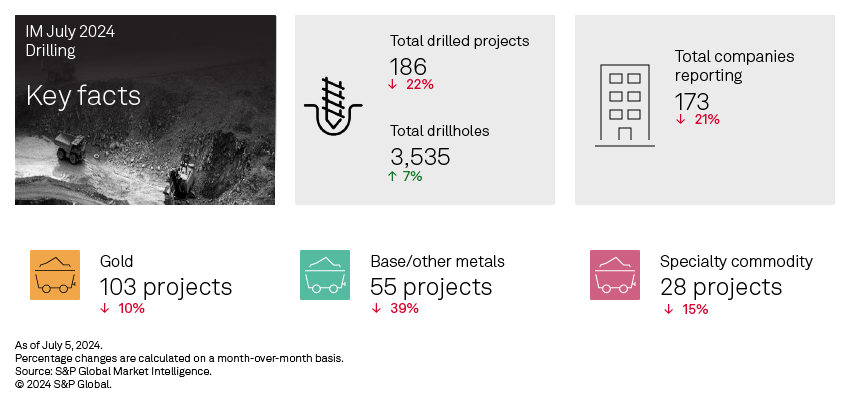

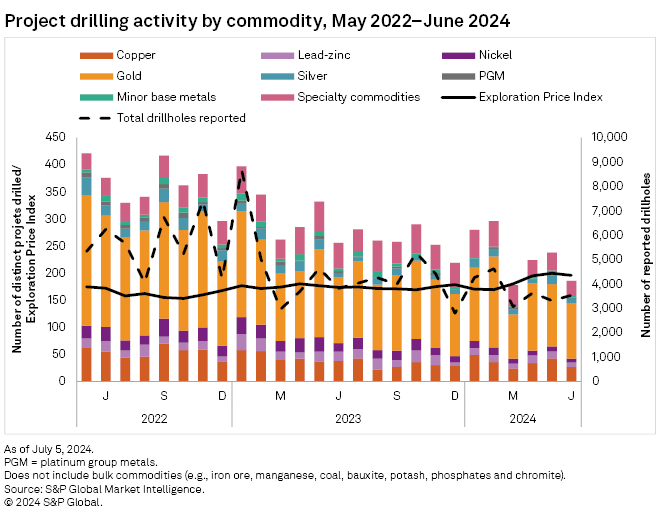

After two months of increases, projects drilling slumped 22% in June, down to 186 projects, resulting in a June low not seen since 2020. Drilling decreased at all project stages, with early-stage projects down 24%, late-stage 21% and minesite down 20%. In contrast, drillholes increased 7% to 3,535.

With all commodity projects experiencing declines in June, gold projects dropped 10% to 103 projects but were still nowhere near the eight-year low in March. Specialty metals projects fell 15% to 28 projects, a 26-month low, and copper projects dropped 37% to 27, a nine-month low. Silver projects were down 44% to nine, nickel 33% to six and lead-zinc 31% to nine projects. Platinum group metals projects dropped by two, to one, and minor base metals halved to three. There were significant increases in gold drillholes for June, up 31% to 2,526 — a four-month high. Small increases in drillholes were reported for nickel, silver and minor base metals, while the remaining commodities mostly decreased.

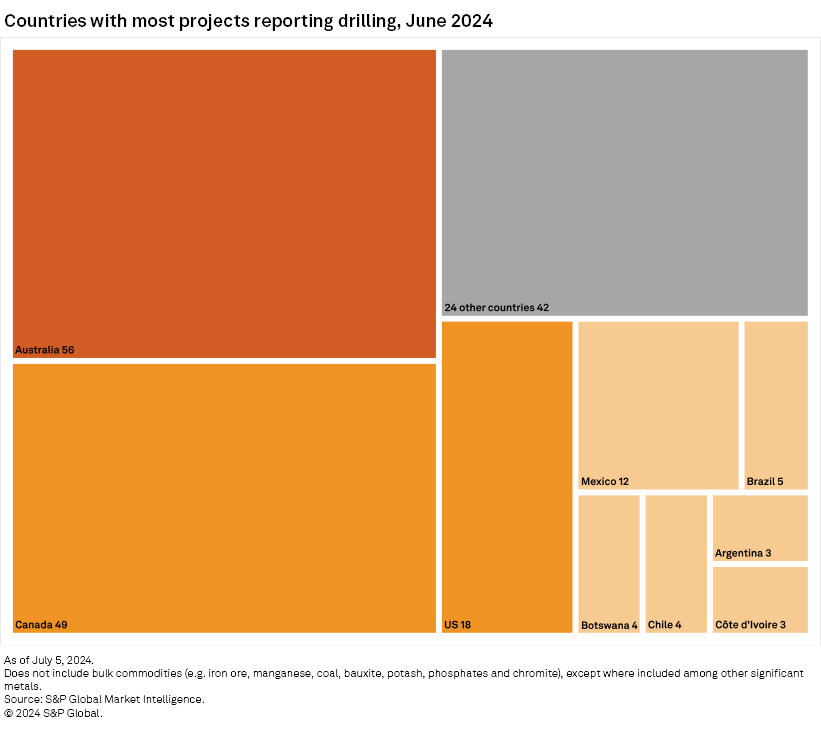

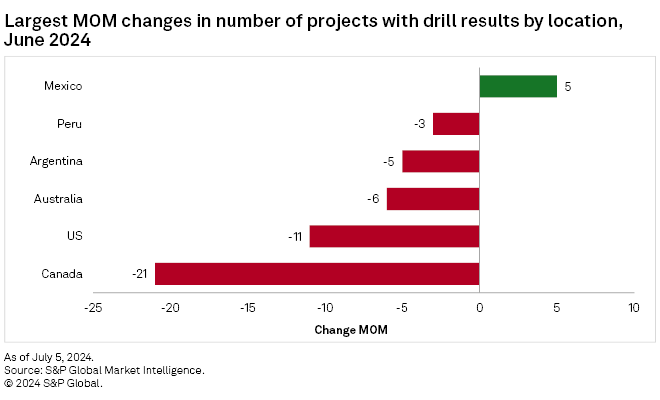

Australia inched past Canada with the most projects reporting drilling for June, although still down 10% month over month to 56 projects. Projects reporting drilling in Canada fell 30% to 49 projects, and those in the US plummeted 38%, down to 18 projects.

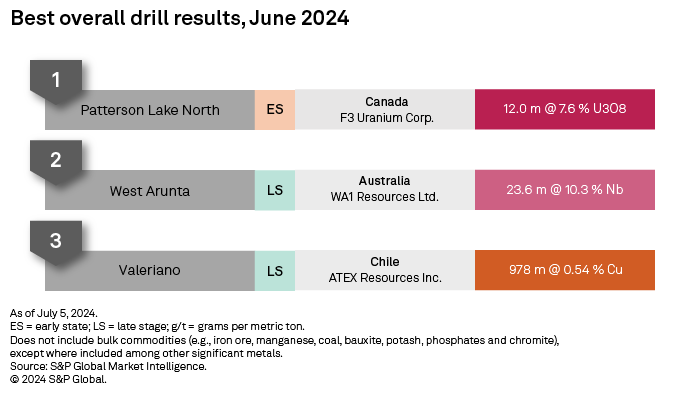

June's top result came from Toronto Stock Exchange-listed F3 Uranium Corp.'s Patterson Lake North project in Saskatchewan. The company reported an intersect of 12.0 meters grading 7.6% uranium. The summer exploration program is proceeding at Patterson Lake North with two diamond drills, results of which thus far have been encouraging, as reported by Sam Hartmann, the vice president of exploration for F3 Uranium.

The second result in line was the Australian Securities Exchange-listed WA1 Resources Ltd.'s West Arunta multimetal project in Western Australia. The company reported an intersect of 26.3 meters grading 10.3% niobium. On July 1, WA1 Resources released an initial Mineral Resource Estimate for the project, and with another drill program starting mid-July, the company aims to continue defining high-grade areas and increase resource confidence.

TSX Venture Exchange-listed ATEX Resources Inc.'s Valeriano copper project in Chile rounded out June's top three results, with a 978-meter intersect grading 0.54% copper. ATEX's phase four drilling program continues, with significant intersects and high grades, as the company continues to explore the limits of mineralization at the project.

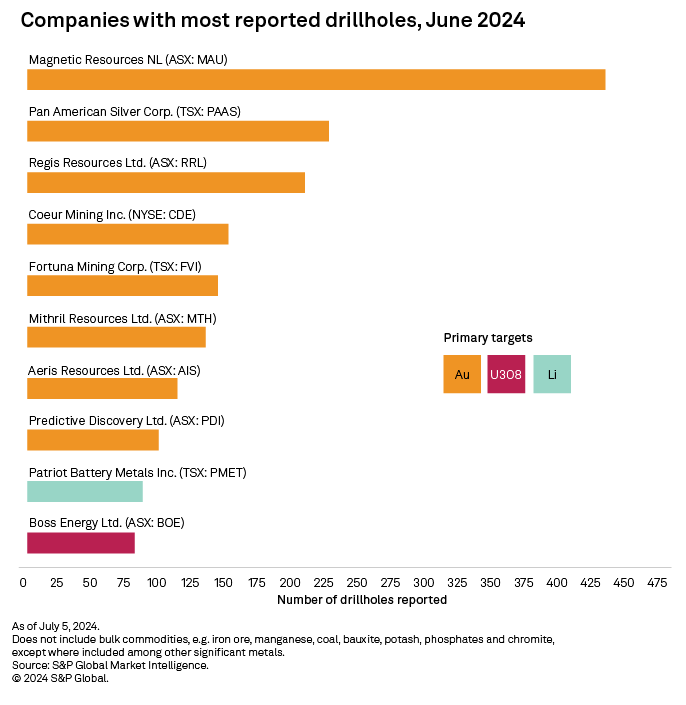

ASX-listed Magnetic Resources NL reported the most drillholes in June, with 431 holes drilled at its Leonora-Laverton gold project in Western Australia. In March, the company released its Prefeasibility Study and a Mineral Resource Estimate for the project, with further drilling planned to increase resource confidence.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.