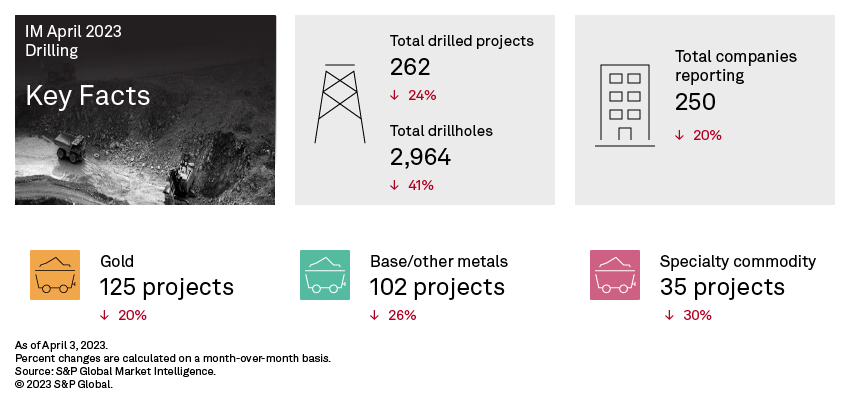

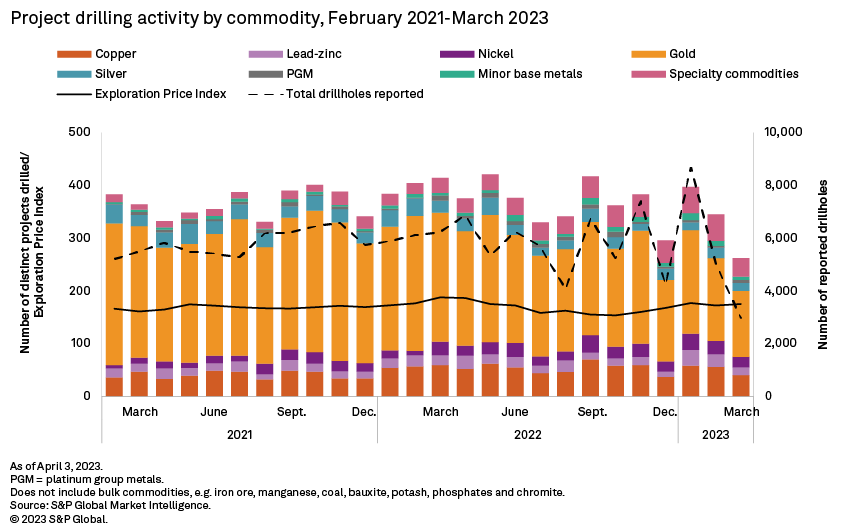

Drilling metrics pulled back in the second consecutive month after a strong start in January. The total drilled projects reported in March plunged to 262, which was 24% lower month over month and the lowest since November 2020. The total distinct holes drilled also declined to 2,964 — almost half of the February total and the lowest since December 2020. Total drilled projects reported declined across all stages, with late stage decreasing the most, to 127 from 160. Reported drilled projects in minesite stage sharply dropped 60% month over month to 22 — an eight-year low — while the number of early-stage projects reported decreased 15% to 113, a 28-month low.

Reported drilled projects declined month over month across all commodities except for platinum group metals, which recorded a marginal increase to six from three projects. Reported gold projects drilled decreased 20% to 125, the lowest for the yellow metal since May 2020. Projects drilled for base metals went down 26% to 102, mostly from copper projects decreasing to 40 from 56 in February. Silver projects receded to January's similar month-over-month total of 15 projects from 20. Specialty metals declined 30% to 35, breaking a seven-month streak of increase in projects reporting drilling. Much of this decrease came from lithium declining 23% to 24 projects, offsetting the slight increase in uranium projects to eight from three.

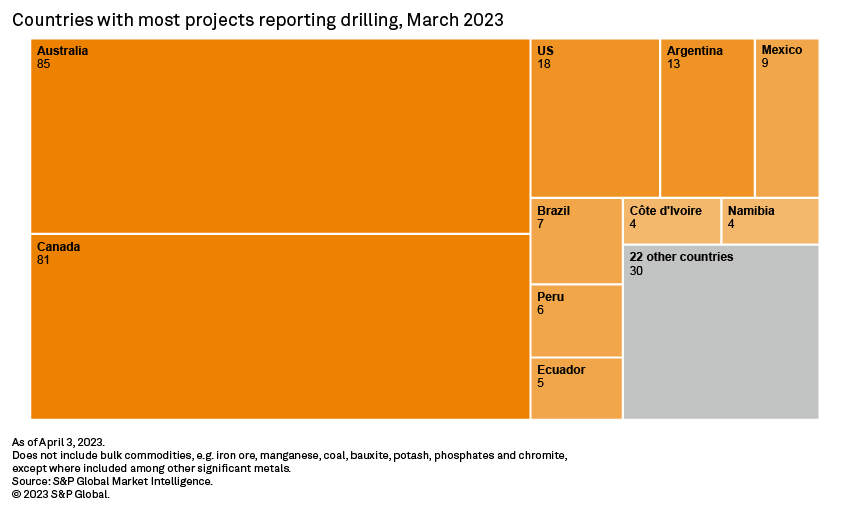

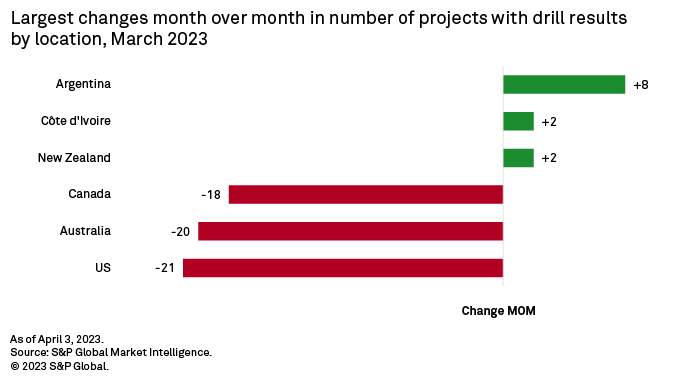

Australia, Canada and the US continued to be the top countries for most reported drilled projects, despite posting the largest declines in March. Australia continued to be the top country two months after Canada temporarily led the totals with a marginal lead. Drilled projects in Australia accounted for 32% of the monthly total, or 85 projects, a 19% month-over-month decline and the lowest since December 2020. The decrease is largely due to less reporting in graphite projects drilled. Canada came in second with 81 projects drilled, the lowest for the country year-to-date. Less reported drilling for nickel and lithium projects accounted for the 18% month-over-month decrease in Canada. The US was at a far third with 18 projects, accounting for merely 7% of the monthly total and the lowest since June 2020. Declines in gold projects drilled pulled down the total for the US by more than half, compared to February.

Despite ranking in fourth place in terms of total projects drilled reporting, Argentina recorded the largest month-over-month increase to 13, the highest monthly total for the country on record. This jump came from more reported projects drilling for copper and lithium.

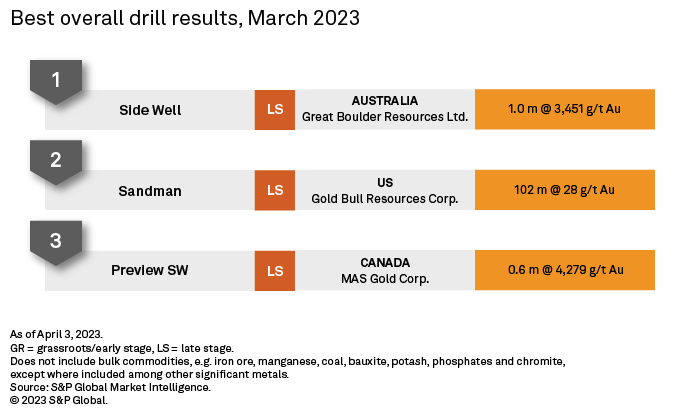

The top three drill results for the month all came from advanced gold projects, with the first one coming from the Australian Securities Exchange-listed Great Boulder Resources Ltd.'s Side Well project in Western Australia. The reported intersection is 1 meter in length, with an average grade of 3,451 grams per metric ton of gold from the Mulga Bill prospect. Reverse circulation and air core drilling in the project has been underway since early March. In February, Great Boulder announced inferred resources of 6.2 million metric tons grading 2.56 g/mt Au in the project, containing 518,000 ounces of gold in the Iron Bark and Mulga Bill prospects.

The second-best result came from the Toronto Stock Exchange Venture-listed Gold Bull Resources Corp.'s Sandman project in Nevada. The company reported a 102-meter intersection grading 28 g/mt Au from the Sleeper deposit. The company also stated that an optimized preliminary economic assessment is underway in the project, targeting an operation for more than 35,000 ounces of gold annually over a 10-year mine life. As of January 2021, the project holds 21.8 MMt of reserves and resources grading 0.7 g/mt Au, containing 493,800 ounces of gold.

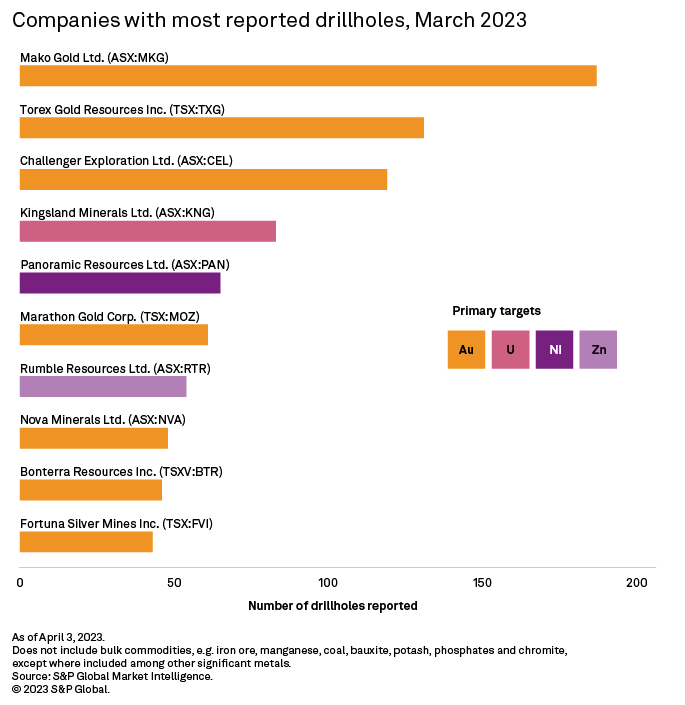

Queensland-based junior company Mako Gold Ltd. reported the most drillholes in March, with a total of 187 holes completed in its Napie late-stage gold project in Cote d'Ivoire. In March, Mako Gold announced that it had completed the phase two, 25,000-meter auger drilling program at the project. In 2022, the company's allocation to gold exploration grew more than 50% year over year to an estimated $7.6 million.

TSX-listed major gold producer Torex Gold Resources Inc. followed in second place, with 131 drillholes concentrated in its Media Luna asset in Mexico under preproduction. Torex plans to begin an infill drill program in 2023 and a pre-feasibility study to be completed in 2024 at the EPO deposit. It is worth noting that the company's gold budget skyrocketed in 2022 to $28 million from just $1.2 million in 2021.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.