| Venture capital firms are pursuing different strategies when investing in AI technology. Source: Laurence Dutton/E+ via Getty Images. |

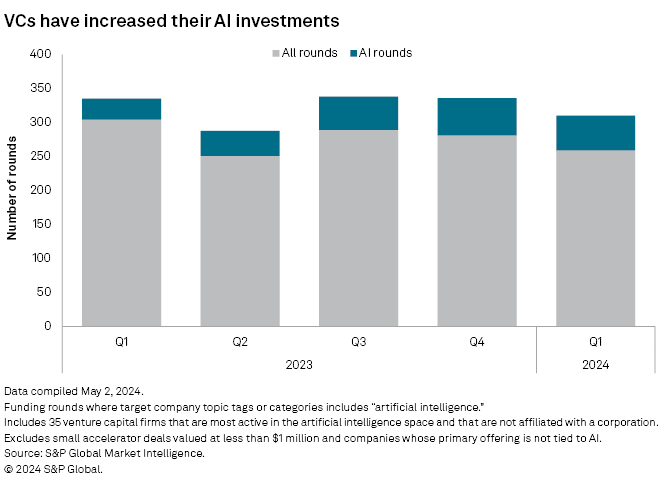

Venture capital firms are doubling down on artificial intelligence investments, even as overall investment activity remains subdued.

In the first quarter, the top 35 venture capital firms announced 51 AI funding rounds, up from 31 a year earlier, according to S&P Global Market Intelligence data. Not only was the total number up, but AI represented a larger share of firms' total investments, increasing to one out of every five in early 2024 versus one out of every 10 in early 2023.

As AI investments increase, firms are also becoming more discriminating about which startups they fund. The question that VCs are trying to answer is which part of the AI supply chain will accrue the most value — and which will not.

"Enterprises want more than just a model trained on large chunks of the public web — they want models tailored to their business needs, and they also want applications that can provide direct business benefit," wrote S&P Global Market Intelligence 451 managing analyst Nick Patience, who specializes in AI and machine learning.

Vertical focus

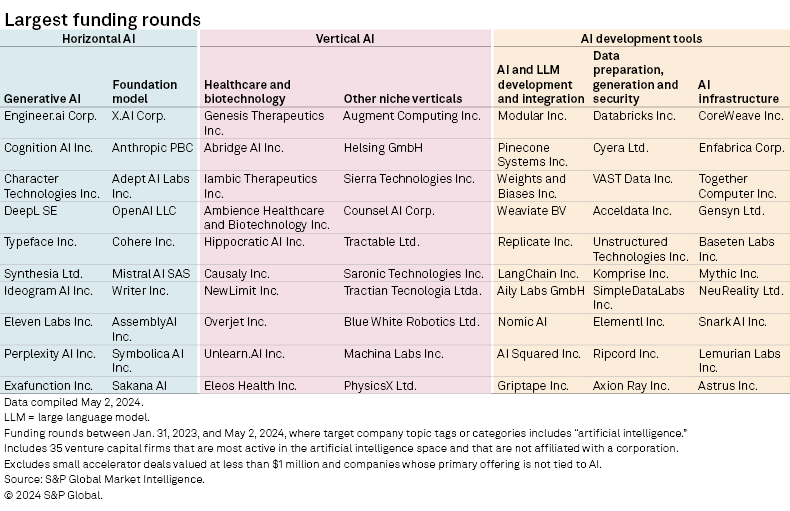

There is a growing realization in the AI industry that foundation models — or general-purpose AI models that can be instructed to generate content, such as text, code, images and synthetic data — will not make sustainable stand-alone business models. While foundation model providers like OpenAI LLC catalyzed the AI industry, building and training new models has proven too expensive for newer players to compete, especially given the plethora of open-source models available from companies such as Meta Platforms Inc. and Mistral AI SAS. Even well-funded AI chatbots like Inflection AI have struggled to compete with ChapGPT in the consumer market.

This has led VCs and other AI investors to focus on generative AI (GenAI) application companies, which leverage third-party foundation models to build software for specific consumer or business purposes. These companies, which marry GenAI features with additional capabilities to solve specific problems, have been funded in droves.

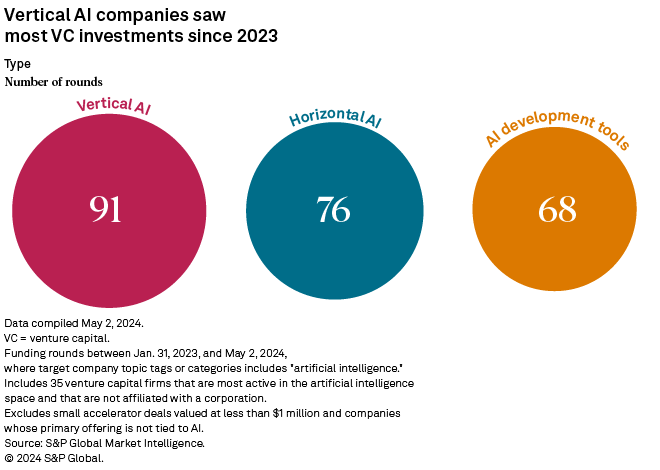

Since 2023, top venture capital firms have participated in 91 funding rounds within the vertical AI space, which is tailored to address the challenges and requirements of a specific sector. By comparison, horizontal AI applications, which can be applied across multiple industries and use cases, attracted 76 funding rounds — and of these, only 14 rounds were for companies that also possess a foundation model.

Perplexity play

An example of a company that combines third-party foundation models with additional capabilities is Perplexity AI, which runs web search results through large language models to create a chat-like search experience. Using multiple models — including Llama 3, ChatGPT and Anthropic PBC's Claude AI — gives the company a competitive advantage over firms that make their own foundation models, Perplexity Chief Business Officer Dmitry Shevelenko told Market Intelligence.

In terms of the most popular verticals, of the 91 funding rounds tracked by Market Intelligence, many were allocated to companies applying GenAI in areas such as healthcare, biotechnology, law, marketing, and defense. Hippocratic AI Inc. is a case in point. The company is building a foundation model fine-tuned for the healthcare industry. Many more are engaged in improving productivity in healthcare and using AI to discover new drugs. Companies focused on applying GenAI to healthcare and biotechnology received the most VC funding by far.

"In a world with multiple competitors seemingly focused on the big horizontal opportunities, and still rapidly evolving underlying technology, a focused competitor can win and then can expand from that position of strength," wrote Sarah Tavel, a general partner at venture capital firm Benchmark, in a recent blog post.

AI architecture

Another play for VCs is AI infrastructure, or companies that provide the nuts and bolts to build GenAI applications. As organizations' experimentation with AI has skyrocketed, so has demand for AI tools and infrastructure. Publicly listed chip companies like NVIDIA Corp. have been among the biggest beneficiaries so far.

In the startup world, Pinecone Systems Inc., a vector database provider that helps companies build GenAI applications faster and cheaper, has seen its valuation increase 10x between its seed round in 2021 and series B in 2023 to $750 million. Weights and Biases Inc., which provides a platform to build GenAI applications, reached unicorn status in 2021. Since then, its valuation has increased further based on its latest funding round in 2023, even as many other unicorns have fallen.

In hardware infrastructure, the rise of fortunes has been even stronger. CoreWeave Inc., which provides cloud services specialized for AI workloads, has seen its valuation surge from $2 billion in mid-2023 to $19 billion in the latest series C round, according to Market Intelligence data.

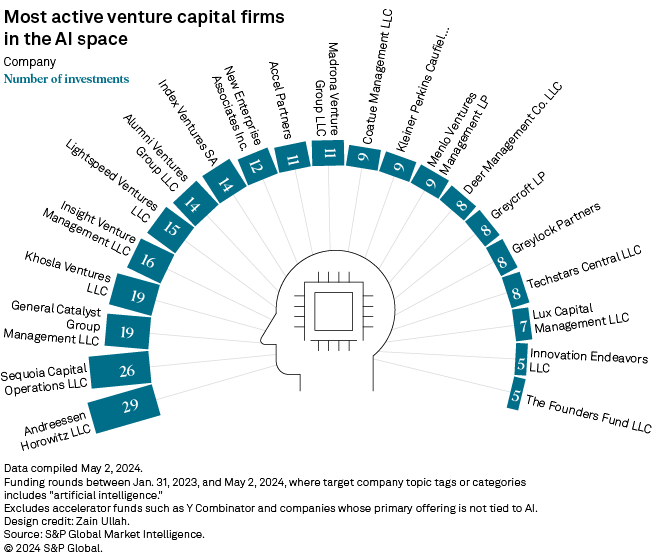

Most active VCs

VC's AI investments often reflect the amount of risk they are willing to take and their funding-stage specialization. Most GenAI startups are early in their journey and are being funded by VCs that also focus on early-stage investing, like Andreessen Horowitz LLC and Sequoia Capital Operations LLC. Later-stage funds like Insight Venture Management LLC have invested more in AI infrastructure and later-stage vertical AI companies active in biotechnology, insurance and robotics.

Andreessen Horowitz has made the most deals in the AI space since 2023, investing in 29 startups, according to data from S&P Global Market Intelligence. Nearly half of the investments are in GenAI companies, including mostly text, video and image generators. The VC has also been active in biotechnology, where it participated in the $224 million round for drug discovery startup Genesis Therapeutics Inc., and two rounds by Hippocratic AI.

Sequoia Capital is the second-most active VC in AI, participating in 26 funding rounds since 2023. Unlike Andreessen Horowitz, Sequoia's AI investments are only about a quarter in the GenAI space, mostly in text and video. However, Sequoia's focus has been bigger in the AI development and data preparation space, investing in companies such as Cyera Ltd. and Replicate Inc., for instance.

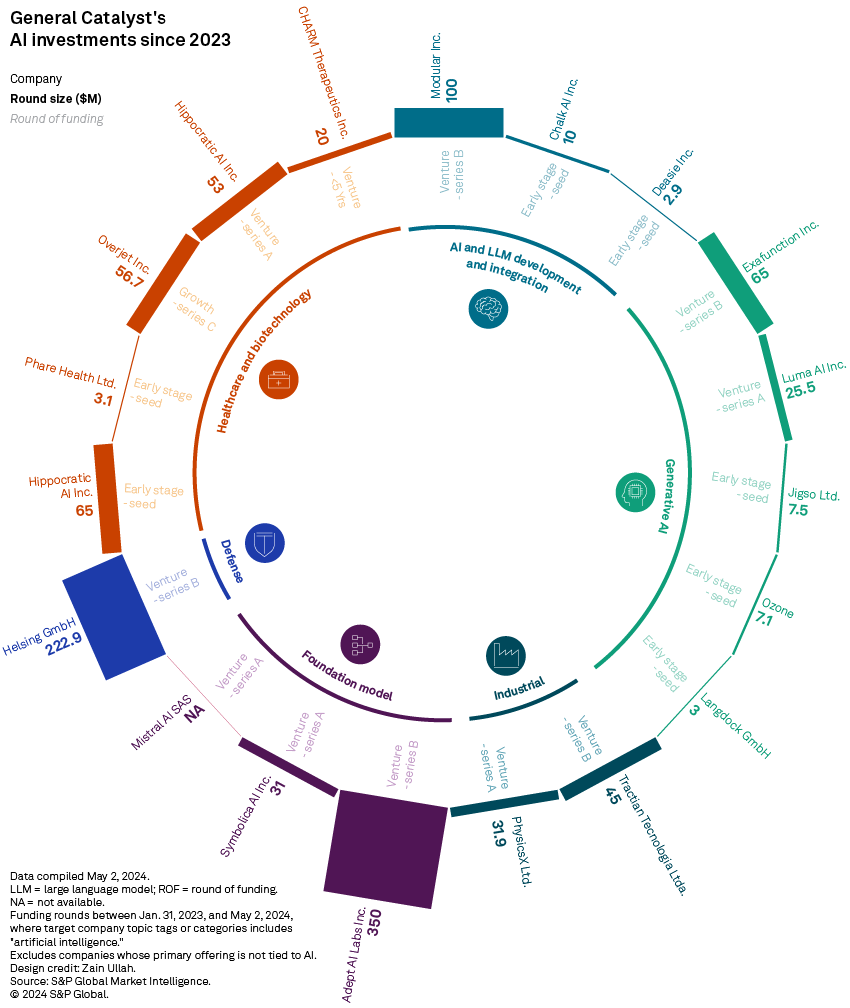

General Catalyst Group Management LLC has made 19 AI investments, with less than half of them in GenAI. Among others, the company invested in Adept AI Labs Inc., which works on models that can do a variety of human tasks on computers, and Symbolica AI Inc., which aims to create a reasoning AI rather than one based on the next-word prediction.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.