Investment banking executives are adding a bit more optimism to their outlooks for M&A, which has been mired in a slump for over a year.

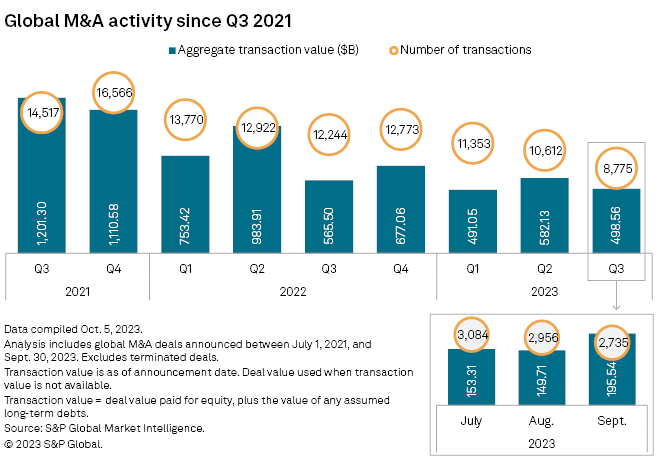

In the third quarter, the number of global M&A announcements dropped below 10,000 for the first time since the pandemic, and the number of deals in the US fell 31% year over year to 3,175 — a faster decline than in the first two quarters of the year, according to S&P Global Market Intelligence's latest M&A and Equity Offerings report.

At the start of 2023, i-bank executives had hoped that M&A would pick up by the back half of the year, but the turmoil in the financial sector played a significant role in delaying the recovery. Now they are cautiously optimistic that 2024 will produce more activity.

"Based on the constructive dialogue among clients, we expect '24 to be better than '23," Lazard Ltd. CEO Peter Orszag said during an Oct. 26 earnings conference call. "The question becomes how much, and that's very difficult to predict right now."

Click here to read the latest M&A and equity offerings white paper

The downturn in M&A dealmaking that started in 2022 continued in the third quarter of 2023, and deals will likely stay depressed through the fourth quarter. Global equity issuance has fallen sequentially in six of the last seven quarters. The higher rate environment has made transacting more difficult as it increases deal financing costs and limits the growth of equity prices. Central banks have signaled to the market that the rate-hiking cycle is nearing an end, but rates will likely remain higher for longer, slowing deal recovery.

I-bank executives often cite higher interest rates as the root cause for the slowdown in M&A. Moelis & Co. Chairman and CEO Kenneth Moelis said a year ago that the potential transactions the company had in its pipeline had less of a chance of reaching the deal agreement stage because discussions started when interest rates were lower, and the increase in rates changed the financing market. He now has more confidence that the potential M&A advisory assignments in the company's pipeline will become actual deal announcements, in part because the Federal Reserve held interest rates steady for the third time in four meetings after increasing rates in 10 straight meetings.

"I think yesterday was a big day," Moelis said during his company's earnings conference call on Nov. 2, one day after the Fed's most recent interest rate announcement.

Moelis said his read on the Fed's messaging to the marketplace is that the central bank will wait and see if the higher rates are creating issues that have yet to be measured by economic data. Moelis himself believes the higher rates have led to trouble that is not being captured.

"Some of the consumption part of the economy has kept GDP up," Moelis said. "But I think companies are having enormous problems with the higher rates."

While a cooling of the economy can give central bankers reason to stop raising rates, a slowdown in growth also tends to add uncertainty, which is never a positive for M&A. Uncertainty around economic growth has weighed on M&A and so have geopolitical tensions, which escalated since the start of the latest Israel-Hamas war.

Evercore Inc. Chairman and CEO John Weinberg acknowledged that geopolitical and economic headwinds were holding M&A back. However, Weinberg said activity would increase without further deterioration in the backdrop.

"Barring an unexpected significant shift in the macro environment, we expect activity levels to continue to build in 2024," Weinberg said during an Oct. 25 earnings call. "While it is still early days, we are seeing this reflected in stronger backlog."

PJT Partners Inc. Chairman and CEO Paul Taubman was hesitant to say the M&A market has hit a low point. "It is always perilous to call the bottom of any market," Taubman said during his company's Oct. 31 earnings call. Taubman said the downturn in M&A has been driven by many factors — including market volatility, higher financing costs, buyer-seller disconnect, recession concerns and antitrust scrutiny. "On every dimension, it has been more difficult to get transactions done," he said.

Still, Taubman added that markets inevitably adjust, and said that the adjustment phase is beginning. The executive said his company's pipeline of potential transactions is stronger than it was at the beginning of the year.

"I think we're a lot closer to getting out of the tunnel, but it's been a long dark tunnel," Taubman said.

Ben Meggeson contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.