Following the recent announcement detailing Teck Resources Ltd.'s plan to split its current structure into separate carbon- and metals-focused business units, Glencore PLC approached Teck with an unsolicited bid for the Canadian miner, which was made public April 3 and roundly rejected.

Glencore replied April 11 to a letter submitted by Teck's board, addressing concerns raised and adding a cash component to the initial bid. While the original offer is largely unchanged, the cash portion would total $8.2 billion and relieve Teck shareholders of their coal exposure. Shareholders would also receive 24% of the post-merger metals spinoff, MetalsCo. The modified proposal would let investors choose among cash, shares or a combination of both in the coal spinoff. The valuation of the total offer would remain the same as the original bid at approximately $23 billion.

In this article, we outline the drivers behind the offer and analyze a theoretical merger of the two companies.

➤ The merger would cement Glencore's place as one of the world's leading copper and zinc producers and increase its metallurgical coal exposure through Teck's Canadian assets.

➤ The Teck shareholder structure gives class A shareholders the equivalent of 100 votes for every 1 vote held by a class B shareholder, effectively controlling the outcome of any offers.

➤ Teck has reiterated that it prefers its spinoff proposal rather than exposing shareholders to numerous environmental, social and governance and geopolitical risks.

➤ Since the hostile bid, Teck has been approached by other miners with assets better aligned with Teck's vision of its environmentally conscious future.

The Glencore proposal, at $44.18 per share at announcement, is an all-share acquisition, offering a ratio of 12.73 Glencore shares for each Teck class A share and 7.78 Glencore shares per Teck class B share. The outcome would result in Glencore shareholders owning 76% of the combined entity, with Teck shareholders owning the remainder. Under the proposal, the combined entity would be separated into two stand-alone, publicly listed companies — MetalsCo and CoalCo — in line with the proposition previously summarized by Teck on Feb. 21. MetalsCo would cover the base metals operations, along with most of Glencore's marketing, and be listed in London, while CoalCo would assimilate the combined coal and carbon steel materials business and be listed on the NYSE. A post-merger Glencore would have an estimated market capitalization of $100 billion prior to the proposed demerger, with an estimated synergy value of $4.25 billion to $5.25 billion. The original offer implied an about 20% premium to Teck's March 26 closing price.

As it stands, Teck's shareholders will vote April 26 on Teck's existing proposal to split off its metallurgical coal assets and metals sector into two separate, publicly listed companies, Elk Valley Resources Ltd. (EVR) and Teck Metals Ltd., respectively. Teck is mostly controlled through a dual-class share system whereby 1 class A share is worth 100 votes, and these have a 60.5% aggregate weighting. Owners of these "supervotes" include Teck's chair emeritus, Norman Keevil, via Keevil Holding Corp., and SMM Resources Inc., through Temagami Mining Co. Ltd. Alongside this separation pitch, a vote will be held on sunsetting this share arrangement in six years. This is just Glencore's latest attempt to acquire Teck. In 2020, they had similar merger talks that ended without a deal, as recently confirmed by Teck.

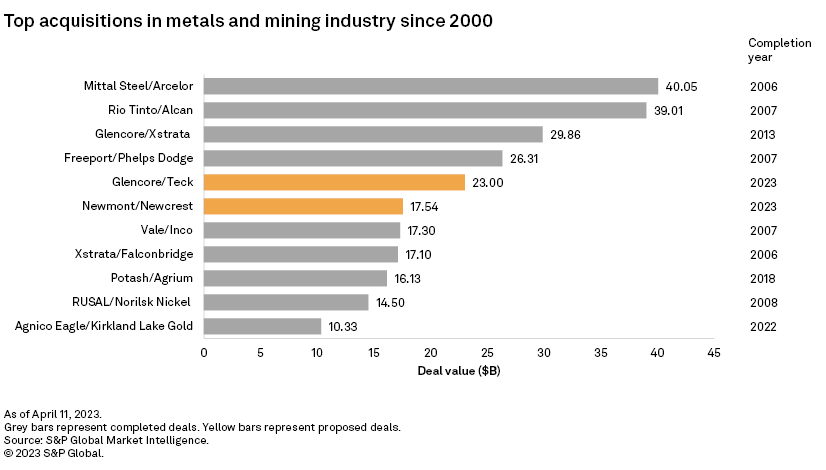

If the deal proceeds in its current form, it would be the biggest merger for Glencore since its 2013 takeover of the mining behemoth Xstrata Ltd., valued at $29.86 billion. It would also rank as the biggest deal of 2023 to date, placing it firmly ahead of the proposed merger between gold mining giant Newmont Corp. and Australia-focused Newcrest Mining Ltd.

Glencore has considerable global reach in mineral and coal assets, and has existing operations in locations where Teck already has coverage. Glencore is attracted by the longer-term growth profile in the pipeline, with the potential for MetalsCo to unlock production of approximately 3 million metric tons of copper per annum should current brownfield and greenfield assets develop into production. Glencore's approach is unsurprising, with the green energy transition at the forefront, including the critical minerals central to it, and a global copper supply deficit projected around 2025–2026, exacerbated by a decline in significant copper discoveries. Teck holds numerous exploration-stage greenfield projects, including Zafranal in Peru (completed feasibility and currently permitting), NuevaUnion in Chile (a 50/50 joint venture with Newmont and currently listed as a "future potential" project after 2033) and Schaft Creek in Canada (currently in prefeasibility).

Teck Resources overview

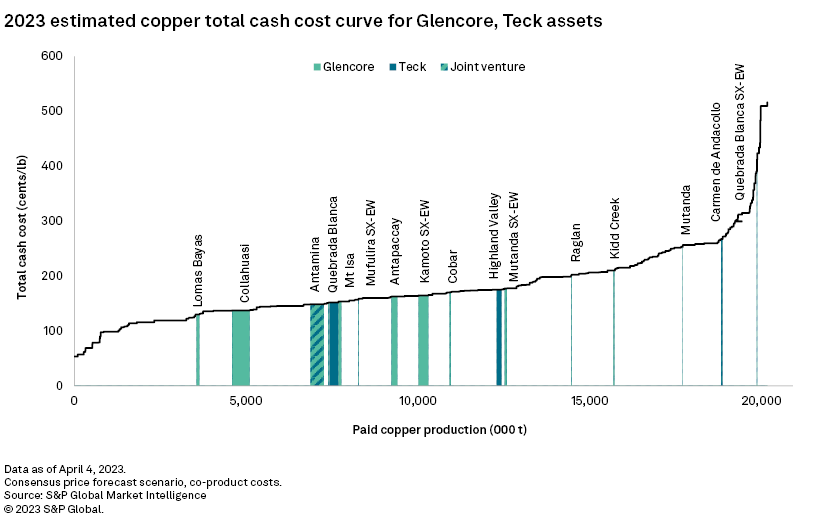

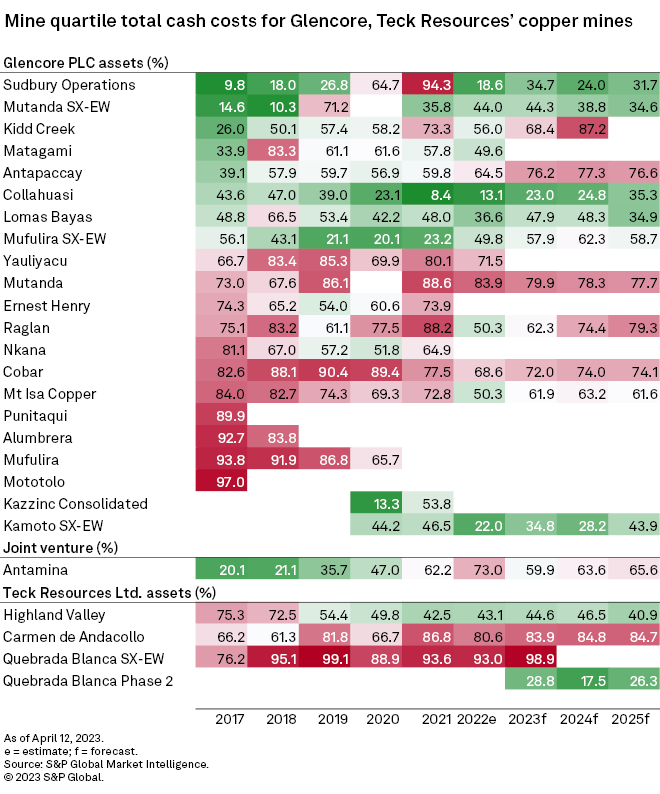

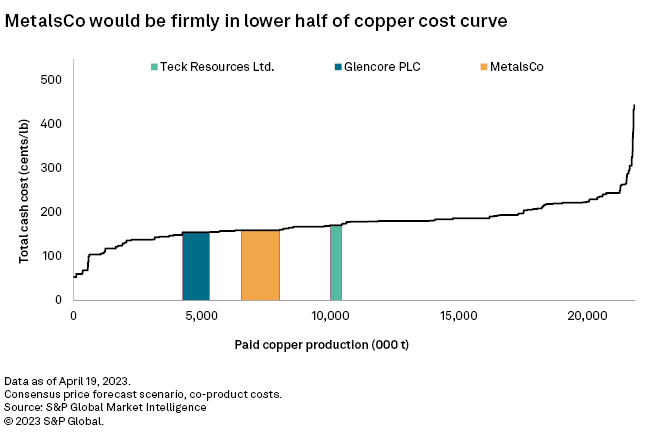

Teck has interests in nine mineral operations throughout the Americas and is the lead operator at four of them. It also has a large metallurgical coal complex based in British Columbia's Elk Valley and several significant copper and zinc development projects. The company's operations have a varied total cash cost profile, with the large-scale Quebrada Blanca Phase 2 (QB2) and Antamina porphyry orebodies sitting below the 50th percentile on the 2023 copper cost curve, while Carmen de Andacollo lies just below the 95th percentile.

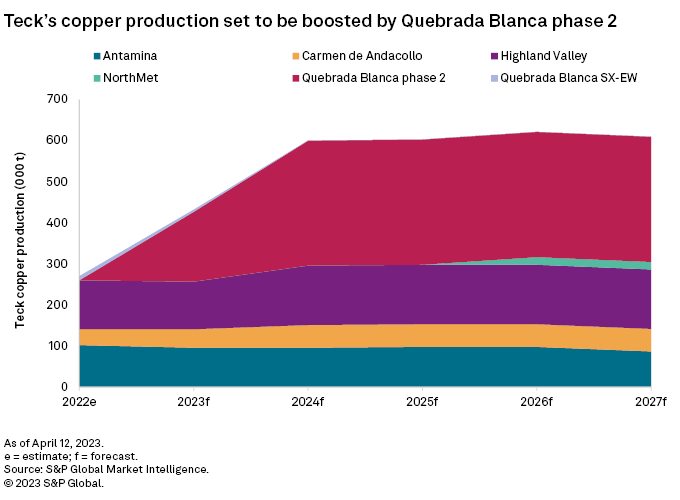

Teck produced 270,500 metric tons of copper in 2022, with guidance for 2023 increasing nearly 55% to 418,000 metric tons. With QB2 ramping up in 2023 through commissioning to full production, the resulting revenue will rebalance Teck's copper portfolio. QB2 currently has a projected mine life of 27 years and would potentially help shift Teck into the top 10 global copper producers, along with the company's other positive pipeline options. There is further growth potential in QB2 as the current mine plan only includes 18% of known resources, which stand at nearly 105 MMt of contained copper, and the orebody is open in all directions. First copper production, in the form of bulk copper concentrate, was recently achieved at the operation, and we currently estimate 2023 cash operating costs to be $1.18 per pound, net of credits.

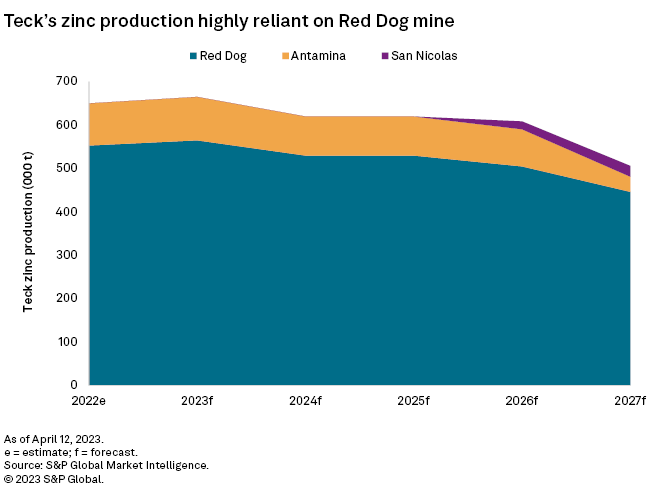

Zinc is extracted as a co-product from the Antamina JV operation in Peru and from the Red Dog mine in Alaska, the world's largest and highest-grade zinc mine. Teck owns 100% of Red Dog and has a 22.5% interest in Antamina. In 2022, Red Dog production accounted for over 12% of Teck's revenue and 10% of gross profit, with concentrate production totaling 650,500 metric tons. Zinc production guidance for 2023 is steady at 630,000–665,000 metric tons and is projected to remain above 600,000 metric tons per year until 2027.

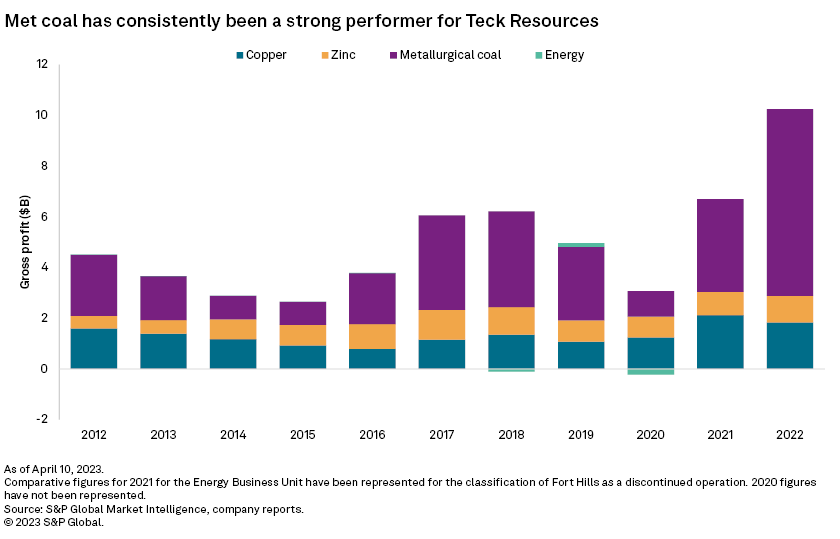

Teck is the world's second-largest exporter of metallurgical coal. In 2022, its four Elk Valley coal operations produced a total of 21.5 MMt of metallurgical coal. Most sales are to Asia-Pacific, with the remainder sold to Europe and the Americas. In 2022, Teck's metallurgical coal business unit accounted for 60.1% of revenue, up from 49.0% in 2021, and 74.6% of gross profit before depreciation and amortization. The company's annual coal production capacity is 26 MMt-27 MMt, with 2023 estimated production guidance of 25 MMt and a reserve base currently at 806 MMt.

With hard coking coal FOB Australia prices averaging $365 per metric ton in 2022 — noted by the company as a historic high — it is easy to see how Teck's company split financing proposal, namely the Transition Capital Structure (TCS), will at least in the short term effectively be funding the Teck Metals business unit.

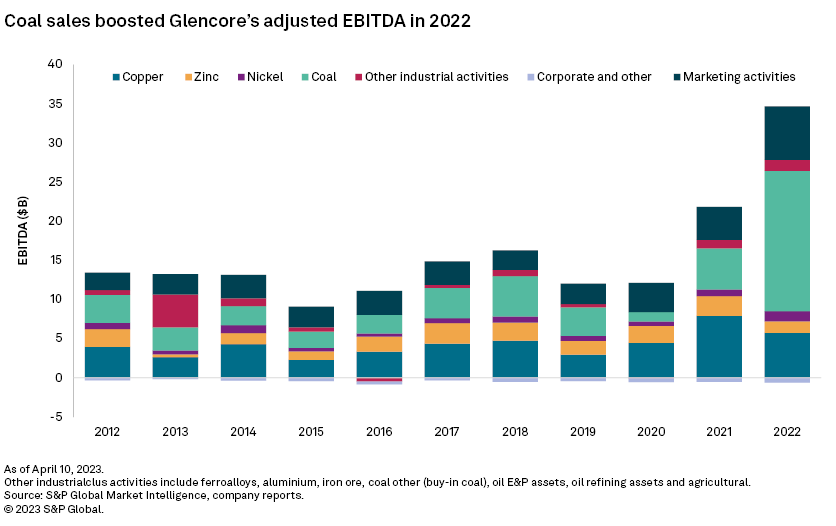

Glencore overview

Glencore has a multicommodity portfolio of reserves and resources, including thermal and metallurgical coal, copper, zinc and cobalt. It has global coverage, although some of its operations are in more geopolitically risky locations, including the Kamoto and Mutanda copper-cobalt mines in the Democratic Republic of the Congo and the El Pachon polymetallic porphyry deposit in Argentina. By contrast, Teck's assets are in relatively stable jurisdictions.

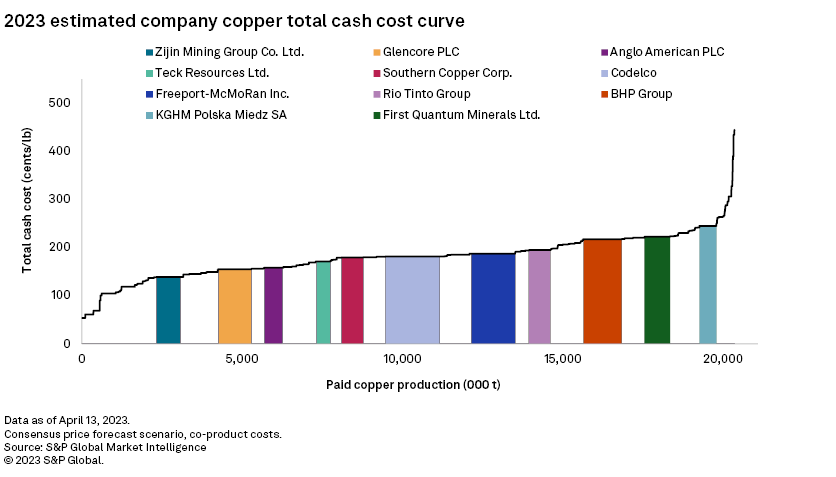

Glencore already has significant copper exposure and ranked third in 2021 in attributable production metric tons, accounting for a global share of just over 6.1%. The 44%-owned Collahuasi operation in Chile, in which it has joint lead ownership with Anglo American PLC, ranked second in 2021, producing 630,000 metric tons of copper with an estimated total value of $5.88 billion. Glencore also has assets in the lower half of the 2023 copper total cash cost curve, including Lomas Bayas in Chile, Mt Isa Copper in Queensland, Australia, and the Mufulira SX-EW operation in Zambia.

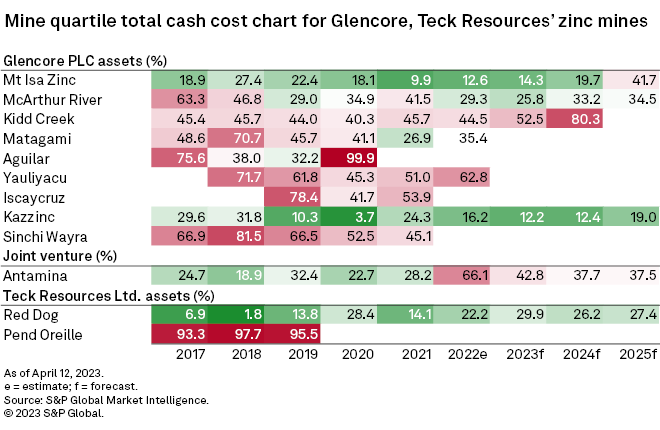

Glencore also has considerable zinc exposure, and ranked as the largest producer in 2021 with nearly 1.2 million attributable metric tons, accounting for 8.6% of global supply. Notable producing projects include the Antamina JV, Mt Isa Zinc and McArthur River in Australia, and the Kazzinc Consolidated complex in Kazakhstan. The company's operations are also generally low cost, with the Kazzinc and Mt Isa Zinc mines sitting in the lowest 15% of total cash costs for 2023.

Teck spent $47.0 million on nonferrous exploration in 2021 and budgeted $64.4 million for 2022. With Glencore spending less on exploration — $42.0 million spent in 2021 and $53.1 million budgeted in 2022 — the company must rely more on mergers and acquisitions to replenish its reserve and resource base.

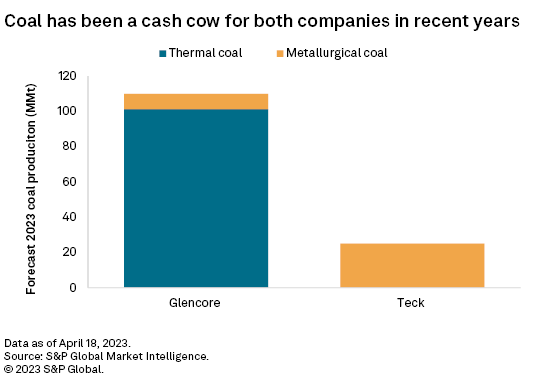

Glencore has global exposure to thermal and metallurgical coal, with its coking coal operations focused around Australia. Notable production comes from the Hunter Valley Operations in New South Wales, Australia, with Glencore in a 49/51 joint venture with Yancoal Australia Ltd. Full-year run-of-mine production for 2022 totaled 11.9 MMt. Production in 2022 also came from their Bulga Complex and Mt Owen Complex Complexes and the Oaky Creek, Hail Creek and Liddell sites.

In January 2022, Glencore acquired the remaining stake in the Cerrejon thermal coal operation in Colombia, which produced 19.7 MMt for the year. The asset is proving troublesome with recent production challenges, including heavy rainfall and numerous blockades by local communities. Most of Glencore's coal production is in the form of thermal coal; in 2022, thermal coal sales accounted for 88.5% of total coal production, and 11.5% was from metallurgical coal. In the latter, 7.9% was mined as coking coal and the remainder was semi-soft production.

Metallurgical coal is less exposed to the energy transition than thermal coal, especially in the US, where some companies, including Arch Resources Inc., have reduced or even completely exited thermal coal production and realigned their focus toward the metallurgical coal market. Glencore has previously rejected calls by one of its investors, Bluebell Capital Partners Ltd., to spin off its thermal coal exposure by slowly winding down assets, with a net-zero target of 2050.

MetalsCo

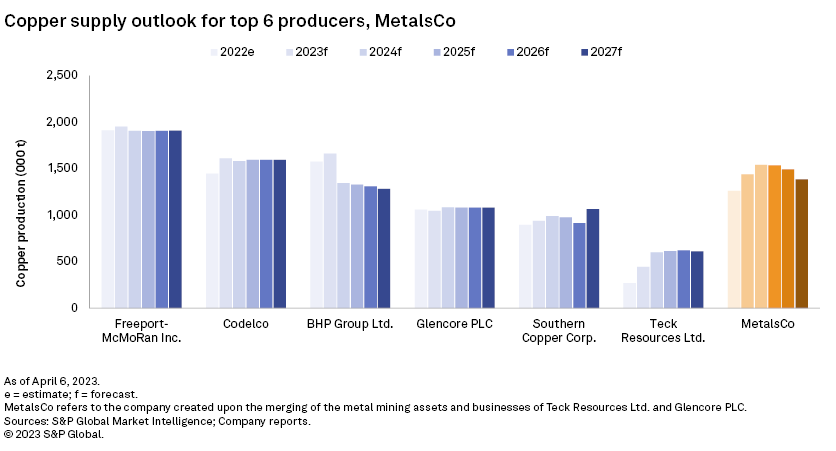

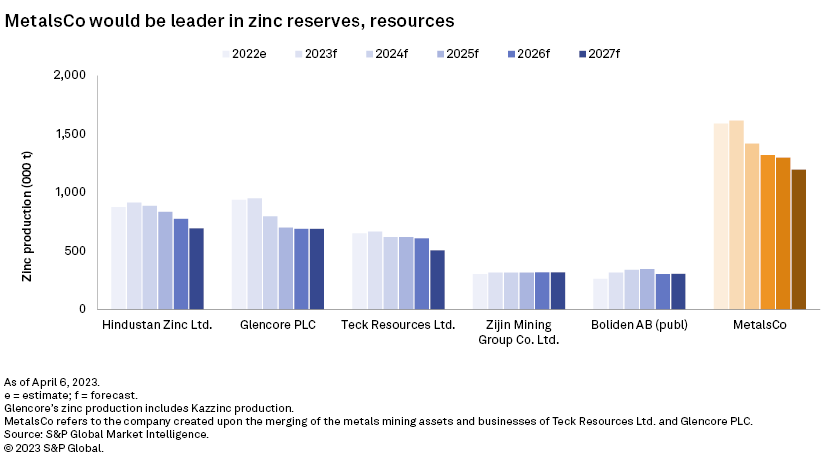

MetalsCo's 2022 pro forma copper and zinc production would have totaled 1.3 MMt and 1.6 MMt, respectively. Its 2022 pro forma EBITDA would have been about $18.2 billion, with annual revenue around $258.6 billion. If QB2 runs at full capacity, we estimate MetalsCo would produce at least 1.5 MMt of copper from 2024, which would make it the world's second-largest copper producer behind Codelco in Chile. Additional undeveloped copper pipeline projects and resources in the MetalsCo portfolio would ensure future growth potential.

A synergy already exists between Glencore and Teck in the form of a JV at the Antamina open pit polymetallic operation. With Glencore and BHP Group Ltd. owning 33.75% stakes and Teck owning 22.5%, MetalsCo would have majority control over the operation. In addition, the Collahuasi mine is located adjacent to QB2, leading Glencore to tout the sharing of processing facilities as an operational efficiency.

In addition, MetalsCo's combined zinc production would firm up Glencore's position as a world leader in the zinc market. Production from Glencore's zinc assets, including its Kazzinc complex, is forecast to be 16.1% less in 2024 compared with 2023; MetalsCo could negate the decline with supplemental production from the Red Dog operation.

The merger of Glencore's and Teck's metals businesses would result in a more diversified portfolio of battery commodities, which would contribute to a strong sustainability portfolio mandate.

CoalCo

CoalCo would comprise Glencore's coal and ferroalloys businesses and Teck's Elk Valley metallurgical coal businesses. The CoalCo division would produce thermal coal in Australia, South Africa and Colombia; metallurgical coal in Australia and Canada; and ferrochrome in South Africa. Glencore has stated that CoalCo would have no ongoing financial obligations to MetalsCo, resulting in a fully stand-alone entity, unlike the TCS scenario that would exist during the transition period should the formation of EVR proceed. A portion of the TCS denotes that EVR would pay Teck Metals 90% of free cash flow, based on coal revenue during the transition period, as a royalty payment until the later of $7.0 billion is paid, or Dec. 31, 2028.

CoalCo's pro forma seaborne thermal and metallurgical coal totals were 97.2 MMt and 34.2 MMt, respectively, in 2022, with Teck's steelmaking coal contribution at 16.3%. CoalCo also produced 1.5 MMt of ferrochrome. CoalCo's 2022 pro forma EBITDA was about $16 billion, with zero net debt.

Conclusion

Should Teck shareholders reject the TCS proposal, we believe Glencore will likely continue sweetening its bid, chasing Teck's long-term pipeline of copper production essential for the global energy transition. Approval of any future bids is down to Teck class A shareholders and the Keevil family, which own most of the supervotes and are reportedly unwilling to sell to Glencore at any price.

A positive indicator for the Glencore deal to proceed, in the eyes of Teck's coal-focused investors, is the stand-alone nature of the CoalCo company, unlike Teck's EVR, which would be required to pay under the TCS with little comparative return — currently modeled to be around 11 years at a long-term hard coking coal price of $185 per metric ton.

If the deal between Glencore and Teck is unsuccessful, Glencore could come under pressure from investors to spin off its coal assets to be viewed as more climate-considerate at a time when sustainability measures are at the forefront of the mining industry. Historically, Glencore has stifled any talk of separating coal in favor of a winding-down strategy under the Paris Agreement on climate change, which is viewed as unlikely to occur in the short term.

Should the April 26 vote favor separation, our analysis suggests that the resulting Teck Metals Corp. will be a likely target for other companies, given the attractiveness of its substantial copper pipeline. Other mining companies are reported to be interested in pursuing Teck Metals Corp. should the separation proceed, including Anglo American, Vale SA and Freeport-McMoRan Inc. Glencore has stated that it will not continue its engagement should this occur, alluding to value destruction as a key reason.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.