectively, women have been given a glass floor as redress for the still-present glass ceiling. This ‘Gender-Based Compensation Management’ not only undermines the goal of equitable pay; but because the high end of the compensation range can be much farther from the median than the low end, this paradigm is a net disadvantage for women.

Figure 1: Women Given a Glass Floor as Redress for the Glass Ceiling[1]

Source: S&P Global Market Intelligence Quantamental Research. Data as of August 26, 2021.

- Compared to men, women in executive roles are more likely to receive compensation in a compressed range around the median of their peer group and are less likely to receive compensation outside this range. The practice of Gender-Based Compensation Management (GBCM) artificially addresses the gender pay gap by increasing the median woman’s compensation without providing women equal access to the full range of compensation. This work shows GBCM has exacerbated the ‘glass ceiling’ and, by extension, the gender disparity in compensation.

- Firms that have been defendants in federal court cases involving compensation disputes, discrimination, fraud, or other governance-related affairs exhibit more pronounced GBCM. This finding suggests GBCM is associated with poor governance.

- The percentage of women holding positions across the C-suite, board of directors, and executive positions grew from 15.4% to 19.2% from 2018 to 2020. While this progress is statistically meaningful, at this rate women have at least 1-2 more decades before they reach parity in their representation across senior roles. In positions where women’s progress has been slower, such as CEO, parity will likely take even longer.

[1]Figure 1 analysis is for board members and executives affiliated with firms in the Russell 3000 as of year-end 2020. See section 8.1 for detailed methodology.