Persistently high interest rates, driven by a stronger outlook for the US economy, are keeping the pressure on the fair value of bank assets accumulated when yields were low.

Rates have rebounded since the end of the first quarter, when turmoil triggered by the failures of SVB Financial Group and Signature Bank raised fresh doubts about the health of the banking sector and possible knock-on effects across the economy. Fair values reported by banks that are not included on balance sheets have, in turn, dropped by $42.04 billion sequentially in the second quarter across publicly traded banks with more than $20 billion of assets, according to data from S&P Global Market Intelligence.

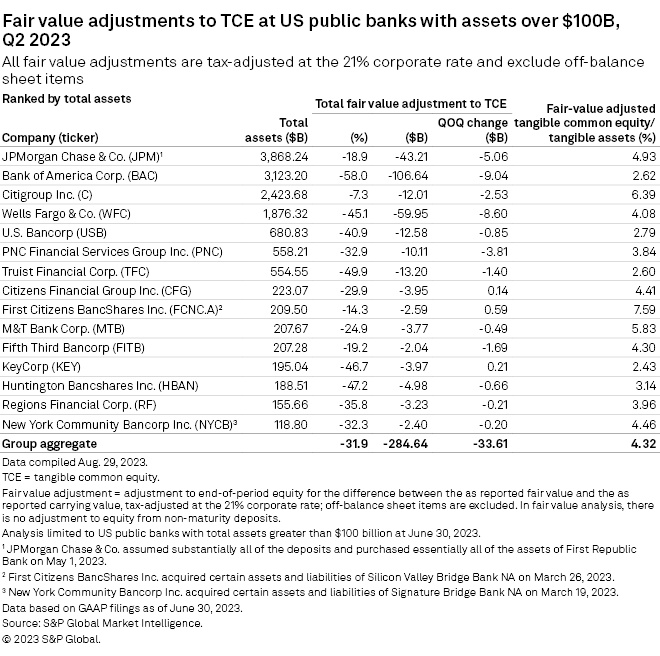

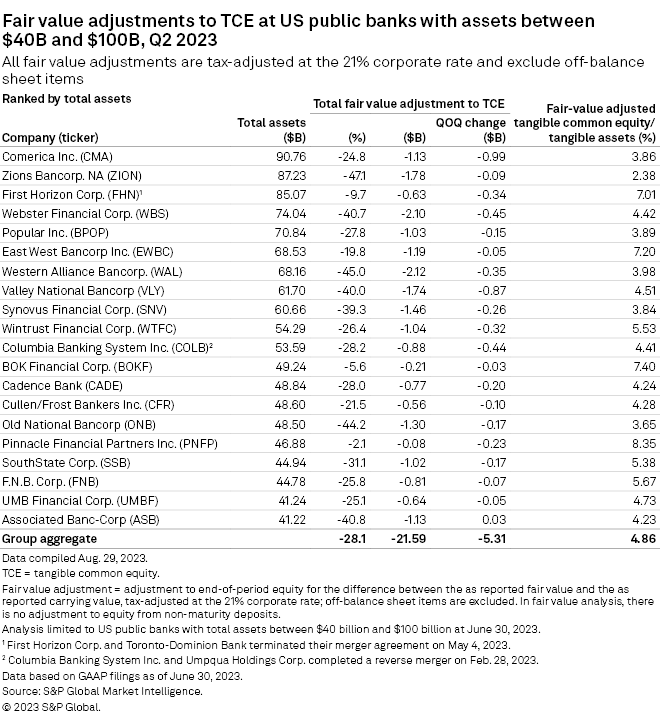

As of June 30, data indicated that those banks had $323.42 billion less in tangible common equity in the aggregate than reported on conventional balance sheets, and an adjusted ratio of tangible common equity to tangible assets of 4.41%. The numbers include upward adjustments for banks' low-rate liabilities, excluding non-maturity deposits that provide cheap funding.

Devalued assets were deadly for banks at the heart of the first-quarter turmoil when large amounts of uninsured deposits vanished and negative equity positions, after adjusting for fair values, left them no way to recover.

Most banks have much more limited exposure to uninsured deposits than those that collapsed, and deposit levels broadly have been relatively stable. Still, the fair value data showed the damage inflicted by the rapid increase in interest rates since early 2022, which turned from a boon to a challenge for bank revenues .

In the hole

A vast majority of the large, publicly traded banks experienced degradation in fair value adjustments in the second quarter, mirroring declines in the value of bond portfolios that are already carried at market value on balance sheets.

The impact varies widely, with adjusted tangible equity ratios staying below 3% at institutions including Bank of America Corp. , U.S. Bancorp and Truist Financial Corp.

Truist's adjusted tangible equity ratio increased seven basis points sequentially to 2.60% despite harsher fair value marks. The bank said it is in capital-building mode , and its capital levels were helped in the second quarter by the sale of a 20% stake in its large insurance brokerage business. The sale of the rest of the business could boost its Tier 1 common equity ratio by another 2 percentage points, Truist said.

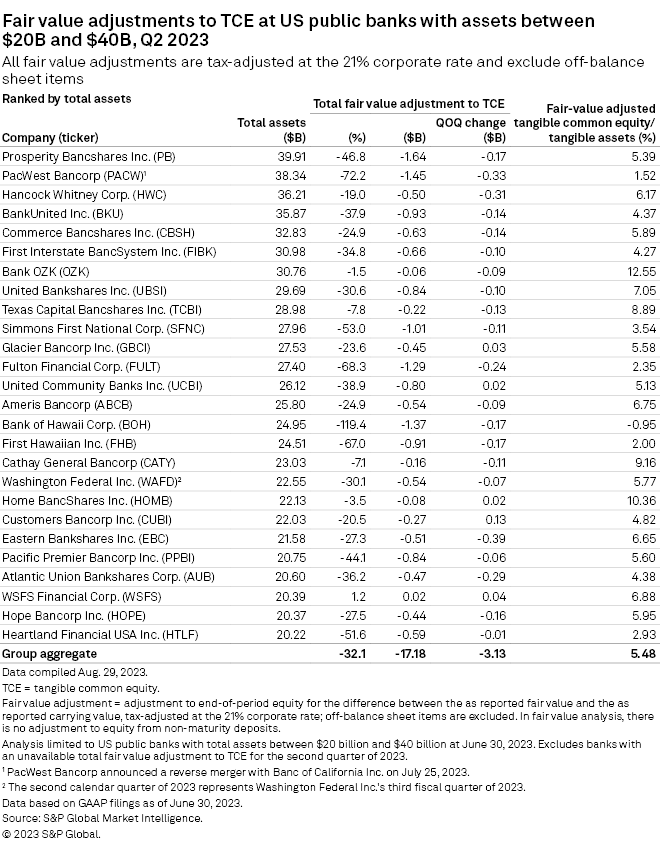

Bank of Hawaii Corp. 's adjusted ratio at negative 0.95% moved deeper into the red, down 71 basis points sequentially.

The fair value adjustment on the bank's assets worsened $213.54 million sequentially to a negative $1.42 billion, a slightly larger hit than the negative $1.41 billion negative adjustment as of the fourth quarter of 2022. The bank did not repurchase shares in the second quarter and said it is seeking to build capital through earnings and managing the size of its balance sheet.

In its second-quarter earnings report , Bank of Hawaii continued to emphasize that it has a diversified deposit base, with the majority either insured or collateralized, even as it added borrowings to build liquidity, including $1.25 billion of fixed-rate, term funding at an average cost of 4.3%.

"Our deposit base has been incredibly stable," Chairman, President and CEO Peter Ho said during a July conference call , adding that the bank has "a pretty good-sized war chest of immediately available backup lines of credit."

The $24.95 billion-asset bank also highlighted that about $2.8 billion of its loans and securities are maturing or paying down each year, noting that new loans are yielding about 7%, compared with 3.8% for the loans that matured or paid down in the second quarter.

Against the grain

Fair value adjustments did improve sequentially at nine of the 61 banks in this analysis.

At some like KeyCorp , improvements in marks on liabilities outweighed degradation in marks against assets. KeyCorp has large derivatives positions that are weighing on its net interest income, but it anticipates a large boost in 2024 and into 2025 as the instruments mature.

Customers Bancorp Inc. 's adjusted tangible equity ratio improved 68 basis points sequentially to 4.82% as the fair value mark against its loans narrowed by $110.9 million to negative $312.0 million. In its second-quarter earnings report , the bank said that about 70% of its loans, which yielded 6.83% during the period, were floating rate.

Customers Bancorp also rejiggered its loan portfolio during the period, selling noncore consumer installment loans and syndicated capital call lines of credit, in part to make room for a $631 million portfolio of former Signature Bank venture banking loans it bought from the Federal Deposit Insurance Corp.

The acquired venture loans yield about 9%, though the consumer loans it sold were even higher yielding at a mid-teens percentage.

Overall, Customers Bancorp's reported net interest margin increased 19 basis points sequentially to 3.15% and it said it expects to hit the high end of its previous forecast for its NIM of 2.85% to 3.05% for the year.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.