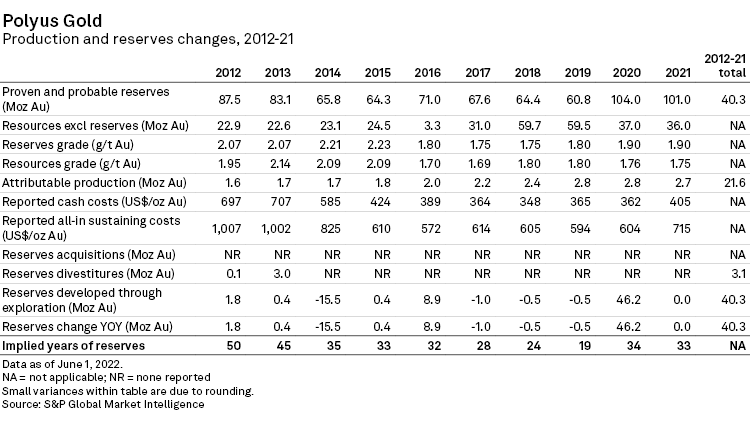

PJSC Polyus, Russia's largest gold mining company, increased its production by almost three-quarters over the past 10 years; at the same time, the company saw its proven and probable reserves rise by more than 15%, or 13 million ounces of gold, from 2012 to 2021.

Our analysis of Polyus' strategies is based on a detailed compilation of its activities over the 2012-21 period, part of the Strategies for Gold Reserves Replacement Study, which includes analysis of the world's top five gold producers in 2021. These compilations show the relationships between each company's production, reserves, costs, exploration budgets, acquisitions, divestitures and gold discoveries during the period.

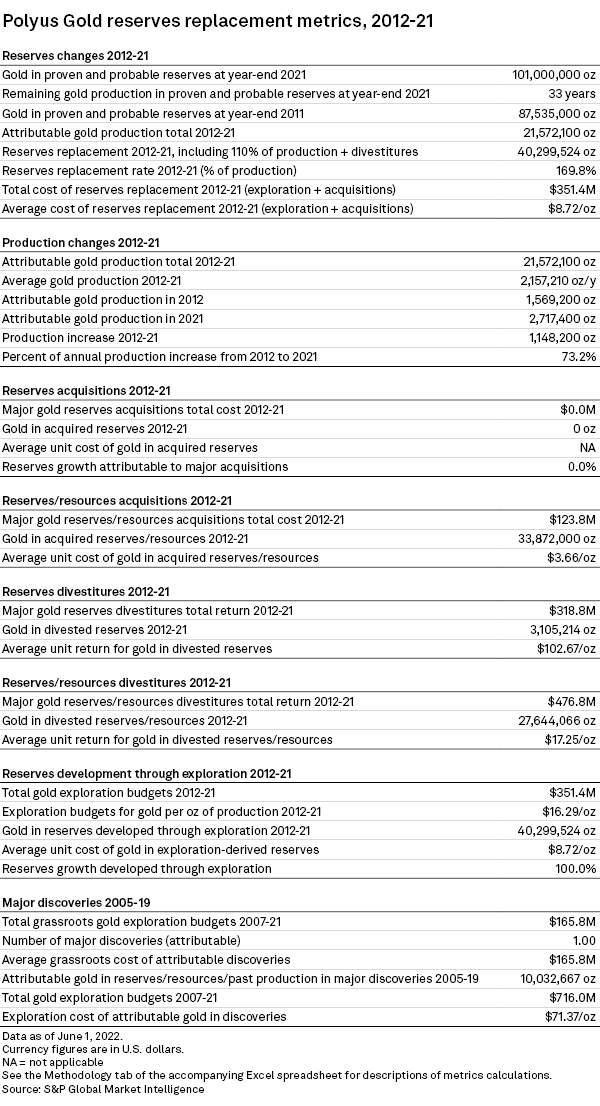

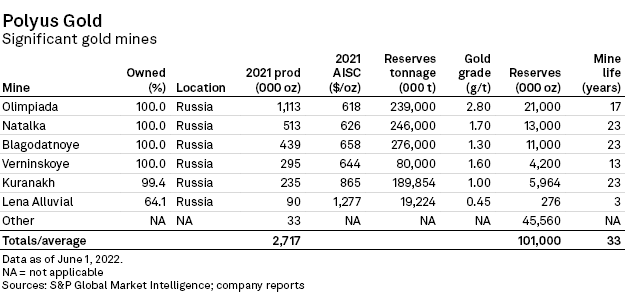

From 2012 to 2021, Polyus added 40.3 million ounces of gold to reserves, replacing 170% of its production over the period. At the end of 2021, the company boasted 101 Moz of proven and probable reserves — more than any other gold producer.

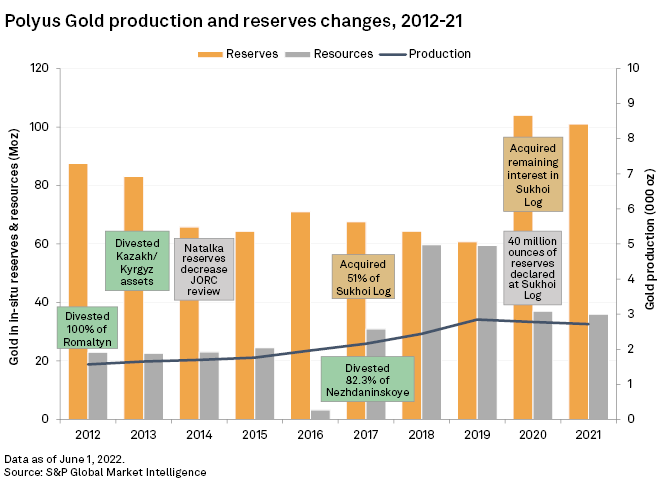

Polyus' reserves position took a hit in 2014 when the company completed a JORC-compliant review of reserves at its Natalka deposit; however, reserves remained fairly stable over the next five years. In 2020, reserves increased dramatically as initial proven and probable reserves of 40 Moz were declared at the company's massive Sukhoi Log deposit. At the end of 2021, reserves were sufficient for 33 years of production at current rates — although this figure will decrease as output from Sukhoi Log is added to Polyus' production profile.

Polyus' reserves growth over the 2012-21 period was accomplished entirely from exploration and development. With gold exploration budgets totaling $351.4 million, the implied cost of 40.3 Moz of exploration-derived reserves was only $8.72 per ounce.

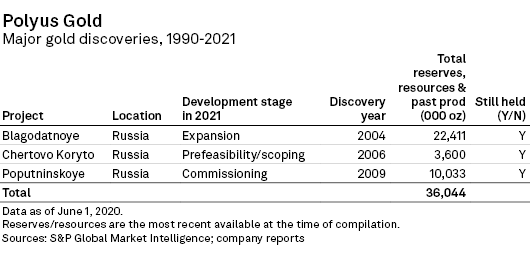

Polyus recorded one major gold discovery during the 2007-2021 period, but when we include discoveries back to 1990, the company is credited with a total of three major finds hosting 36 Moz of gold. All three deposits remain in Polyus' portfolio, with the Blagodatnoye deposit in production — the $450 million open pit operation produced 438,900 oz of gold in 2021 — and the Poputninskoye deposit at the preproduction stage. The Chertovo Koryto deposit is undergoing prefeasibility work.

Polyus made no acquisitions of assets with proven and probable reserves during the 2012-2021 period; it has, however, gradually secured ownership of the Sukhoi Log deposit in Irkutsk, one of the world's largest gold deposits. In September 2020, Polyus consolidated 100% ownership of the orebody.

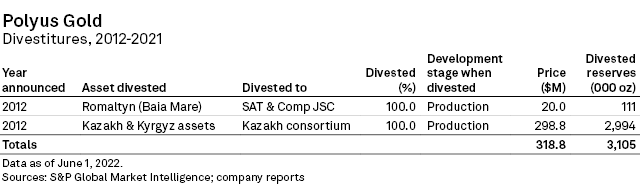

Polyus completed two noteworthy divestitures over the past 10 years. In 2012, it sold the Romaltyn gold-silver project in Romania for $20 million, and later that year divested assets in Kazakhstan and Kyrgyzstan to a Kazakh consortium for $298.8 million.

The Olimpiada mine remains Polyus' flagship operation, producing 1.1 Moz of gold in 2021. The Natalka and Blagodatnoye mines together contributed nearly 1 Moz of gold to the company's production in 2021.

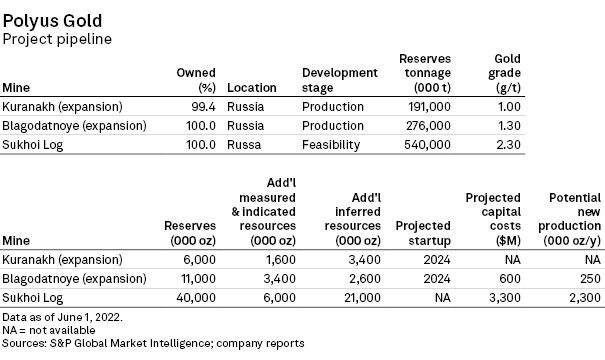

Polyus is developing two expansions at existing mines in the near term. At Kuranakh, in the Republic of Sakha, a new project has been launched that will increase mill processing capacity to 7.5 million tonnes per year.

At Blagodatnoye, the company's largest brownfields project located in Krasnoyarsk Territory, Polyus is proceeding with the construction of a new mill, Mill 5, that would increase processing capacity to 17 Mt/y from 9 Mt/y. To supply the new plant with sufficient feed, the company expects to increase the depth of the open pit. The $328 million expansion would add about 250,000 oz/y of incremental production.

Polyus is progressing with the bankable feasibility study for Sukhoi Log, the company's flagship greenfields project. Most importantly, it has finalized the open pit geotechnical parameters and outlined the main processing equipment specifications for the Sukhoi Log mill. In 2021, the company also completed a deep-level and flank exploration drill campaign, with 32,000 meters drilled. It also finalized engineering surveys and began construction of the power supply infrastructure for the mill, comprising a substation and a 220-kilovolt power grid.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.