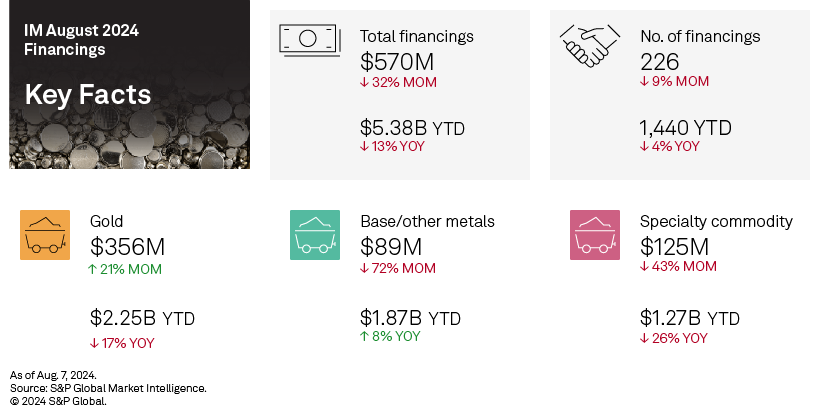

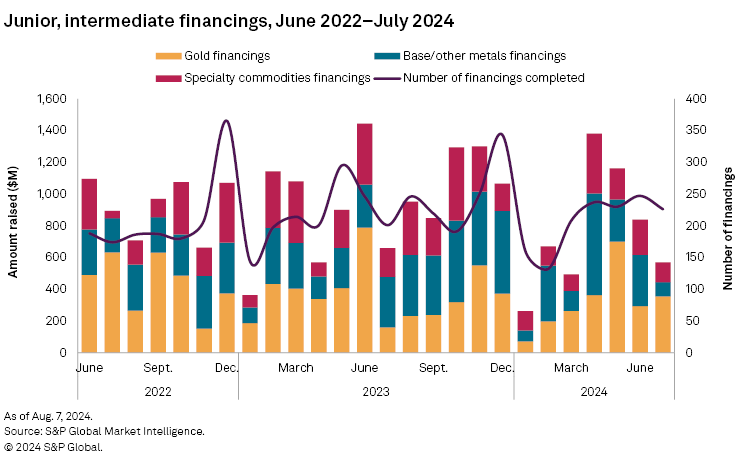

Funds raised by junior and intermediate companies declined for the third consecutive month in July, down 32% to US$570 million. Total funds raised have consecutively fallen since peaking at US$1.38 billion in April. While gold financings recovered in August, the significant decline in base metals and specialty commodity financings weighed down July's totals.

The number of transactions fell to 226, the lowest in four months. The number of significant financings, defined as transactions valued at more than US$2 million, fell to 51 — the lowest since February 2024. There were only two transactions valued at more than US$50 million, compared to four in June.

The July 2024 financing data is available in the accompanying databook.

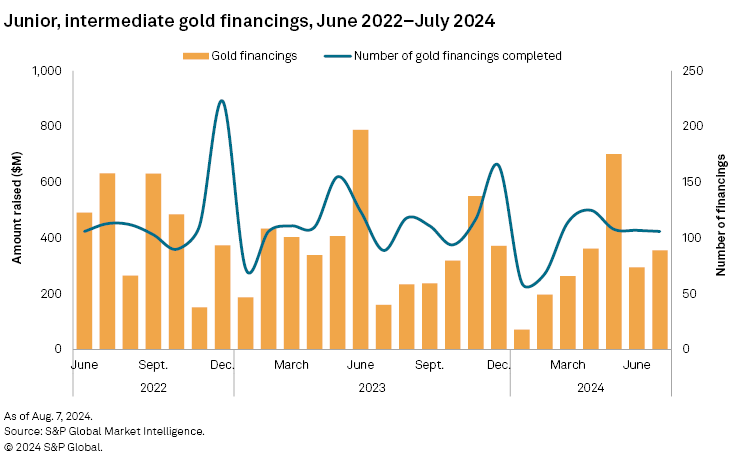

Gold financings recover slightly

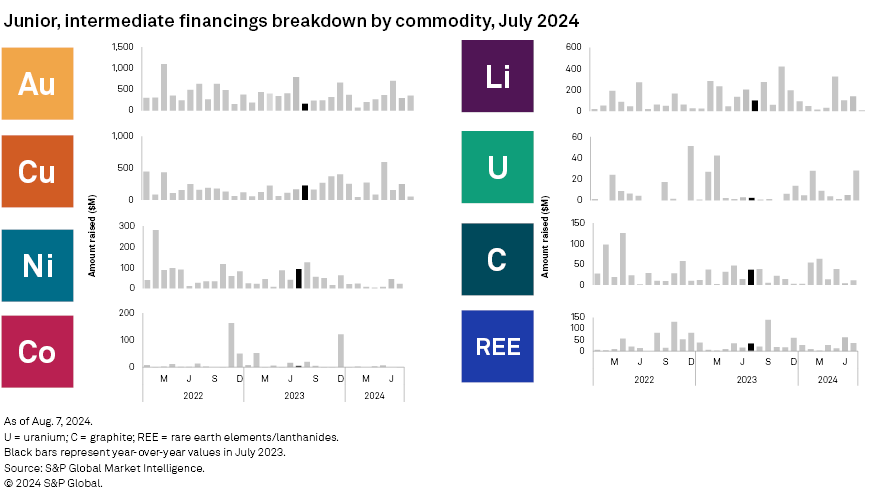

Gold financings increased 21% to US$356 million in July, a slight improvement from the low of US$295 million posted in June. The number of gold transactions fell by one to 106. Two transactions were valued at more than US$50 million, up from one in June.

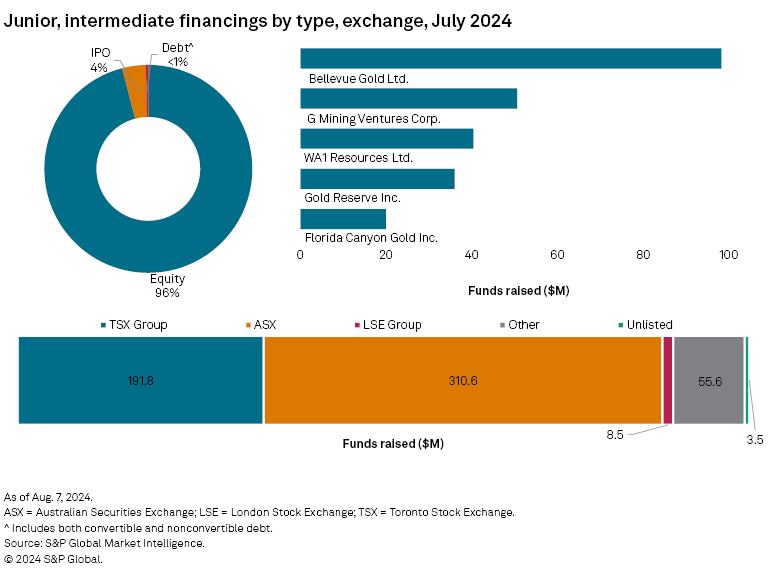

The largest gold financing and largest overall was the A$150-million institutional placement transaction from the Australian Securities Exchange-listed Bellevue Gold Ltd. The company raised A$150 million from its placement of new shares valued at A$1.55 per share. Proceeds of the transaction will be used to repay debt and unlock free cash flow to allow the company to fund its expansion. In 2023, Bellevue announced that it had poured the first gold in its namesake project in Western Australia, which it acquired in 2015.

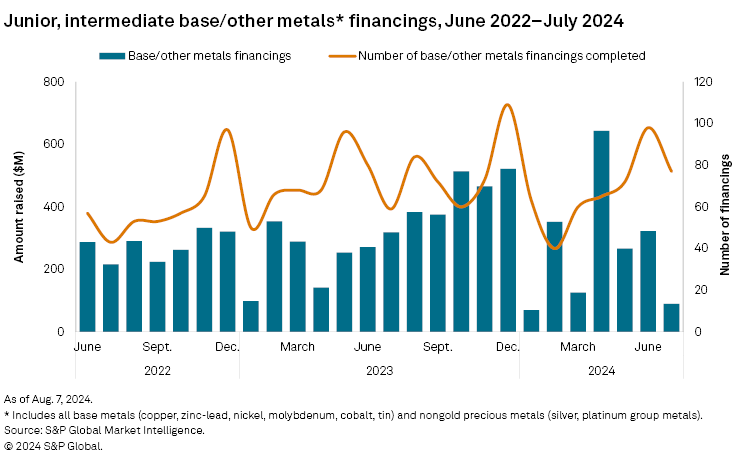

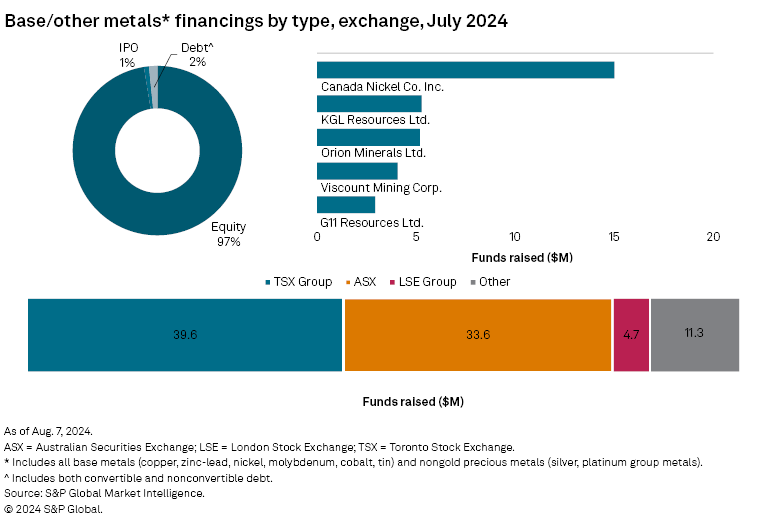

Lower copper, nickel, zinc financings drag group

The base/other metals group fell 72% to US$89 million — the lowest in six months. Lower funds raised for copper, nickel and zinc dragged the group's totals. The number of financings fell to 77 from 98, with no transaction valued at more than US$50 million, down from one in June.

The largest base/other metals financing and the seventh-largest overall was the US$15-million bridge loan facility of Toronto-based Canada Nickel Co. Inc. from its returning investor Auramet International Inc. The loan is due in January 2025, with an interest rate of 1% per month, and is subject to a 2.5% arrangement fee. The company owns various nickel and other base metals projects in Ontario, and proceeds of the debt will be used to advance its permitting, engineering and other financing activities.

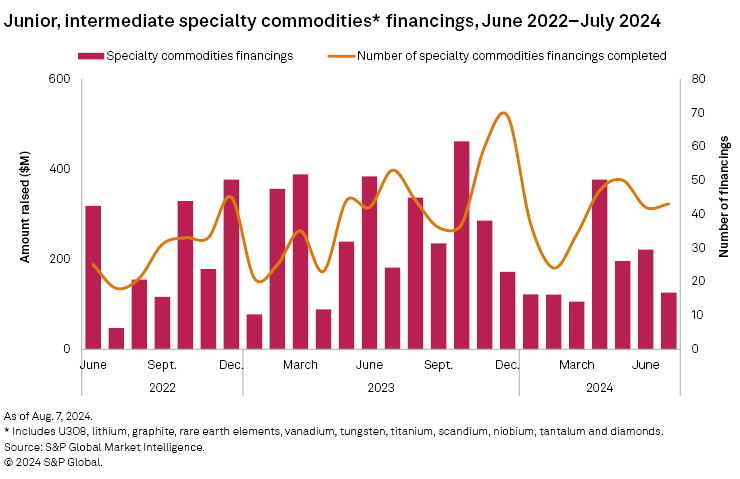

Lithium, rare earth elements decline

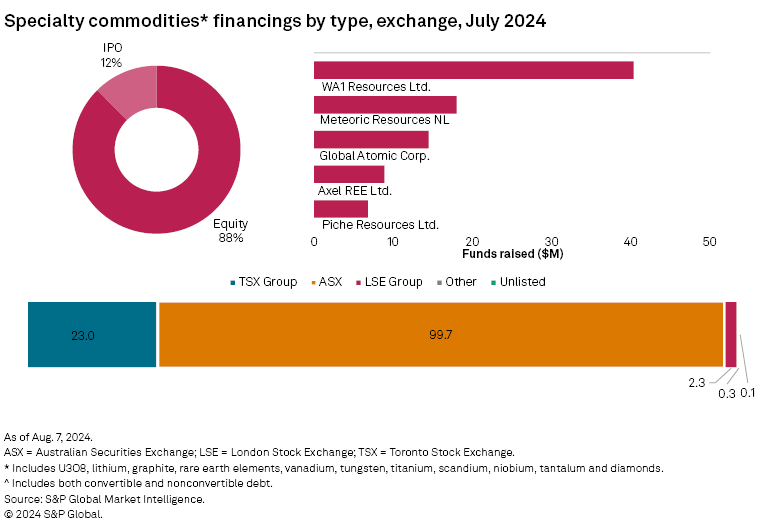

Funds raised for the specialty commodity group fell 43% to US$125 million – the lowest in four months. Lithium and rare earth elements fell the most, down 96% and 41%, respectively. There was a slight uptick in funds raised for graphite, but not enough to offset the decline. The number of specialty metals transactions was up by one to 43. There were no transactions valued at more than US$50 million, down from two in June.

The group's largest transaction and the third-largest overall was from the A$60-million private placement by ASX-listed WA1 Resources Ltd. The company is conducting drilling, metallurgical test work, permitting and development in its niobium-lanthanides project in Western Australia.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.